Macroeconomist @TS_Lombard, bookworm and gourmet (and glutton). Stubbornly trying to make sense of data before speaking. RT=interesting

How to get URL link on X (Twitter) App

Prior to 2008-09 crisis, consensus had German fiscal multipliers around 0.6-0.7. But studies glossed over the state-dependent nature of multipliers and differences in fiscal tools. Since then, literature has shown that output multipliers are larger in certain conditions: 2/

Prior to 2008-09 crisis, consensus had German fiscal multipliers around 0.6-0.7. But studies glossed over the state-dependent nature of multipliers and differences in fiscal tools. Since then, literature has shown that output multipliers are larger in certain conditions: 2/

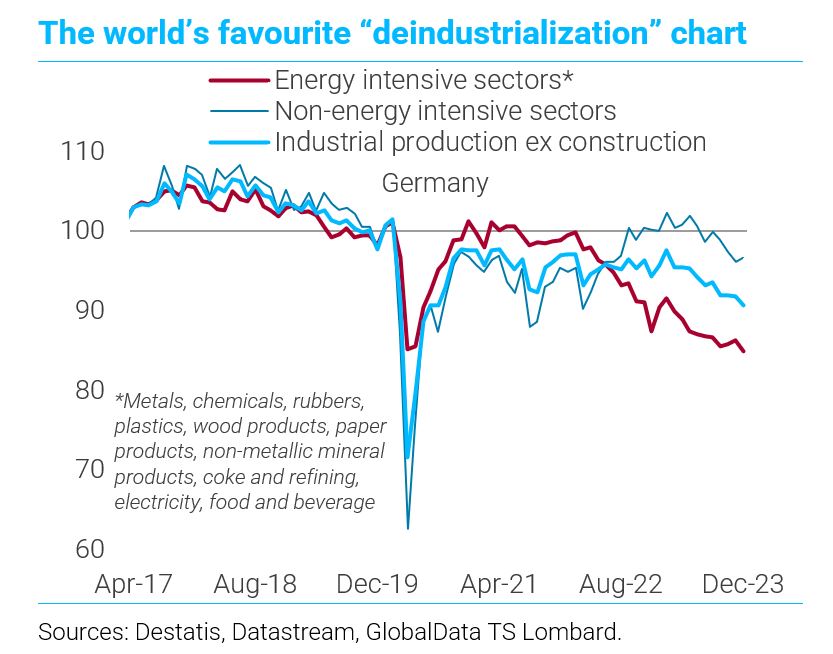

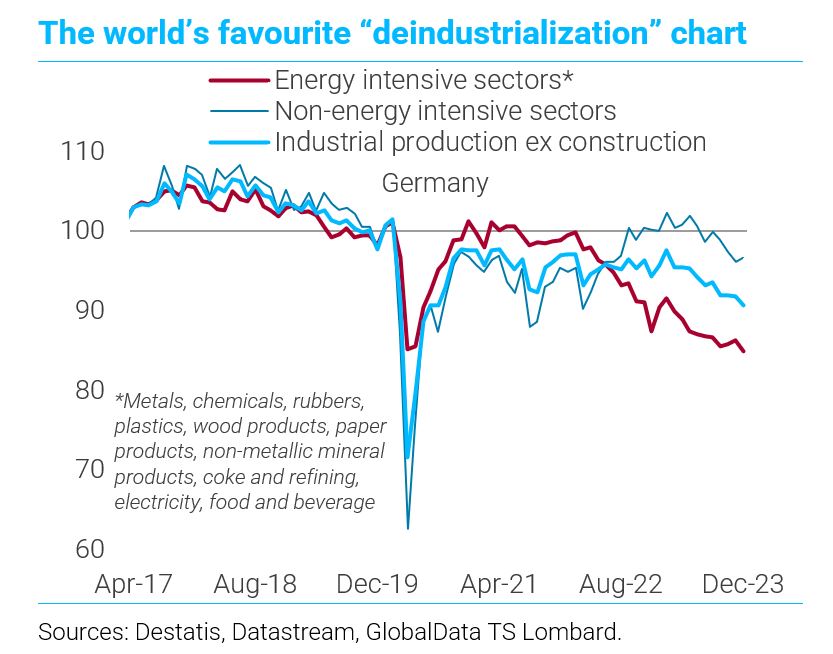

Unlike in the past, structural headwinds now affect Germany more than the EA 'periphery' because of Germany’s overexposure to manufacturing and exports.

Unlike in the past, structural headwinds now affect Germany more than the EA 'periphery' because of Germany’s overexposure to manufacturing and exports.

First, the fall in German and EA intermediate goods orders (most relevant for energy-intensive output), has been steeper than for other foreign orders. And it has continued despite the drop in energy/input costs, and easing supply bottlenecks.

First, the fall in German and EA intermediate goods orders (most relevant for energy-intensive output), has been steeper than for other foreign orders. And it has continued despite the drop in energy/input costs, and easing supply bottlenecks.

https://twitter.com/DavideOneglia/status/1668548071267917824?s=20The EA heads for cyclical stagnation: fade ultra-bears talking about rising risks of “deep recession”, but dropping industrial orders and retail sales since March simply confirm EA underlying growth weaknesses 2/

No doubt, the old export-led EA growth model is dead. The EA is losing competitiveness. First, China is turning from key export market into industrial rival. A big problem for overexposed EA economies and firms 2/

No doubt, the old export-led EA growth model is dead. The EA is losing competitiveness. First, China is turning from key export market into industrial rival. A big problem for overexposed EA economies and firms 2/

In EU, banks’ credit risk via CRE concentrates in the Nordics and Central Europe. Sweden tops the table, but, in the EZ, fixed-rate mortgages make Germany, the Netherlands and France less exposed (although more exposed in terms of loan profitability!) than Austria and Finland 2/

In EU, banks’ credit risk via CRE concentrates in the Nordics and Central Europe. Sweden tops the table, but, in the EZ, fixed-rate mortgages make Germany, the Netherlands and France less exposed (although more exposed in terms of loan profitability!) than Austria and Finland 2/

https://twitter.com/RobinBrooksIIF/status/1138422290683744261In EU this is a vital *political* debate. Given the well-known output gap measurement issues especially in real-time, references to 'cyclically-adjusted' fiscal balances in budgetary rules at EU level and in member states are a serious problem (2/x)