It's not even been 2 weeks that we launched EURC on @base and the growth trajectory couldn't look better:

• €7.3 million EURC issued on Base

• leading to +20% growth of EURC market cap overall to ~€40 million today

• liquidity on @AerodromeFi, the top DEX on base, approaches ~5 million EURC very quickly, trading volume ~$6.5 million --> onchain FX is coming!

• EURC on base is already supported by @coinbase @AerodromeFi @mavprotocol @Uniswap @tokenterminal @crossmint

The base momentum is real. The traction for the onchain euro and onchain FX (EURC<>USDC) is organic.

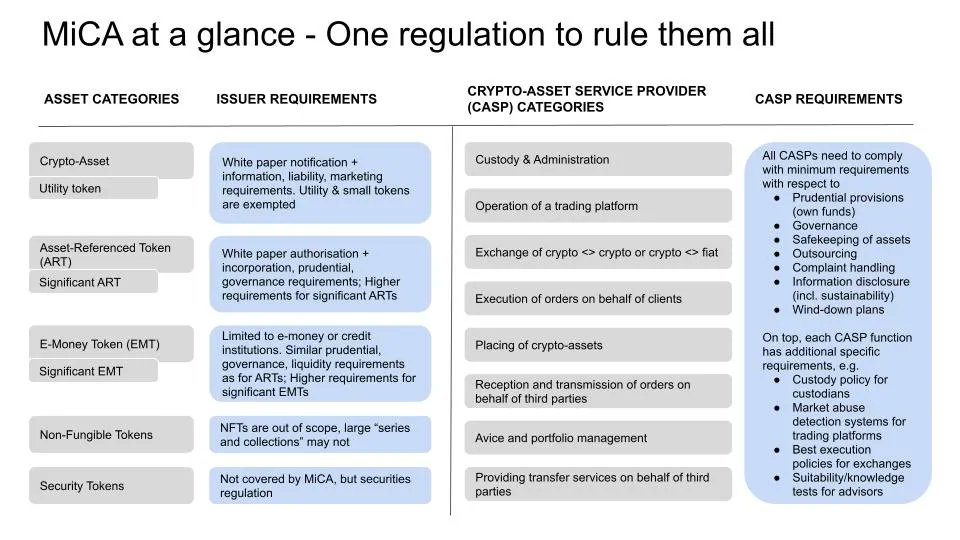

If this growth trajectory continues, it's only a matter of weeks until EURC, the largest MICA-compliant euro stablecoin, also becomes the largest euro stablecoin overall. More to come!

• €7.3 million EURC issued on Base

• leading to +20% growth of EURC market cap overall to ~€40 million today

• liquidity on @AerodromeFi, the top DEX on base, approaches ~5 million EURC very quickly, trading volume ~$6.5 million --> onchain FX is coming!

• EURC on base is already supported by @coinbase @AerodromeFi @mavprotocol @Uniswap @tokenterminal @crossmint

The base momentum is real. The traction for the onchain euro and onchain FX (EURC<>USDC) is organic.

If this growth trajectory continues, it's only a matter of weeks until EURC, the largest MICA-compliant euro stablecoin, also becomes the largest euro stablecoin overall. More to come!

Cc @jessepollak

https://twitter.com/jessepollak/status/1823496291701416375

• • •

Missing some Tweet in this thread? You can try to

force a refresh