Regular at @tochnyi

Creative speller, fanatical aggadist, I also dabble in economics

How to get URL link on X (Twitter) App

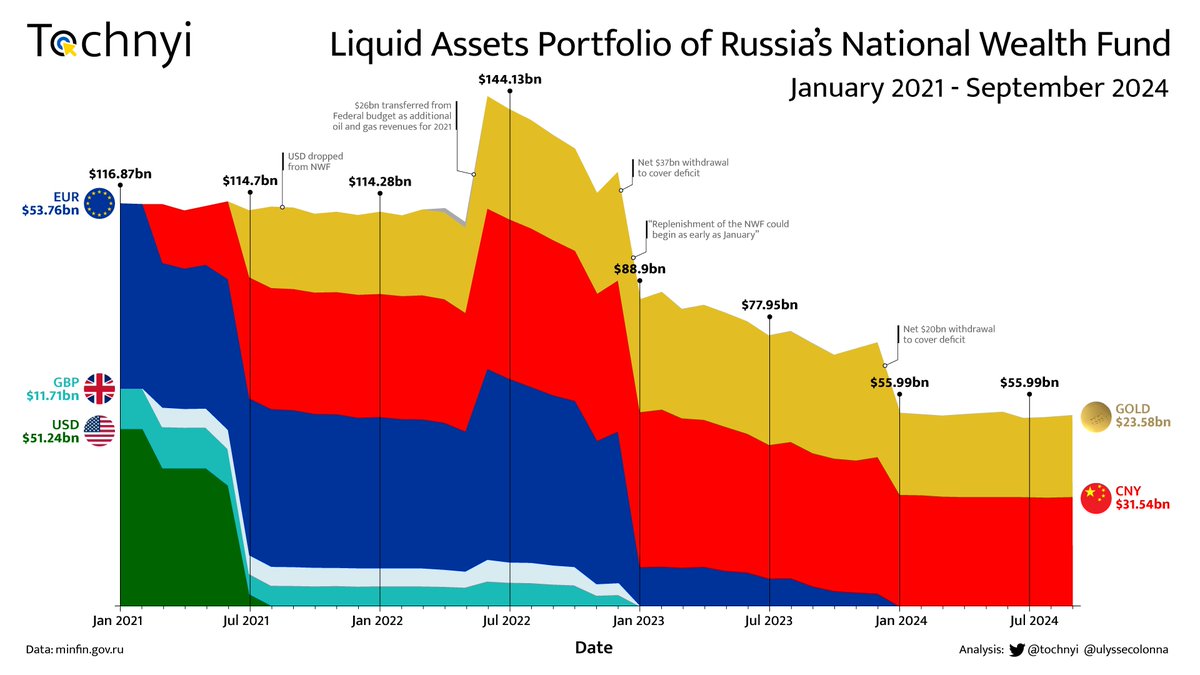

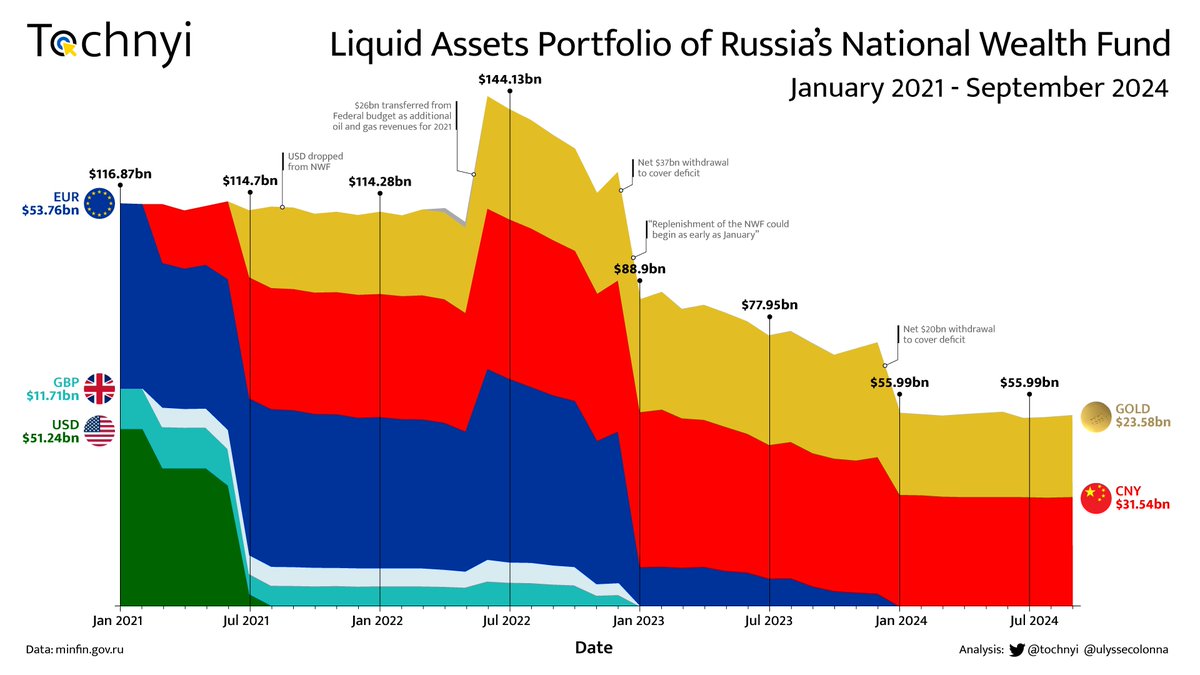

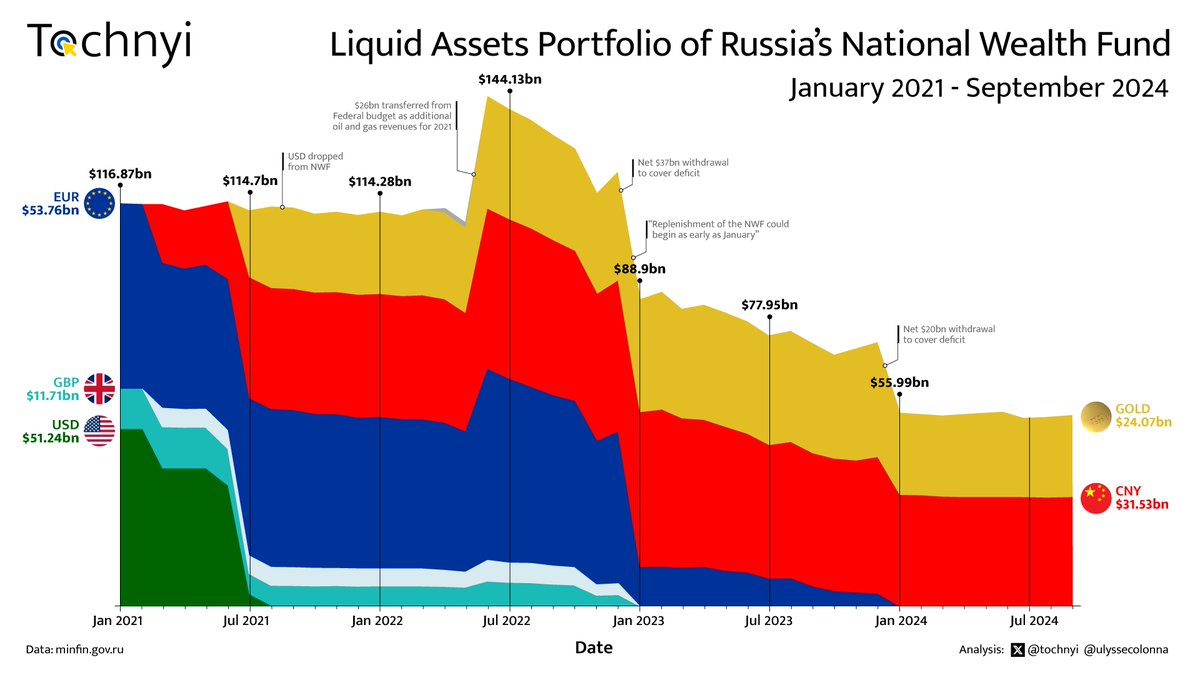

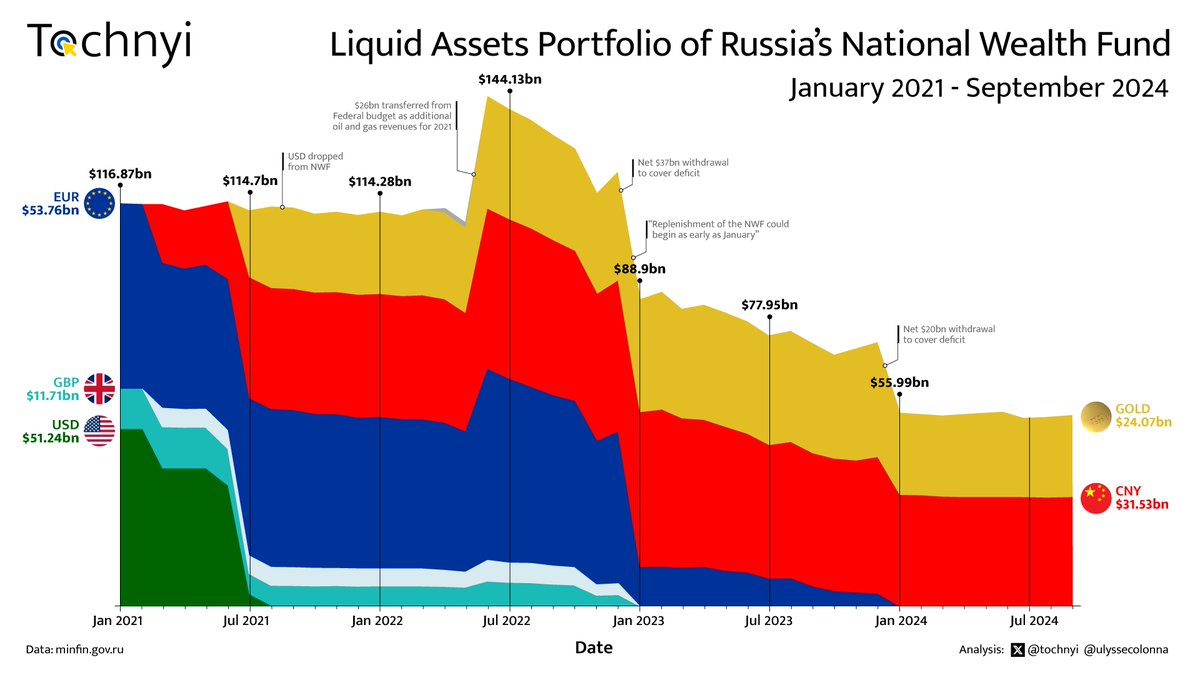

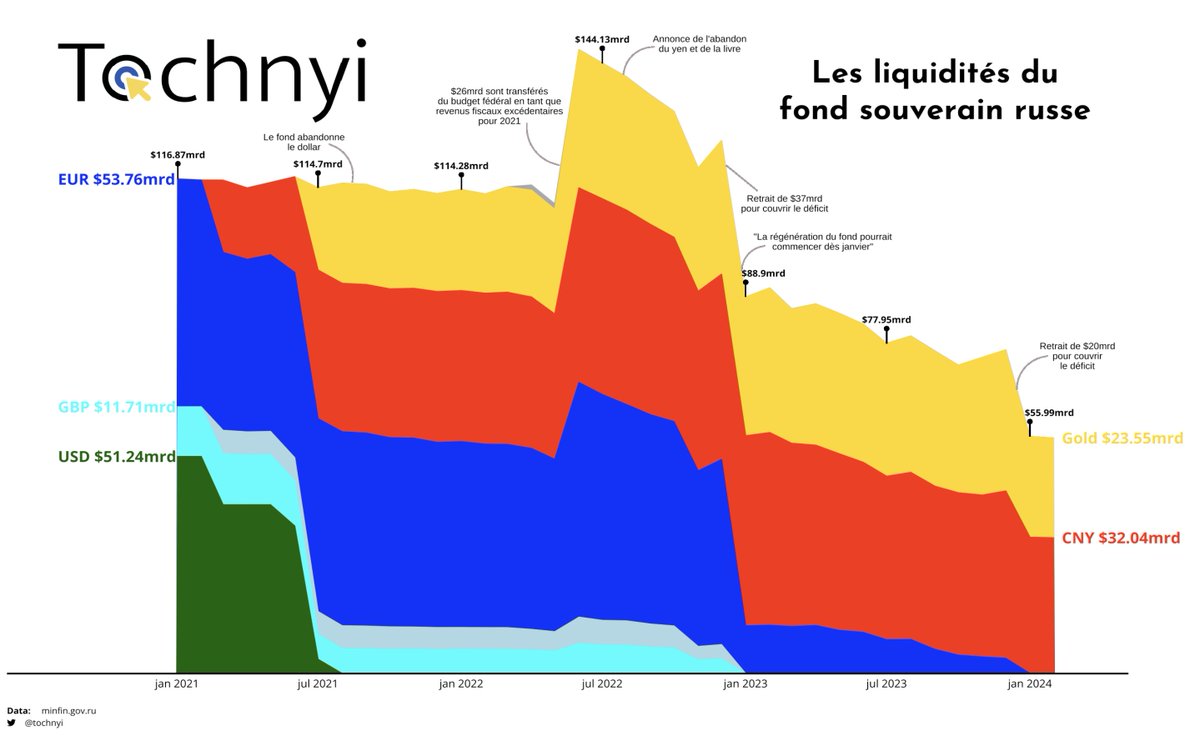

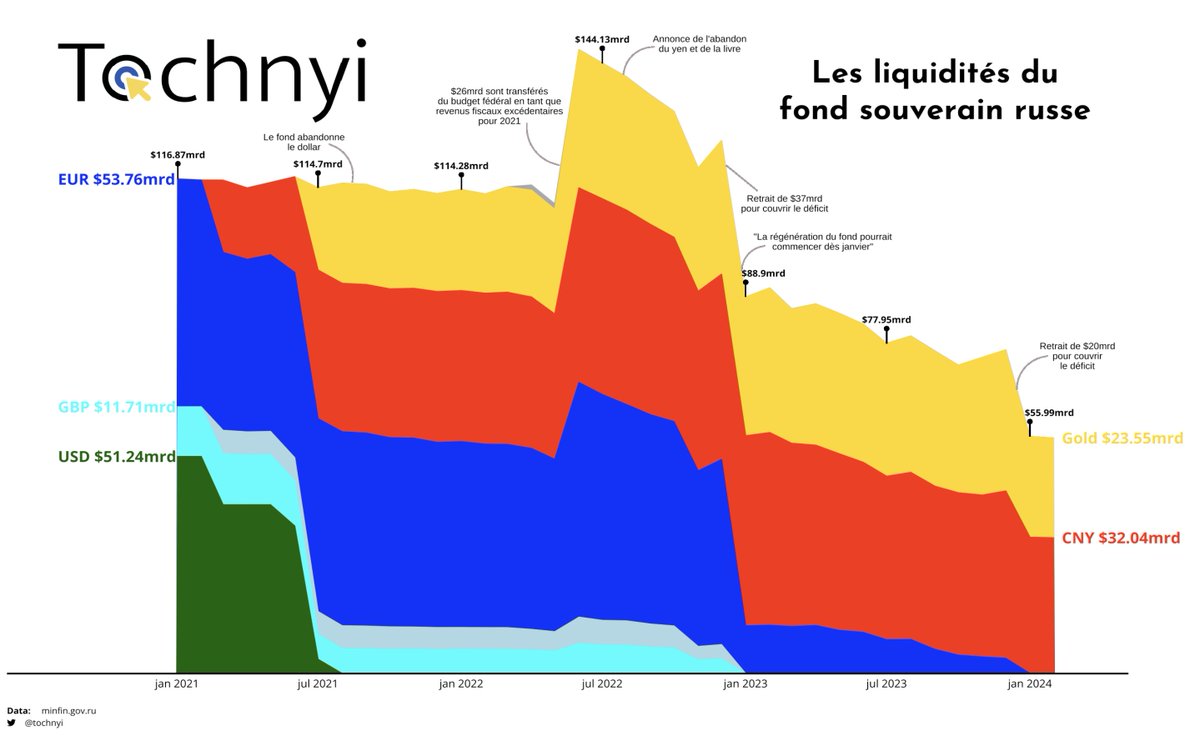

As exposed in an earlier post, the MinFin is taking advantage of the rising value of its assets in ruble terms to sell off some without the total value of the fund being affected.

As exposed in an earlier post, the MinFin is taking advantage of the rising value of its assets in ruble terms to sell off some without the total value of the fund being affected. https://x.com/ulyssecolonna/status/1844097342515053056

The stability of the fund since last January prompts four remarks:

The stability of the fund since last January prompts four remarks:

La Russie n'a pas de fond souverain similaire aux énormes fond d'investissement 🇳🇴 ou 🇸🇦. Plutôt, il s'agit d'une sorte de banque de développement achetant des bons et des actions d'entreprises locales stratégiques. En plus, le fond a aussi un énorme compte en banque.

La Russie n'a pas de fond souverain similaire aux énormes fond d'investissement 🇳🇴 ou 🇸🇦. Plutôt, il s'agit d'une sorte de banque de développement achetant des bons et des actions d'entreprises locales stratégiques. En plus, le fond a aussi un énorme compte en banque.

Source: theguardian.com/world/2023/feb…

Source: theguardian.com/world/2023/feb…

https://twitter.com/peterbdoran/status/1617878074749779970

https://twitter.com/voxeu/status/1536297969011392513Again, let me restate: the man is brilliant and has been fighting the battle for knowledge for decades. He ought to be endlessly praised. Even in this piece, he makes a very valid arching point: don’t get caught in the mercantilist fallacy.