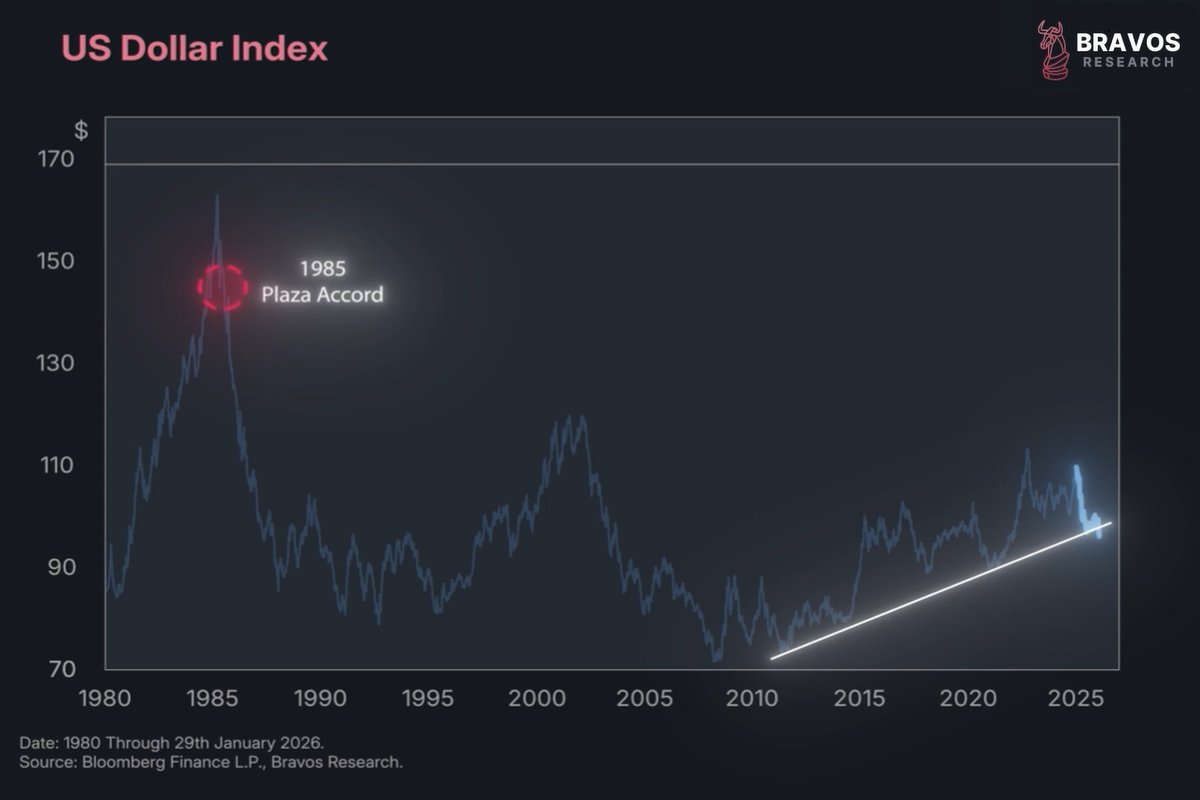

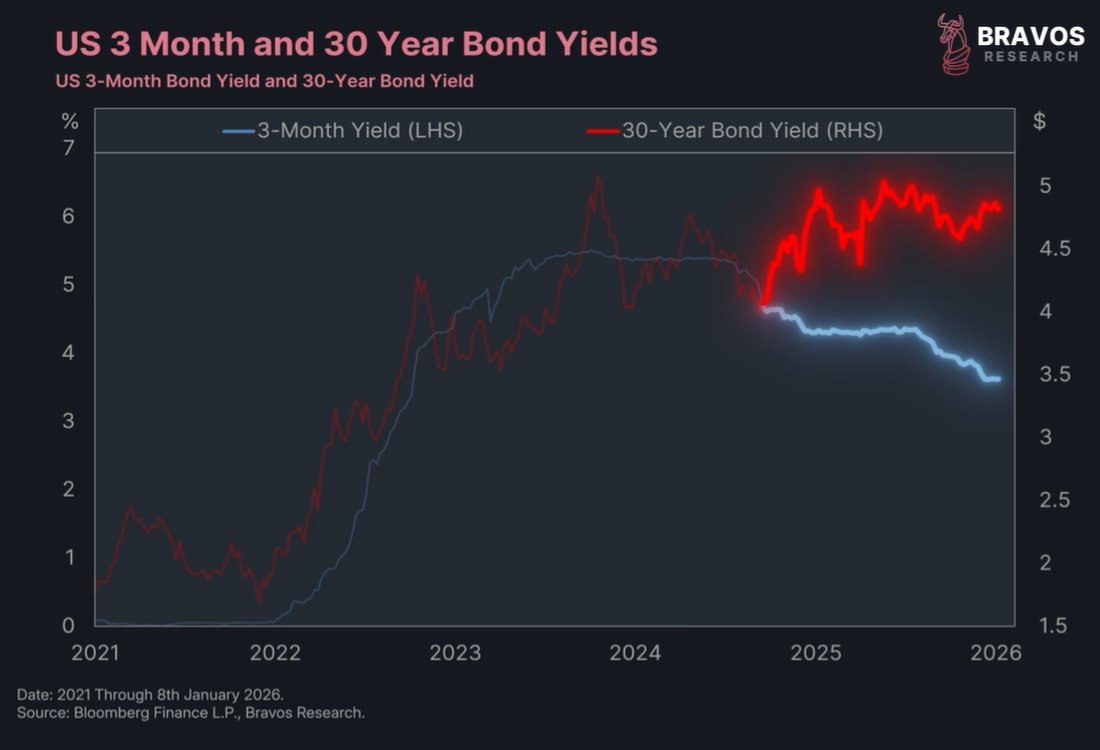

2/ US government bonds have broken below a 40-year uptrend

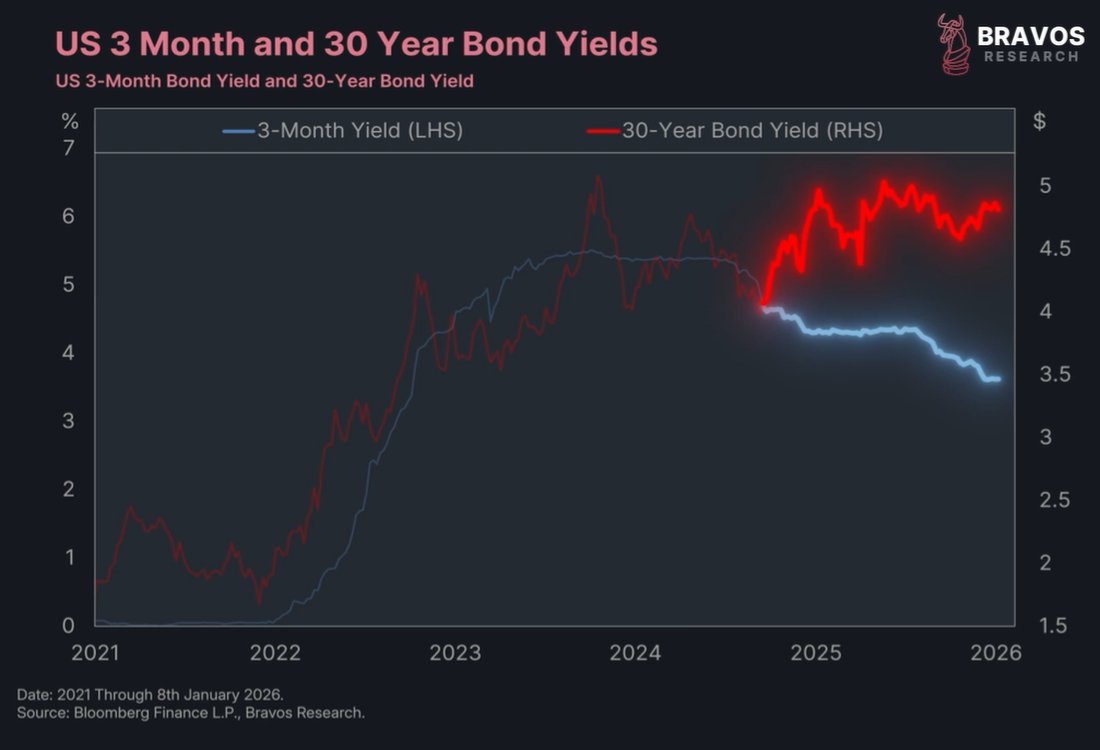

After experiencing one of the most aggressive bear market since the 1980s

After experiencing one of the most aggressive bear market since the 1980s

3/ Treasury bonds, typically 40% of an investor's portfolio, have led to significant losses because of their sharp decline

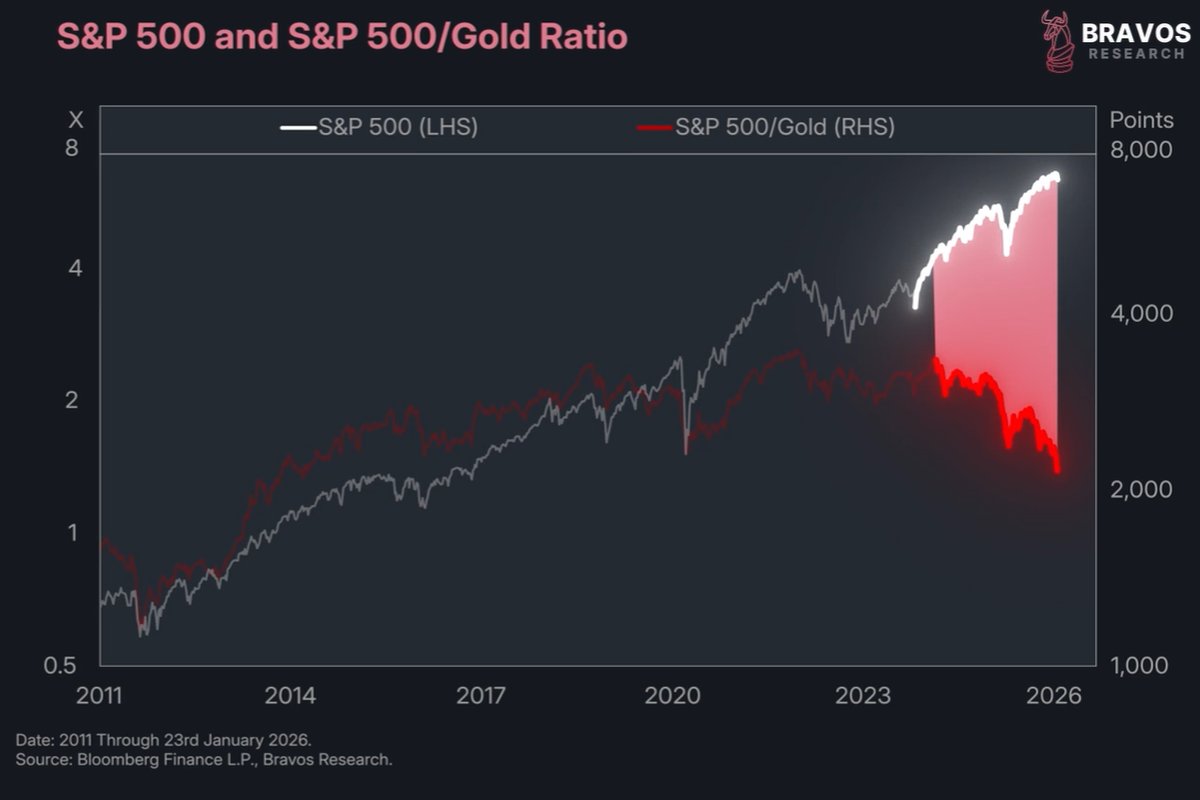

4/ Since March 2020, gold has outperformed Treasury bonds by +100% amid surging government spending

Government expenditures have risen from $3.4 trillion to almost $4 trillion in just 2 years

Government expenditures have risen from $3.4 trillion to almost $4 trillion in just 2 years

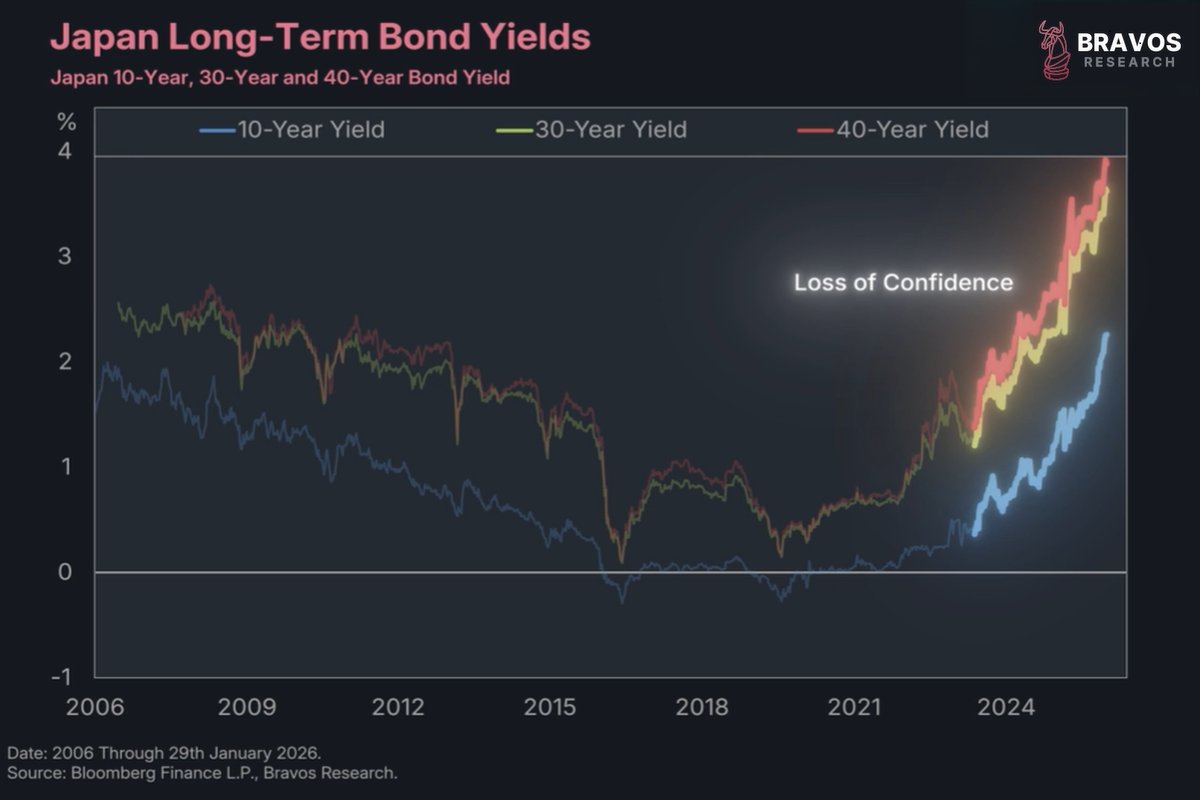

5/ Constantly rising government spending, financed by issuing more Treasury bonds, is a BIG problem

This has caused bond prices to drop significantly

This has caused bond prices to drop significantly

6/ Treasury bond issuance in 2024 is expected to hit $1.9 trillion

This level is higher than even the peak of the 2008 Financial Crisis levels

This level is higher than even the peak of the 2008 Financial Crisis levels

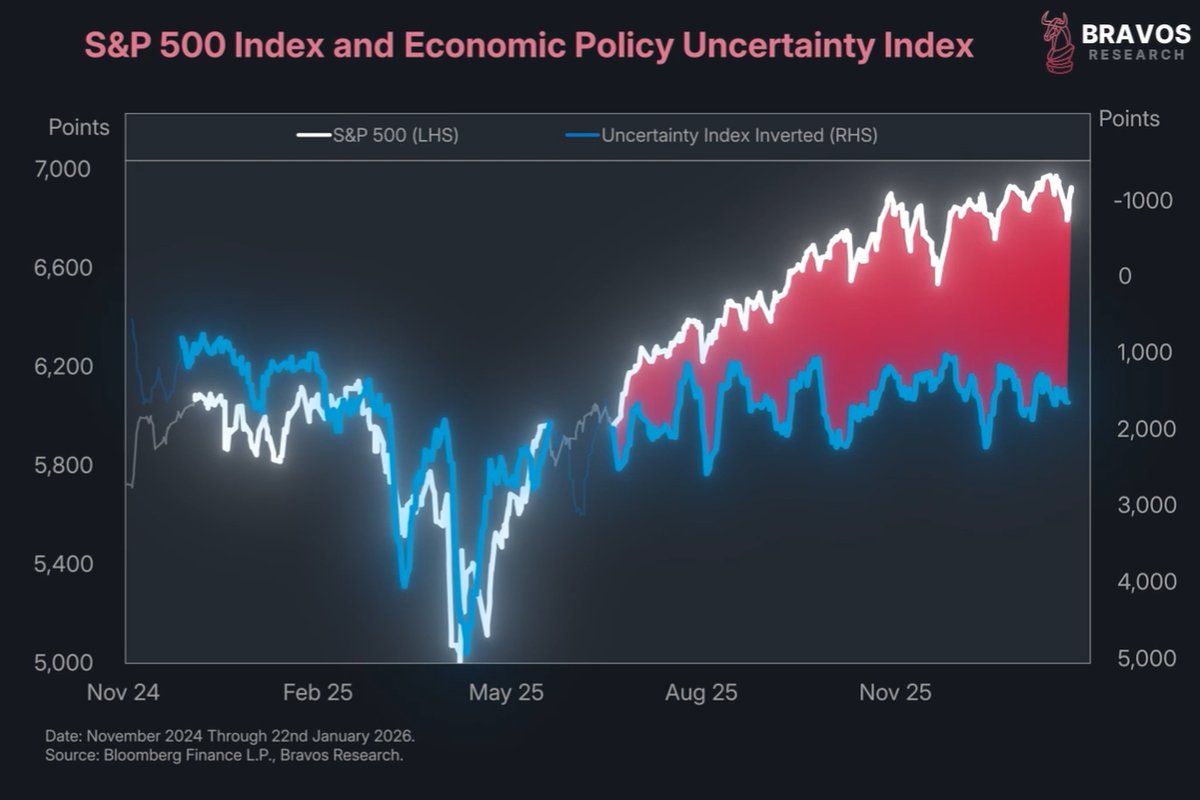

7/ Although we expect a bounce in bonds, our long-term outlook on it is bearish

You can find our latest Watchlist and all our Trade Setups with at:

bit.ly/GameofTrades

You can find our latest Watchlist and all our Trade Setups with at:

bit.ly/GameofTrades

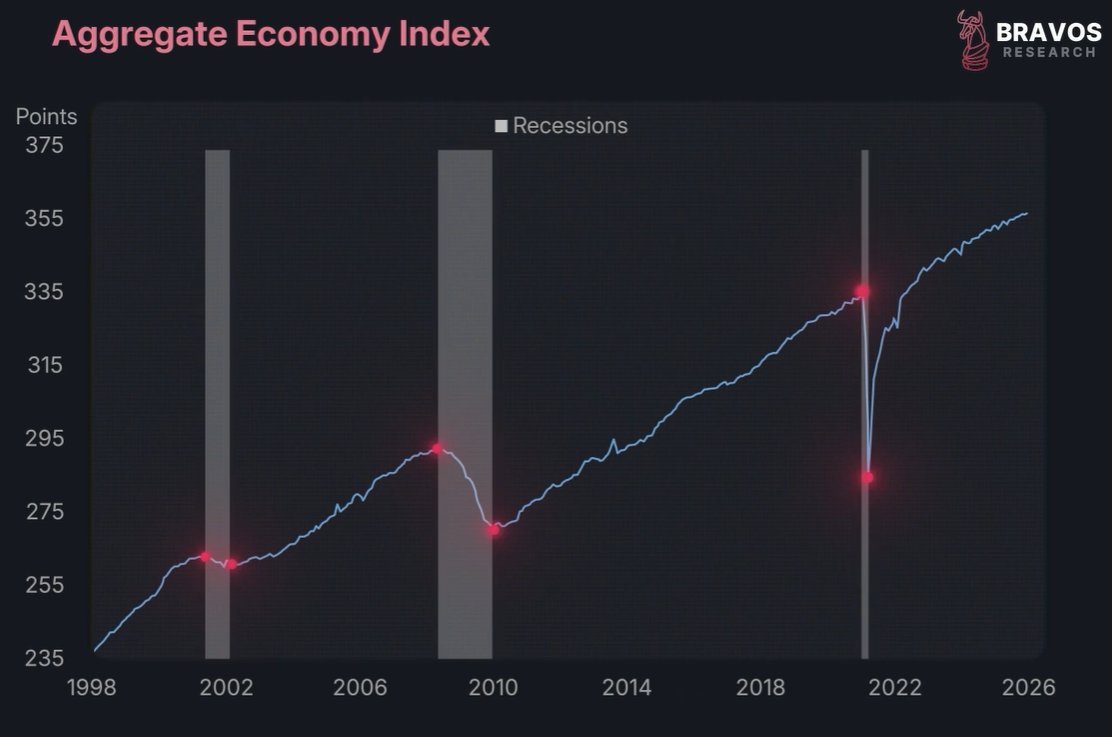

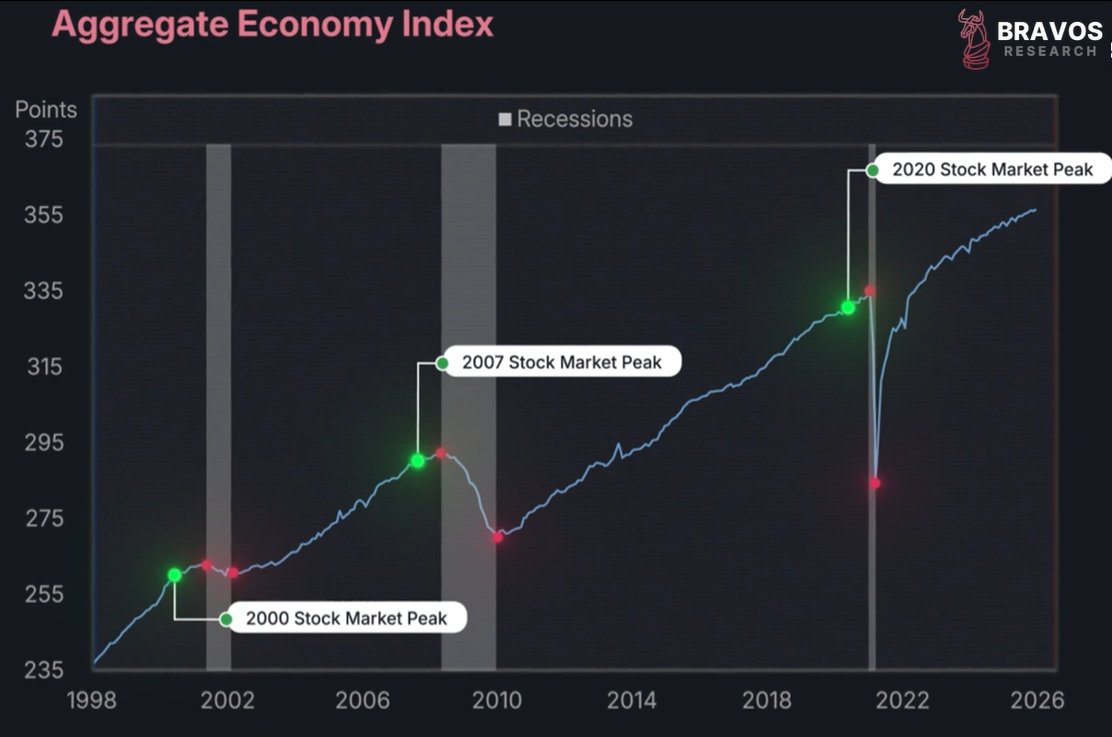

8/ A key factors that’s driving this long-term breakdown in Treasury bonds is the decline in labor force participation rate

This metric has shown a strong negative correlation to US government debt since 1999

This metric has shown a strong negative correlation to US government debt since 1999

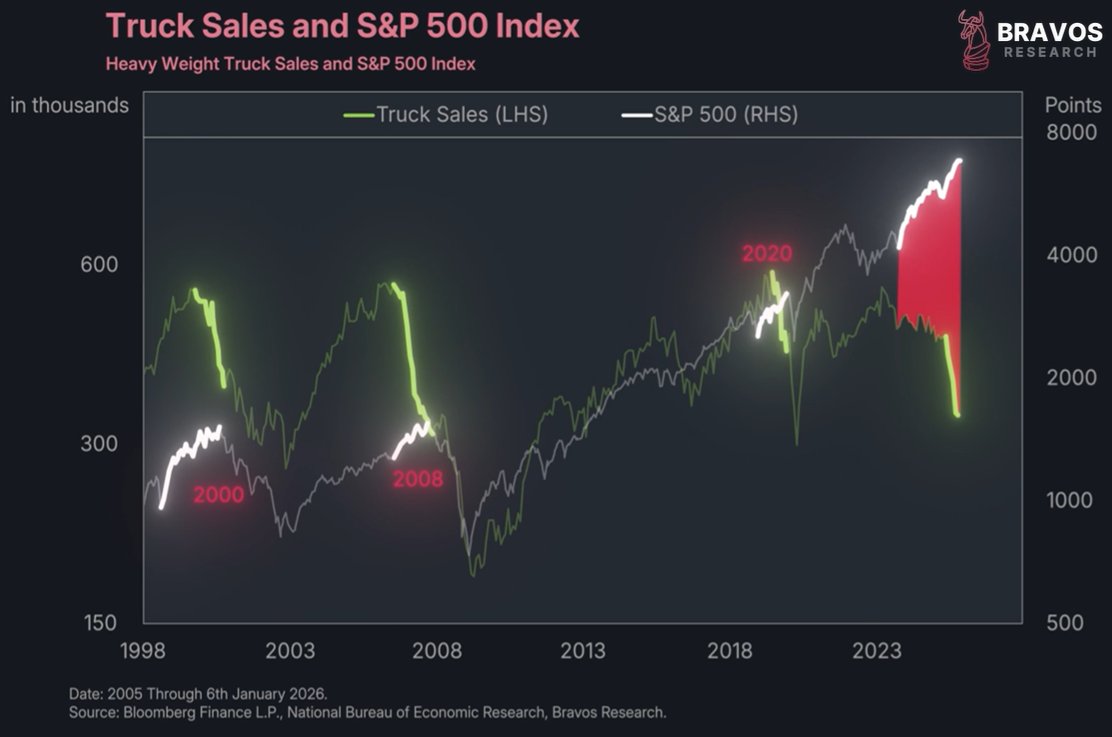

9/ The decreasing labor force participation + increasing government debt indicate economic strain

This is because of more people retiring and fewer people working

The combination has required the government to increase its spending

This is because of more people retiring and fewer people working

The combination has required the government to increase its spending

10/ With the aging US population and more people retiring

Labor force participation is likely to decline further

This would increase government debt even more, unless spending changes

Labor force participation is likely to decline further

This would increase government debt even more, unless spending changes

11/ That’s why Gold has seen a lot of bullishness

Surging +35% since Oct 2023

Our members have already secured a 22% gain on $GDX when we booked partial profits on 23rd May

And continue to hold the rest for more upside

Surging +35% since Oct 2023

Our members have already secured a 22% gain on $GDX when we booked partial profits on 23rd May

And continue to hold the rest for more upside

12/ You can check all our 2024 closed trades for FREE on our landing page

It's been a solid year for our members with an average win of 16.92% and average loss of just 3.93%

It's been a solid year for our members with an average win of 16.92% and average loss of just 3.93%

13/ Join us now for just $1.45/day to access our real-time Trade Alerts with full details:

- Long/Short position

- Allocation weight

- Entry

- Stop-loss

- Reasoning for the trade

bit.ly/GameofTrades

- Long/Short position

- Allocation weight

- Entry

- Stop-loss

- Reasoning for the trade

bit.ly/GameofTrades

14/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

https://x.com/GameofTrades_/status/1826635563908432333

• • •

Missing some Tweet in this thread? You can try to

force a refresh