Head of Firmwide Research $GLXY @galaxyhq @glxyresearch Bitcoin / Crypto / AI 🎙️https://t.co/C0Vf35sWm9 Former VC @Fidelity Patron @pubkey_nyc disclaim https://t.co/wlEnSXUSy7

3 subscribers

How to get URL link on X (Twitter) App

all the data in this thread comes from this great report from @SimritDhinsa and @OrejasSebastian from @galaxyhq mining and @hiroto_btc from @glxyresearch galaxy.com/insights/resea…

all the data in this thread comes from this great report from @SimritDhinsa and @OrejasSebastian from @galaxyhq mining and @hiroto_btc from @glxyresearch galaxy.com/insights/resea…

Legal Disclosure:

Legal Disclosure:

all the data in this thread comes from our new quarterly VC report w/ @hiroto_btc read it here. note that fund data comes from galaxy research's visiontrack database. learn more visiontrack.galaxy.com galaxy.com/insights/resea…

all the data in this thread comes from our new quarterly VC report w/ @hiroto_btc read it here. note that fund data comes from galaxy research's visiontrack database. learn more visiontrack.galaxy.com galaxy.com/insights/resea…

we got some intel on the harris campaign’s current posture on economic policy, and who they are working with, from some bloomberg @business reporting this morning

we got some intel on the harris campaign’s current posture on economic policy, and who they are working with, from some bloomberg @business reporting this morning

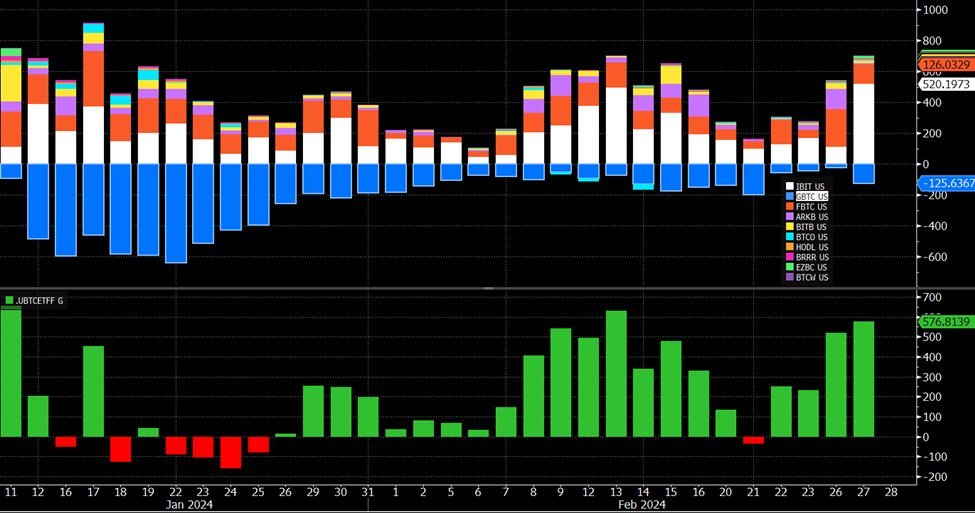

https://x.com/DylanLeClair_/status/1762608995989115254?s=20

disclaimers below

disclaimers below

when dealers are short gamma and price moves up, or when they are long gamma and price moves down, they need to buy spot to stay delta neutral. last week’s expiries will dampen potential explosiveness, but it’s still in play.

when dealers are short gamma and price moves up, or when they are long gamma and price moves down, they need to buy spot to stay delta neutral. last week’s expiries will dampen potential explosiveness, but it’s still in play.

when dealers are short gamma and price moves up, or when they are long gamma and price moves down, they need to buy spot to stay delta neutral.

when dealers are short gamma and price moves up, or when they are long gamma and price moves down, they need to buy spot to stay delta neutral.

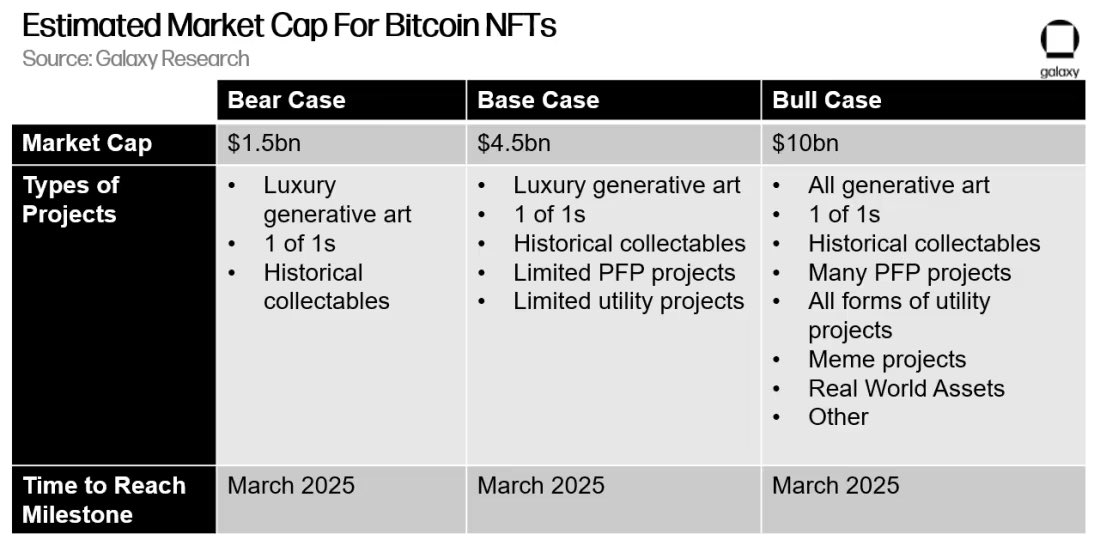

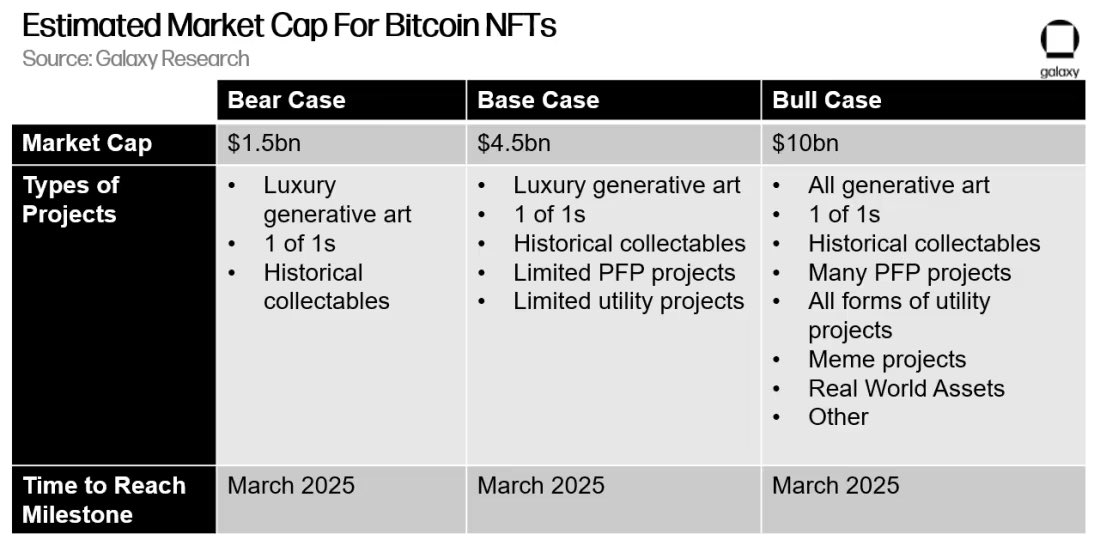

https://twitter.com/yugalabs/status/1632162026641342469my guy @hiroto_btc wrote in friday’s @glxyresearch newsletter about the importance of yuga, the worlds largest issuer of NFT intellectual property (30%+ of global NFT market cap), entering the inscriptions fray. read gabe’s note at the top here: galaxy.com/research/insig…

everything in this thread comes from a new @glxyresearch white paper we released this morning, written by the teams at galaxy research & bitcoin mining

everything in this thread comes from a new @glxyresearch white paper we released this morning, written by the teams at galaxy research & bitcoin mining

this is the first one ordinals.com/inscription/51…

this is the first one ordinals.com/inscription/51…

this thread is a summary. i sent this note to our clients moments ago. conta.cc/3wjbUdB you can sign up to receive our newsletter here gdr.email

this thread is a summary. i sent this note to our clients moments ago. conta.cc/3wjbUdB you can sign up to receive our newsletter here gdr.email

this thread is a summary. read the full report i sent to clients friday here:

this thread is a summary. read the full report i sent to clients friday here:

i explain the low-fee environment in 5 key trends:

i explain the low-fee environment in 5 key trends:

june 27, 2021 was the slowest block time by a LONG SHOT since 2010. here are the top 25 SLOWEST days since 2010 for #bitcoin's average block time. (we exclude 2009 because few people even knew bitcoin existed and there were many days with slow blocks).

june 27, 2021 was the slowest block time by a LONG SHOT since 2010. here are the top 25 SLOWEST days since 2010 for #bitcoin's average block time. (we exclude 2009 because few people even knew bitcoin existed and there were many days with slow blocks).

Smartphone games are generating an enormous amount of revenue. via @NewzooHQ

Smartphone games are generating an enormous amount of revenue. via @NewzooHQ