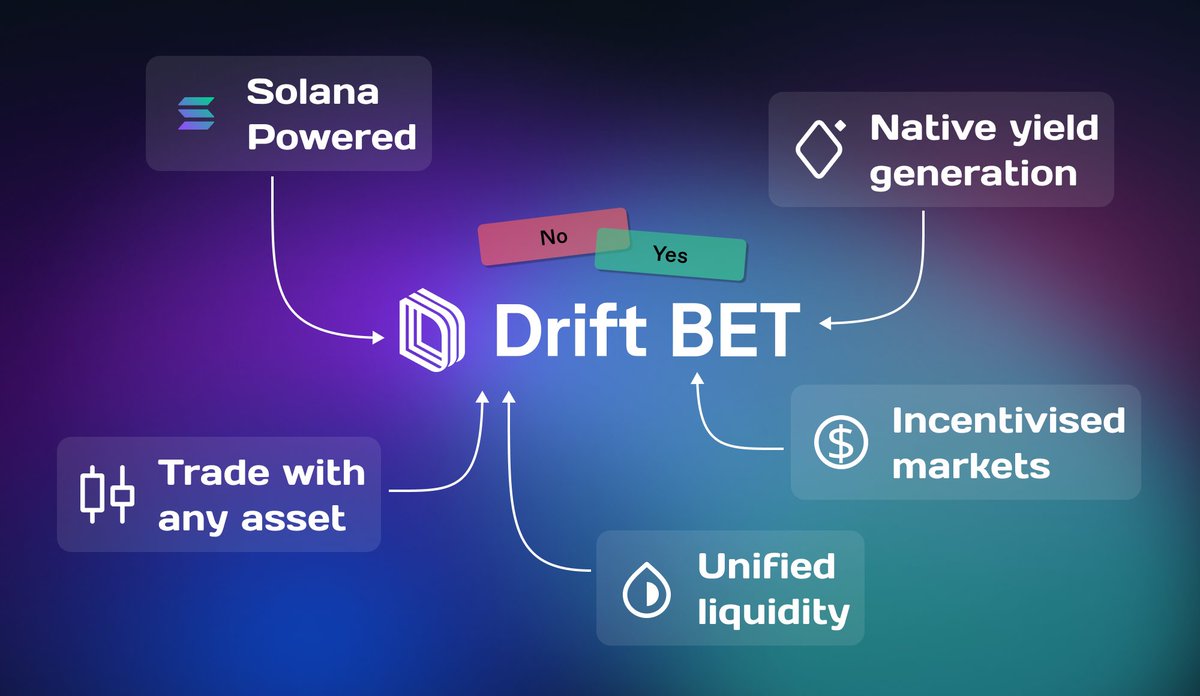

Introducing BET: The First Capital-Efficient Prediction Markets on @solana

Bet bigger on the future.

Hedge on a unified platform.

Earn yield from your positions.

Bet bigger on the future.

Hedge on a unified platform.

Earn yield from your positions.

Prediction markets are DeFi’s next frontier, merging trading with real-world outcomes.

With today’s launch of BET, Drift transforms global sentiment shifts into tradeable, decentralised foresight.

This is the future of on-chain trading.

With today’s launch of BET, Drift transforms global sentiment shifts into tradeable, decentralised foresight.

This is the future of on-chain trading.

Discover a unique prediction market experience with BET:

⚡ Solana's speed and low-cost

⚡ Earn yield on your positions

⚡ Trade with all supported collateral

⚡ Unified liquidity from Drift's $500M+ pool of deposits

⚡ Incentivized markets via FUEL

⚡ Solana's speed and low-cost

⚡ Earn yield on your positions

⚡ Trade with all supported collateral

⚡ Unified liquidity from Drift's $500M+ pool of deposits

⚡ Incentivized markets via FUEL

With 30+ crypto assets available, use more assets on Drift's prediction markets — not just USDC.

Utilize yield-bearing stables like PyUSD & USDY, your favorite tokens on Solana, including LSTs from @jito_sol, @MarinadeFinance, @sanctumso and more!

Utilize yield-bearing stables like PyUSD & USDY, your favorite tokens on Solana, including LSTs from @jito_sol, @MarinadeFinance, @sanctumso and more!

All trading activity on BET will receive a 5x FUEL boost for the next 2 weeks.

FUEL rewards the most loyal driftoors, with redemptions coming soon for prizes within the Drift and Solana ecosystem. Lock in.

FUEL rewards the most loyal driftoors, with redemptions coming soon for prizes within the Drift and Solana ecosystem. Lock in.

Explore the US Election prediction market: app.drift.trade/bet

Read more: drift.trade/updates/introd…

These are the only official community channels, beware of scams.

Discord:

Telegram: discord.gg/driftprotocol

t.me/+G4i0AZcHf6cxN…

Discord:

Telegram: discord.gg/driftprotocol

t.me/+G4i0AZcHf6cxN…

• • •

Missing some Tweet in this thread? You can try to

force a refresh