Improve your trade entries using this SIMPLE entry model! 🎯

In this thread, I’ll break down my personal approach and show you how you can apply it to your trades.

A thread🧵

In this thread, I’ll break down my personal approach and show you how you can apply it to your trades.

A thread🧵

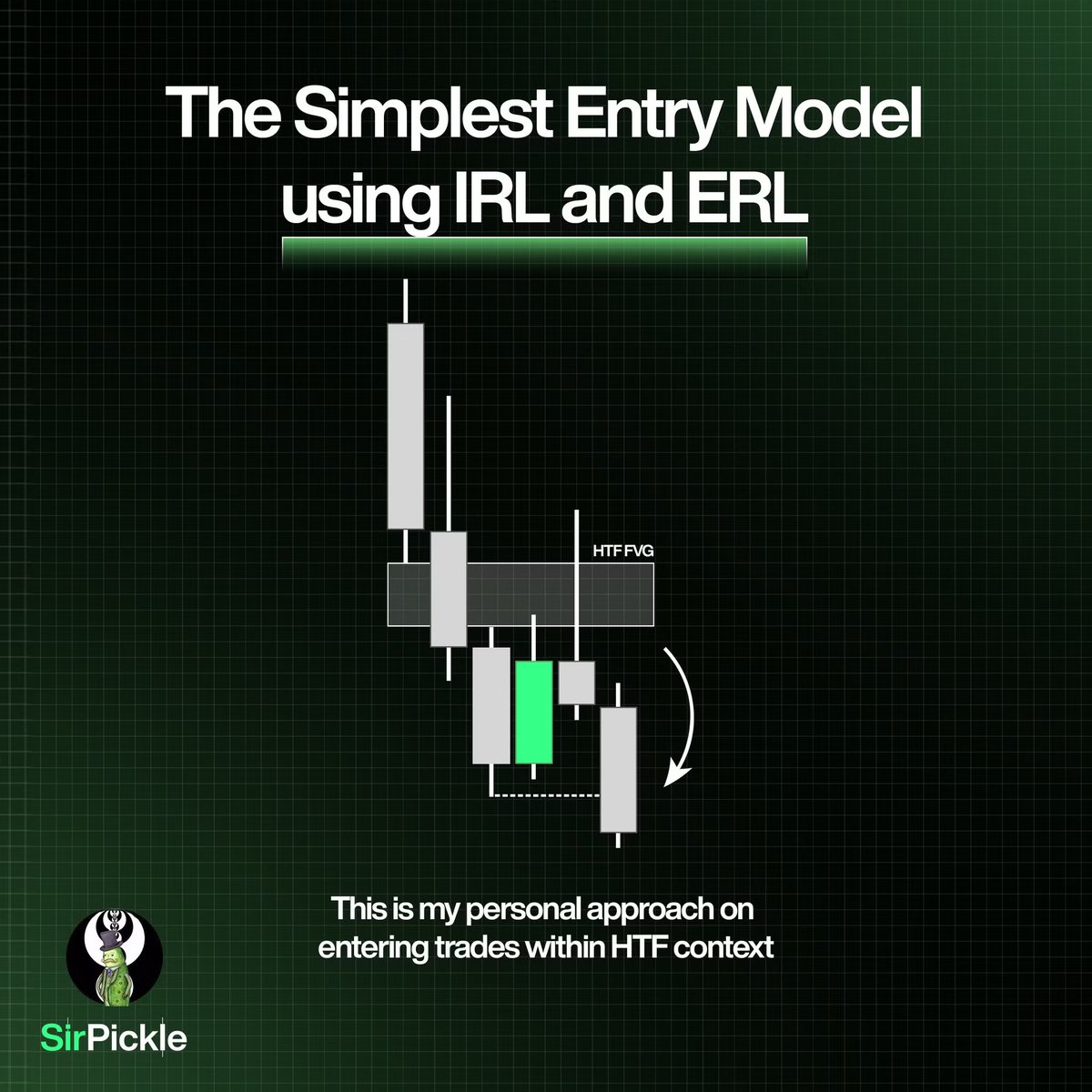

If you’ve been following me, you know that I always look for HTF context in every trade.

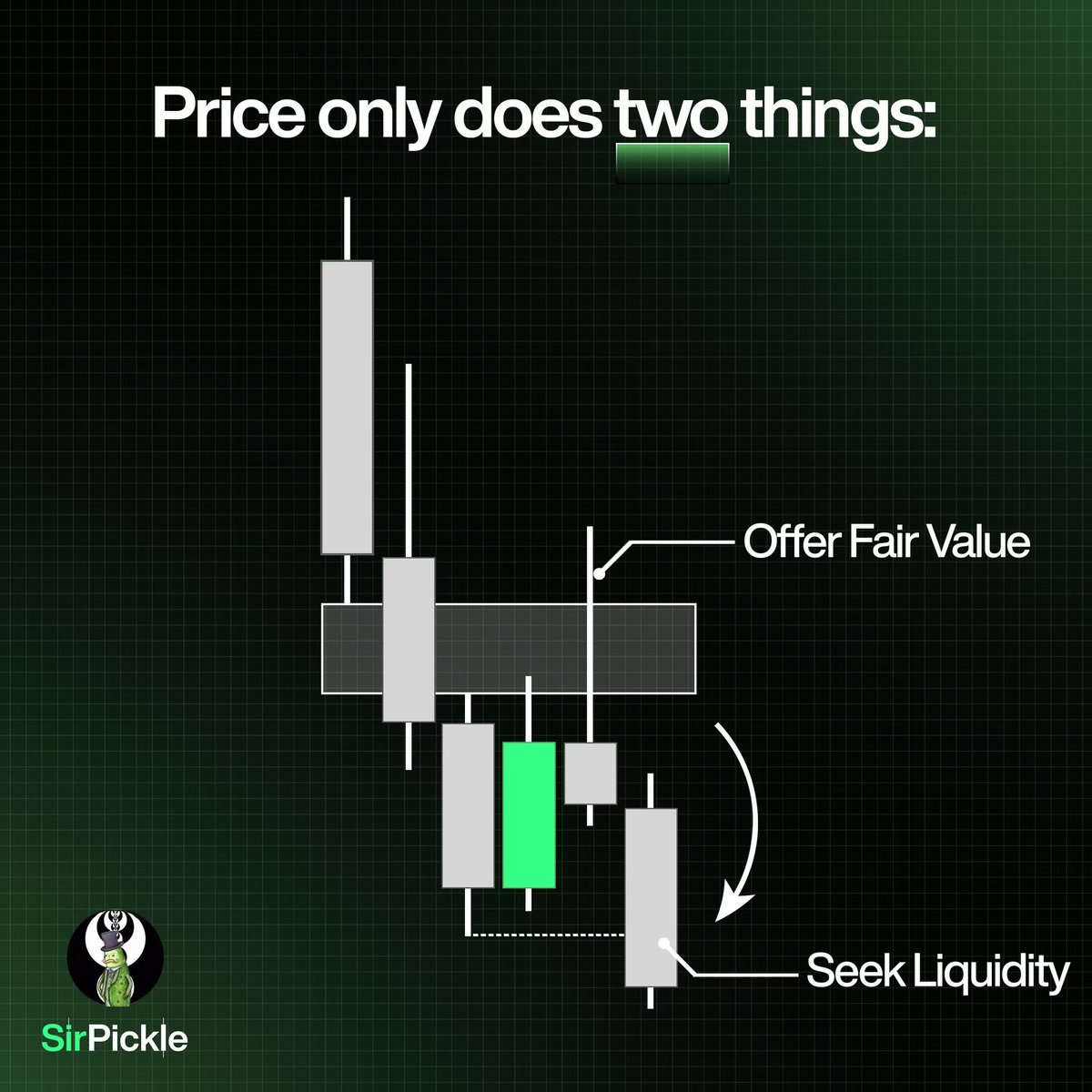

As I’ve said countless times before, price only does 2 things:

-Seek Liquidity

-Offer fair value

Understanding this will give you a simple and accurate view of market direction.

Want to learn more? Check out my video on IRL / ERL:

As I’ve said countless times before, price only does 2 things:

-Seek Liquidity

-Offer fair value

Understanding this will give you a simple and accurate view of market direction.

Want to learn more? Check out my video on IRL / ERL:

For now, we will focus on LTF entries.

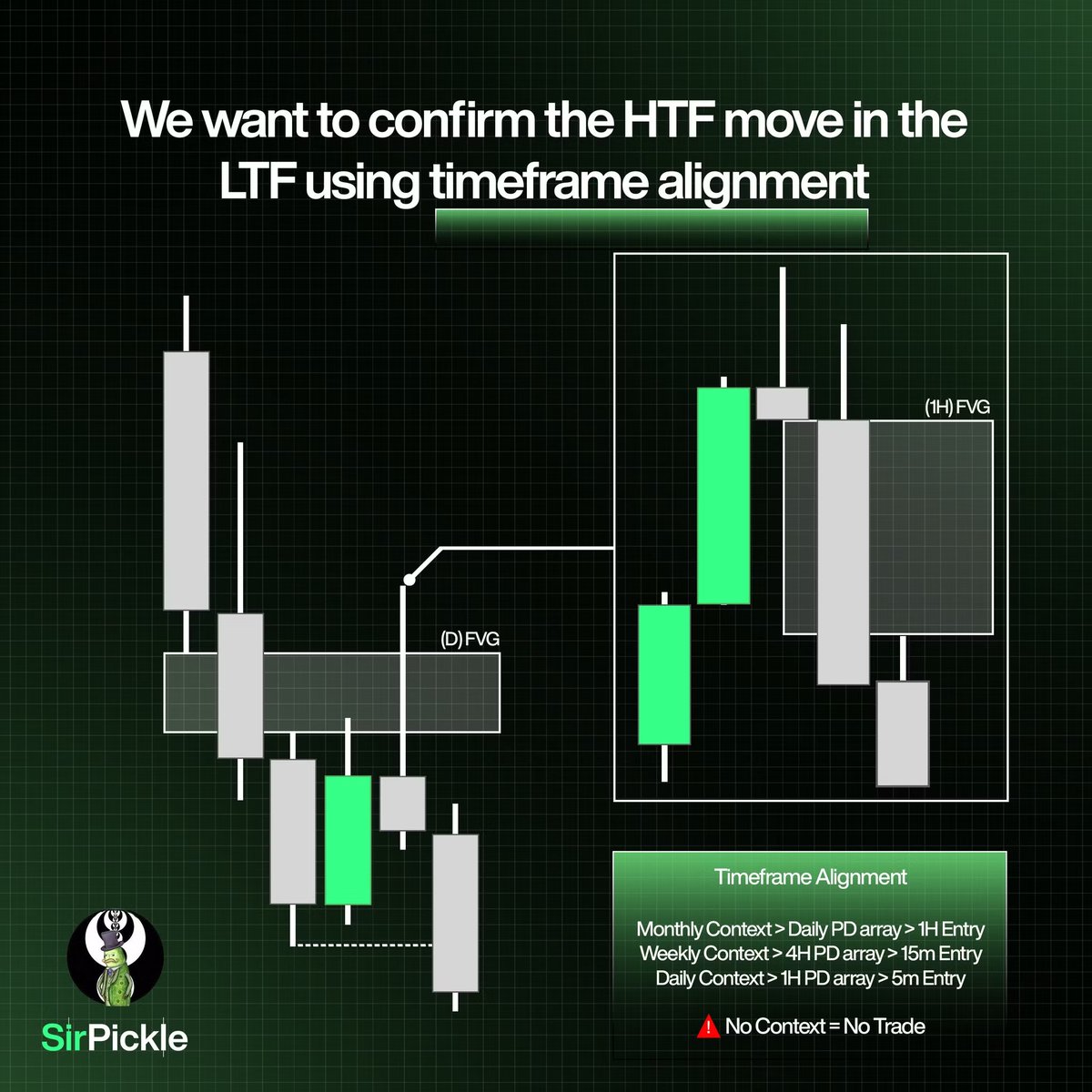

For LTF entries, we want to use the timeframe alignment that I’ve given in my IRL / ERL video (link above)

Timeframe alignment allows us to trade with the HTF trend giving us that high-probability intraday trades.

For LTF entries, we want to use the timeframe alignment that I’ve given in my IRL / ERL video (link above)

Timeframe alignment allows us to trade with the HTF trend giving us that high-probability intraday trades.

Okay, but what do we want to see in the LTF? More specifically, the hourly?

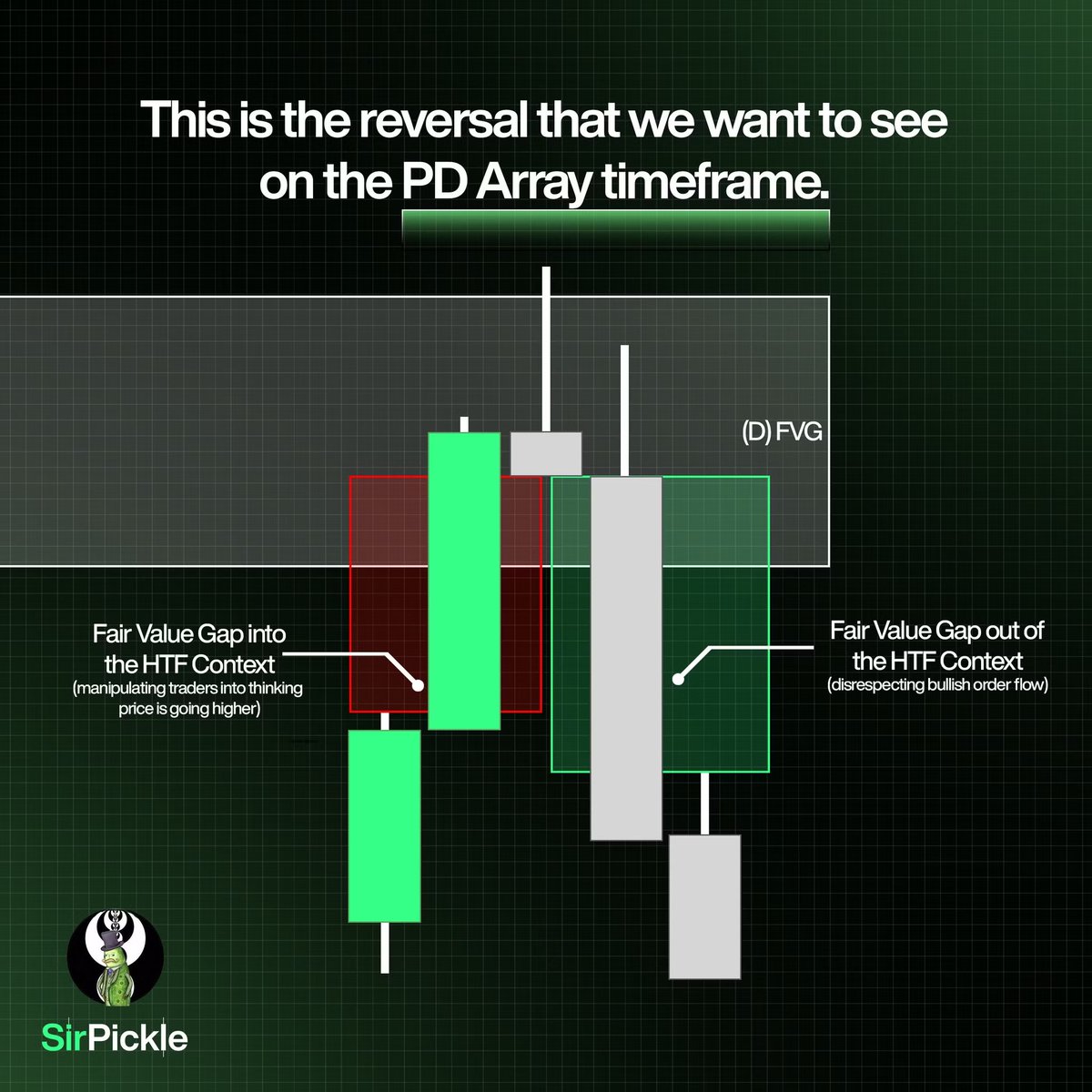

We want to see a shift in order flow done by a displacement towards the context target.

It looks like a fair value gap going into the HTF Context and a fair value gap going out of it.

We want to see a shift in order flow done by a displacement towards the context target.

It looks like a fair value gap going into the HTF Context and a fair value gap going out of it.

Remember what I’ve told you in the order flow thread.

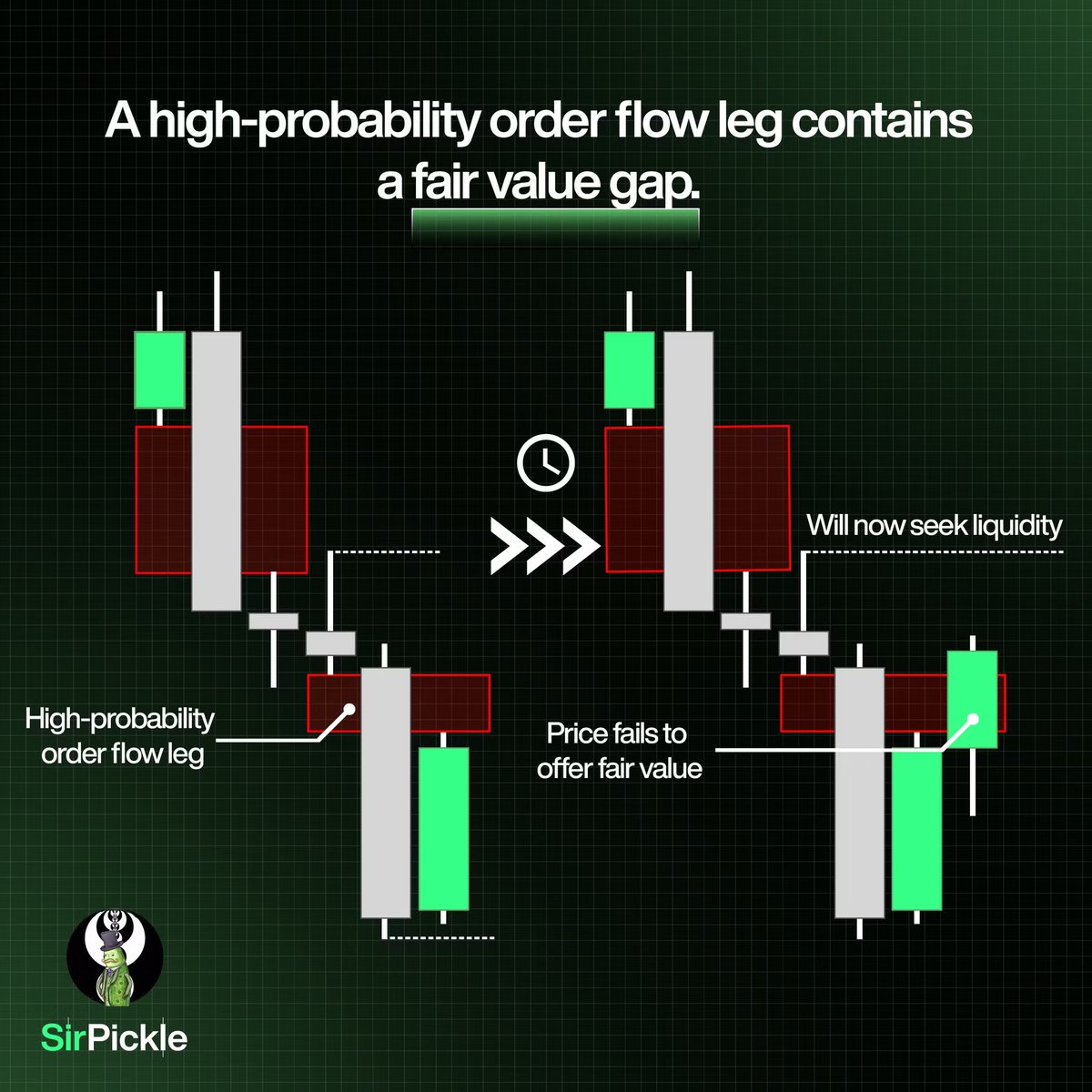

A high probability order flow leg contains a fair value gap.

If that fair value gap fails, then it is most likely that price is going to seek the liquidity that formed the fair value gap.

If you haven’t read the order flow thread, here’s the link:

A high probability order flow leg contains a fair value gap.

If that fair value gap fails, then it is most likely that price is going to seek the liquidity that formed the fair value gap.

If you haven’t read the order flow thread, here’s the link:

https://x.com/SirPickle_/status/1832441476518993933

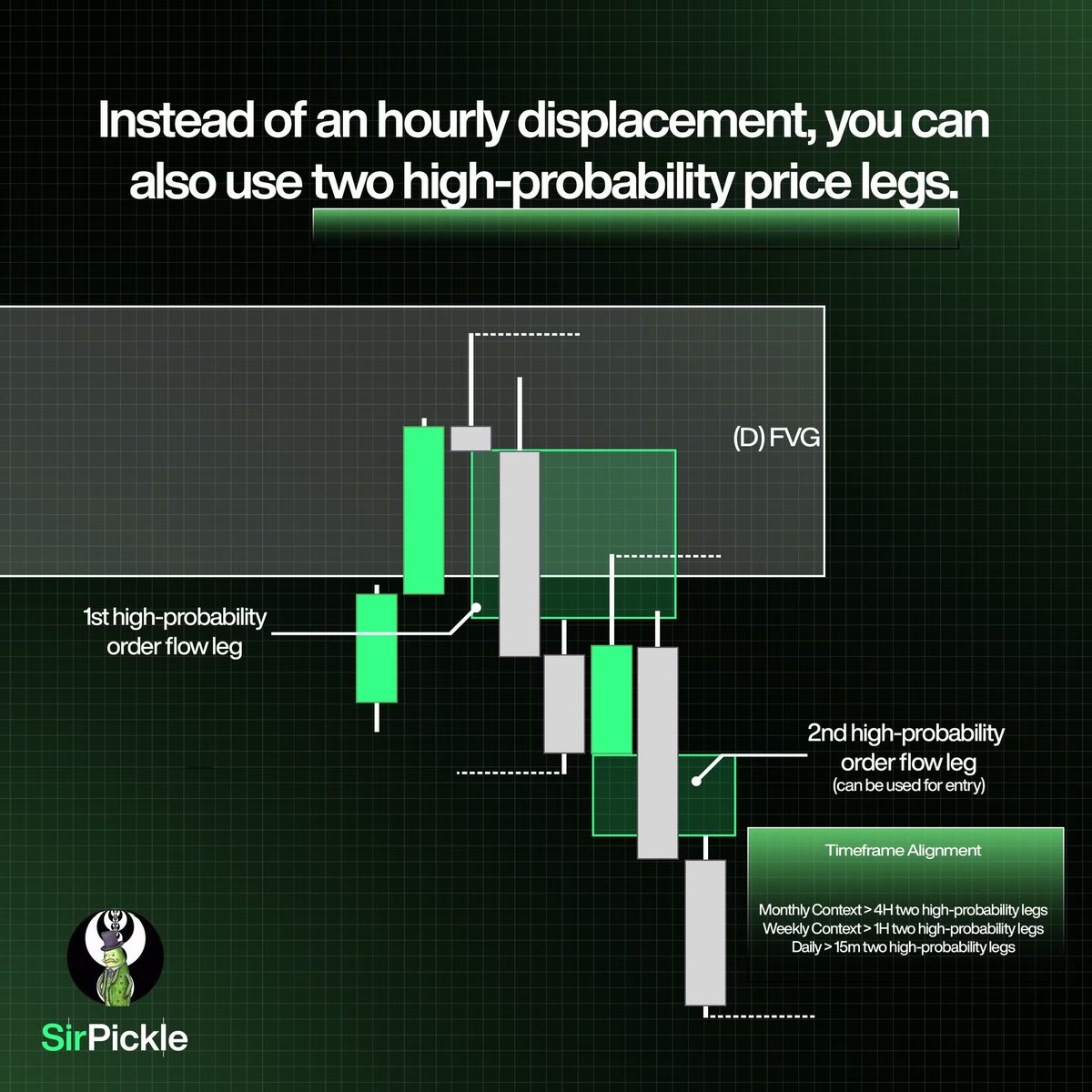

We can also use two high-probability legs to confirm the reversal lower.

Keep in mind that a price leg contains a swing high, a fair value gap, and a swing low.

The lower the timeframe, the more confirmation you want to see.

So you’ll want to demand two high-probability price legs instead of just one going away from the daily context.

(Credits to @Arjoio for this timeframe alignment)

Keep in mind that a price leg contains a swing high, a fair value gap, and a swing low.

The lower the timeframe, the more confirmation you want to see.

So you’ll want to demand two high-probability price legs instead of just one going away from the daily context.

(Credits to @Arjoio for this timeframe alignment)

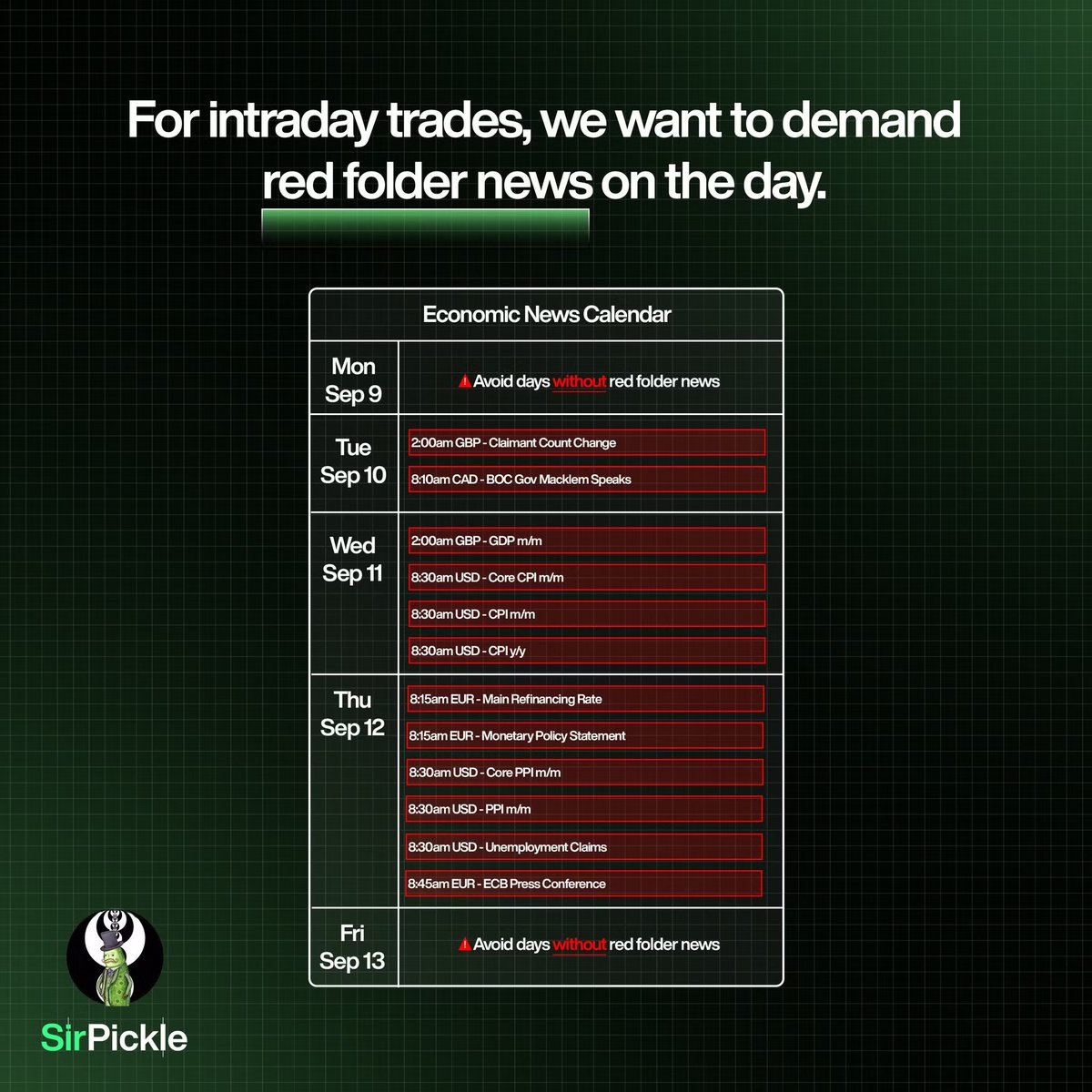

In my system, I also require the day to have red folder news for intraday trades.

It gives the price the volatility it needs to have those energetic price moves.

For swing trades this differs, I just look for news on the week itself.

If you don’t know where to check for red folder news here’s the link: forexfactory.com/calendar/

It gives the price the volatility it needs to have those energetic price moves.

For swing trades this differs, I just look for news on the week itself.

If you don’t know where to check for red folder news here’s the link: forexfactory.com/calendar/

For my intraday trades, I also require my trades to be within a killzone.

I use 8-12 AM EST as my killzone as it covers both 8:30 and 9:30 open, both of which are highly volatile.

I use 8-12 AM EST as my killzone as it covers both 8:30 and 9:30 open, both of which are highly volatile.

That’s all for intraday trades!

For swing trades, check out my previous thread down below!

For swing trades, check out my previous thread down below!

https://x.com/SirPickle_/status/1827713436882526565

Hope you found this insightful!

Liked the new thread design? If so, like, comment, retweet, and share this thread with your friends!

Appreciate you reading this💚

Have a great trading week!

Liked the new thread design? If so, like, comment, retweet, and share this thread with your friends!

Appreciate you reading this💚

Have a great trading week!

And again, If you want more content like this as well as detailed breakdown of my trades,

JOIN my free discord server by clicking this link:

See you in the Jar ;) discord.gg/picklejar/

JOIN my free discord server by clicking this link:

See you in the Jar ;) discord.gg/picklejar/

• • •

Missing some Tweet in this thread? You can try to

force a refresh