Trade perps on Solana with ultimate performance:

Deep liquidity, multi-asset collateral and yield on all deposits.

How to get URL link on X (Twitter) App

2/ With Leveraged Swaps on Drift users can:

2/ With Leveraged Swaps on Drift users can:

https://twitter.com/aeyakovenko/status/1465699414710779908?s=20&t=w1U8WT5sbXpLmXCx2eumuA

2/ A brief history on derivatives -- the first modern derivatives exchange operated in 18th century Edo Japan, as the Dōjima Rice Exchange, where rice farmers, merchants and brokers traded the world's first cash-settled commodity futures through a central clearinghouse.

2/ A brief history on derivatives -- the first modern derivatives exchange operated in 18th century Edo Japan, as the Dōjima Rice Exchange, where rice farmers, merchants and brokers traded the world's first cash-settled commodity futures through a central clearinghouse.

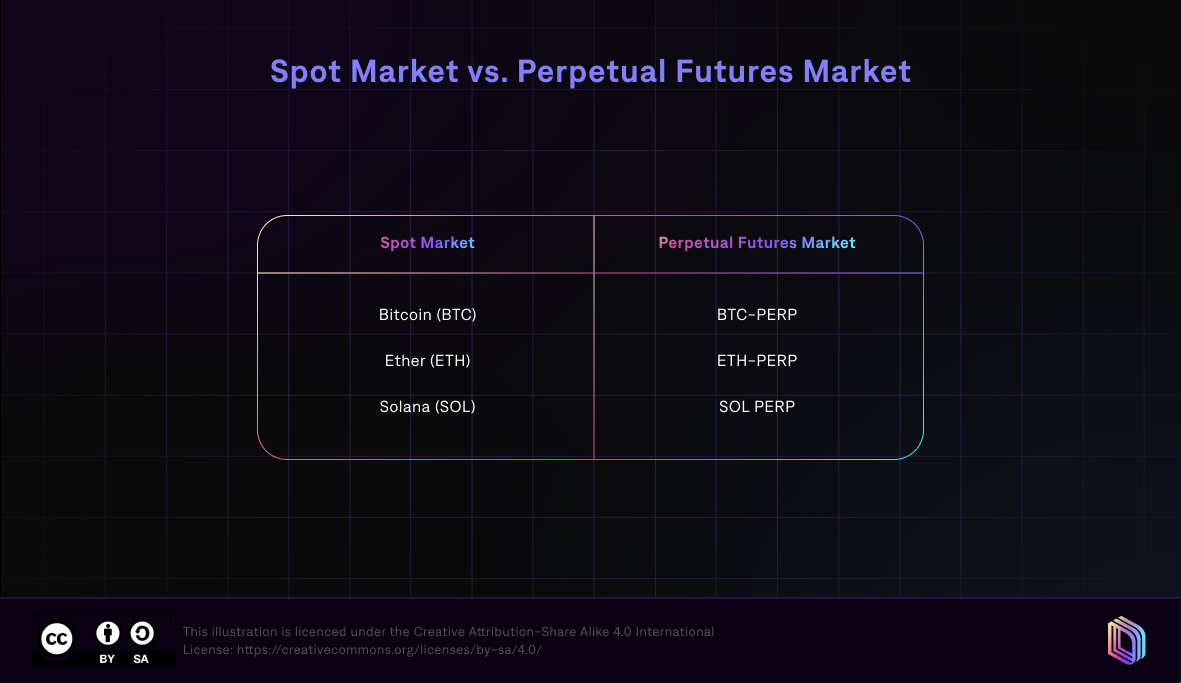

2/ Perpetual swaps make it intuitive for traders to use futures as they never need to be rolled. Since perpetuals are just contracts they can deviate from their underlying price so stay tethered to their spot prices in terms of their premiums with a funding rate mechanism. ⚙️

2/ Perpetual swaps make it intuitive for traders to use futures as they never need to be rolled. Since perpetuals are just contracts they can deviate from their underlying price so stay tethered to their spot prices in terms of their premiums with a funding rate mechanism. ⚙️