Summarizing the #DraghiReport as “Germany should pay for others” is absurd and ignores basic data.

Germany would be a top beneficiary of the plan.

Charts from my note earlier this week👇1/n

Germany would be a top beneficiary of the plan.

Charts from my note earlier this week👇1/n

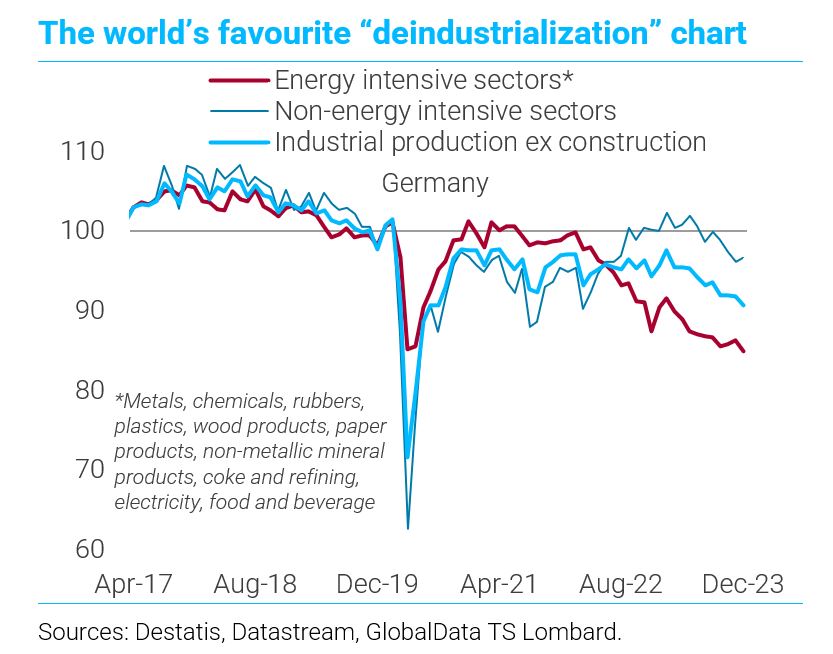

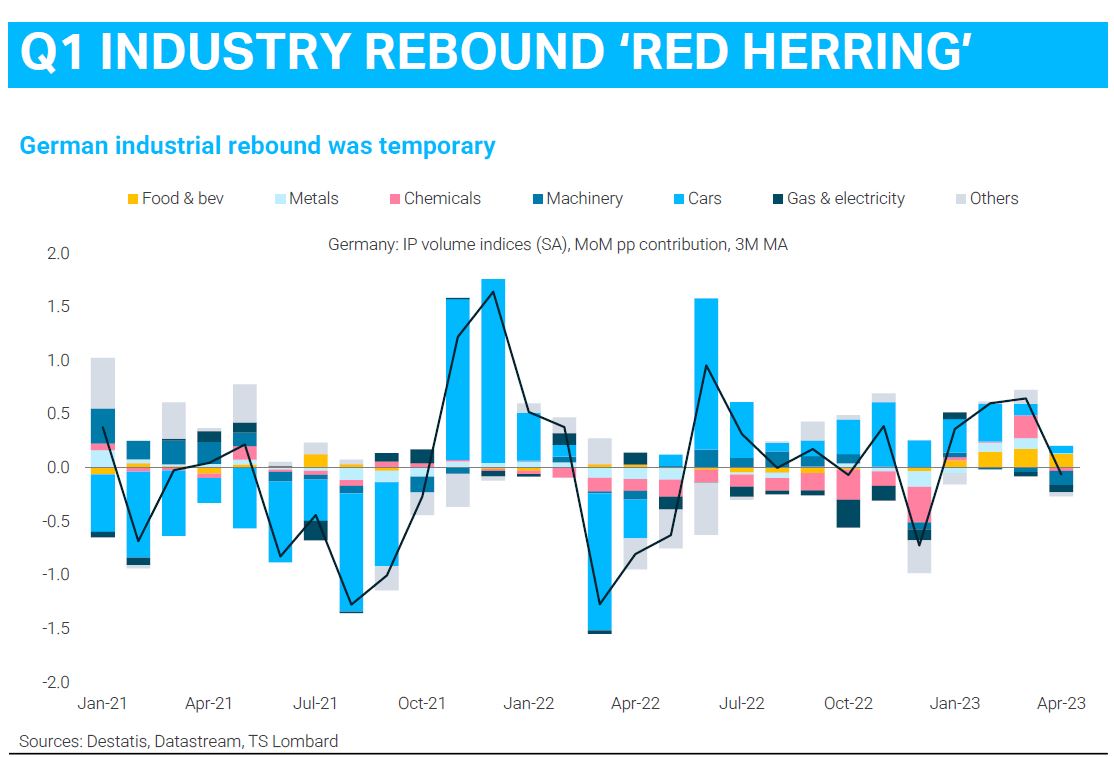

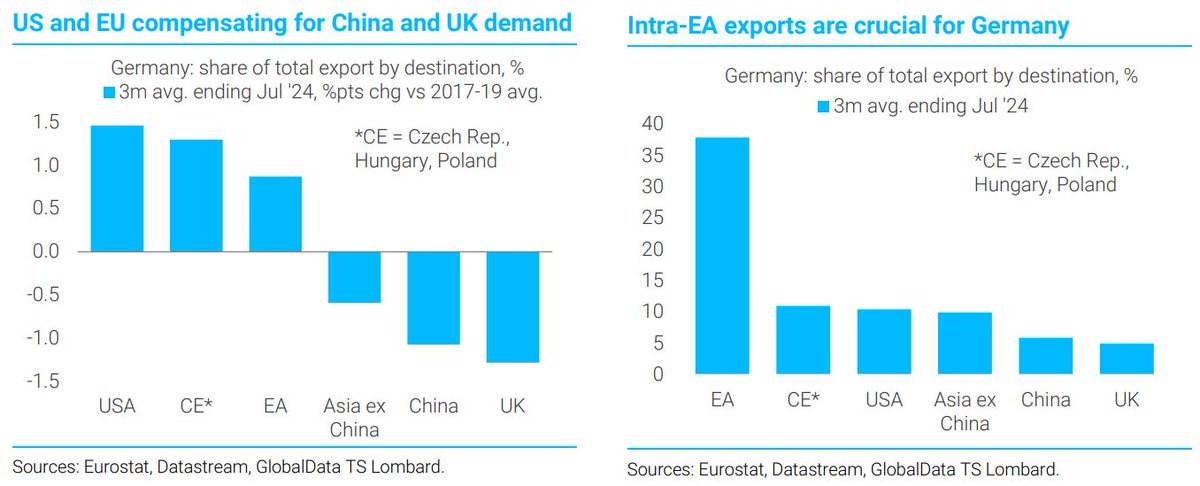

Unlike in the past, structural headwinds now affect Germany more than the EA 'periphery' because of Germany’s overexposure to manufacturing and exports.

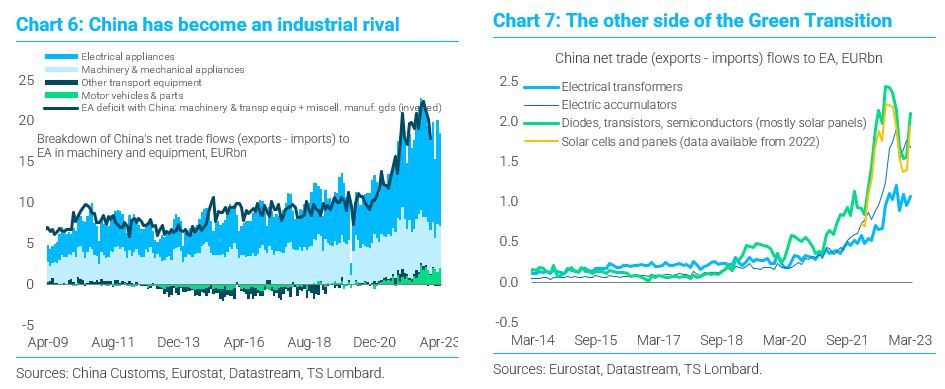

First, China turned from key export market into fierce industrial rival in the auto sector and across advanced industries. 2/n

First, China turned from key export market into fierce industrial rival in the auto sector and across advanced industries. 2/n

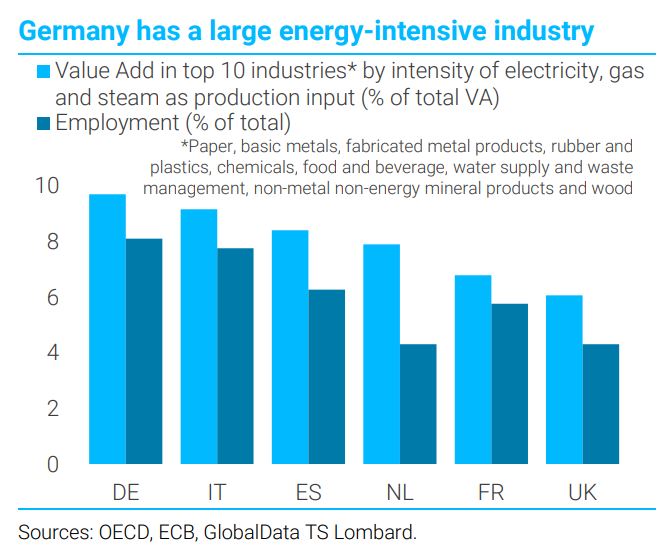

Second, energy cost-competitiveness is now a major factor threatening the existence of a large share of the German manufacturing base – ~10% of Value Add and 8% of total employment, roughly equivalent to the car manufacturing sector. 3/n

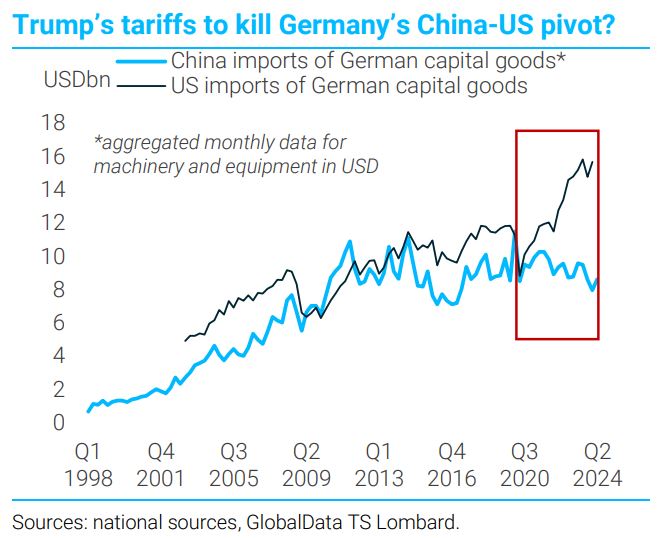

Third, Germany needs strong EU demand more than ever, as US protectionism rises. Strong US demand after Covid has helped German exporters to partly pivot away from China. But US tariffs risk crushing German manufacturers in a deadly pincer movement. 4/n

Meanwhile, also to compensate for lost UK demand after Brexit, Germany has been fighting with CEE countries for market share in the EU, which remains its top export destination. Helping sustain investment and demand in the EU is in the interest of Germany itself. 5/n

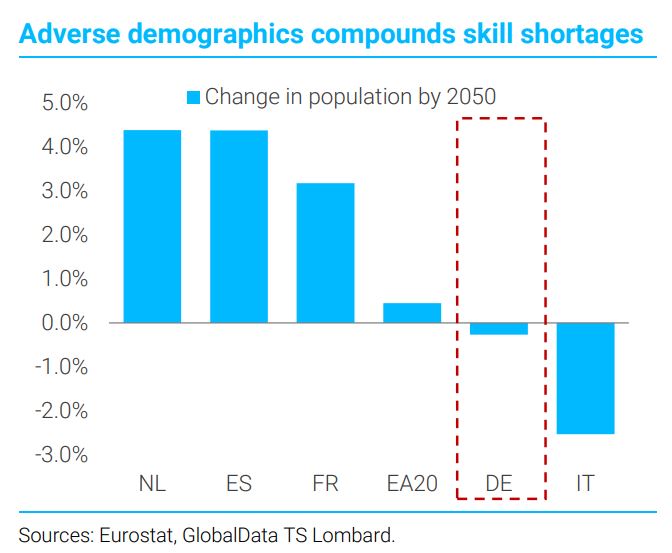

Fourth, German demographic trends point to a faster decline in population by 2050 than for the EA average. Rapid demographic decline will compound the already big labour (largely skill) shortages. Investing to boost skill upgrades and revive productivity is key. 6/n

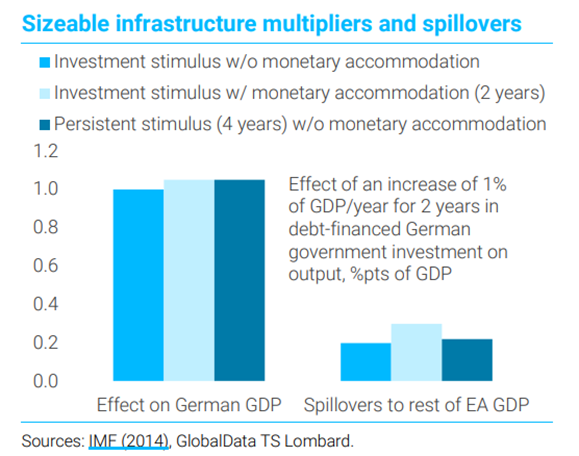

But financial benefits for Germany would also be TANGIBLE:

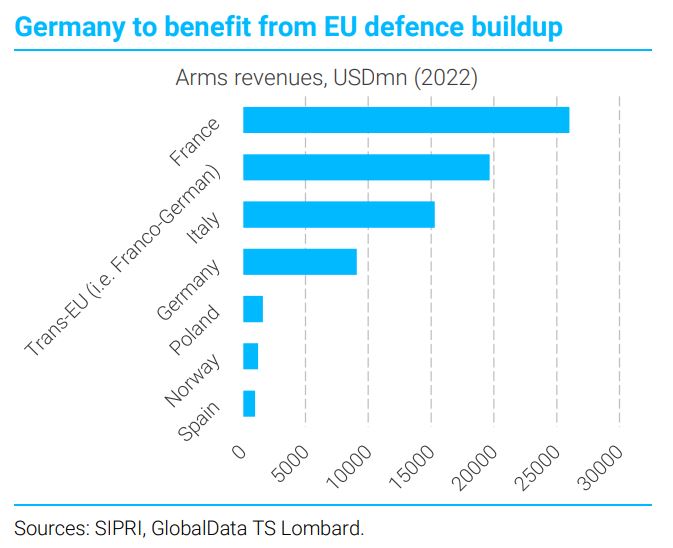

The EU defence industry is largely Franco-German: new military procurement rules that favor EU suppliers and any new joint effort to coordinate and scale up investment would make money flow to German firms. 7/n

The EU defence industry is largely Franco-German: new military procurement rules that favor EU suppliers and any new joint effort to coordinate and scale up investment would make money flow to German firms. 7/n

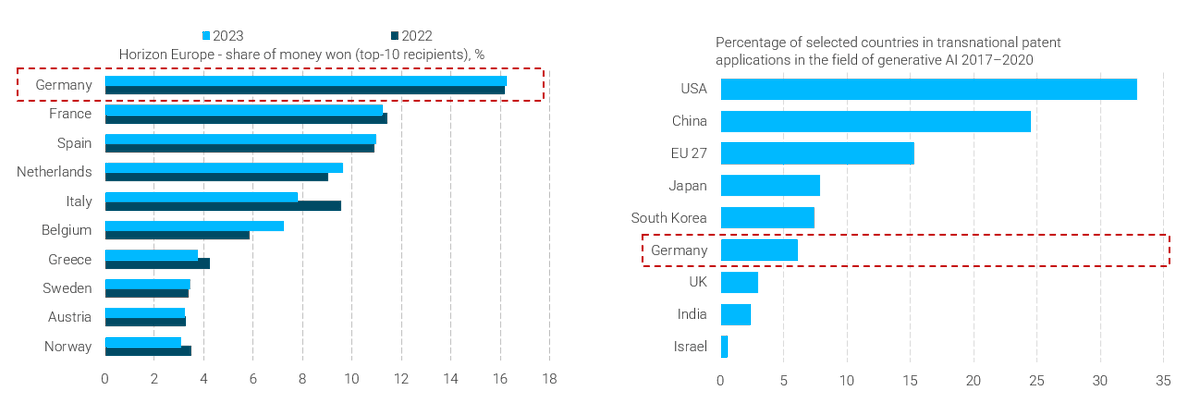

There is more: Germany is consistently the largest recipient of EU funds to research (Horizon Europe) and it’s the place where innovative research is most concentrated (e.g. AI patents). Scaling up investment in innovation would naturally benefit Germany and the EA 'core'. 8/n

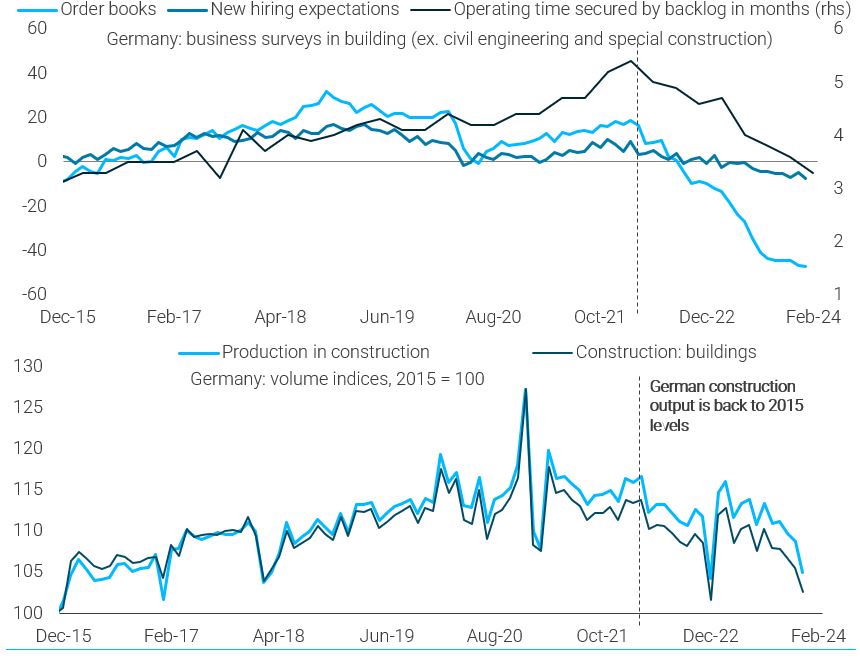

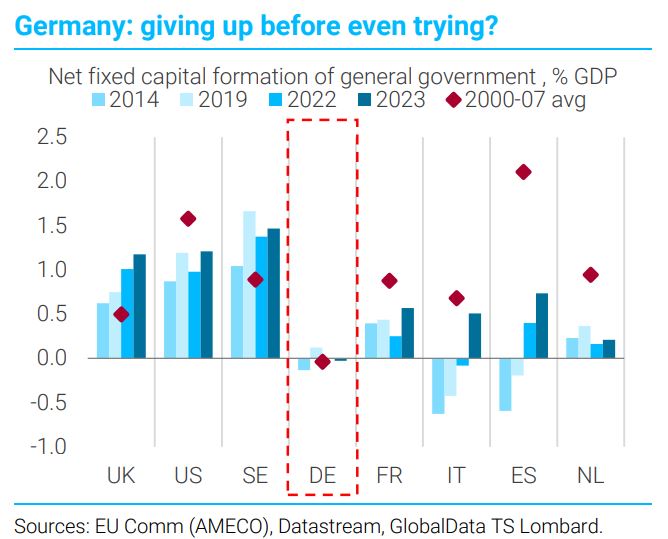

Germany scores terribly on public investment. On average in 25 yrs public capex growth has been virtually ZERO, net of depreciation! Depleted transport infrastructure is a top reason for firms to hold back capex. Germany looks like should be a net RECIPIENT of EU transfers😉9/n

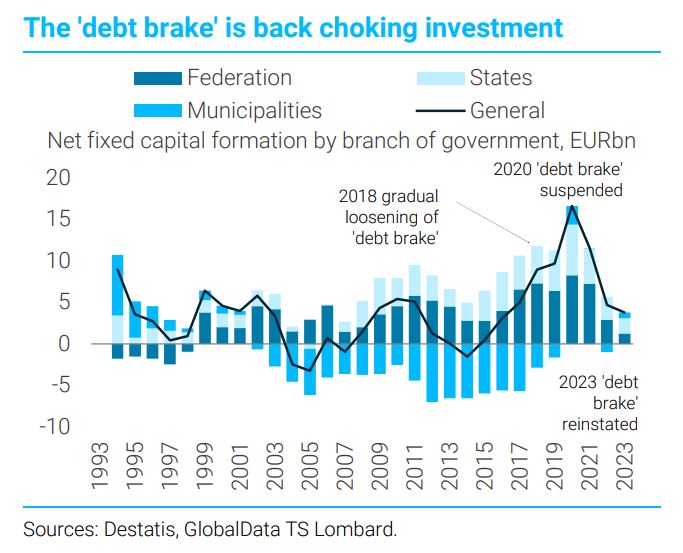

But Germany will never be able to overcome its huge challenges on its own if the “debt brake” remains in place. The Federation of German Industries (BDI) puts the investment need to restore German competitiveness at 1.6% of GDP per annum until 2030… 10/n

english.bdi.eu/#/article/news…

english.bdi.eu/#/article/news…

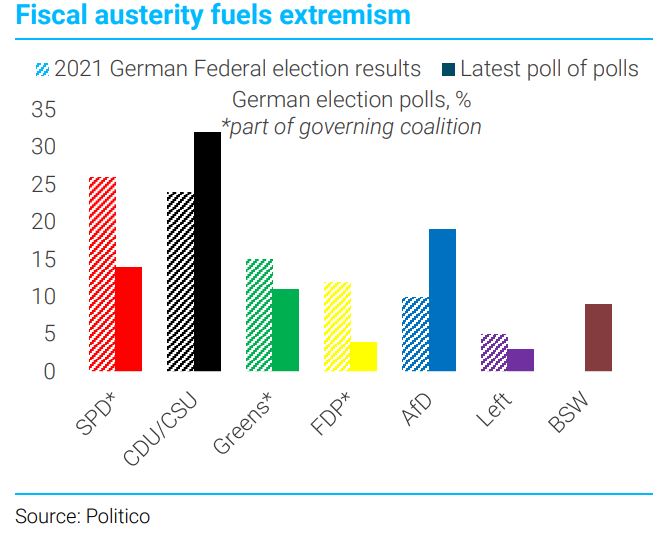

Finally, underinvestment in social and physical infrastructure exacerbating the retreat of private capital from peripheral regions (Eastern Germany) is what drives political polarization – immigration is just the trigger. Will Berlin listen? 11/n

Many have pointed a lot of this out at the same time, but especially @SanderTordoir , @BergAslak et al @CER_EU , who made a thorough and well-balanced summary of the original report. END

cc: @TS_Lombard

cc: @TS_Lombard

• • •

Missing some Tweet in this thread? You can try to

force a refresh