How to get URL link on X (Twitter) App

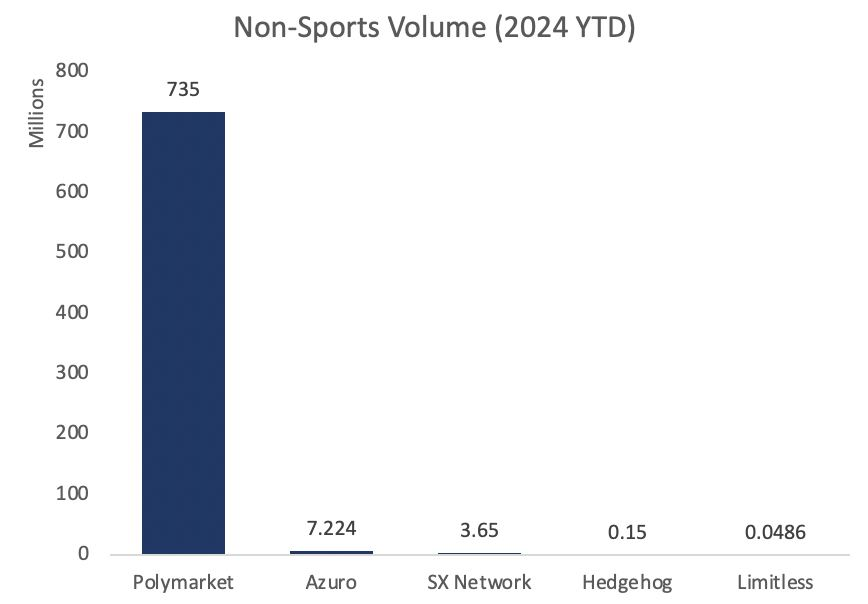

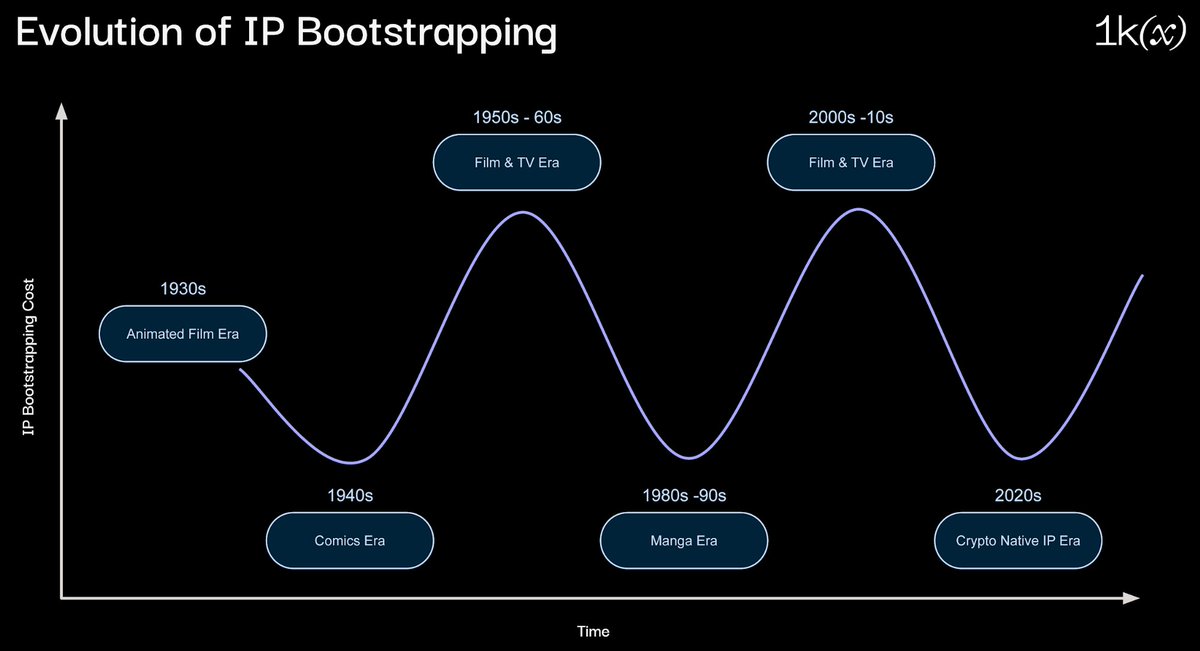

There are broadly two methods of GTM: nonsports and sports. The former is a relatively unexplored space, with several areas to target: crypto, politics, cultural events

There are broadly two methods of GTM: nonsports and sports. The former is a relatively unexplored space, with several areas to target: crypto, politics, cultural events

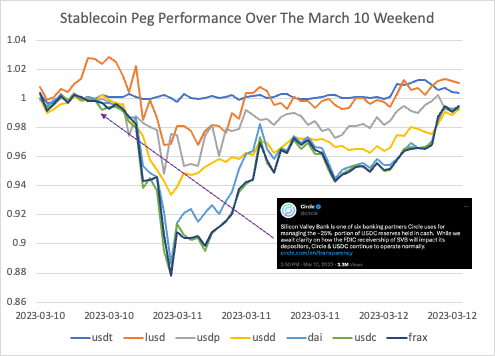

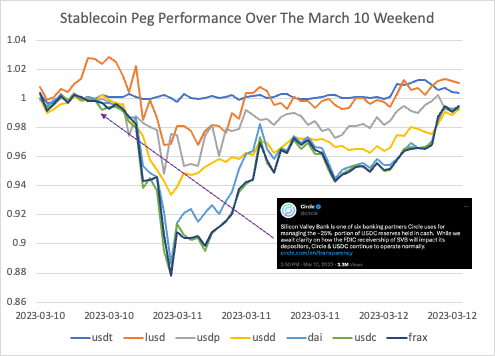

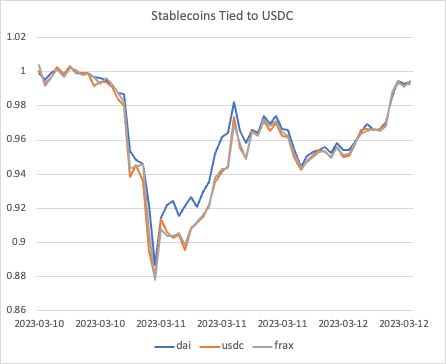

2/ Within 8 hrs of Circle's tweet, USDC fell to ~$0.88, which is below the max possible impact if all funds in SVB were written off to 0 (1 USDC = $0.92). Smart money started buying.

2/ Within 8 hrs of Circle's tweet, USDC fell to ~$0.88, which is below the max possible impact if all funds in SVB were written off to 0 (1 USDC = $0.92). Smart money started buying.

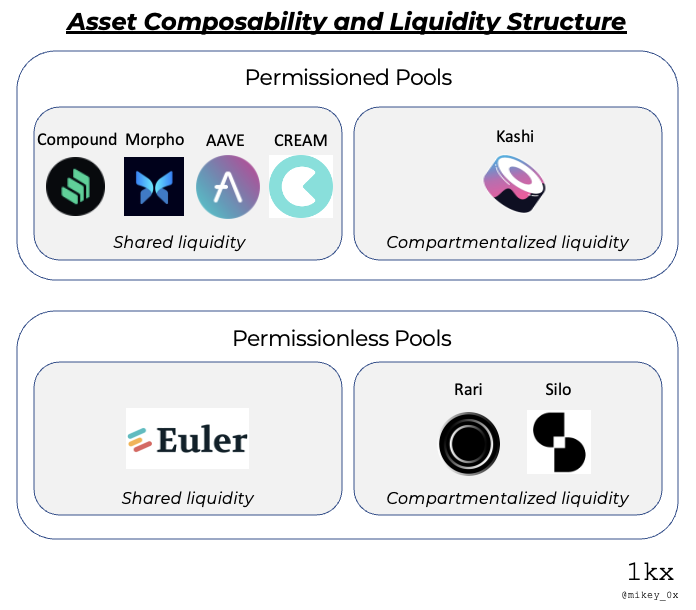

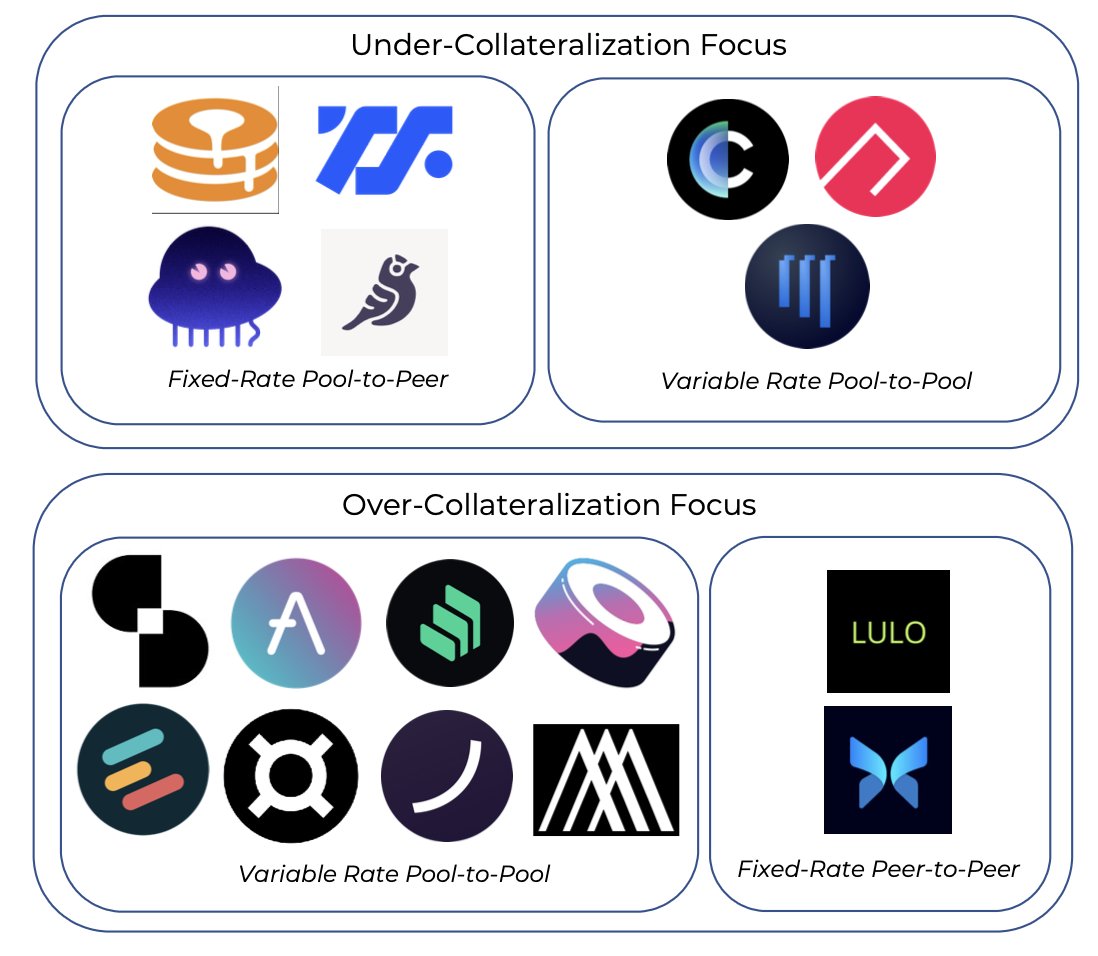

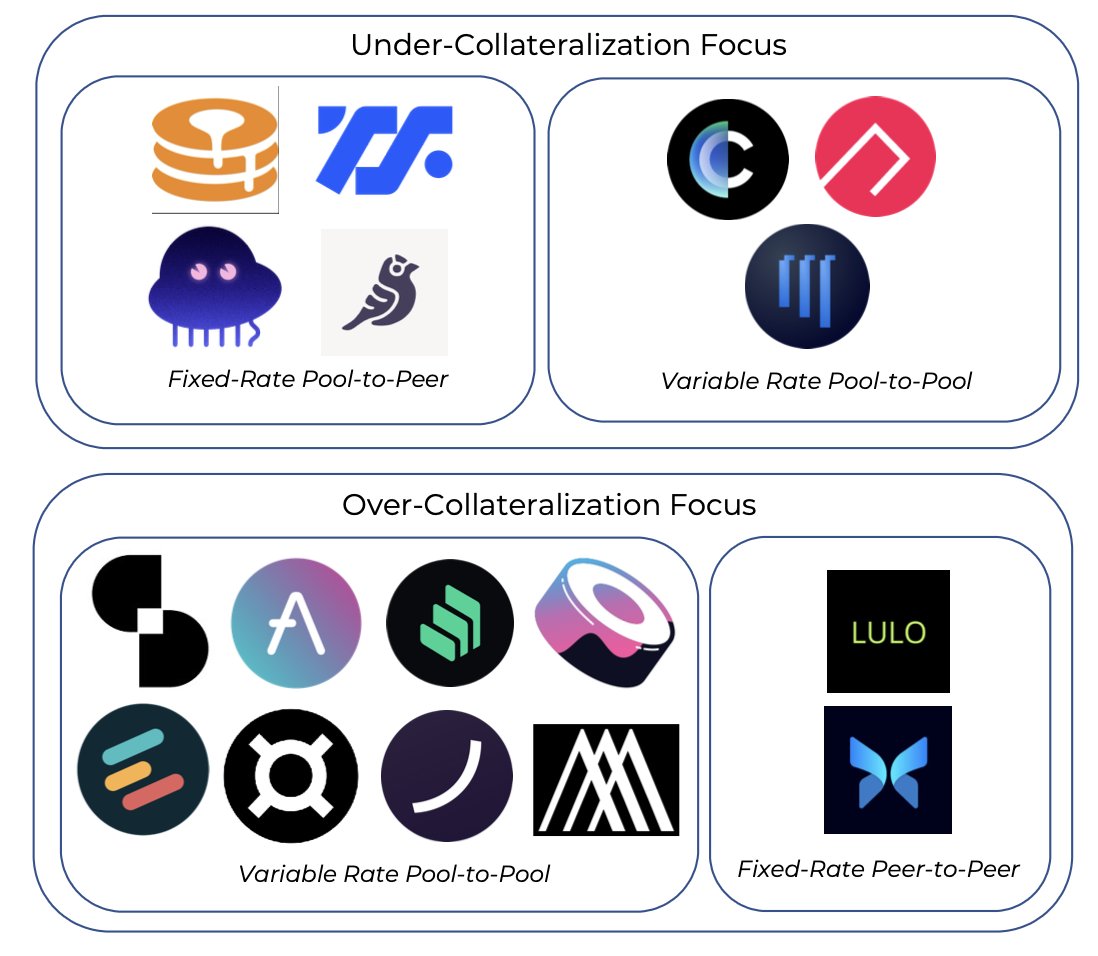

New lending protocols:

New lending protocols: