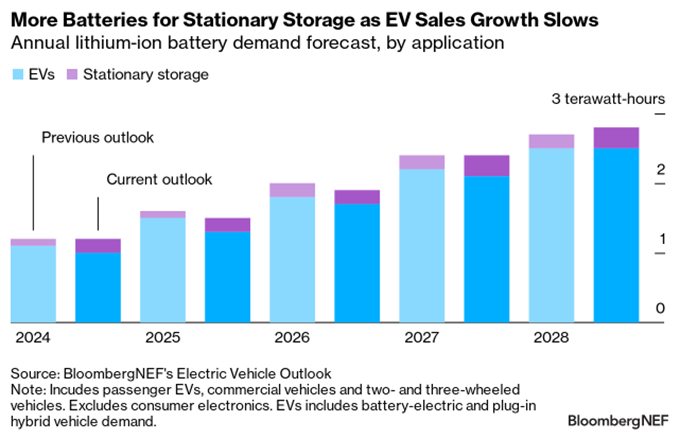

EVs are the largest source of demand for batteries, but stationary energy storage is catching up quickly.

BNEF expects stationary storage battery demand to rise 61% this year in capacity terms.

BNEF expects stationary storage battery demand to rise 61% this year in capacity terms.

Globally, energy storage will account for around 13% of total li-ion battery demand this year, up from 6% in 2020

Putting this another way, the ratio of EV battery demand to stationary battery demand has fallen from 15-to-1 to 6-to-1 in the last 4 years.

Putting this another way, the ratio of EV battery demand to stationary battery demand has fallen from 15-to-1 to 6-to-1 in the last 4 years.

Expected EV battery demand in BNEF’s latest EV Outlook was lowered due to a lower adoption outlook in markets like Germany and the US.

But the overall lithium-ion battery demand forecast remained almost constant due to increased expectations on the stationary side.

But the overall lithium-ion battery demand forecast remained almost constant due to increased expectations on the stationary side.

Prices for turn-key energy storage systems are down 43% from a year ago and that is leading to big increase in deployments

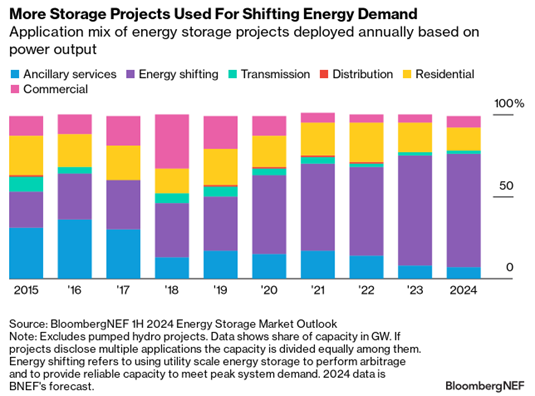

The ways these batteries are being used is also changing. This year, two thirds of all storage installations are being used for energy shifting applications like price arbitrage and helping to integrate renewables.

Even with lots of stationary storage demand, there is going to be significant overcapacity in the battery market for quite some time. Nameplate annual battery manufacturing capacity online in China at the end of 2023 was 2.2 TWh. BNEF estimate for demand this year: 1.2TWh.

The outlook for battery demand will continue to be tied closely to EVs, but the stationary storage market is worth watching.

As one part of the energy transition slows temporarily, another is speeding up.

As one part of the energy transition slows temporarily, another is speeding up.

You can sign up for the daily Hyperdrive Newsletter here:

Our team of analysts @BloombergNEF have a weekly spot. Always lots of cool charts and data!bloomberg.com/account/newsle…

Our team of analysts @BloombergNEF have a weekly spot. Always lots of cool charts and data!bloomberg.com/account/newsle…

Thanks this week to my colleagues @YayoiSekine and Jiayan Shi for their knowledge and input on this topic.

Full report with much more detail is available to BNEF clients here:

bnef.com/insights/34547

Full report with much more detail is available to BNEF clients here:

bnef.com/insights/34547

• • •

Missing some Tweet in this thread? You can try to

force a refresh