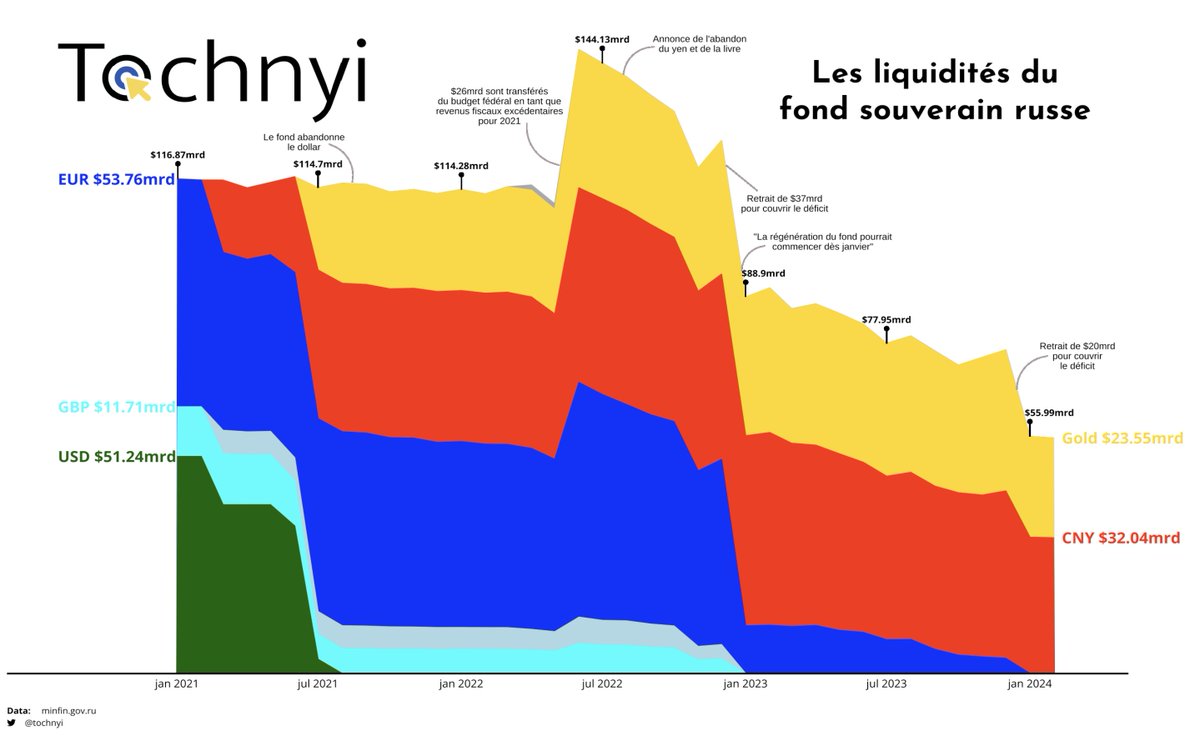

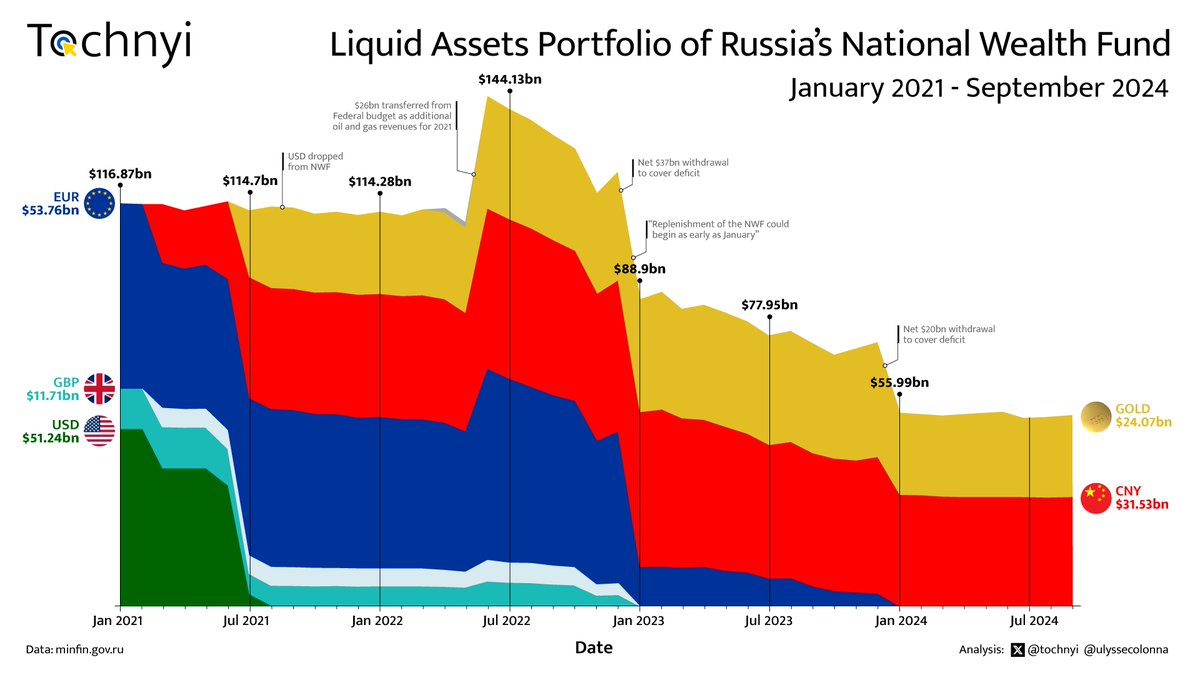

Resuming the @tochnyi coverage of the slow-motion disappearance of Russia's last piggy bank, the liquid part of the so-called National Wealth Fund.

There was a slight contraction of the value of the fund in dollar (-1.5%) but overall the net worth of the fund has remained stable

There was a slight contraction of the value of the fund in dollar (-1.5%) but overall the net worth of the fund has remained stable

The stability of the fund since last January prompts four remarks:

1. it fits a seasonal patern of limited withdrawls in the first 10 months of the year (things get hairy when bills come due in December)

2. the absence of any replenishment show that the government is tight

1. it fits a seasonal patern of limited withdrawls in the first 10 months of the year (things get hairy when bills come due in December)

2. the absence of any replenishment show that the government is tight

3. past experience suggests that the Kremlin tends to sterilize funds that have fallen below a certain threshold to avoid the humiliation of having to close them. Sure it remains a cushion in the worst case scenario but in effect that money cannot be touched any longer.

4. Moscow has not dipped in this particular cookie jar to pay for its electoral promises suggesting that either these have been shelved or that they are being paid for by reallocating already invested money, creating non-trivial systemic risks.

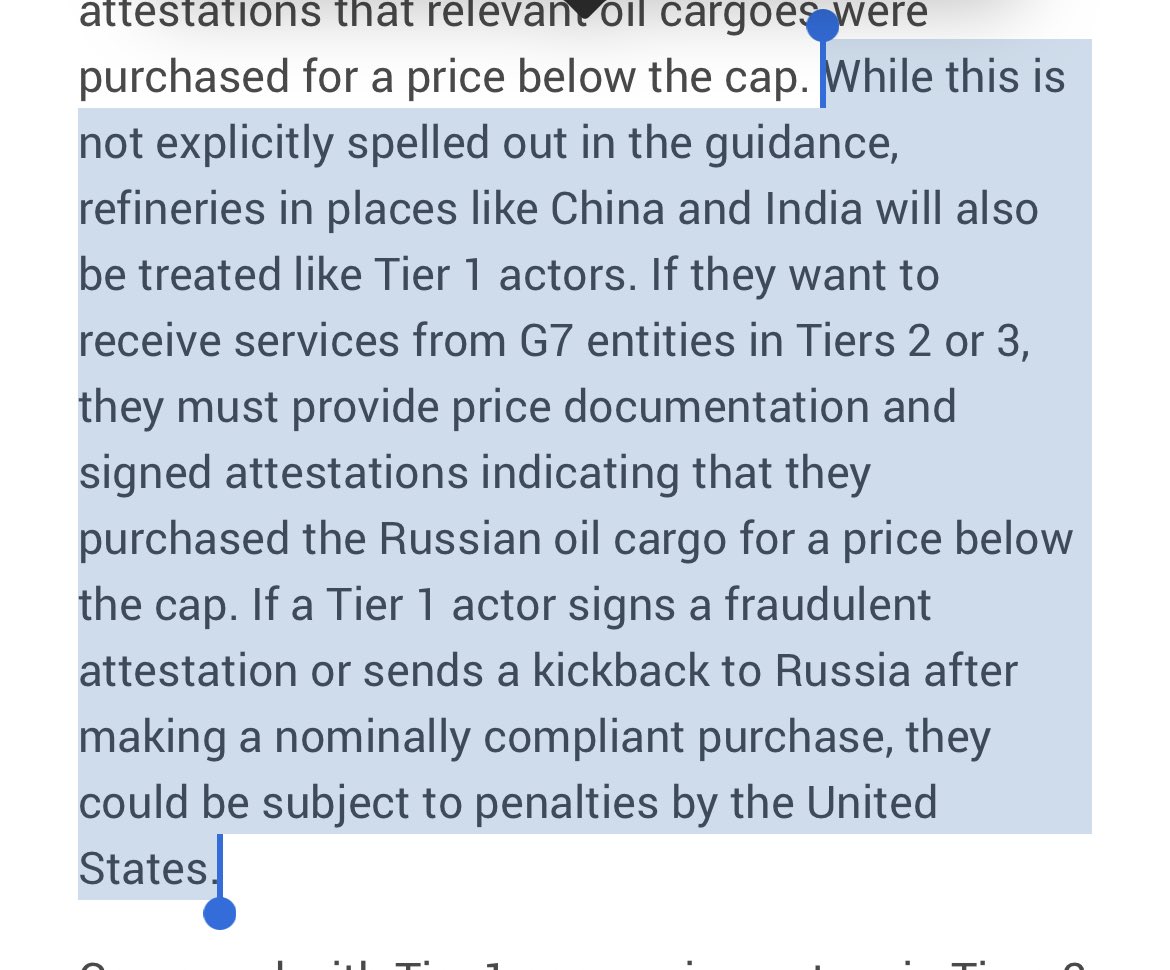

But, as @Prune602 judiciously remarked a while back: market value, does not tell the whole story!

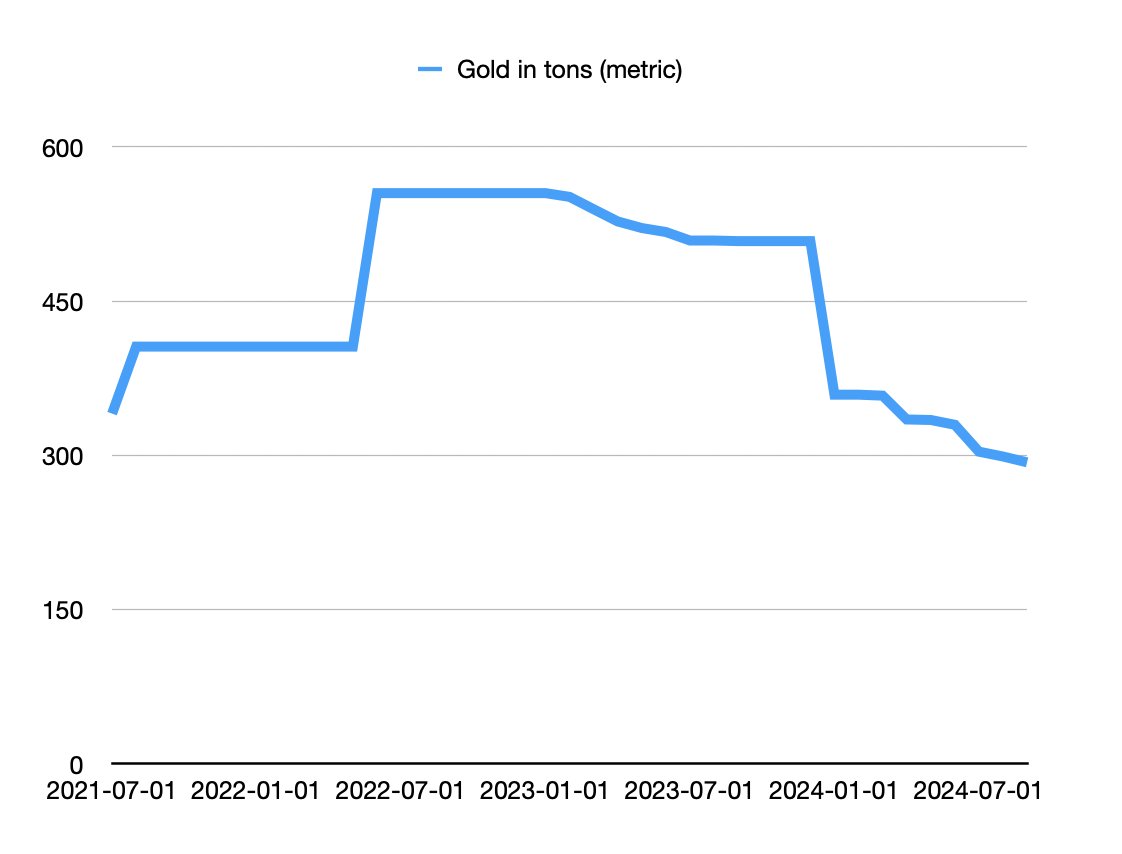

The volume of gold held by the NWF has been steadily diminishing since last January's big drop. More than 60t have been sold (18%).

The volume of gold held by the NWF has been steadily diminishing since last January's big drop. More than 60t have been sold (18%).

Not suprisingly, that's almost the exact proportion of the appreciation of the value of gold since early January 2024. So basically, the appreciation of the value of gold is masking the unloading of the metal by the NWF.

Some may recognise the practice of rebalancing.

Some may recognise the practice of rebalancing.

But rebalancing implies reinvesting the proceeds in new assets to maintain the target distribution of the portfolio. Here no such purchase is visible in the liquid part of the portfolio.

This is strictly an opportunistic move to empty the piggy bank without appearing to touch it

This is strictly an opportunistic move to empty the piggy bank without appearing to touch it

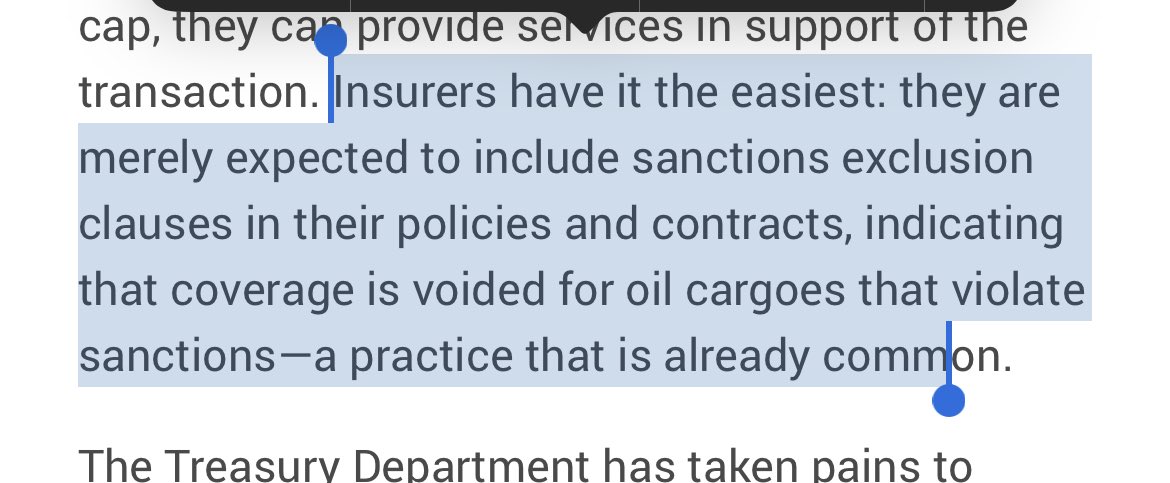

The official press releases do note that "gold [is] being sold and the proceeds used to finance certain projects." But while Yuans appear to be withdrawls to purchase Yuan-denominated Russian corporate bonds, the gold never reappears on the account books, it just goes poof!

So despite the apparent stability of the fund's value, the NWF is being drained at a relatively rapid pace by the Kremlin. What's more, of course, is that the fund is now severely exposed to the value of gold. If the price of the precious metal was to drop significantly, it would

immediately show on the balance sheet and probably severely affect the trust in the government.

The Kremlin would thus have to either bite the bullet or allocate tens of billions of dollars in replenishing its piggy bank just to show it can.

The Kremlin would thus have to either bite the bullet or allocate tens of billions of dollars in replenishing its piggy bank just to show it can.

And of course: an immense thank you to @clockworkChris for the amazing graphics! (only the first one, obviously, the second one is quick and dirty and Chris is not responsible for any of it)

• • •

Missing some Tweet in this thread? You can try to

force a refresh