All my high-probability trades have this in common:

They are aligned with HTF Order Flow.

Apply this to your trading and watch your win rate rise✅

A Thread🧵

They are aligned with HTF Order Flow.

Apply this to your trading and watch your win rate rise✅

A Thread🧵

First, let’s define Order Flow 📝

Specifically, bullish and bearish order flow.

On a bullish order flow, discount arrays hold while premium arrays fail.

On a bearish order flow, discount arrays fail while premium arrays hold.

Specifically, bullish and bearish order flow.

On a bullish order flow, discount arrays hold while premium arrays fail.

On a bearish order flow, discount arrays fail while premium arrays hold.

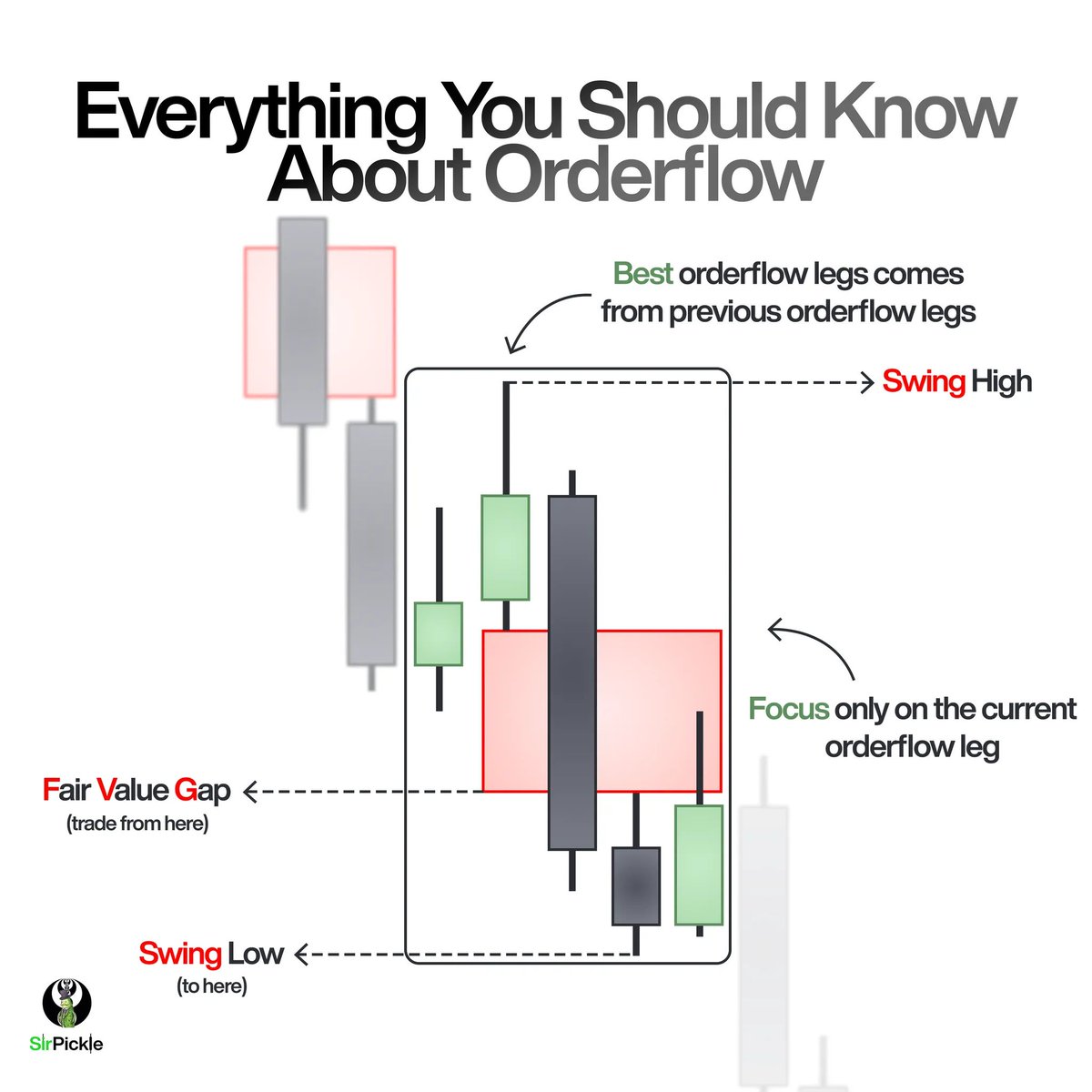

Let’s zoom in further and define what makes up a high-probability order flow leg 🧐

It consists of a

-Swing high

-FVG

-Swing low.

Recall what I’ve said in my last video, a lack of a fair value gap in a price leg results in a low-probability leg to hold.

Live by the FVG, die by the FVG.

Check the video out here:

It consists of a

-Swing high

-FVG

-Swing low.

Recall what I’ve said in my last video, a lack of a fair value gap in a price leg results in a low-probability leg to hold.

Live by the FVG, die by the FVG.

Check the video out here:

Great! Now that we’ve defined order flow, why should we use it?

As traders, we want to trade with the trend as all high-probability trades happen in that IRL → ERL context.

We don’t want to trade ERL → IRL against the HTF order flow since you are essentially picking the tops and bottoms of the market.

As traders, we want to trade with the trend as all high-probability trades happen in that IRL → ERL context.

We don’t want to trade ERL → IRL against the HTF order flow since you are essentially picking the tops and bottoms of the market.

So how will we incorporate order flow with trading?♻️

If you’re new to using my system, I start by doing a top-down analysis of the M / W / D timeframe.

I want to see a clear context aligned with the HTF order flow.

Think of IRL → ERL. That’s what I want to see. Without it, there would be no trade.

Below is the weekly timeframe of EURO futures, the context I used in my previous trade.

If you’re new to using my system, I start by doing a top-down analysis of the M / W / D timeframe.

I want to see a clear context aligned with the HTF order flow.

Think of IRL → ERL. That’s what I want to see. Without it, there would be no trade.

Below is the weekly timeframe of EURO futures, the context I used in my previous trade.

As I’ve already established that there’s a weekly context,

I then move to the 4h timeframe and look for a CISD, change in state of delivery).

In here, I want to see price form a FVG away from the weekly FVG and it did.

I then trade the FVG intraday using my entry model.

I then move to the 4h timeframe and look for a CISD, change in state of delivery).

In here, I want to see price form a FVG away from the weekly FVG and it did.

I then trade the FVG intraday using my entry model.

Lastly, the entry 🦄

Dropping down to the lower timeframe which is 5m,

I want to see the unicorn form after stinging into the 4h FVG within a killzone.

As you can see, the unicorn is a breaker block overlapping with a fair value gap (the strongest algorithmic entry pattern)

Dropping down to the lower timeframe which is 5m,

I want to see the unicorn form after stinging into the 4h FVG within a killzone.

As you can see, the unicorn is a breaker block overlapping with a fair value gap (the strongest algorithmic entry pattern)

Don’t miss out on all the insane free value being dropped in my FREE discord server

Unicorns are discussed daily... so if you wanna learn more about them come on by :)

Join here! 👉 discord.gg/picklejar

Unicorns are discussed daily... so if you wanna learn more about them come on by :)

Join here! 👉 discord.gg/picklejar

Apply this simple concept to your top down approach and your win rate will improve!💎

Thank you for reading this far fam.

If you’ve found this valuable I would greatly appreciate a bookmark, retweet, like, and comment!💚

Thank you for reading this far fam.

If you’ve found this valuable I would greatly appreciate a bookmark, retweet, like, and comment!💚

• • •

Missing some Tweet in this thread? You can try to

force a refresh