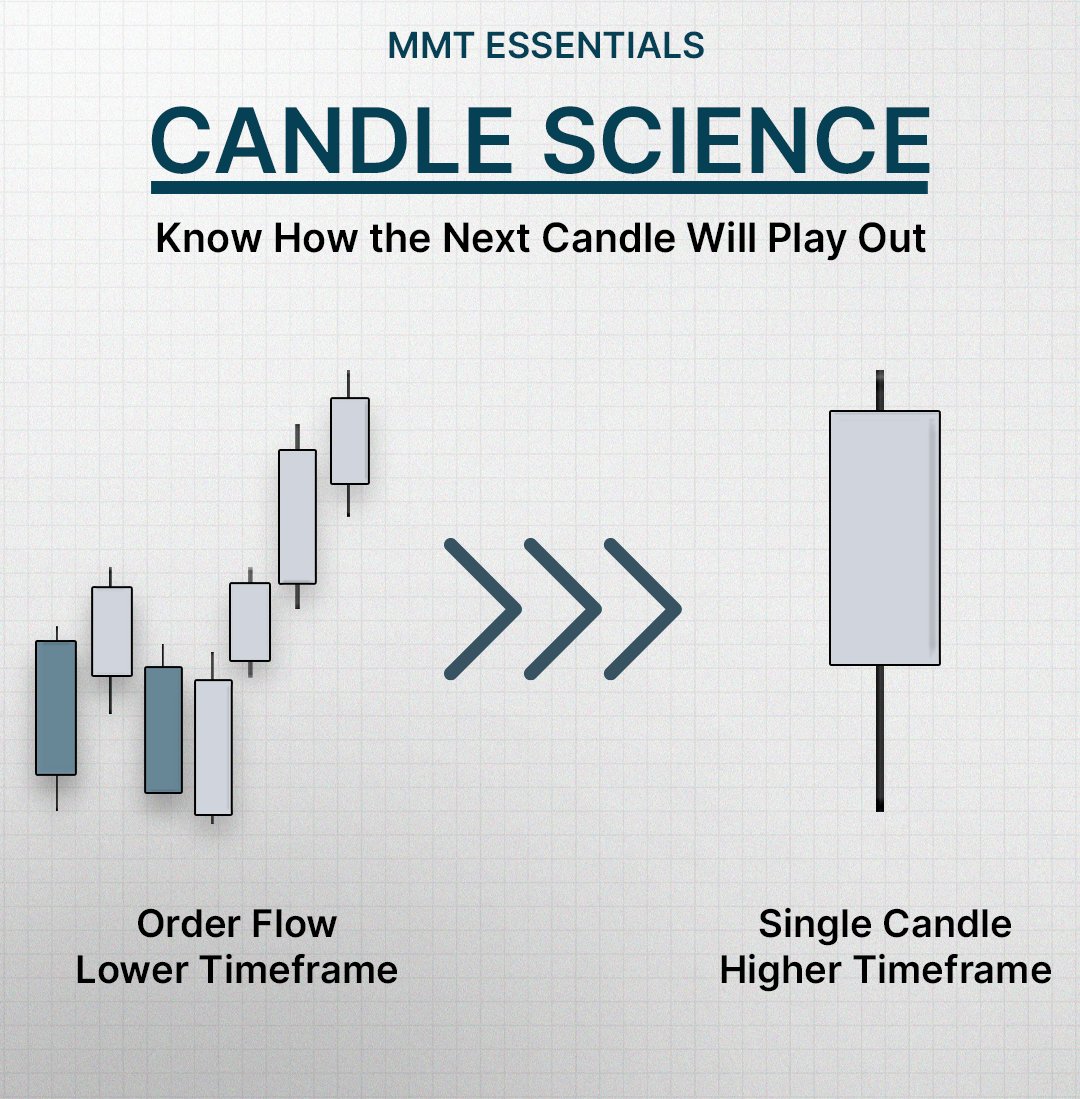

𝐍𝐚𝐫𝐫𝐚𝐭𝐢𝐯𝐞 𝐢𝐬 𝐭𝐡𝐞 𝐏𝐃 𝐀𝐫𝐫𝐚𝐲 𝐟𝐫𝐨𝐦 𝐰𝐡𝐞𝐫𝐞 𝐰𝐞 𝐜𝐚𝐧 𝐭𝐫𝐚𝐝𝐞 𝐡𝐢𝐠𝐡𝐞𝐫/𝐥𝐨𝐰𝐞𝐫 𝐢𝐧 𝐭𝐡𝐞 𝐝𝐢𝐫𝐞𝐜𝐭𝐢𝐨𝐧 𝐨𝐟 𝐭𝐡𝐞 𝐏𝐃 𝐀𝐫𝐫𝐚𝐲 𝐰𝐞 𝐰𝐚𝐧𝐭 𝐭𝐨 𝐭𝐫𝐚𝐝𝐞 𝐭𝐨𝐰𝐚𝐫𝐝𝐬

An order flow leg shows us the PD array to trade from and the PD array to trade towards

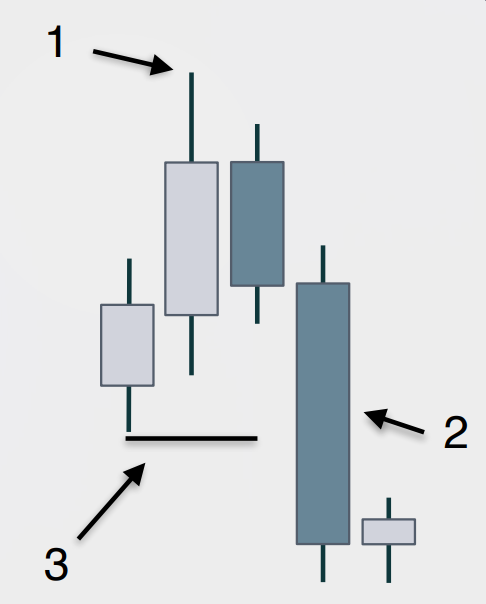

The order flow leg has all 3 PD Arrays:

1) 𝑆𝑤𝑖𝑛𝑔 𝑃𝑜𝑖𝑛𝑡𝑠

2) 𝐹𝑎𝑖𝑟 𝑉𝑎𝑙𝑢𝑒 𝐺𝑎𝑝

3) 𝐹𝑎𝑖𝑟 𝑉𝑎𝑙𝑢𝑒 𝐴𝑟𝑒𝑎

Price could retrace to any of the PD arrays in the order flow leg. 𝐇𝐨𝐰𝐞𝐯𝐞𝐫, 𝐭𝐡𝐞 𝐩𝐫𝐨𝐛𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐟𝐨𝐫 𝐞𝐚𝐜𝐡 𝐏𝐃 𝐚𝐫𝐫𝐚𝐲 𝐝𝐢𝐟𝐟𝐞𝐫𝐬

Our job is to find the PD array with a higher probability to trade from in the order flow leg so that the odds for profitability are in our favor

To find the highest probability narrative, let us discuss the three lines of defense🛡️

The order flow leg has all 3 PD Arrays:

1) 𝑆𝑤𝑖𝑛𝑔 𝑃𝑜𝑖𝑛𝑡𝑠

2) 𝐹𝑎𝑖𝑟 𝑉𝑎𝑙𝑢𝑒 𝐺𝑎𝑝

3) 𝐹𝑎𝑖𝑟 𝑉𝑎𝑙𝑢𝑒 𝐴𝑟𝑒𝑎

Price could retrace to any of the PD arrays in the order flow leg. 𝐇𝐨𝐰𝐞𝐯𝐞𝐫, 𝐭𝐡𝐞 𝐩𝐫𝐨𝐛𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐟𝐨𝐫 𝐞𝐚𝐜𝐡 𝐏𝐃 𝐚𝐫𝐫𝐚𝐲 𝐝𝐢𝐟𝐟𝐞𝐫𝐬

Our job is to find the PD array with a higher probability to trade from in the order flow leg so that the odds for profitability are in our favor

To find the highest probability narrative, let us discuss the three lines of defense🛡️

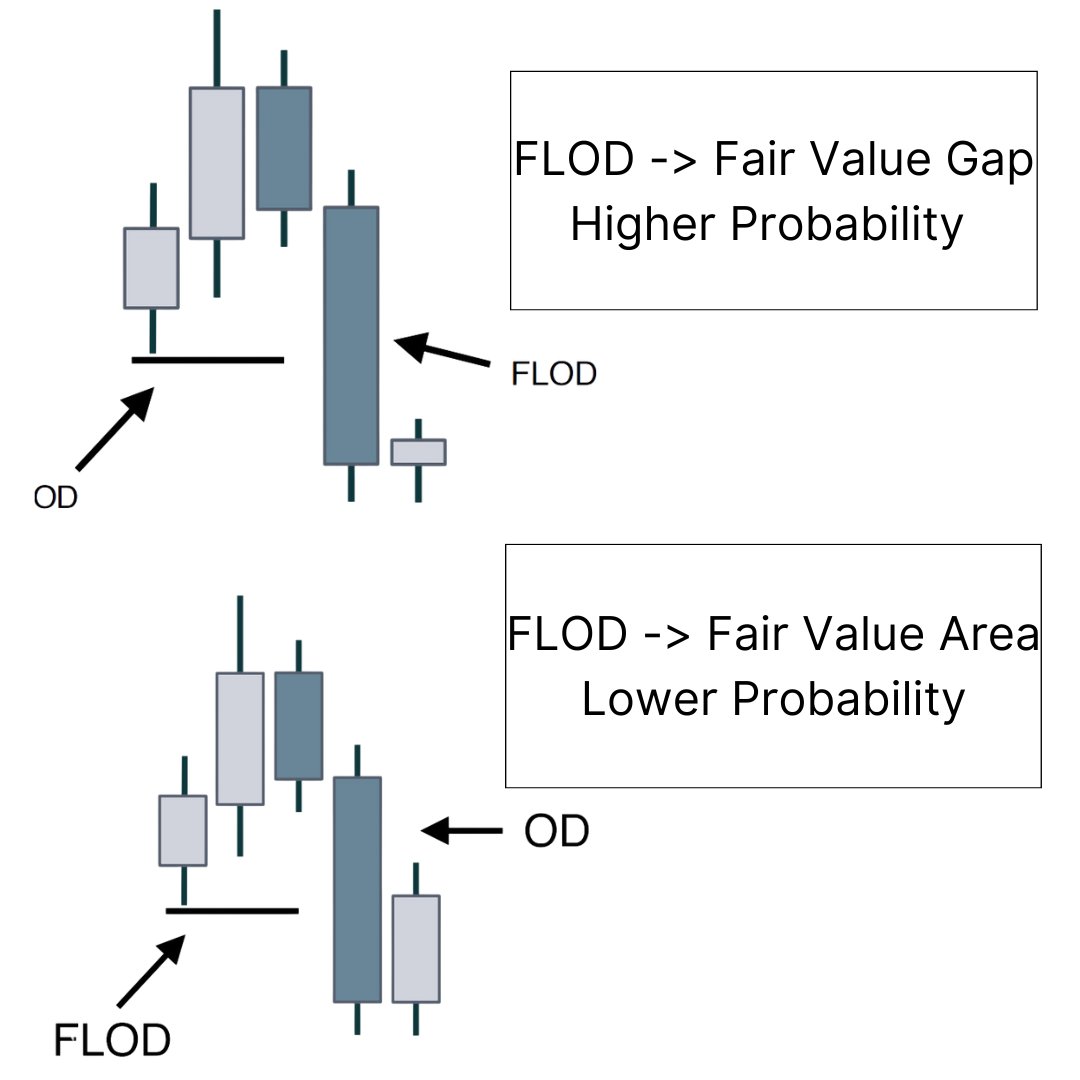

𝐅𝐢𝐫𝐬𝐭 𝐥𝐢𝐧𝐞 𝐨𝐟 𝐃𝐞𝐟𝐞𝐧𝐬𝐞🛡️

𝑊ℎ𝑒𝑛 𝑝𝑟𝑖𝑐𝑒 𝑟𝑒𝑡𝑟𝑎𝑐𝑒𝑠 𝑖𝑛𝑡𝑜 𝑎𝑛 𝑜𝑟𝑑𝑒𝑟 𝑓𝑙𝑜𝑤 𝑙𝑒𝑔, 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑃𝐷 𝑎𝑟𝑟𝑎𝑦 𝑖𝑡 𝑒𝑛𝑐𝑜𝑢𝑛𝑡𝑒𝑟𝑠 𝑖𝑠 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑙𝑖𝑛𝑒 𝑜𝑓 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

The highest probability scenario to trade from the FLOD is when the FLOD is a Fair Value Gap✅

When the FLOD is a Fair Value Area (FVA), it has a lower probability than an FVG as we can see in the picture that there is a recent bullish momentum going against us⛔

𝑊ℎ𝑒𝑛 𝑝𝑟𝑖𝑐𝑒 𝑟𝑒𝑡𝑟𝑎𝑐𝑒𝑠 𝑖𝑛𝑡𝑜 𝑎𝑛 𝑜𝑟𝑑𝑒𝑟 𝑓𝑙𝑜𝑤 𝑙𝑒𝑔, 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑃𝐷 𝑎𝑟𝑟𝑎𝑦 𝑖𝑡 𝑒𝑛𝑐𝑜𝑢𝑛𝑡𝑒𝑟𝑠 𝑖𝑠 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑙𝑖𝑛𝑒 𝑜𝑓 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

The highest probability scenario to trade from the FLOD is when the FLOD is a Fair Value Gap✅

When the FLOD is a Fair Value Area (FVA), it has a lower probability than an FVG as we can see in the picture that there is a recent bullish momentum going against us⛔

𝐎𝐯𝐞𝐫𝐥𝐚𝐩𝐩𝐢𝐧𝐠 𝐃𝐞𝐟𝐞𝐧𝐬𝐞🛡️

𝑇ℎ𝑒 𝑎𝑟𝑒𝑎 𝑤ℎ𝑒𝑟𝑒 𝑝𝑟𝑖𝑐𝑒 𝑓𝑖𝑟𝑠𝑡 𝑟𝑒𝑡𝑟𝑎𝑐𝑒𝑠 𝑖𝑛𝑡𝑜 𝑡ℎ𝑒 𝑜𝑣𝑒𝑟𝑙𝑎𝑝𝑝𝑖𝑛𝑔 𝑜𝑓 𝑡𝑤𝑜 𝑃𝐷 𝐴𝑟𝑟𝑎𝑦𝑠 𝑖𝑠 𝑡𝑒𝑟𝑚𝑒𝑑 𝑡ℎ𝑒 𝑜𝑣𝑒𝑟𝑙𝑎𝑝𝑝𝑖𝑛𝑔 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

The highest probability scenario to trade from the OD is when it is a Fair Value Area because price has no reason to retrace above the FVA as they have already been offered fair value✅

A Fair Value Gap as OD is a probable narrative compared to the FVA⛔

Remember, we want to identify the highest probable scenario to remain profitable in the long run

𝑇ℎ𝑒 𝑎𝑟𝑒𝑎 𝑤ℎ𝑒𝑟𝑒 𝑝𝑟𝑖𝑐𝑒 𝑓𝑖𝑟𝑠𝑡 𝑟𝑒𝑡𝑟𝑎𝑐𝑒𝑠 𝑖𝑛𝑡𝑜 𝑡ℎ𝑒 𝑜𝑣𝑒𝑟𝑙𝑎𝑝𝑝𝑖𝑛𝑔 𝑜𝑓 𝑡𝑤𝑜 𝑃𝐷 𝐴𝑟𝑟𝑎𝑦𝑠 𝑖𝑠 𝑡𝑒𝑟𝑚𝑒𝑑 𝑡ℎ𝑒 𝑜𝑣𝑒𝑟𝑙𝑎𝑝𝑝𝑖𝑛𝑔 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

The highest probability scenario to trade from the OD is when it is a Fair Value Area because price has no reason to retrace above the FVA as they have already been offered fair value✅

A Fair Value Gap as OD is a probable narrative compared to the FVA⛔

Remember, we want to identify the highest probable scenario to remain profitable in the long run

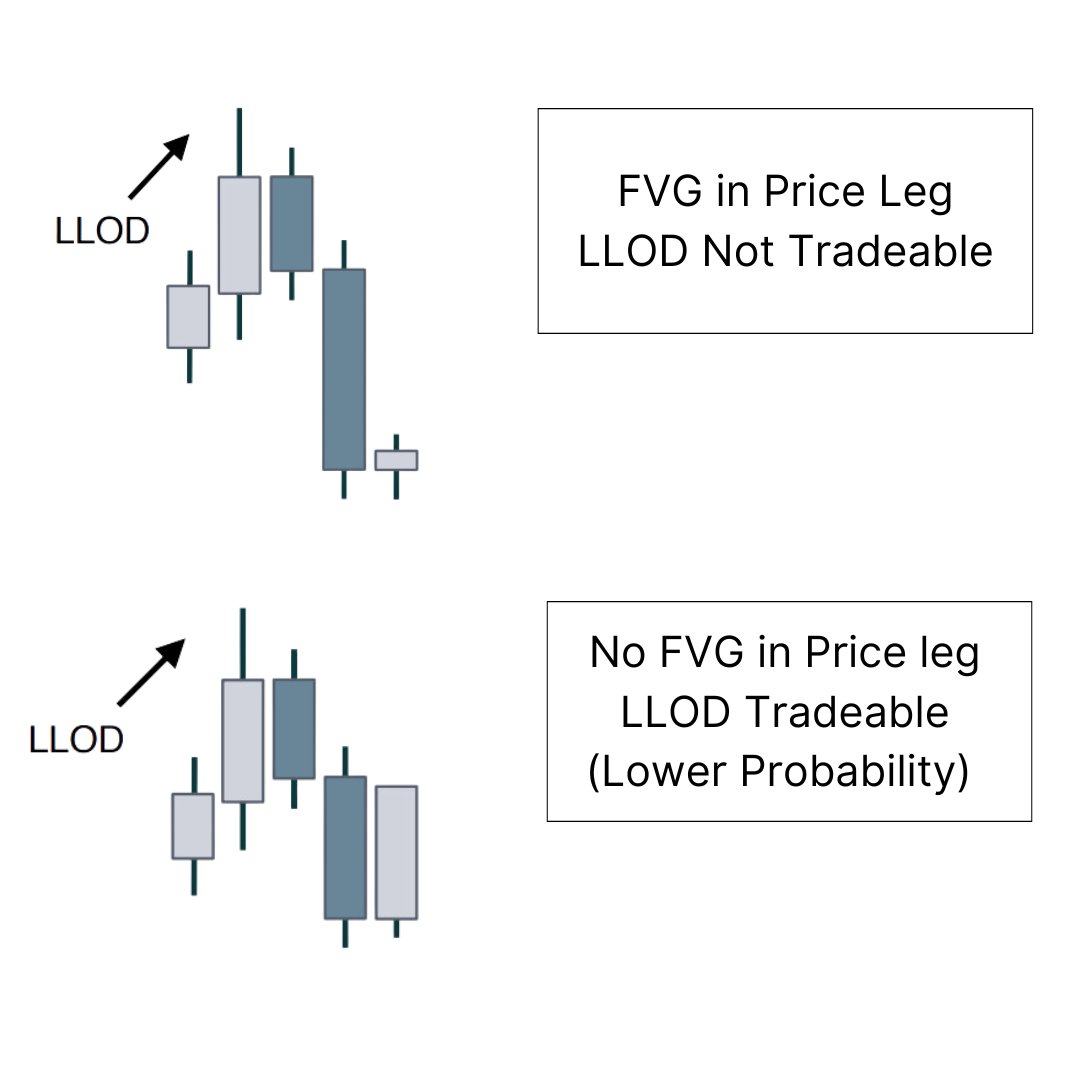

𝐋𝐚𝐬𝐭 𝐥𝐢𝐧𝐞 𝐨𝐟 𝐃𝐞𝐟𝐞𝐧𝐬𝐞🛡️

𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑃𝐷 𝑎𝑟𝑟𝑎𝑦 𝑡ℎ𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 𝑤𝑖𝑙𝑙 𝑟𝑒𝑡𝑟𝑎𝑐𝑒 𝑡𝑜 𝑠𝑡𝑖𝑙𝑙 𝑐𝑜𝑛𝑡𝑖𝑛𝑢𝑒 𝑙𝑜𝑤𝑒𝑟/ℎ𝑖𝑔ℎ𝑒𝑟 𝑖𝑠 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑙𝑖𝑛𝑒 𝑜𝑓 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

We do not expect to use LLOD for narrative. we use them as the PD array to trade towards (direction)

We could still use LLOD if there is no FVG in the leg. With no FVG, there is no order flow leg

So the swing point becomes the only line of defense to trade off of.

𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑃𝐷 𝑎𝑟𝑟𝑎𝑦 𝑡ℎ𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 𝑤𝑖𝑙𝑙 𝑟𝑒𝑡𝑟𝑎𝑐𝑒 𝑡𝑜 𝑠𝑡𝑖𝑙𝑙 𝑐𝑜𝑛𝑡𝑖𝑛𝑢𝑒 𝑙𝑜𝑤𝑒𝑟/ℎ𝑖𝑔ℎ𝑒𝑟 𝑖𝑠 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑙𝑖𝑛𝑒 𝑜𝑓 𝑑𝑒𝑓𝑒𝑛𝑠𝑒

We do not expect to use LLOD for narrative. we use them as the PD array to trade towards (direction)

We could still use LLOD if there is no FVG in the leg. With no FVG, there is no order flow leg

So the swing point becomes the only line of defense to trade off of.

• • •

Missing some Tweet in this thread? You can try to

force a refresh