So @OlympusDAO has started buyback-n-burn of $OHM, using DSR yield generated from $181M treasury. That's $83K per week.

But this isn't your typical buyback-n-burn: OHM can access its DAI backing by borrowing from itself at 81% LTV.

This creates a **leveraged** buyback: a single $1 of bid translates to $5.22 in leveraged bid. That's a very efficient buyback program!

Below I go into detail how a single week's worth of buyback moves the price +27% (many assumptions in there) 👇

But this isn't your typical buyback-n-burn: OHM can access its DAI backing by borrowing from itself at 81% LTV.

This creates a **leveraged** buyback: a single $1 of bid translates to $5.22 in leveraged bid. That's a very efficient buyback program!

Below I go into detail how a single week's worth of buyback moves the price +27% (many assumptions in there) 👇

First, you can track buybacks here:

$165K in DAI represents 2 weeks worth but I use a single week in my calcs = $83K

To find how much OHM you can buyback, we know that protocol has $4.5M in OHM-ETH liquidity. Most of $83K bid pressure will go through this LP.debank.com/profile/0xf7de…

$165K in DAI represents 2 weeks worth but I use a single week in my calcs = $83K

To find how much OHM you can buyback, we know that protocol has $4.5M in OHM-ETH liquidity. Most of $83K bid pressure will go through this LP.debank.com/profile/0xf7de…

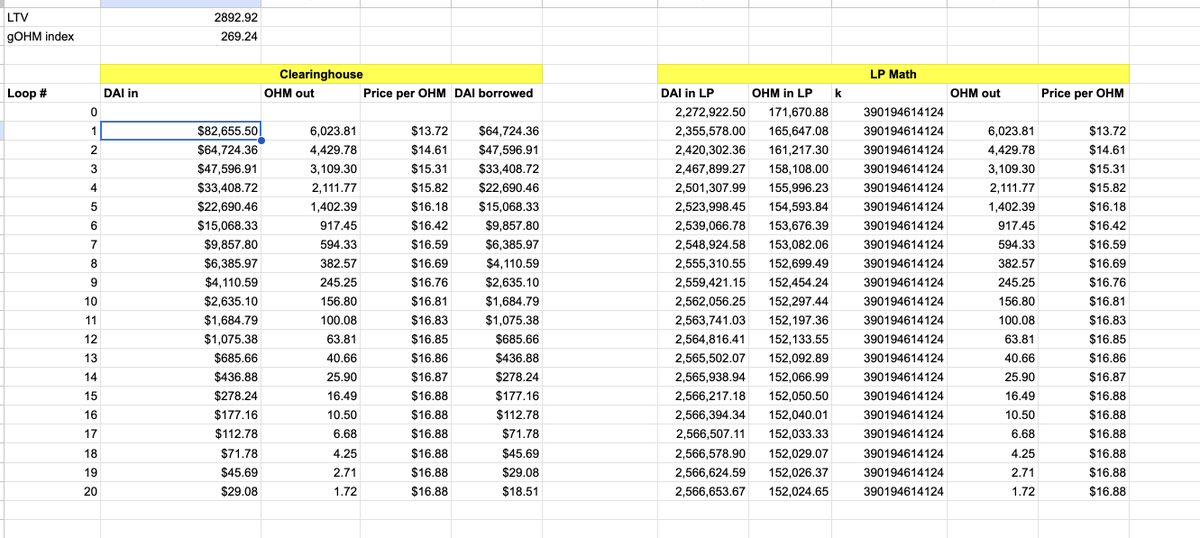

There are 3 parts to the buyback:

1. Buy OHM from LP

2. Collateralize OHM in native lending facility to access backed DAI

3. Use borrowed DAI to repeat Step 1

Things to keep in mind: Step 1 routes through pool and impacts market price. Step 2 takes OHM supply off-market permanently.

If you repeat this 20 times, you would move price from $13.24 to $16.88 (+27%) while taking 19,646.24 OHM out of circulation!

1. Buy OHM from LP

2. Collateralize OHM in native lending facility to access backed DAI

3. Use borrowed DAI to repeat Step 1

Things to keep in mind: Step 1 routes through pool and impacts market price. Step 2 takes OHM supply off-market permanently.

If you repeat this 20 times, you would move price from $13.24 to $16.88 (+27%) while taking 19,646.24 OHM out of circulation!

But this example is contrived and assumptions need to be clarified:

1. As price increases, sellers wanting to exit will take profits, pushing price down

2. Third-party LPs absorb some of the buy pressure, depressing price appreciation.

3. Slippage reduces OHM received, reducing overall leverage.

On (1), sellers exiting the system is bullish as it reduces sell pressure long-term and brings in new capital with no overhang. On (2), 3rd party LPs are basically first in line to sell, experiencing IL and exiting the system for good at a low premium. Sucks to suck.

1. As price increases, sellers wanting to exit will take profits, pushing price down

2. Third-party LPs absorb some of the buy pressure, depressing price appreciation.

3. Slippage reduces OHM received, reducing overall leverage.

On (1), sellers exiting the system is bullish as it reduces sell pressure long-term and brings in new capital with no overhang. On (2), 3rd party LPs are basically first in line to sell, experiencing IL and exiting the system for good at a low premium. Sucks to suck.

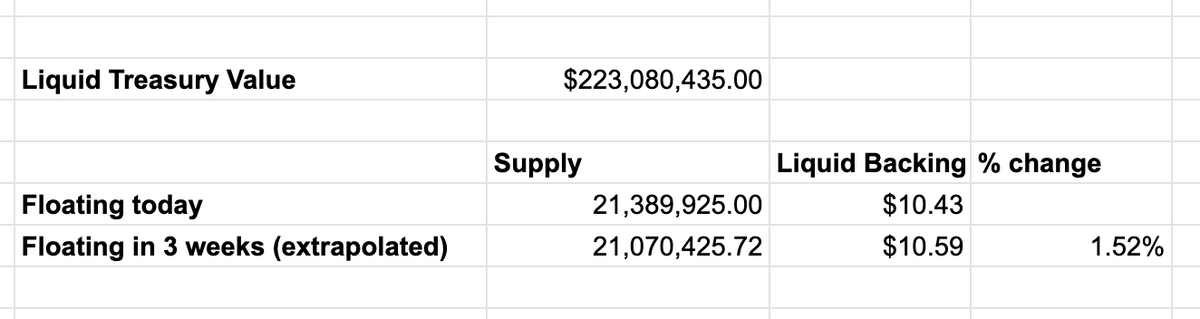

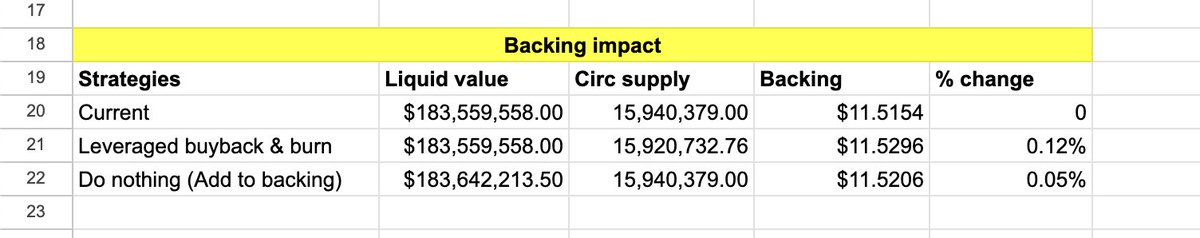

This buyback program also has a net positive impact on $OHM backing.

Whereas previous strategy was to add DSR yield to reserves, the buyback strategy keeps reserves constant but reduces supply *on leverage*.

This has 2.4x impact on backing increase vs status quo.

Whereas previous strategy was to add DSR yield to reserves, the buyback strategy keeps reserves constant but reduces supply *on leverage*.

This has 2.4x impact on backing increase vs status quo.

ok so TLDR:

- $181M treasury yielding $83K/week for buybacks

- $1 in buyback is actually $5 bc OHM is backed

- market price moves +27%, supply shrinks by 19K per week. However, true market price must be adjusted for old holders exiting

- Backing grows 2.4x more efficiently

$OHM is dead. Now let's watch it burn.

Math here: docs.google.com/spreadsheets/d…

- $181M treasury yielding $83K/week for buybacks

- $1 in buyback is actually $5 bc OHM is backed

- market price moves +27%, supply shrinks by 19K per week. However, true market price must be adjusted for old holders exiting

- Backing grows 2.4x more efficiently

$OHM is dead. Now let's watch it burn.

Math here: docs.google.com/spreadsheets/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh