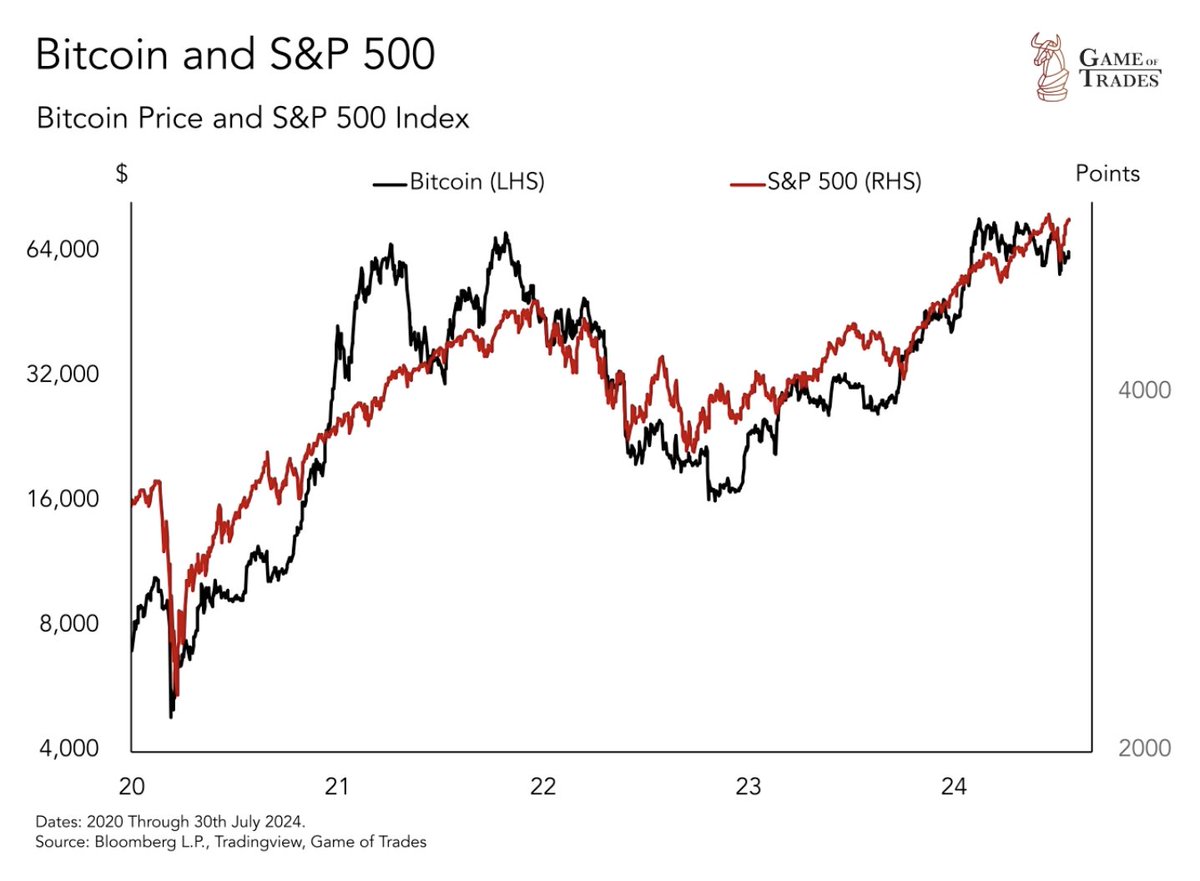

2/ Bitcoin’s trajectory typically mirrors that of the US stock market

When the S&P 500 rises, Bitcoin also climbs

Conversely, when the S&P 500 falls, Bitcoin follows suit

When the S&P 500 rises, Bitcoin also climbs

Conversely, when the S&P 500 falls, Bitcoin follows suit

3/ Bitcoin is influenced by the same factors as the stock market:

- Liquidity

- Risk-taking

- Investor optimism

- Liquidity

- Risk-taking

- Investor optimism

4/ That's why in August, when the market dropped 6% in 3 days due to recession fears

Bitcoin also fell around 30% in a short-time

Now, the market has recovered, trading near ATH’s

But, Bitcoin still remains significantly below its highs

Bitcoin also fell around 30% in a short-time

Now, the market has recovered, trading near ATH’s

But, Bitcoin still remains significantly below its highs

5/ We've discussed that the recent recession fears are likely temporary and the market's recovery was justified

Get access to 3 Premium Videos every week that cover our investment strategy

Join today and secure a 20% DISCOUNT at:

bit.ly/GameofTrades

Get access to 3 Premium Videos every week that cover our investment strategy

Join today and secure a 20% DISCOUNT at:

bit.ly/GameofTrades

6/ However, some argue that the rally is driven by a few companies, like Nvidia and Apple

Which masks the actual strength of the market

So, instead of looking at the S&P 500

Let’s consider RSP → an equal-weighted version of the S&P 500

Which masks the actual strength of the market

So, instead of looking at the S&P 500

Let’s consider RSP → an equal-weighted version of the S&P 500

7/ RSP recently:

- Broke above a downtrend line dating back to April

- Reached a new all-time high

- Has been consistently above key MA’s

This healthy structure indicates potential for further gains

- Broke above a downtrend line dating back to April

- Reached a new all-time high

- Has been consistently above key MA’s

This healthy structure indicates potential for further gains

8/ If the RSP moves higher, Bitcoin is likely to follow

Right now, there's a noticeable gap between Bitcoin and RSP

But this divergence could be similar to early 2024 when Bitcoin eventually caught up

Right now, there's a noticeable gap between Bitcoin and RSP

But this divergence could be similar to early 2024 when Bitcoin eventually caught up

9/ View all our closed crypto trades for FREE on our website

We actively scan the crypto market for attractive opportunities

Large volatility brings the potential for massive returns

But only if you manage your risk well

We actively scan the crypto market for attractive opportunities

Large volatility brings the potential for massive returns

But only if you manage your risk well

10/ Our strict & selective crypto trading has brought success to our clients

In 2024, our avg. crypto win is 15.97% and avg. crypto loss is only 1.74%

Get 20% OFF your membership today to get all our real-time Crypto and other assets’ Trade Alerts at:

bit.ly/GameofTrades

In 2024, our avg. crypto win is 15.97% and avg. crypto loss is only 1.74%

Get 20% OFF your membership today to get all our real-time Crypto and other assets’ Trade Alerts at:

bit.ly/GameofTrades

11/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @gameoftrades_ for more market insights, finance and investment strategies

https://x.com/GameofTrades_/status/1828415996329390464

• • •

Missing some Tweet in this thread? You can try to

force a refresh