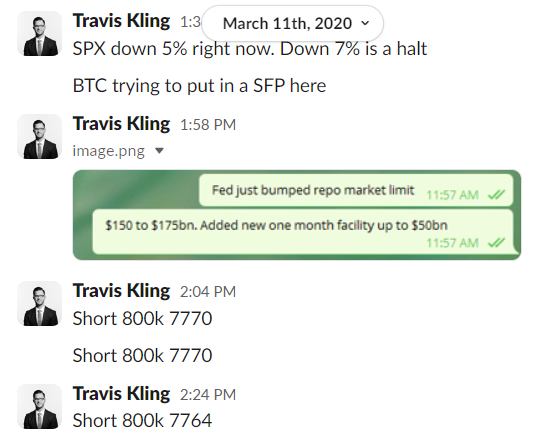

🚨🚨 On the heels of pretty atrocious vibes this summer for crypto, I'm publishing part 3 in a series that included: "A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything" and "Financial Nihilism: The Zeitgeist of Young America".

It's a ~10 min read. It's called Pervasive Quiet Quitting-

It's a ~10 min read. It's called Pervasive Quiet Quitting-

I’ve been focused on crypto for seven years now, running Ikigai for 6+. I’ve got a reasonably big network in (American) crypto and talk to dozens of crypto folks on a regular basis.

There has been an attitude, a stance, that I have recently observed or been told about with such frequency that it must be a trend.

Crypto is experiencing Pervasive Quiet Quitting.

There has been an attitude, a stance, that I have recently observed or been told about with such frequency that it must be a trend.

Crypto is experiencing Pervasive Quiet Quitting.

Just to set the stage, in case you’re not familiar with the term “Quiet Quitting”, it’s a relatively new one-

Part of the reason people have come to me so frequently to discuss this stance of Quiet Quitting is because of my “Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything” piece and my “Financial Nihilism” piece.

https://x.com/Travis_Kling/status/1764696621097378299

Those were the two most widely read long-form posts I’ve ever written. I still get tagged about them on Twitter. I was at a crypto conference last week and at least a half dozen folks brought those pieces up to me in person. So they really resonated.

This Pervasive Quiet Quitting trend is an extension of the views of those posts, which so accurately captured (and predicted) the current state of the crypto landscape.

This Pervasive Quiet Quitting trend is an extension of the views of those posts, which so accurately captured (and predicted) the current state of the crypto landscape.

What I’m seeing and hearing is that a meaningful swath of the crypto community is simply much less engaged than in prior years. And they are much less engaged because there is much less belief in the potential of crypto projects to solve real world problems and gain significant adoption as a result. That was a dream that was consistently sold and bought from 2017 (the year I got in) until 2022 – “crypto will solve real world problems and gain significant adoption as a result”. Many billions of dollars of venture capital funding were raised on this premise.

And there were stops along the way that would lead you to believe something in that general direction was occurring: DeFi was one of those. NFTs were one of those. Stablecoin proliferation was one of those. Axie Infinity was one of those. Plus Bitcoin adoption was rising and price was rising right along with it and Bitcoin got Paul Tudor Jones and Saylor and Elon and a bunch of other good stuff, and that made people optimistic about crypto just because Bitcoin was doing well.

All the above plus a bunch of smaller flashes (e.g., DAOs, Metaverse) kept folks generally pretty optimistic and also served to bring a lot of new people into crypto, both in terms of buyers but also full-time employees. At times that optimism would propagate into euphoria, but even in the most euphoric times, most folks knew in the back of their mind that a lot of this stuff was shaky, overvalued and lacking product-market fit. Those fears were always present. And during bear market periods, those fears would become outsized as optimism faded to pessimism, but even in the deepest bears (late 18, 2H-19), there was acute optimism for various projects and a broad hope about the technology’s potential in general.

The sentiment we’re currently dealing with is something different IMO (and many seem to agree). The curtain has been pulled back on how utterly pointless and ridiculously overvalued so much of all this is, while the potential of the existing projects is simultaneously getting LESS believable.

The points-to-airdrops daisy chain was an embarrassing and ill-advised failed attempt to drive adoption. The memecoin mania was embarrassing and ill-advised further still. For many multicycle crypto participants, the realization is sinking in that we’ve simultaneously come so far while accomplishing so little. This realization is jarring for those of us who have dedicated a tremendous amount of time and effort to this space for years.

All of a sudden, your life’s work starts to feel like mostly a waste. You don’t like what crypto has to show for itself and you don’t like the direction that it’s headed.

The points-to-airdrops daisy chain was an embarrassing and ill-advised failed attempt to drive adoption. The memecoin mania was embarrassing and ill-advised further still. For many multicycle crypto participants, the realization is sinking in that we’ve simultaneously come so far while accomplishing so little. This realization is jarring for those of us who have dedicated a tremendous amount of time and effort to this space for years.

All of a sudden, your life’s work starts to feel like mostly a waste. You don’t like what crypto has to show for itself and you don’t like the direction that it’s headed.

There is all manner of cognitive dissonance going on to try and rationalize this realization, but for many it has simply sunk in. This realization has caused many to leave the space entirely. People have left crypto in droves. But a meaningful portion have stayed and are just WAY less motivated, way less enthused, way less of a believer. The main reason many people stay is because it’s difficult to imagine spending your time doing anything else or deploying your capital elsewhere. What are you going to do, go get a corporate normie job? That sounds like a disaster.

And then there’s the “vote with your wallet” perspective. Despite many becoming deeply disenfranchised with crypto fulfilling its potential, they stick around the space because the “time adjusted, risk adjusted” returns are still believed to be more attractive than most anywhere else you could spend time investing your money. This may seem oxymoronic, but it goes like this –

"I believe BTC will outperform every other asset class every year for most years, and every once in a while BTC will have a really bad year. Alongside that, I believe there will be select Alts that will massively outperform BTC during those up years. It may be a few Alts or it may be a lot of Alts, but there will be at least some. And if I can identify those, I can easily make 3, 5, 10, 20, 50, 100, 1000x my money. So it’s worth me sticking around and paying attention…."

"I believe BTC will outperform every other asset class every year for most years, and every once in a while BTC will have a really bad year. Alongside that, I believe there will be select Alts that will massively outperform BTC during those up years. It may be a few Alts or it may be a lot of Alts, but there will be at least some. And if I can identify those, I can easily make 3, 5, 10, 20, 50, 100, 1000x my money. So it’s worth me sticking around and paying attention…."

Imagine being 30 and having say, $2mm liquid net worth that you got by investing in crypto over the last 5 years. A lot of money sure, but prob not enough to retire on. You need to turn the $2mm into $5mm or $10mm to really be set. Plus you’re a young guy and you’re not ready to retire yet anyway.

You got into crypto in 2017 because it was exciting and revolutionary and full of potential. You’ve personally done well financially, but you’re disappointed in how little the space has actually accomplished, and you’re less excited than ever about the future prospects of crypto…but you don’t leave. You can’t. What are you going to spend your time doing? Picking stonks instead of Alts? That makes no sense. Way more competitive, way more efficient, way less returns. So you just kinda hang out and keep an eye on the market and hope to get a fat pitch where you can 3x your net worth in a year…many, many such cases.

You got into crypto in 2017 because it was exciting and revolutionary and full of potential. You’ve personally done well financially, but you’re disappointed in how little the space has actually accomplished, and you’re less excited than ever about the future prospects of crypto…but you don’t leave. You can’t. What are you going to spend your time doing? Picking stonks instead of Alts? That makes no sense. Way more competitive, way more efficient, way less returns. So you just kinda hang out and keep an eye on the market and hope to get a fat pitch where you can 3x your net worth in a year…many, many such cases.

This stance is pervasive, despite a growing lack of confidence “that any of this shit does anything or will ever do anything”. Crypto enthusiasts cannot see what is going to drive the next big leg up. No DeFi summer. No NFT summer. Gaming is currently DOA. Metaverse turned out to be a complete joke. Decentralized social media has flatlined. People are trying to get excited about crypto x AI, but I (along with many others) think that excitement is likely misplaced(at least thus far).

DePIN is working and growing and is exciting – probably the brightest spot in the Alts landscape at the moment. So that’s certainly a sector folks are looking to for strong future price performance driven by real world adoption. But those areas in crypto are few and far between.

DePIN is working and growing and is exciting – probably the brightest spot in the Alts landscape at the moment. So that’s certainly a sector folks are looking to for strong future price performance driven by real world adoption. But those areas in crypto are few and far between.

The other aspect of this is the much-chagrined crypto VC investing landscape. Put simply, the crypto market continues to reward VC’s that invest early in token projects by allowing them to dump on retail at a massive profit, even if that project shows little discernable traction with its intended use case.

The token project can:

1) run a points-to-airdrop daisy chain;

2) concoct a ridiculously overvalued market cap;

3) hire a market maker and pay them so much they win no matter what happens;

4) list the token on a major exchange; and

5) dump into oblivion.

The token project can:

1) run a points-to-airdrop daisy chain;

2) concoct a ridiculously overvalued market cap;

3) hire a market maker and pay them so much they win no matter what happens;

4) list the token on a major exchange; and

5) dump into oblivion.

Even if the token price goes down 85% from listing, the early VCs are still up multiples on their money. This is a dominant feature of the current Alts market structure. The crypto market has allowed VC’s to return their funds (and raise new ones) based on investments that never did much of anything and will never do much of anything. This is a brutal case of misaligned incentives. You can hardly blame the VC’s – people are gonna do what they’re incentivized to do. And so far, the market is saying “please VC, list more dogshit on major CEX’s at insane FDV’s and dump on me.” Until the market collectively decides that opportunity will no longer be made available, you should hardly expect VC’s to act any differently. They’re getting private jet money off this whole deal.

There is a saying in crypto made popular by a friend of mine, “do you want to be right, or do you want to make money?” This has been a rallying cry of sorts for many in crypto. I get it. It speaks to profits over all else, especially over your egotistic desire to be “right”. But to posit a counterpoint – “if you are wrong enough long enough while making money, you may run out of chances to be wrong and make money.” We’re seeing some of that now.

All of the above adds up to an explanation for the Pervasive Quiet Quitting in crypto. Turning back to the traditional definition of Quiet Quitting from the New Yorker article above – Quiet Quitting in the workplace kills a company’s culture. It’s an ambitious CEO’s worst nightmare. Employees see others not working, not believing in the mission, naturally makes you want to not work and not believe in the mission. We are creatures of imitation. Enthusiasm is contagious and so is a lack of enthusiasm. In this way, Quiet Quitting begets Quiet Quitting.

And so far this cycle, we haven’t even come close to bringing in the number of new people we have in prior cycles (new ETF investors excluded). Crypto is NOT a preferred avenue for the best and brightest young minds in America. The industry still has a LOT of egg on its face from the damage done in 2022 and we haven’t done nearly enough since then to rectify the reputational hit we took in terms of attracting top talent to the space. Imagine you were contemplating joining a company experiencing Pervasive Quiet Quitting. Does that sound like the kind of opportunity you would jump at?

So What?

I am well aware this is the sort of post that traders would label a “bottom signal.” Historically in crypto, buying when sentiment is most sour and selling when sentiment is most sweet has generated incredible returns. And this Pervasive Quiet Quitting thesis is certainly a sour one, so usually you want to be buying this sort of thing with both hands. I get it.

I am well aware this is the sort of post that traders would label a “bottom signal.” Historically in crypto, buying when sentiment is most sour and selling when sentiment is most sweet has generated incredible returns. And this Pervasive Quiet Quitting thesis is certainly a sour one, so usually you want to be buying this sort of thing with both hands. I get it.

Another retort to the thesis I’ve laid out here is “we’re so early bro.” Stop. Stop it. It’s not that early.

Bitcoin is worth a trillion bucks and half of Wall Street owns it at this point. All the rest of crypto is worth another trillion. Tether owns more Treasuries than Germany. There’s been more than $20bn of venture capital poured into this space in the last four years. We’re not that early.

Stop with the comparisons to “the internet in the late 90’s and look what happened there.” This ain’t the internet in the late 90’s. Bitcoin has product-market fit and stables have product-market fit and the rest of this stuff is lost at sea. Solutions looking for problems at best, a relentless and brutal grift at worst.

Bitcoin is worth a trillion bucks and half of Wall Street owns it at this point. All the rest of crypto is worth another trillion. Tether owns more Treasuries than Germany. There’s been more than $20bn of venture capital poured into this space in the last four years. We’re not that early.

Stop with the comparisons to “the internet in the late 90’s and look what happened there.” This ain’t the internet in the late 90’s. Bitcoin has product-market fit and stables have product-market fit and the rest of this stuff is lost at sea. Solutions looking for problems at best, a relentless and brutal grift at worst.

All of that to be said, there is reason to be optimistic about Alts. The most exciting path in my view is a Trump win in November that leads to a de factor regulatory framework that allows for Alt token structures to be redesigned with security-like features that allow for compelling value accrual.

We’ve been talking about this concept for years here – value creation and value accrual, and the bridge between the two being token structure. In a Trump administration, it could potentially be out with the worthless governance tokens, in with the yield-bearing, token burning pseudo-securities – courtesy of a US regulatory framework that allows for such a thing. That’s a world where two years from now you could imagine a much less Fugazi Alt landscape.

That’s the kind of thing worth keeping at least one eye on…

We’ve been talking about this concept for years here – value creation and value accrual, and the bridge between the two being token structure. In a Trump administration, it could potentially be out with the worthless governance tokens, in with the yield-bearing, token burning pseudo-securities – courtesy of a US regulatory framework that allows for such a thing. That’s a world where two years from now you could imagine a much less Fugazi Alt landscape.

That’s the kind of thing worth keeping at least one eye on…

• • •

Missing some Tweet in this thread? You can try to

force a refresh