Lucid's CEO Peter Rawlinson tries to smear Tesla's technology in this clip. @LucidMotors @elonmusk @larsmoravy @Tesla @PIF_en

Peter, if it was true that your tech was so capable at low cost (which of course it isn't) how on earth is it possible that your company:

1. Has the worst gross margin: negative 134%

2. You spend $196,000 per vehicle (costs of goods sold, not operating loss) which you sell on average for just $84,000

3. Your company ranks globally as the least profitable automaker with a negative profit before tax margin of shocking 321%.

Beyond all of this, how/why should anyone believe you now Peter after you missed your 2023 deliveries goal by 88%. Lucid told investors to deliver 49,000 vehicles in 2023 but delivered only 6,001.

Dear PIF leadership, Peter is just fooling you. He creates technology and products which are not cost competitive. Please take a minute and look through the attached materials.

x.com/LucidOasis/sta…

Peter, if it was true that your tech was so capable at low cost (which of course it isn't) how on earth is it possible that your company:

1. Has the worst gross margin: negative 134%

2. You spend $196,000 per vehicle (costs of goods sold, not operating loss) which you sell on average for just $84,000

3. Your company ranks globally as the least profitable automaker with a negative profit before tax margin of shocking 321%.

Beyond all of this, how/why should anyone believe you now Peter after you missed your 2023 deliveries goal by 88%. Lucid told investors to deliver 49,000 vehicles in 2023 but delivered only 6,001.

Dear PIF leadership, Peter is just fooling you. He creates technology and products which are not cost competitive. Please take a minute and look through the attached materials.

x.com/LucidOasis/sta…

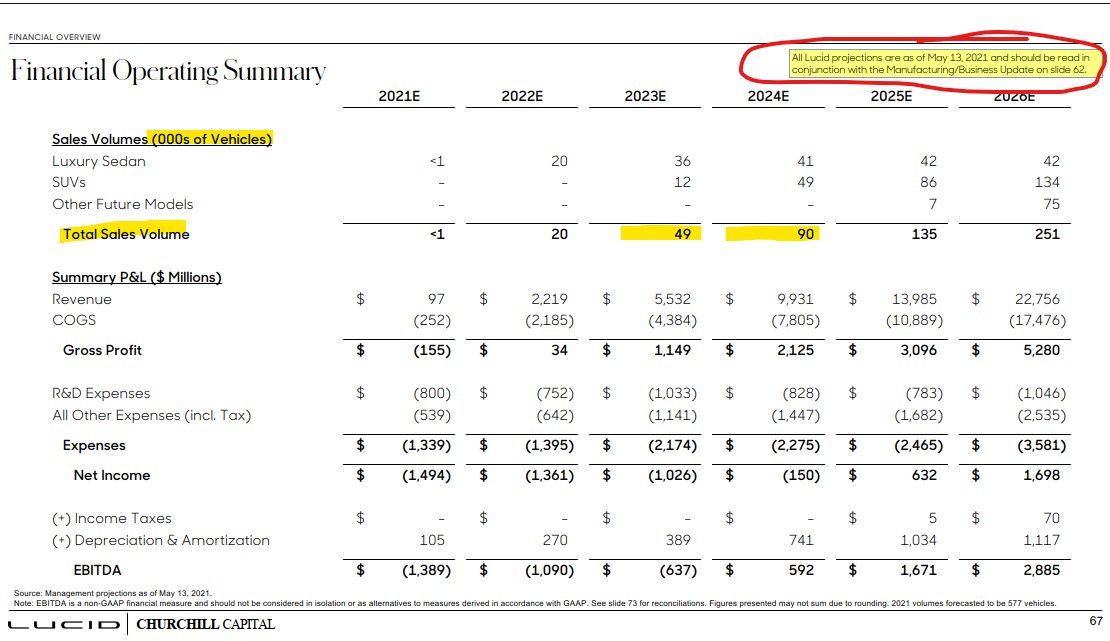

This slide is from Lucid's investor presentation as of May 13, 2021 in which Lucid promised investors 49,000 vehicle sales in 2023 and 90,000 in 2024.

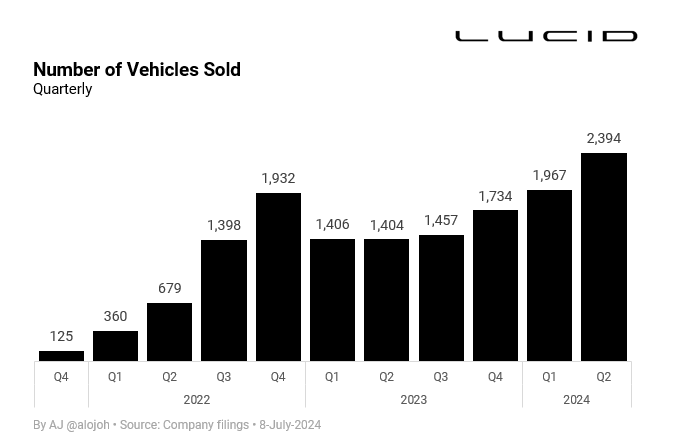

Lucid delivered exactly 6,001 vehicles in 2023 which is an 88% target miss! This was not a 10 year forecast. This forecast was only 2.5yrs out.

Lucid sold 4,361 vehicles in the first 6 months of 2024. A large share went to Lucid's controlling shareholder.

Lucid delivered exactly 6,001 vehicles in 2023 which is an 88% target miss! This was not a 10 year forecast. This forecast was only 2.5yrs out.

Lucid sold 4,361 vehicles in the first 6 months of 2024. A large share went to Lucid's controlling shareholder.

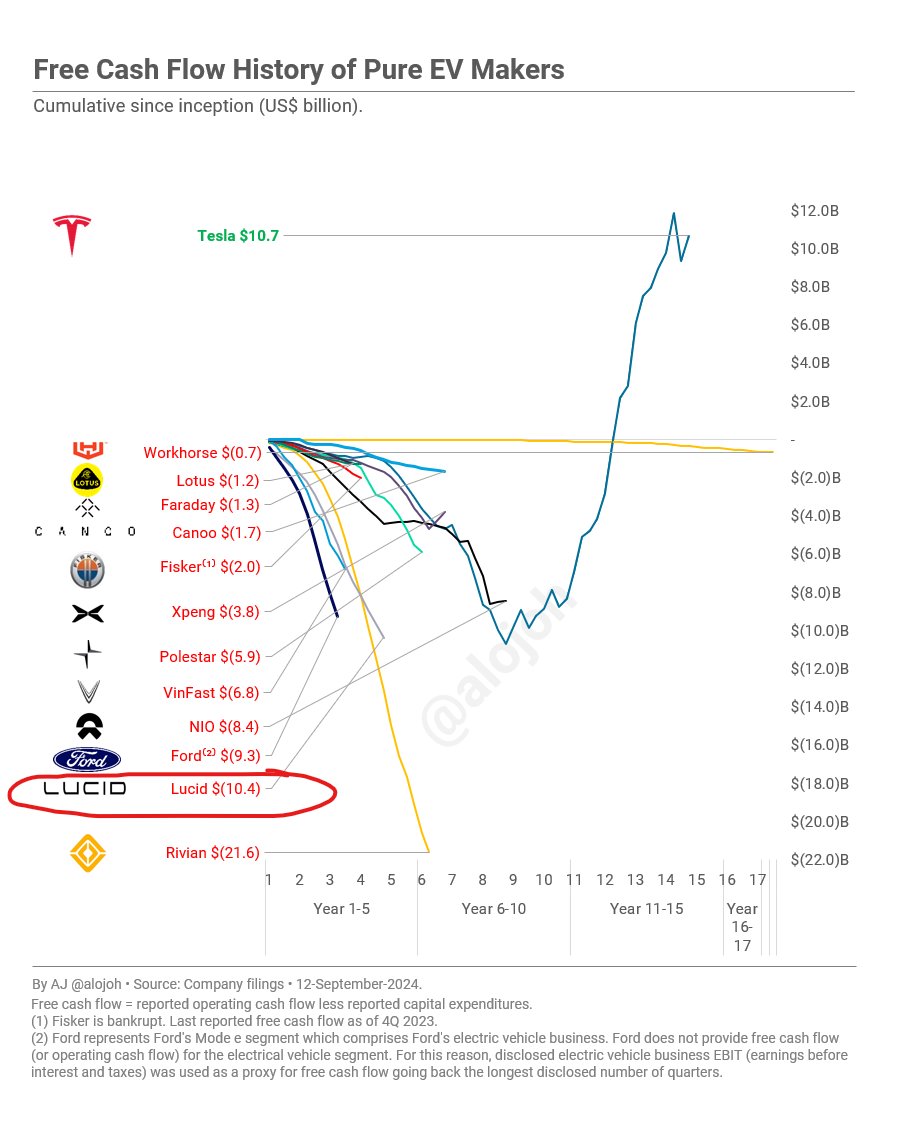

Only Rivian has burned more cash than Lucid but Rivian has also reached a greater maturity state with LTM revenue of $5.0B vs $668M!!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh