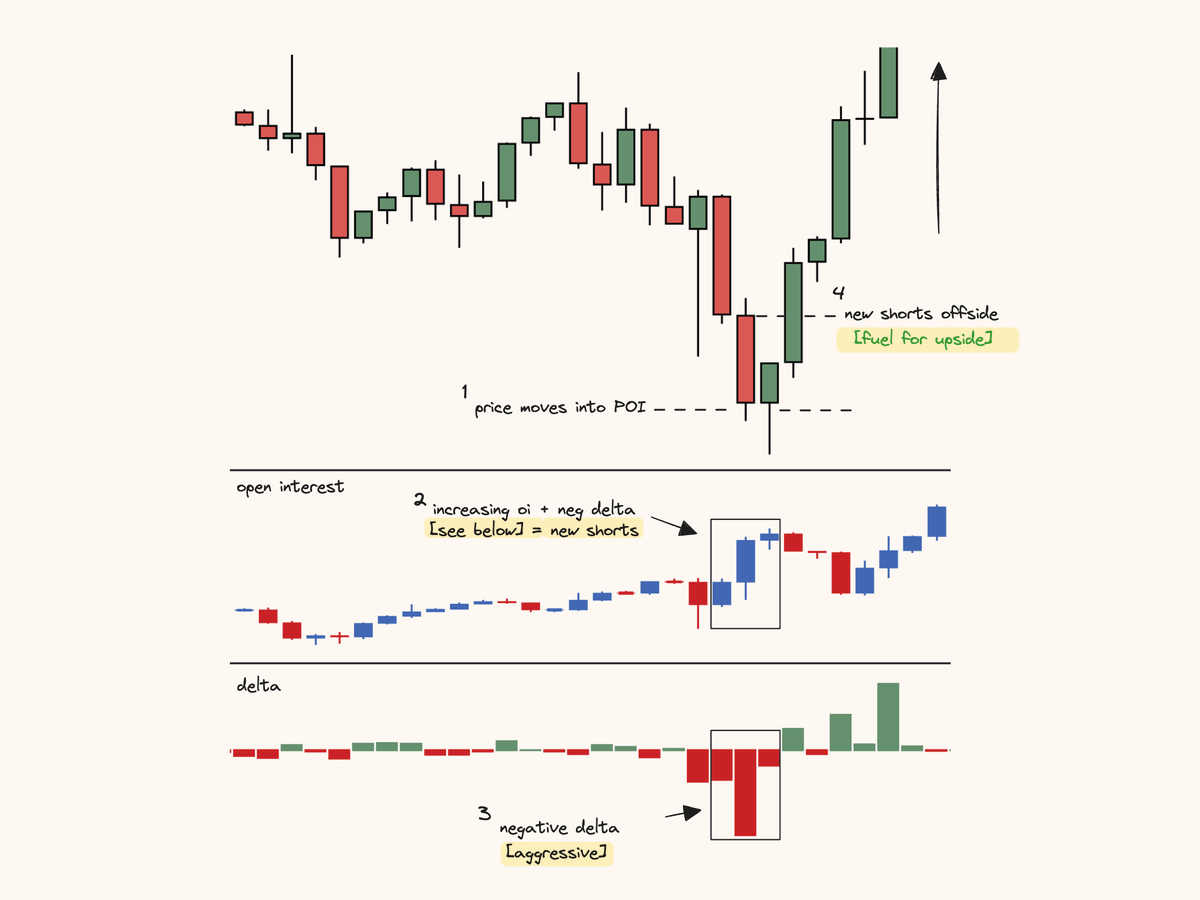

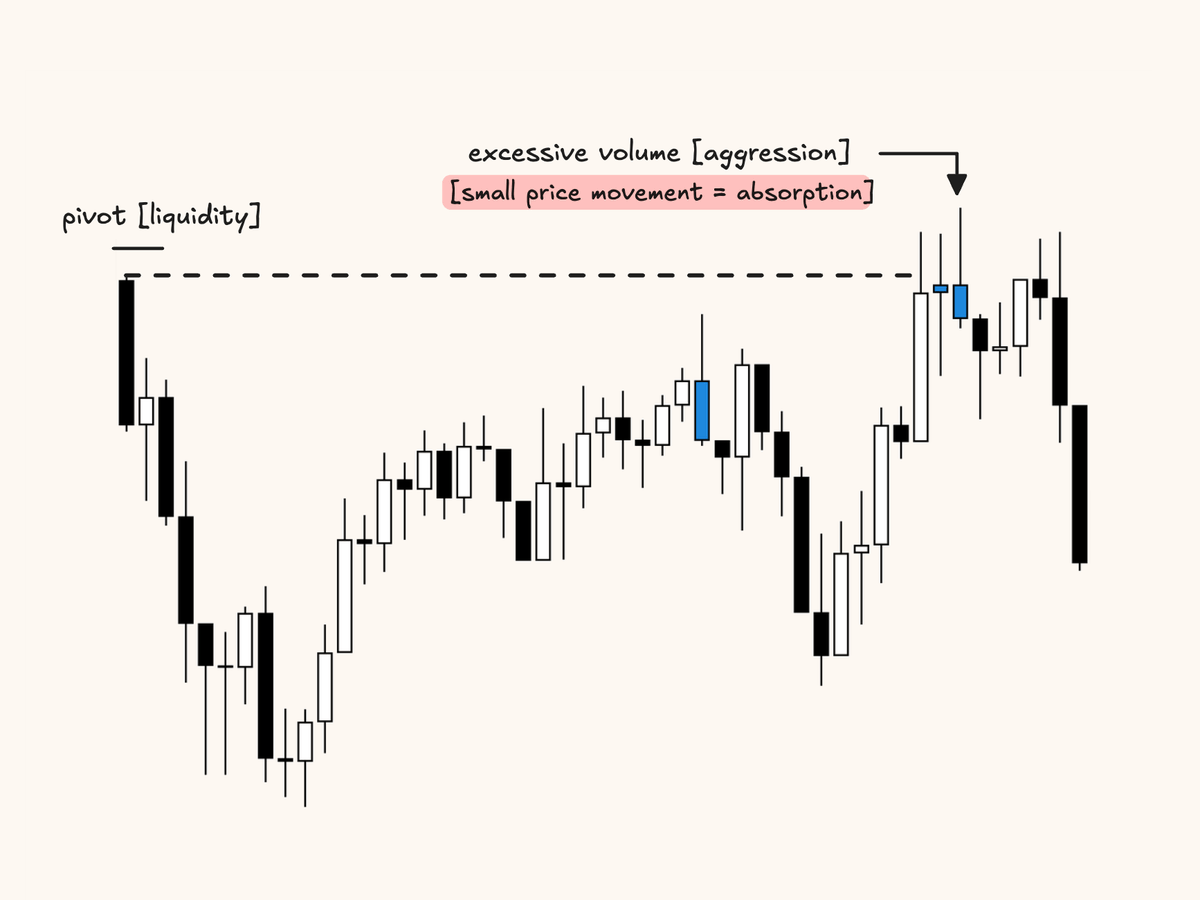

Orderflow & Footprint essentials

https://twitter.com/1468002736260235267/status/1770940317623075237

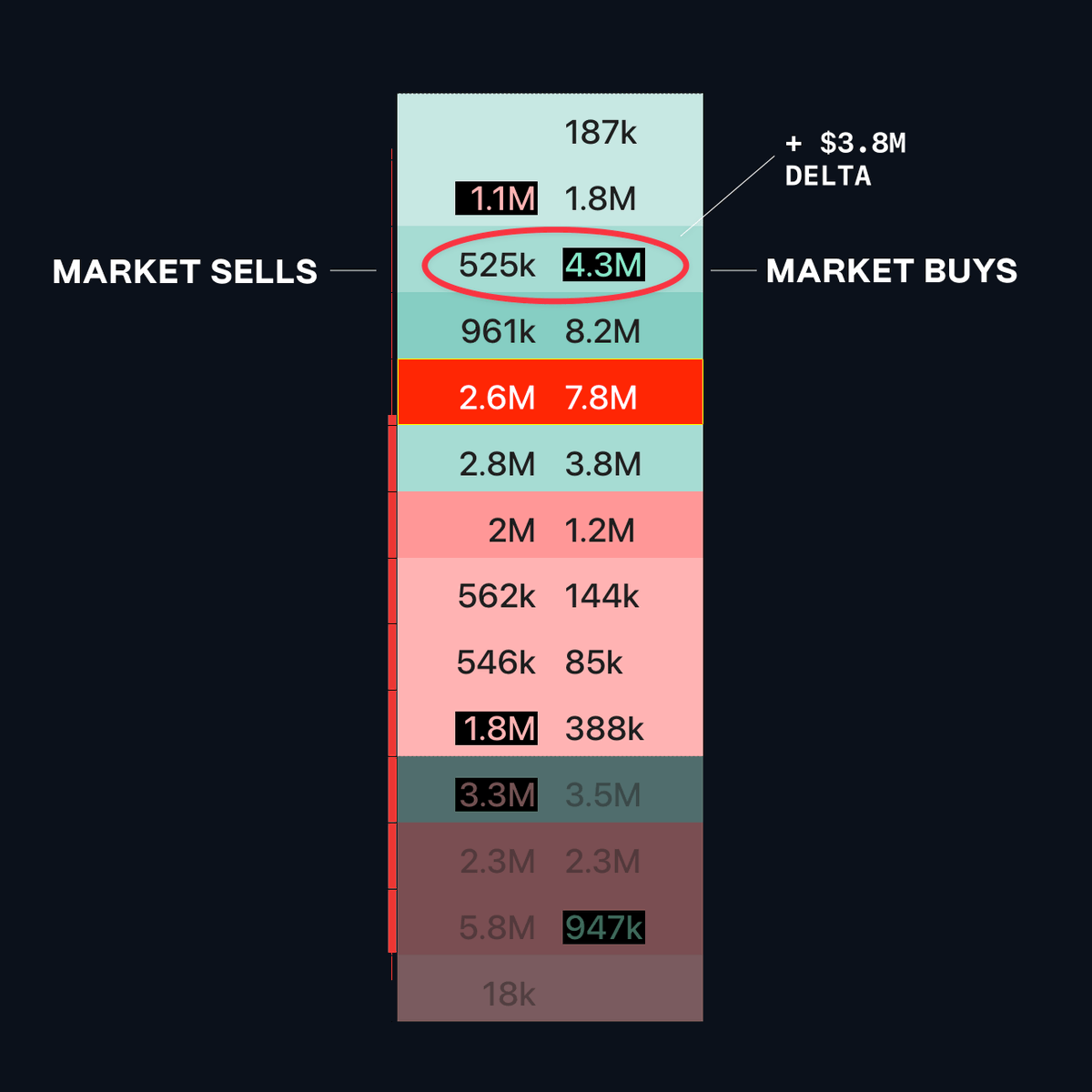

Entry triggers using Footprint charts

https://twitter.com/1468002736260235267/status/1779036177690927434

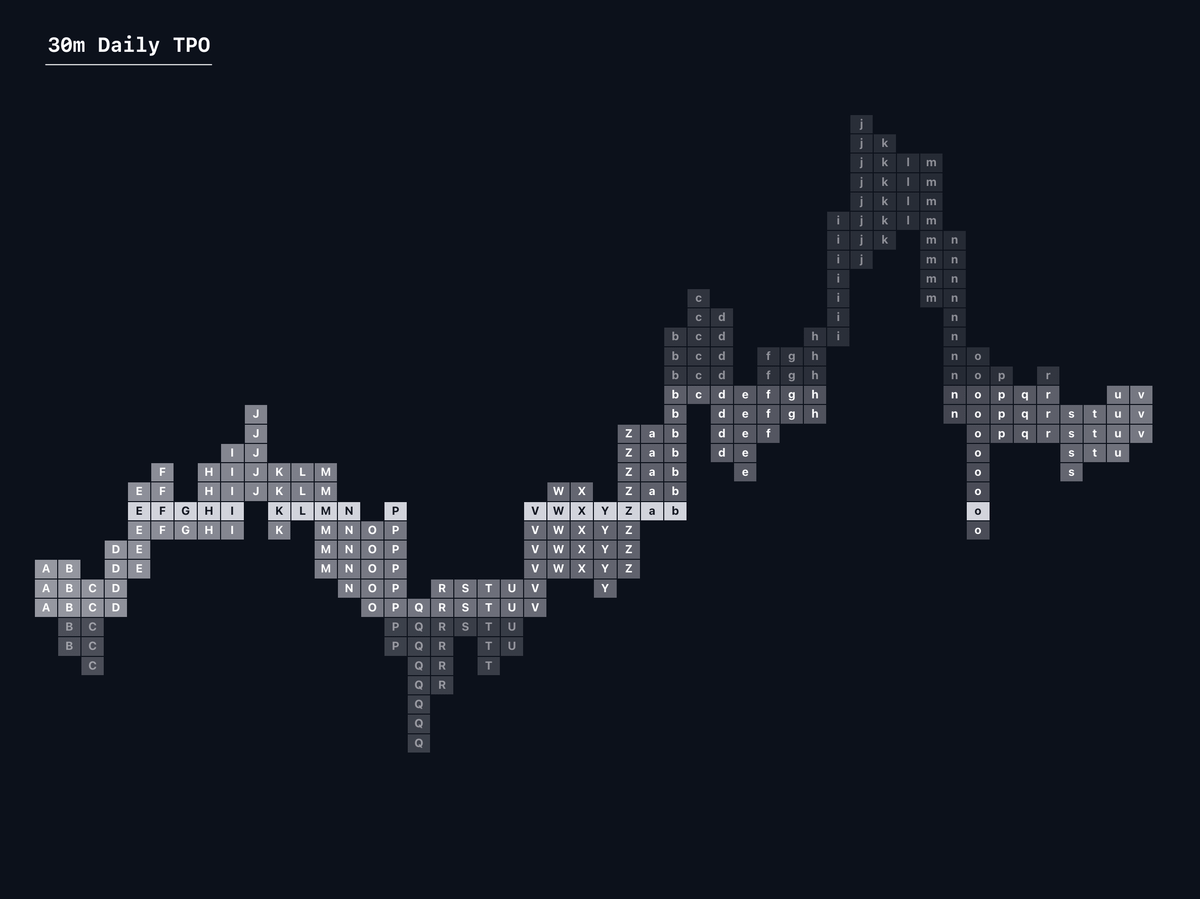

TPO & Market profile guide

https://twitter.com/1468002736260235267/status/1794307075960369272

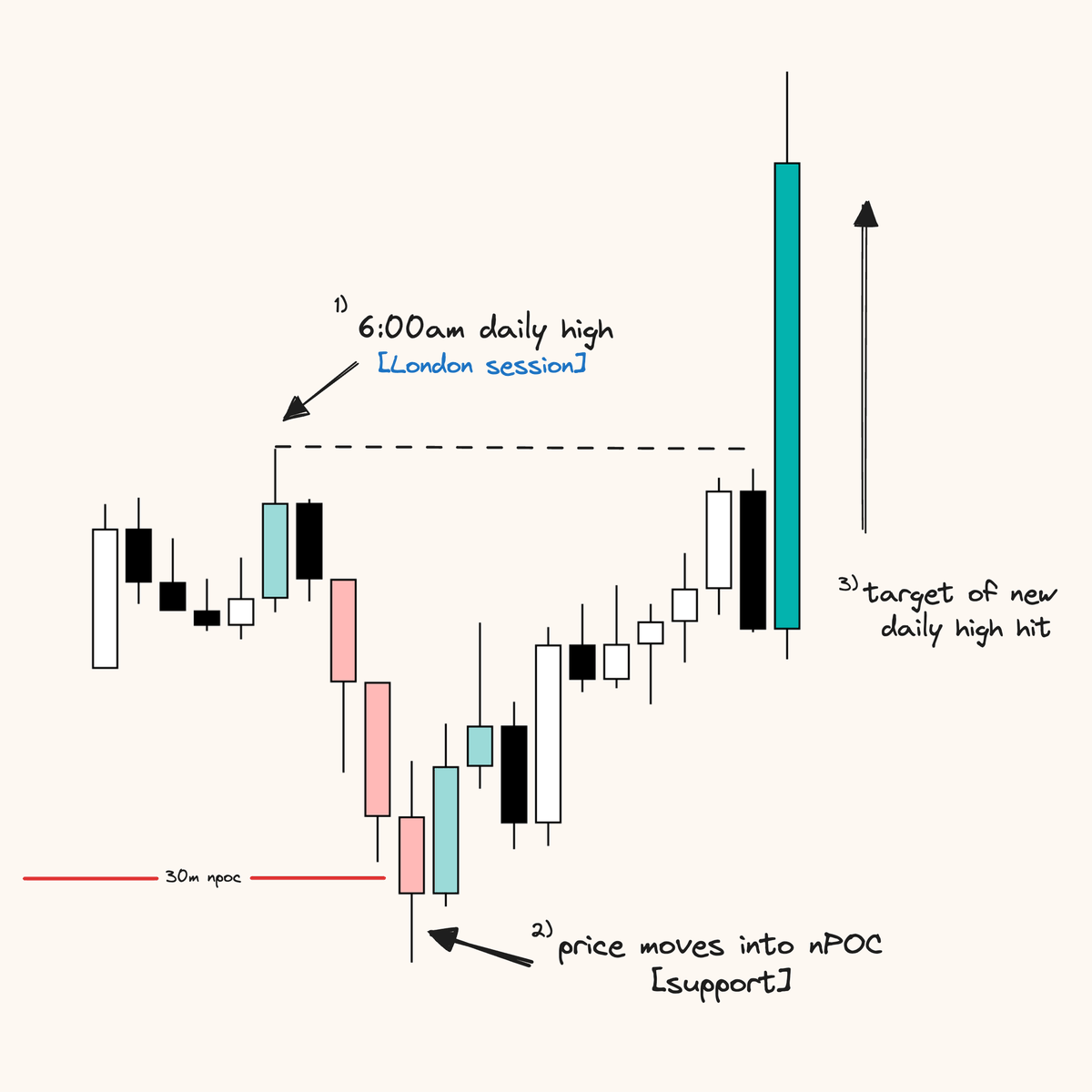

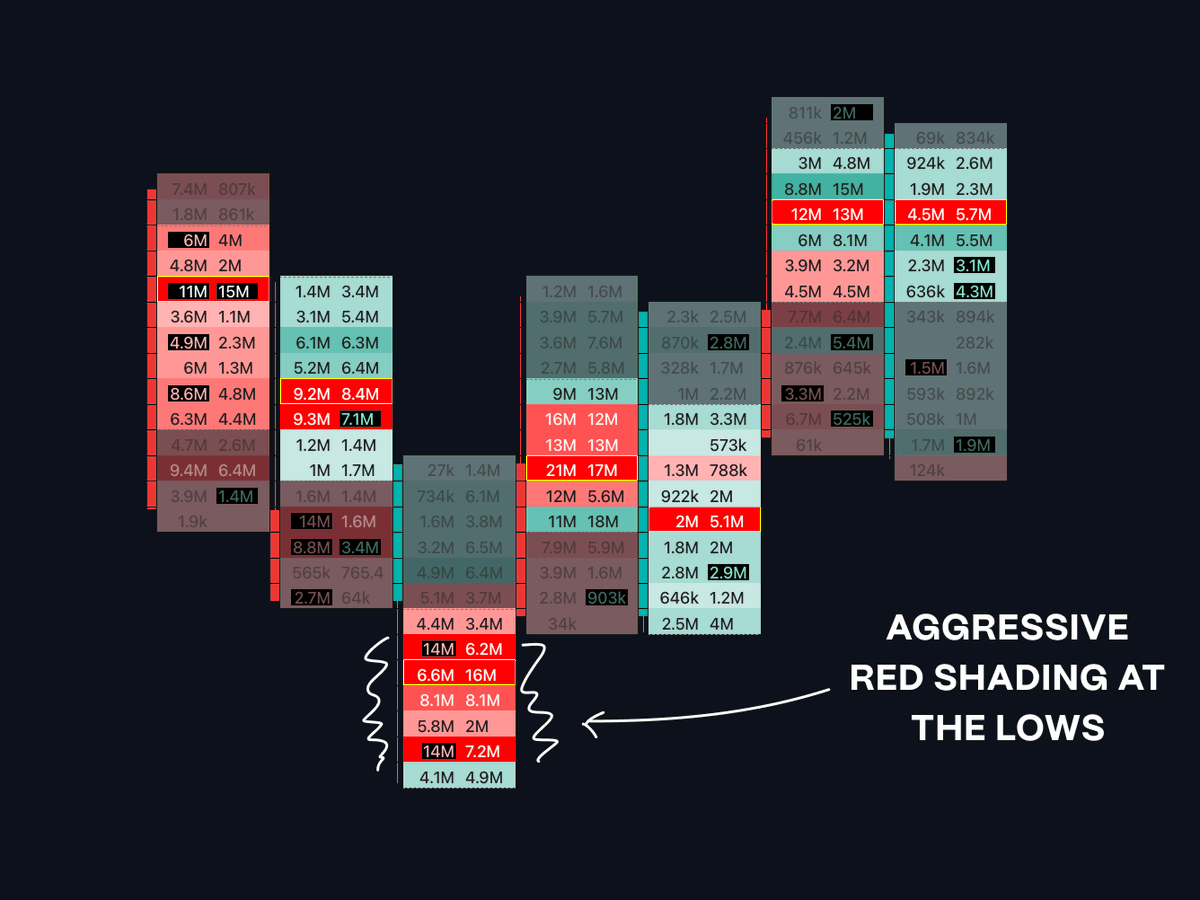

Trading with Onside Traders [footprint strategy]

https://twitter.com/1468002736260235267/status/1775801281342214488

All likes & reposts on the 1st post are appreciated.

If you find these useful be sure to bookmark 🔖 this thread for later.

Further materials [all free in my pinned post]

- footprint/tpo templates

- tradingview indicators list

- newsletter

- more videos [yt]

thank you again.

If you find these useful be sure to bookmark 🔖 this thread for later.

Further materials [all free in my pinned post]

- footprint/tpo templates

- tradingview indicators list

- newsletter

- more videos [yt]

thank you again.

• • •

Missing some Tweet in this thread? You can try to

force a refresh