Put together a complete overview of the prediction markets space as many new teams are building in the vertical.

A quick summary on prediction market categories, their GTM strategies, product updates, some numbers, mechanism explanations, and where we are headed:

A quick summary on prediction market categories, their GTM strategies, product updates, some numbers, mechanism explanations, and where we are headed:

There are broadly two methods of GTM: nonsports and sports. The former is a relatively unexplored space, with several areas to target: crypto, politics, cultural events

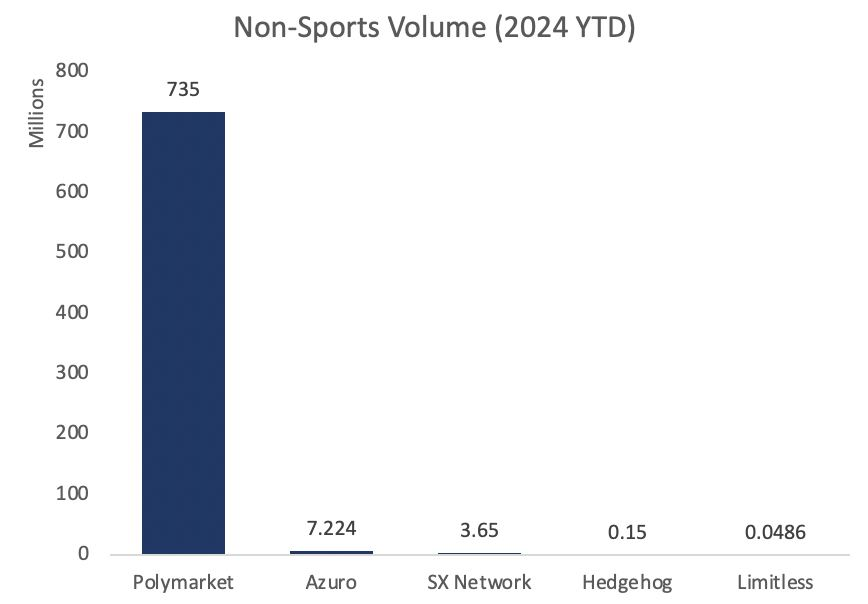

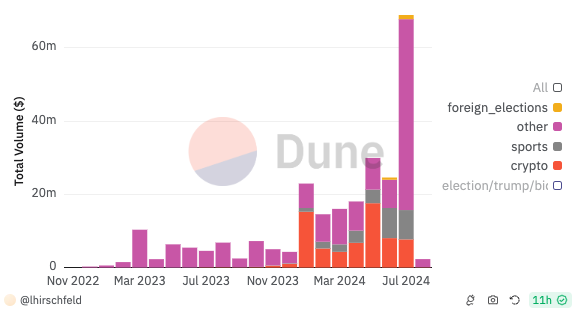

Polymarket is the clear nonsports leader, with its GTM mainly focused on political events.

Polymarket is the clear nonsports leader, with its GTM mainly focused on political events.

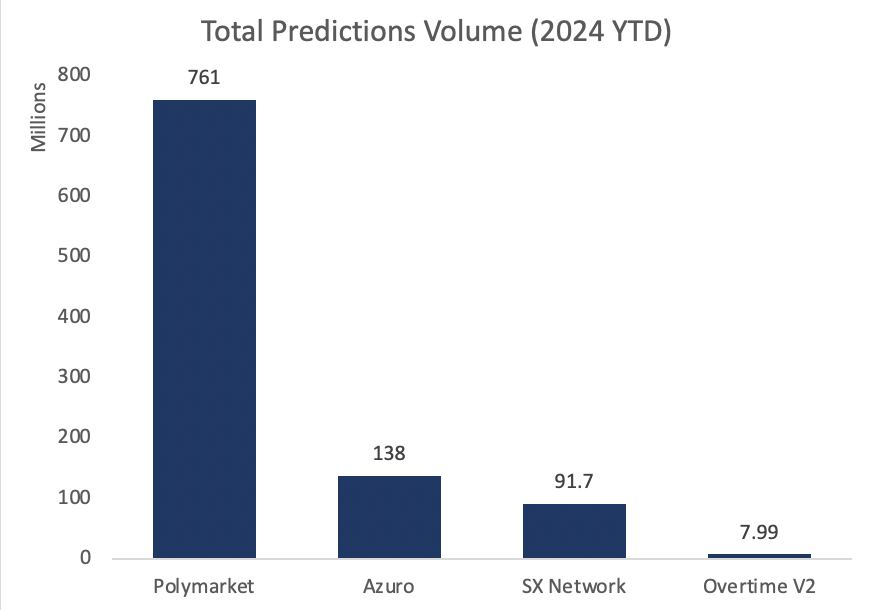

when comparing overall YTD volumes including sports, Azuro and SX Network are much closer to Polymarket.

A few competitor projects are already live, including @LimitlessExchange on EVM where some markets are offered in ETH, and @HedgehogMarkets on SOL, which has pooled bets ($$ first, odds later).

pipeline also includes @DriftExchange, @xMarkets, @InertiaSocial, @Doxa, @Contro.

pipeline also includes @DriftExchange, @xMarkets, @InertiaSocial, @Doxa, @Contro.

Two common themes that newcomers are working on:

1. permissionless markets – open market creation and incentives layer

2. resolution – relying on AI for market settlement, or creating a more efficient system

Polymarket users have repeatedly requested these themes.

1. permissionless markets – open market creation and incentives layer

2. resolution – relying on AI for market settlement, or creating a more efficient system

Polymarket users have repeatedly requested these themes.

The sports category has proven traction in Web2 given its popularity and event regularity

It's hard to get users to convert to crypto, as most users value brand and UX. Web2 sportsbooks also have unlimited marketing dollars; at least 5 sportsbooks spend $100M+ per year.

It's hard to get users to convert to crypto, as most users value brand and UX. Web2 sportsbooks also have unlimited marketing dollars; at least 5 sportsbooks spend $100M+ per year.

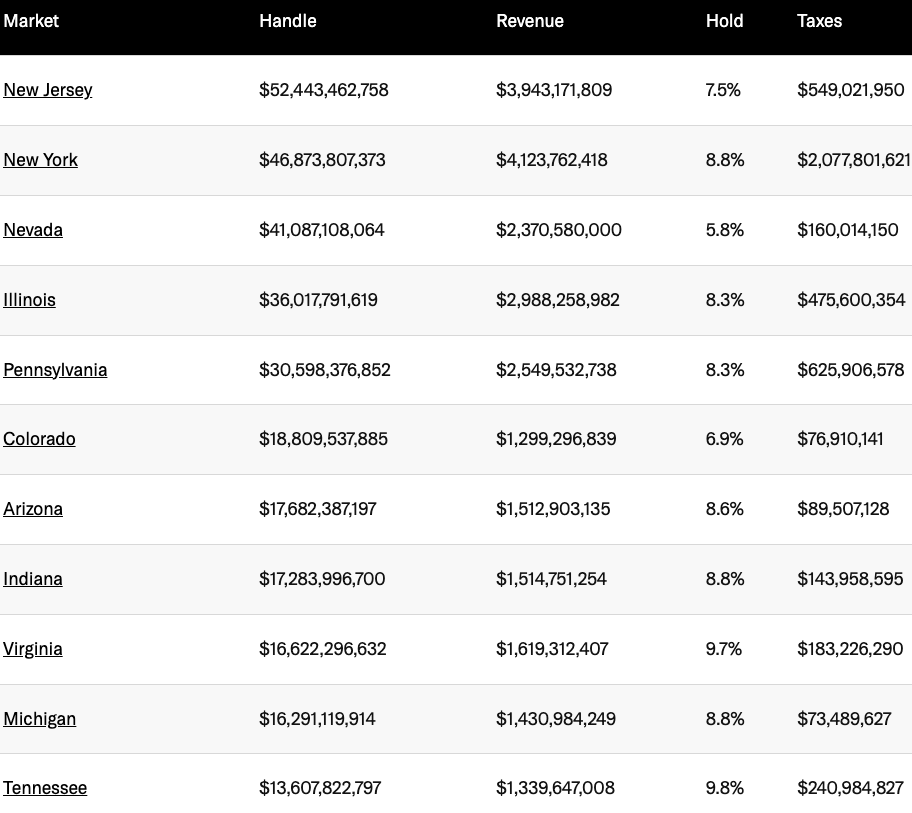

Americans bet 10x more money on a single Super Bowl (~$23B) than the all-time crypto PM volume (~$2B). Even single States widely surpass the $2B figure.

Thesis: more money onchain = more sports betting onchain, just like how the internet bookies took over with phones

Thesis: more money onchain = more sports betting onchain, just like how the internet bookies took over with phones

One of the limiting factors of PMs is the absence of lev. On the nonsports side, @LogX_trade will allow perps on TRUMP, similar to FTX in 2020. @doxamarket is also working on lev.

The counterparty for both projs is pooled liquidity. Liquidations and bad debt remain open q's.

The counterparty for both projs is pooled liquidity. Liquidations and bad debt remain open q's.

It would be interesting to see Polymarket explore multi-leg markets (parlays) more. Technically, the market “Trump and Biden to win Nomination” is a levered bet because it relies on guessing two separate events correctly.

I would love to see markets such as “will a, b, c, and d happen”

I don’t think initial liquidity would be a problem either, LPs love farming their daily rewards!

I don’t think initial liquidity would be a problem either, LPs love farming their daily rewards!

On the sports side, several protocols already allow for leverage through something called parlays, where payouts only occur if users correctly guess multiple non-correlated events. SX Bet, Azuro, and Overtime support this already.

there are broadly two types of PM mechanisms, web2.5 and and web3.

web2.5 = crypto is used as a payment rail, e.g. Stake/Rollbit. Users can bet with crypto but the counterparty is the team behind the application, and the product is not interacting directly with onchain.

web2.5 = crypto is used as a payment rail, e.g. Stake/Rollbit. Users can bet with crypto but the counterparty is the team behind the application, and the product is not interacting directly with onchain.

web3 PMs have some sort of onchain footprint, whether it is positions as NFTs, or bets executed through smart contracts.

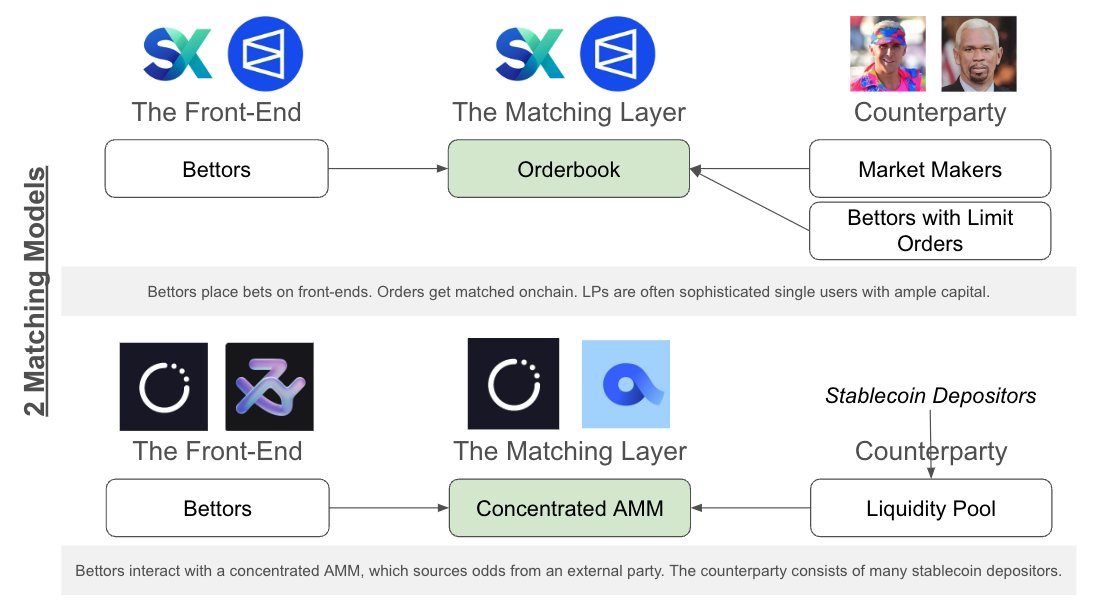

There are typically two ways to match bets onchain, either AMMs which rely on passive LPs, or orderbooks where the platform purely acts as the exchange.

There are typically two ways to match bets onchain, either AMMs which rely on passive LPs, or orderbooks where the platform purely acts as the exchange.

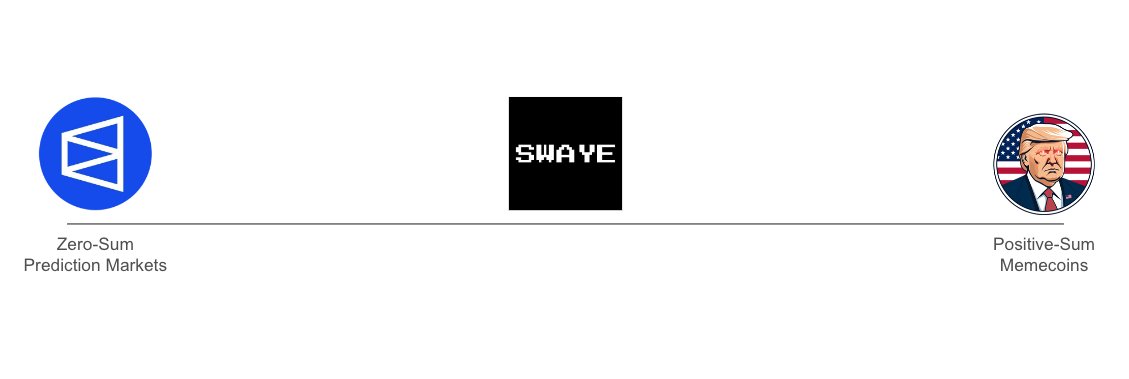

in web3, memecoins have become PMs themselves, $TRUMP and $BODEN are examples of holders getting upside on smth being:

1) directionally correct and

2) an attention accruer

memecoins allow you to speculate on other people’s speculative behavior, regardless if you’re right/wrong

1) directionally correct and

2) an attention accruer

memecoins allow you to speculate on other people’s speculative behavior, regardless if you’re right/wrong

a new protocol called @swaye_co tries to combine the best properties of PMs and memecoins

users who are early to a market are not only betting on a particular outcome but have an incentive to accrue attention because betting activity on either side helps increase PnL

users who are early to a market are not only betting on a particular outcome but have an incentive to accrue attention because betting activity on either side helps increase PnL

zooming out, there are several ways to make money as a protocol:

- trading fees

- A portion of trader winnings (web2 models follow this path)

- Accrue counterparty PnL (web2 loves serving losing customers)

Most protocols either do 1 or 3. Polymarket takes no fees.

- trading fees

- A portion of trader winnings (web2 models follow this path)

- Accrue counterparty PnL (web2 loves serving losing customers)

Most protocols either do 1 or 3. Polymarket takes no fees.

What’s next? AI agents are the next big user in the space, as they can react quickly to news. They will manage orders, inventory, and place bets. They can also calculate expected values of outcomes and take calculated risks. A couple of teams are working on this in stealth.

at some point in the next few years, there will be at least 1 protocol that competes head-to-head with Polymarket’s volumes.

Given how much Polymarket is incentivizing its markets at the moment, heavy use of incentives e.g. points, tokens, or USDC, will likely be needed.

Given how much Polymarket is incentivizing its markets at the moment, heavy use of incentives e.g. points, tokens, or USDC, will likely be needed.

Everyone asks how sustainable the volume will be after the election, and thus far, non-election volume on Polymarket has been uponly since the beginning of the year.

If you’re building in the space, would love to chat!

If you’re building in the space, would love to chat!

• • •

Missing some Tweet in this thread? You can try to

force a refresh