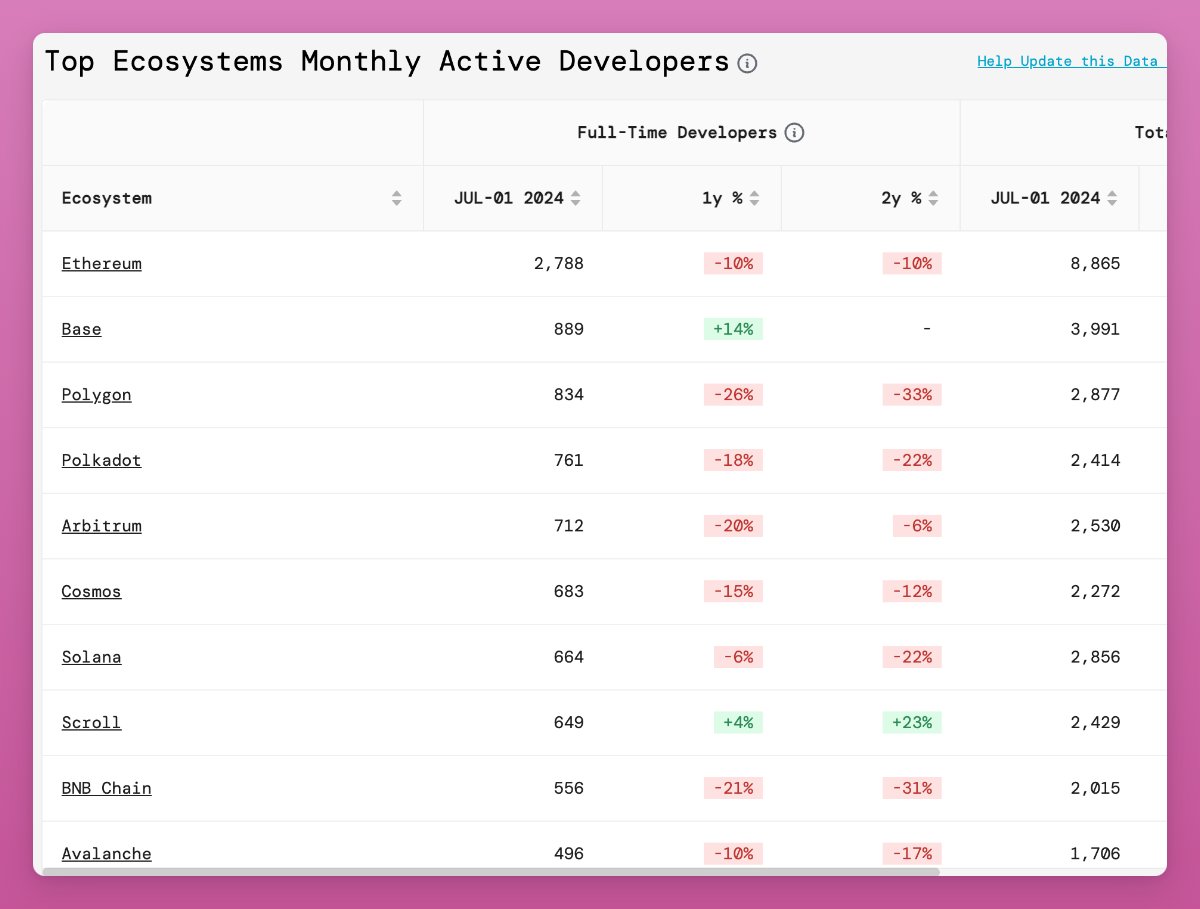

How does the Ethereum Foundation spend its ETH?

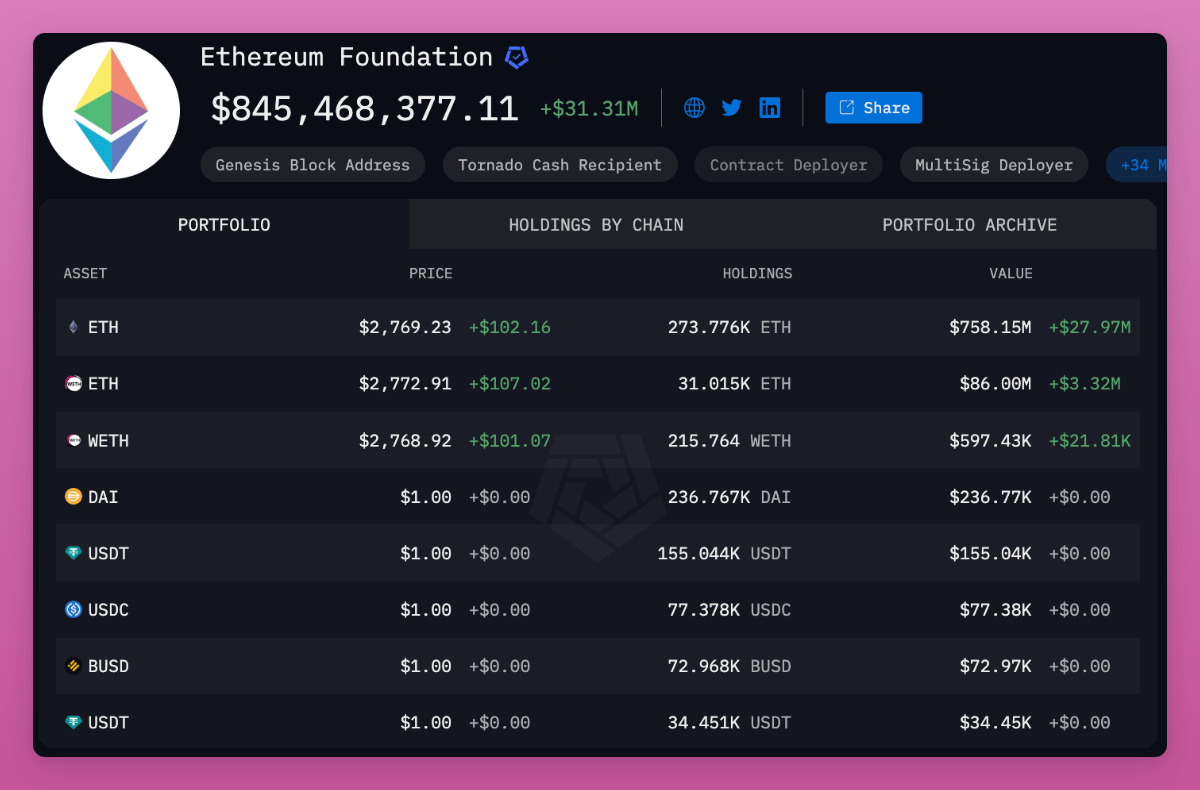

EF holds $845 million in ETH, representing 0.25% of the total ETH supply.

In 2023 Q4, EF spent $30M in grants, according to their latest report. And in Q3 2023, they allocated $8.9M in grants.

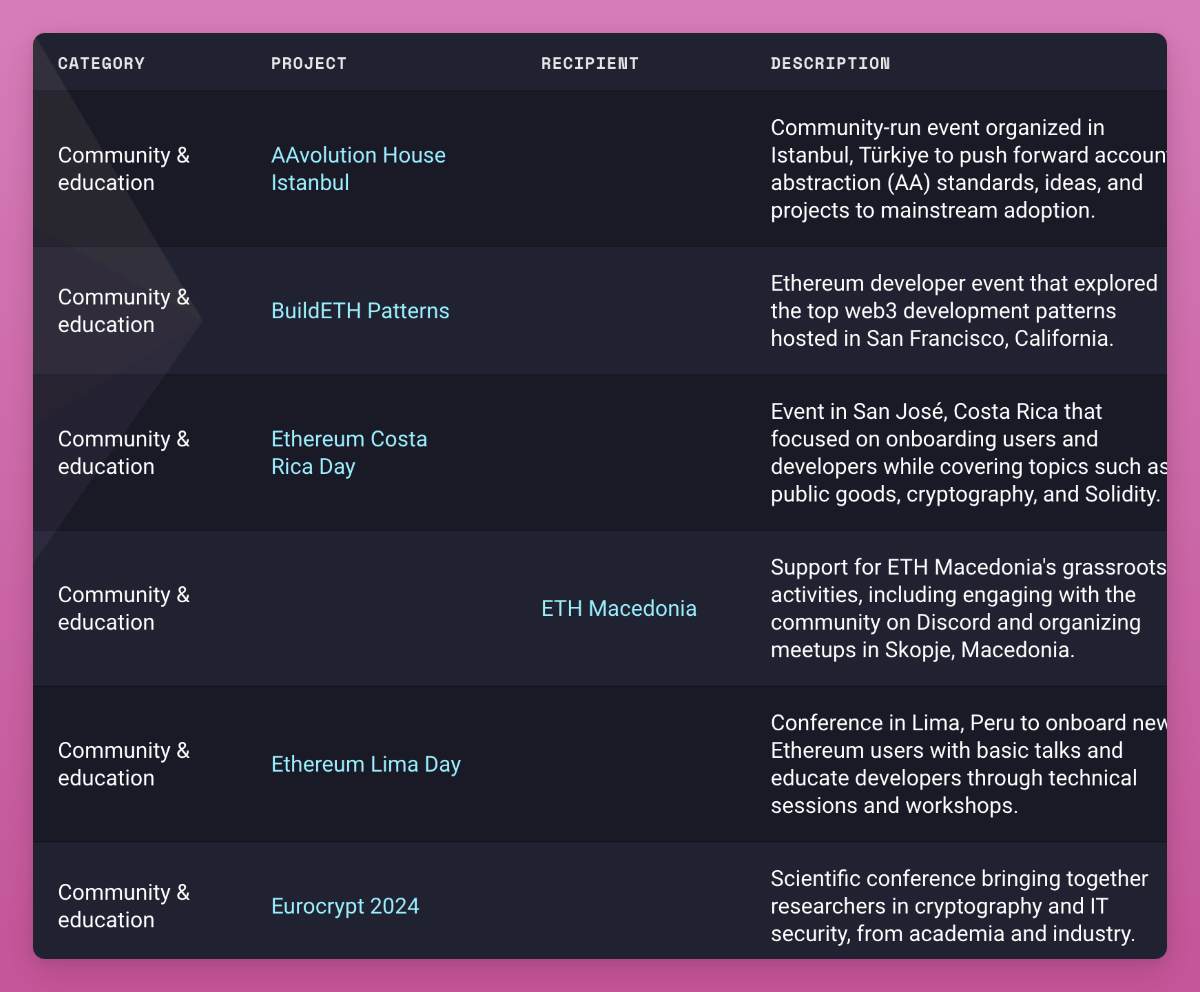

Here are some examples:

• Conferences around the world to "onboard new Ethereum users with basic talks and educate developers through technical sessions and workshops."

• Online course on core concepts and components of zero knowledge (ZK) systems.

• "Email Wallet" that lets users send crypto via email, no recipient action needed.

• "Daimo" ERC-4337 smart contract wallet: stablecoins only, non-custodial, no seed phrases needed.

It seems EF allocates grants for education and niche (but cool) products that might not get significant VC support.

It could explain their reluctance to fund DeFi protocols as they get external funding from VCs anyway.

However, there's a lack of comprehensive and transparent total expenditure reports. Who's auditing EF?

----

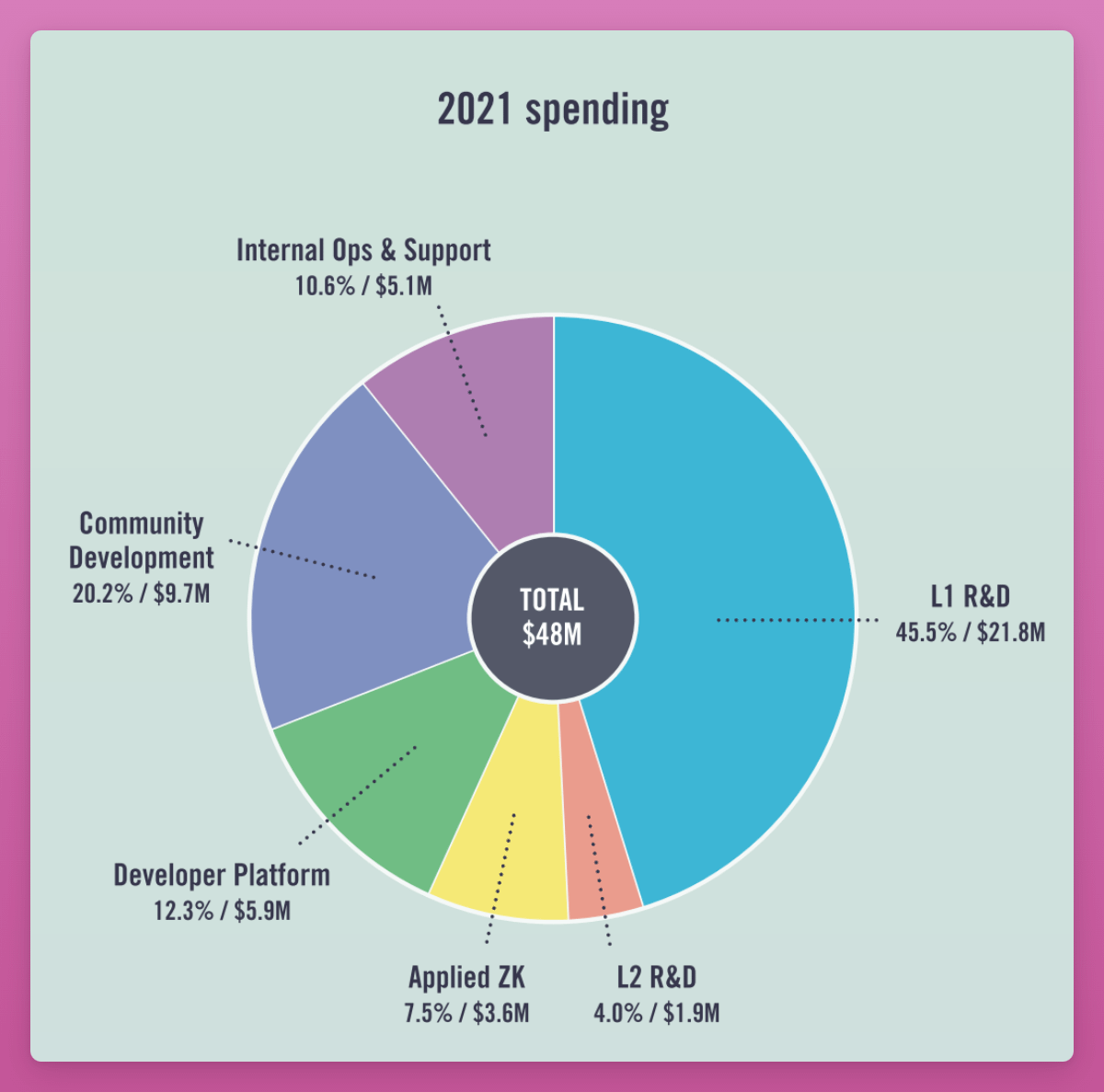

The most recent report available is for 2021, showing a total expenditure of $48M on internal expenses and external grants and bounties.

The largest expenses were:

• $21M on L1 R&D

• $9.7M on community development, including grants and education

• $5.1M on internal operations (salaries, legal fees, etc.)

So, 10% of the total expenditure in 2021 went to salaries for devs, and supporting maintaining the EF.

If I missed something, or you have updated financial report data, please let me know!

EF holds $845 million in ETH, representing 0.25% of the total ETH supply.

In 2023 Q4, EF spent $30M in grants, according to their latest report. And in Q3 2023, they allocated $8.9M in grants.

Here are some examples:

• Conferences around the world to "onboard new Ethereum users with basic talks and educate developers through technical sessions and workshops."

• Online course on core concepts and components of zero knowledge (ZK) systems.

• "Email Wallet" that lets users send crypto via email, no recipient action needed.

• "Daimo" ERC-4337 smart contract wallet: stablecoins only, non-custodial, no seed phrases needed.

It seems EF allocates grants for education and niche (but cool) products that might not get significant VC support.

It could explain their reluctance to fund DeFi protocols as they get external funding from VCs anyway.

However, there's a lack of comprehensive and transparent total expenditure reports. Who's auditing EF?

----

The most recent report available is for 2021, showing a total expenditure of $48M on internal expenses and external grants and bounties.

The largest expenses were:

• $21M on L1 R&D

• $9.7M on community development, including grants and education

• $5.1M on internal operations (salaries, legal fees, etc.)

So, 10% of the total expenditure in 2021 went to salaries for devs, and supporting maintaining the EF.

If I missed something, or you have updated financial report data, please let me know!

I must say, despite the controversy Polkadot faced over their crazy expenditure, at least the reports were transparent and here to find.

I somewhat expected a more transparent functioning and reporting from Ethereum Foundation.

I somewhat expected a more transparent functioning and reporting from Ethereum Foundation.

Just realized that EF will burn through their ETH in 8 years at a $100M annual spend.

They need the price to go up or start staking to earn yields and fund their operations longer.

They need the price to go up or start staking to earn yields and fund their operations longer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh