NEW EVIDENCE THAT @KamalaHarris WILL CONTINUE CRYPTO CRACKDOWN

her advisor choices suggest she will keep biden’s hostile attitude to crypto

harris is working w/ brian deese & bharat ramamurti, 2 key anti-crypto officials from biden admin..

thread 🧵

her advisor choices suggest she will keep biden’s hostile attitude to crypto

harris is working w/ brian deese & bharat ramamurti, 2 key anti-crypto officials from biden admin..

thread 🧵

we got some intel on the harris campaign’s current posture on economic policy, and who they are working with, from some bloomberg @business reporting this morning

deese and ramamurti are two key architects of the biden admin’s anti-crypto crusade, including chokepoint 2.0

deese and ramamurti are two key architects of the biden admin’s anti-crypto crusade, including chokepoint 2.0

deese famously wrote a blog on the white house website “the administration’s roadmap to mitigating cryptocurrency’s risks” on jan 27, 2023

the blog claims to support innovation, but casts the whole of their crypto policy through a “fraud” and “risk mitigation” lens whitehouse.gov/nec/briefing-r…

the blog claims to support innovation, but casts the whole of their crypto policy through a “fraud” and “risk mitigation” lens whitehouse.gov/nec/briefing-r…

harris advisor brian deese’s anti-crypto white house blog was published on jan 27, 2023 — that very same day:

- the Fed rejected @custodiabank’s membership ()…

- …and master account application ()

- the Fed extended jan 3 2023 bank restrictions on crypto activities to all members, including state-chartered entities ()

- jan 27 was a friday, but when the senate opened again on feb 2, sen. dick durbin (majority whip, number 2 senate dem) took to the floor to lambast firms like fidelity for working on crypto (video: , press release: ). durbin also specifically praises the fed for its denials of custodia’s application

white house blog, two key fed denials, fed guidance expanding its authority on crypto dramatically, and 11 min floor speech from senate banking it’s hard to believe that the concurrent timing of these actions was not coordinated. and given the national economic council’s central role in forming white house economic policy, it’s obvious that deese was a central figure in the enactment of “chokepoint 2.0,” of which the actions above were central parts. but we don’t have to infer — it’s been widely reported (more later in thread)federalreserve.gov/newsevents/pre…

subscriber.politicopro.com/article/2023/0…

federalreserve.gov/newsevents/pre…

durbin.senate.gov/newsroom/press…

- the Fed rejected @custodiabank’s membership ()…

- …and master account application ()

- the Fed extended jan 3 2023 bank restrictions on crypto activities to all members, including state-chartered entities ()

- jan 27 was a friday, but when the senate opened again on feb 2, sen. dick durbin (majority whip, number 2 senate dem) took to the floor to lambast firms like fidelity for working on crypto (video: , press release: ). durbin also specifically praises the fed for its denials of custodia’s application

white house blog, two key fed denials, fed guidance expanding its authority on crypto dramatically, and 11 min floor speech from senate banking it’s hard to believe that the concurrent timing of these actions was not coordinated. and given the national economic council’s central role in forming white house economic policy, it’s obvious that deese was a central figure in the enactment of “chokepoint 2.0,” of which the actions above were central parts. but we don’t have to infer — it’s been widely reported (more later in thread)federalreserve.gov/newsevents/pre…

subscriber.politicopro.com/article/2023/0…

federalreserve.gov/newsevents/pre…

durbin.senate.gov/newsroom/press…

now to bharat ramamurti. he worked under deese at the national economic council (the two probably met at yale law, where they overlapped in the 2000s) and has extensive experience working for sen. elizabeth warren, the senate’s biggest crypto antagonist. he worked in her senate office and led economic policy for her presidential campaign

fortune describe bharat as “the white house’s top crypto critic”

@leomschwartz reported that it was ramamurti who intervened to block the stablecoin compromise between @PatrickMcHenry and @RepMaxineWaters in july 2023 finance.yahoo.com/news/white-hou…

@leomschwartz reported that it was ramamurti who intervened to block the stablecoin compromise between @PatrickMcHenry and @RepMaxineWaters in july 2023 finance.yahoo.com/news/white-hou…

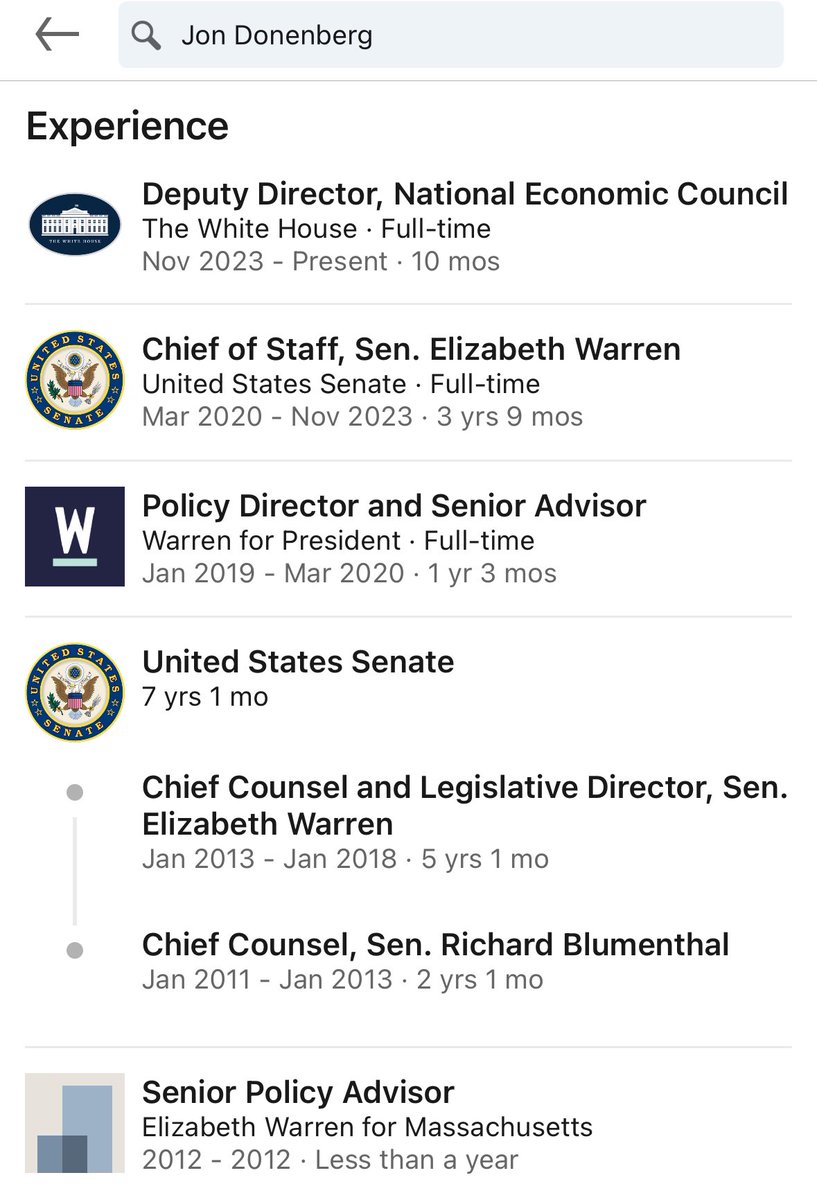

by the way, bharat later left the white house and was replaced on the NEC by jon donenberg, yet ANOTHER former warren aide. based on harris’ advisor choices, i won’t be surprised to hear shortly that he TOO will advise the harris/walz campaign. SAD!

in april, @rkuttnerwrites confirmed leo’s reporting, saying that it was specifically deese and ramamurti who intervened to kill the stablecoin legislation ()

keep in mind that this bill would have legalized but *heavily regulated* stablecoins — both with oversight (how they operate) and prudential (what collateralizes them) powers. regardless of what you think of such a bill, it would undoubtedly have brought stables in from the cold and added significant consumer safetyprospect.org/power/2024-04-…

keep in mind that this bill would have legalized but *heavily regulated* stablecoins — both with oversight (how they operate) and prudential (what collateralizes them) powers. regardless of what you think of such a bill, it would undoubtedly have brought stables in from the cold and added significant consumer safetyprospect.org/power/2024-04-…

by the way, the well-known primary sticking point was that republicans like @PatrickMcHenry wanted to preserve a state pathway for stablecoin issuer registration, meaning that a state-chartered depository (a state bank) could be allowed to issue a stablecoin. democrats seems okay with this, until deese and ramamurti’s intervention, at which point the democrats decided they would ONLY support a stablecoin bill if it gave regulatory authority SOLELY to the federal reserve and national banks

the irony in this is, of course, that on jan. 3 2023 (7 months earlier), the fed (and OCC and FDIC) issued guidance effectively prohibiting national banks from doing anything with crypto, and on jan. 27 2023 (6mos earlier) extended that guidance to state banks).

so when the democrats changed their stablecoin negotiating position to “only national banks under fed oversight can issue stables” at the urging of deese and bharat, it wasn’t intellectually honest. the fed and national bank regulators already prohibited it! brian and bharat knew this of course, because they helped orchestrate the operation chokepoint 2.0 policies with the fed and regulators in the first place!

so when the democrats changed their stablecoin negotiating position to “only national banks under fed oversight can issue stables” at the urging of deese and bharat, it wasn’t intellectually honest. the fed and national bank regulators already prohibited it! brian and bharat knew this of course, because they helped orchestrate the operation chokepoint 2.0 policies with the fed and regulators in the first place!

mchenry and the republicans couldn’t accept that position because they knew that leaving it up to the national banking regulators and federal reserve would ultimately prevent any legal stablecoins from being issued, negating the purpose of the bill itself (fwiw states like New York have long allowed stablecoin issuers with strict oversight, but it has worked)

if harris’ campaign is really about the future, why are the backwards thinkers of the biden administration advising her on economic policy? she would do well to instead listen to democrats like @RoKhanna @RitchieTorres @WileyNickel @RepDarrenSoto @SenGillibrand and others who know that blockchains are the futures

people are policy at the end of the day, and if brian deese, bharat ramamurti, wally adeyamo et al are set to lead economic policy in a harris/walz administration, it’s VERY UNLIKELY the administration will soften its stance on crypto

.@CaitlinLong_ talked about bharat’s influence beginning at 32:45 on @laurashin’s podcast that came out today — worth a listen

• • •

Missing some Tweet in this thread? You can try to

force a refresh