Product & GTM of interesting mechanism designs

Core team @OlympusDAO

Core team @BaselineMarkets

How to get URL link on X (Twitter) App

pumpfun changed the game by standardizing on token supply, price, mc and liquidity.

pumpfun changed the game by standardizing on token supply, price, mc and liquidity.

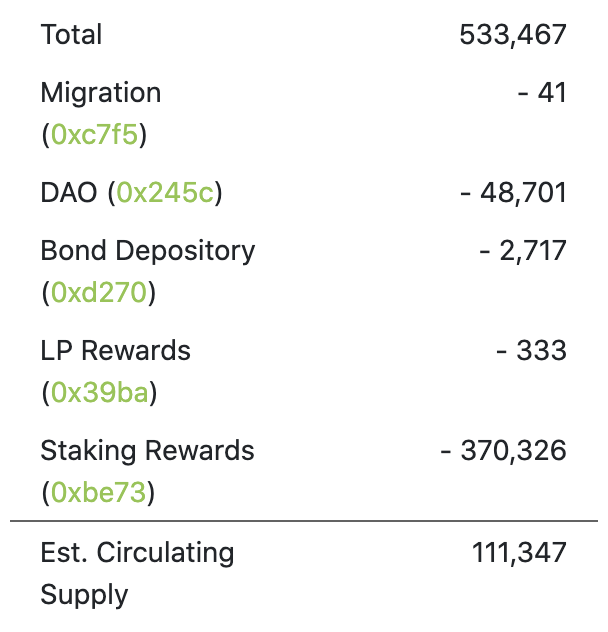

First, you can track buybacks here:

First, you can track buybacks here:

How it works: great thread by @0x_Beans

How it works: great thread by @0x_Beans https://x.com/0x_beans/status/1764336691211620842?s=46&t=nDRif1Sh_f4FuxRoeR9C5A

The only other time we saw deflation was during market volatility of May and Jun. BUT... on a much smaller scale. Collectively, those deflationary days burned only 28% of what has been burned since Oct 6!

The only other time we saw deflation was during market volatility of May and Jun. BUT... on a much smaller scale. Collectively, those deflationary days burned only 28% of what has been burned since Oct 6!

1/n What is liquid backing? By definition:

1/n What is liquid backing? By definition:

1/ Modern VC started in 70s. Semiconductors were labor and capital intensive. Factories had to be built, r&d worked on multi-year roadmaps and go-to market required heavy investment.

1/ Modern VC started in 70s. Semiconductors were labor and capital intensive. Factories had to be built, r&d worked on multi-year roadmaps and go-to market required heavy investment.

Maslow categorizes human motivation into 5 stages starting with physical survival, transitioning to psychological safety and ending with vision-driven narratives.

Maslow categorizes human motivation into 5 stages starting with physical survival, transitioning to psychological safety and ending with vision-driven narratives.