When do people spend their money?

When do people refrain from spending their money?

When do people refrain from spending their money?

People Buy & Spend on weekends and holidays.

People will not spend their money when they can't afford to. For instance Week days prior to payday after holiday spending.

People will not spend their money when they can't afford to. For instance Week days prior to payday after holiday spending.

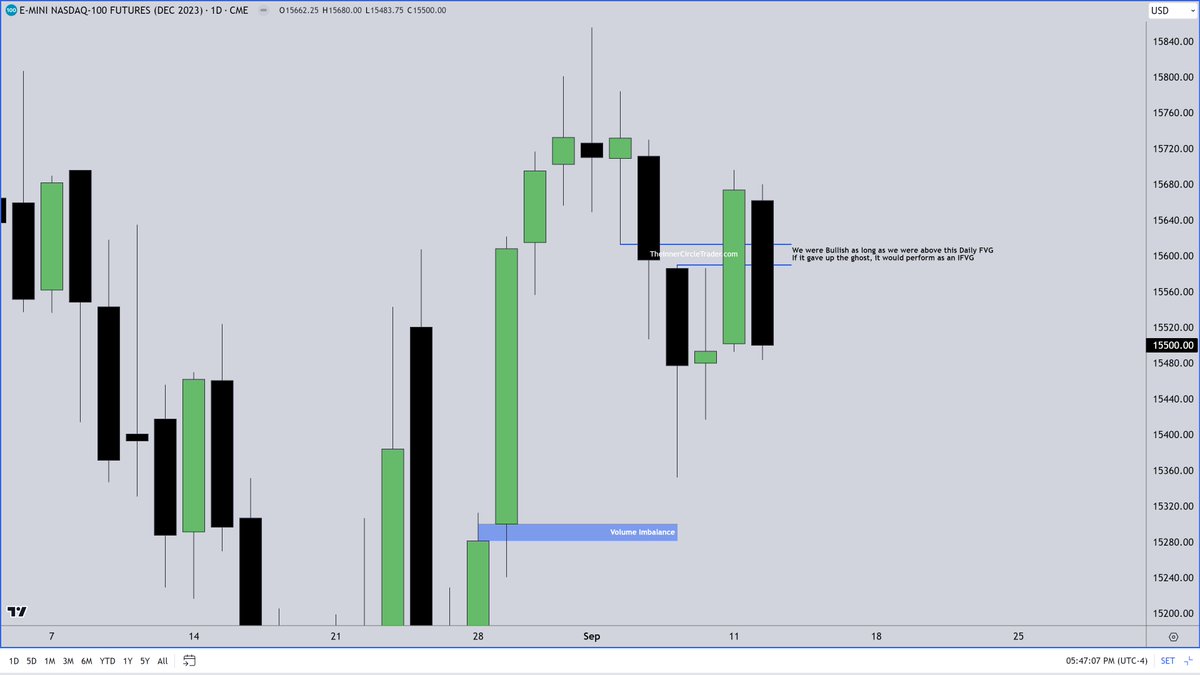

Market Making is manipulating the impulses of every Trader. Through Fear & Greed... they offer Price to willing Buyers and Sellers. The constant delivery model is used to drive liquidity and disrupt or engineer "sentiment" that later gets devoured.

More on this tomorrow.

More on this tomorrow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh