1/ sorry for the long thread: I’ve had many convos around the SEC approval of IBIT options. my smart colleagues in the industry (h/t @dgt10011) have written great commentary around it...

my own views are more nuanced and tempered, but as always expect the unexpected in crypto:

my own views are more nuanced and tempered, but as always expect the unexpected in crypto:

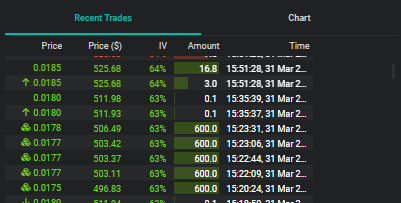

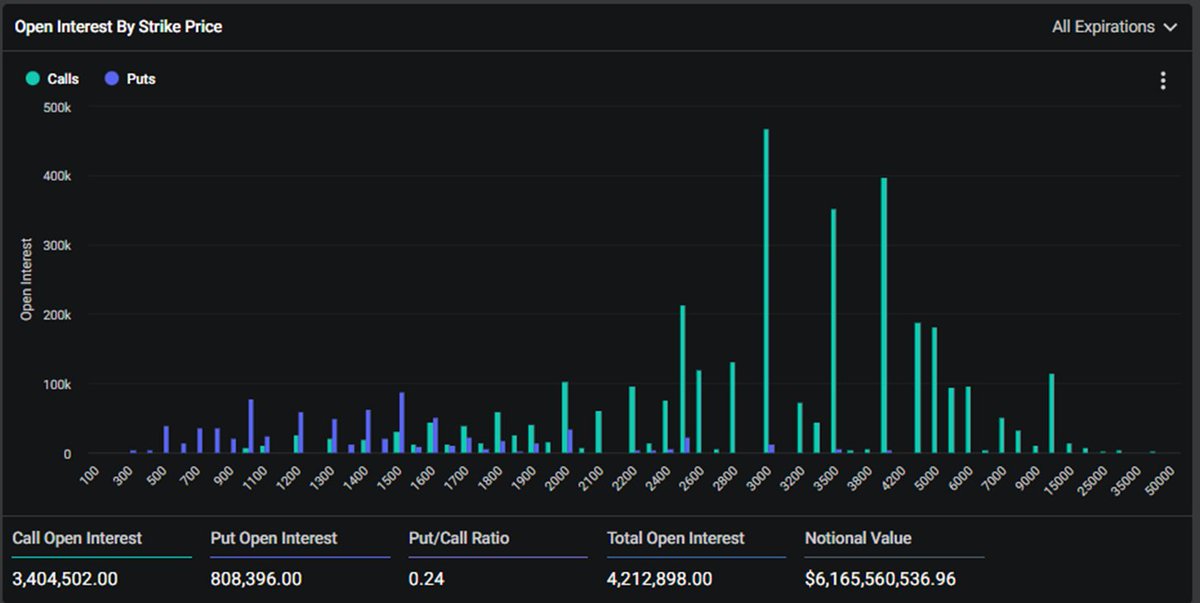

2/ first things first, we have to remember crypto already has a well-known and extremely liquid (by crypto standards) options venue called Deribit. it trades ~$40 bn notional monthly in BTC options. this compares to CME at ~$3bn

3/ yes, it’s an “offshore” and “crypto-native” venue. yes, it’s where crypto retail traders who have some derivatives savvy go to trade. But a lot of tradfi firms are market-making there too…

4/ you think firms like IMC, Optiver, Citadel, Jane St, SIG don’t go to where there’s retail trading volumes at healthy margins (relative to other tradfi macro markets)?

5/ and yes, I know those firms’ interest in crypto has come and gone over the years, but I guarantee at least some are active on Deribit now, and if not directly, their fmr employees have spun out innumerable small (and in some cases large) crypto prop shops to trade on Deribit

6/ there are also plenty of institutional users who are active there. we've seen directional traders overlay Dec call spreads or 1x2s to cheapen upside. And also vol-arb type buyers of high-strikes as a relative value to ATM straddles. and in large size prints of $100k+ vega at a time

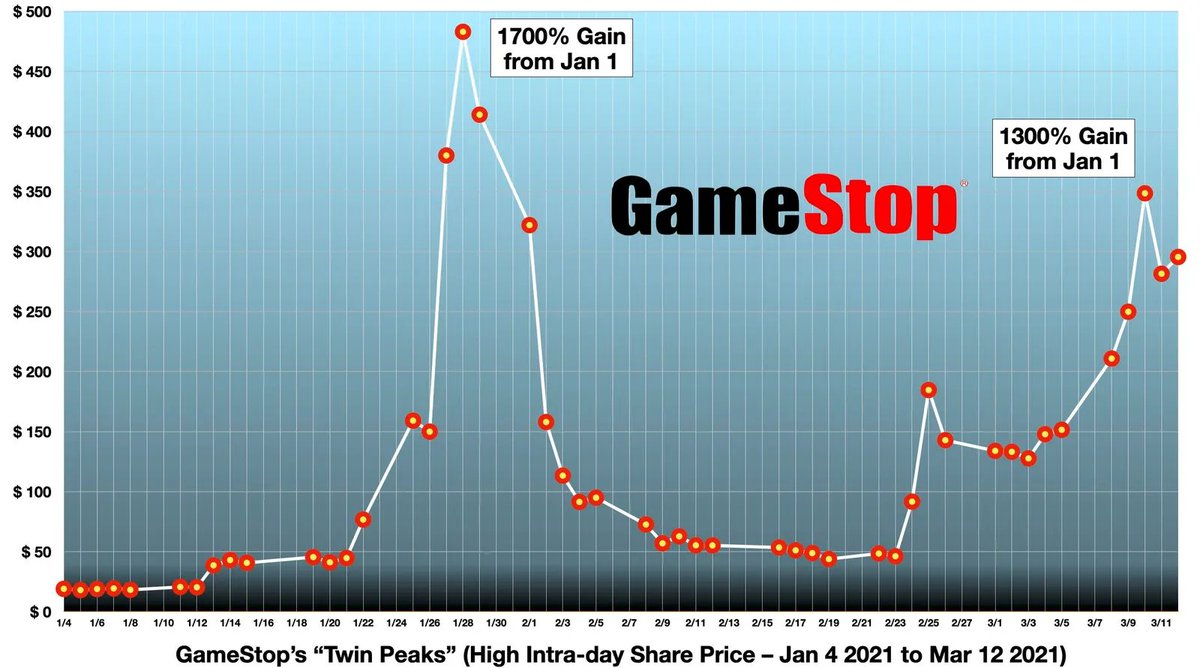

7/ it’s hard to argue that tradfi or retail players are encountering BTC options for the first time. at the same time I acknowledge that the 0-dte market of r/wsb traders are a real force to be reckoned with

8/ any liquidity provider in options has GME, AMC seared into our brains. at the same time GME peak mkt cap was something like $33bn, which is 1/36th of BTC at $1.25tn…

9/ it’s hard to squeeze a $1tn+ asset class. Can it happen? Sure crazier things have happened. The Hunt Brothers squeezed silver in 1980, though cursory Googling says peak global supply ~$30bn in 1980 dollars which is $114bn today, so again much easier than moving $1tn+ asset

10/ but BTC is a digital-native asset by definition, it’s a lot easier to financialize it and move it around for trade settlements than other commods. IBIT and the other ETFs have increased velocity making certain otherwise cold-storage-bound BTC available for liquid trading

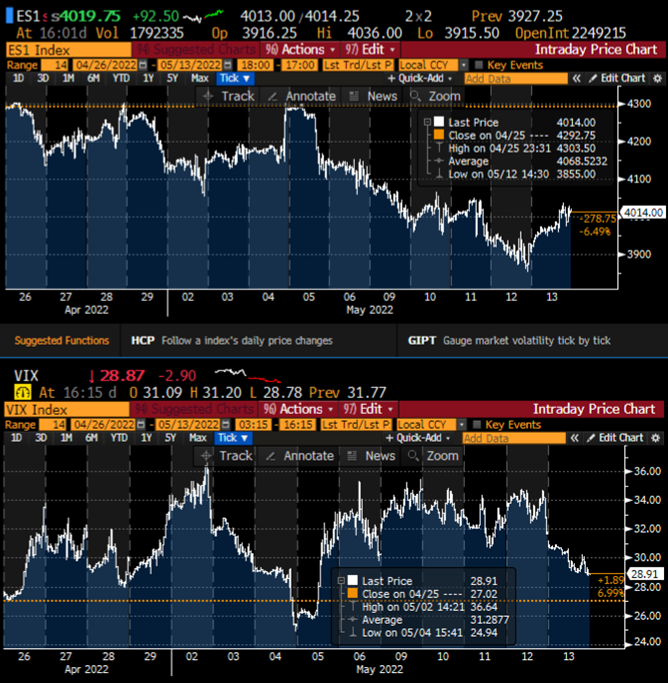

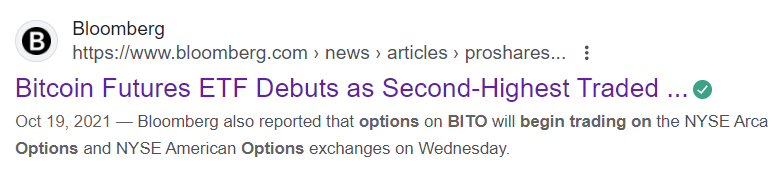

11/ two more questions to consider: first, why didn’t the advent of CME options (on the cash-settled futures, launched Jan 2020) or BITO options (on the rolling CME futures strategy ETF, launched Oct 2021) result in a meaningful or concerted short squeeze on BTC?

12/ squint a chart of BTC/USD and you'll see both launches were near local tops -- of course for exogenous reasons like Covid and Fed hiking cycle, but that speaks to the point that the macro flows on BTC are more impactful than options gamma-squeeze potential

12/ second q, if the idea is to screen for commodities with squeeze potential, why not focus on many other smaller markets in energy, ags or metals that have either much less tradable supply / annual production?

14/ I’ve been reading a lot of macro pieces speculating that gold and silver could see hyperbolic gains (“Is silver the next NVDA??”) but again that would be motivated by the hard-money properties of those precious metals...

15/ can another parabolic move higher happen to BTC because of its unique properties as a non-sovereign store of value in a world that requires digital value transfer? of course – but that’s less about retail short-squeeze in options gamma than macro capital allocation inflows

16/ "so is loading up on IBIT gamma a good trade?" Maybe! if you believe in the fundamental thesis of BTC! and in some ways BTC is the ultimate reflexive asset (i.e. it goes up because it’s more likely to be a globally accepted store of value because it goes up)

17/ but waiting for the trade to work is also tough unless you have a great pulse on r/wsb. just check a chart of GME and imagine what it is like holding options on it 95% of the time that it just chops / bleeds lower

18/ "ok so are you just dismissing IBIT options entirely?" no, there will definitely be some huge unlocks coming out of it:

19/ first, it will be a huge net positive for volumes across the entire derivs complex. just as the launch of CME options was a net positive for Deribit (more cross-venue arbs) so will the ETF options

20/ even more so because prime brokers / FCMs will allow some risk-netting across the ETF and CME product set in a way that existing crypto OTC and Deribit markets can't participate in yet

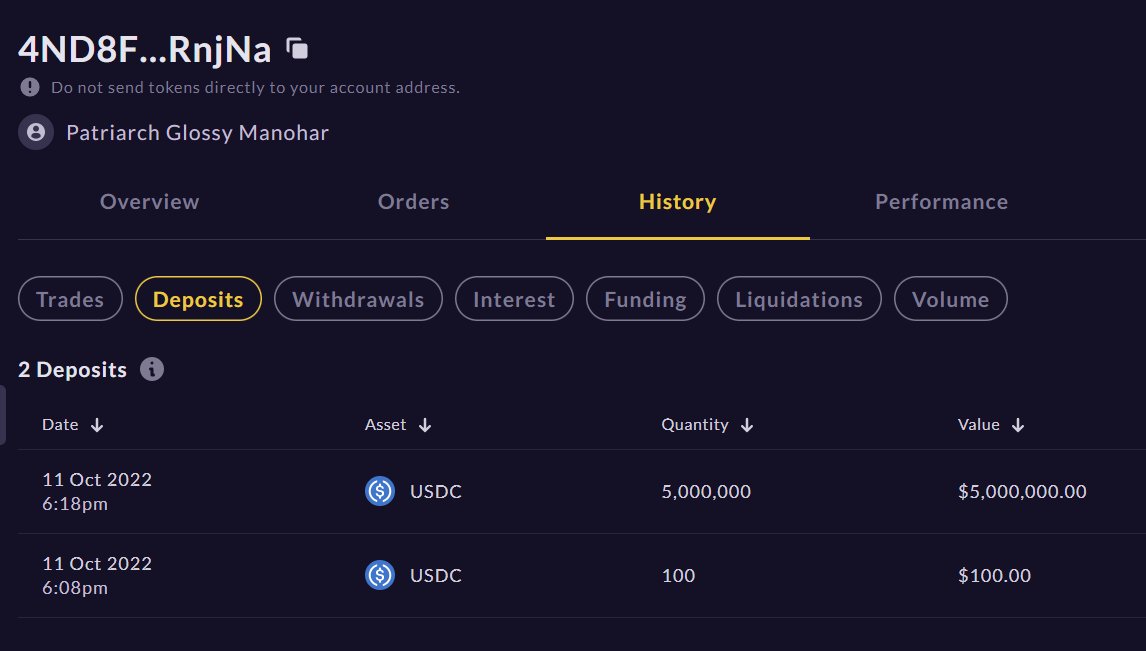

21/ second, new tradfi options markets can and often do dampen vols because of structured product supply. the US structured notes market is ~$100bn annually. much of this is vol-selling as they are income notes that sell options for yield

22/ if some of that RIA, private bank money makes its way into IBIT-linked notes, even $5bn of issuance on IBIT would be a quarter of Deribit open interest (currently around $20bn)

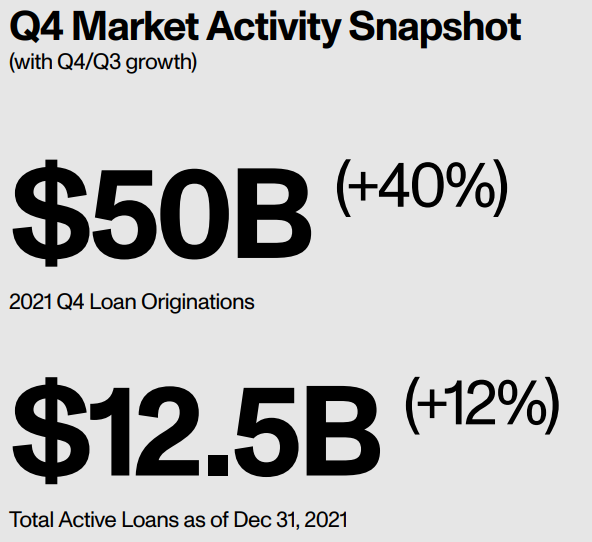

23/ third, there will be an altcoin boom if crypto lending comes back. one of the largest loan books in crypto was $12.5bn at the end of 2021. this has been one area that hasn't fully recovered since last cycle

24/ prime brokers margin lending USD against BTC collateral greatly expands the availability of USD cash within crypto. that would lead to investment in riskier parts of the ecosystem as capital is recycled from the BTC ETF to memecoins, NFTs, alt L1s and speculative VC bets

25/ options markets on IBIT (and market-maker willingness to bear the risk) will make it easier to price the risk inherent in margin lending against IBIT and make it more likely for prime brokers to lend against crypto… there will be an altcoin boom

26/ fourth, basis spreads will compress. the futures premium in BTC vs spot is due to longs needing to maintain exposure via perps / futures. With easier access to USD per the above, USD funding rates in the ecosystem will go down and as a result basis spreads will compress

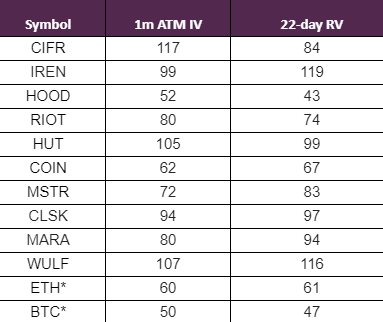

27/ lastly, elevated / expensive vols on single-name proxies for crypto exposure (MSTR, COIN, miners etc, which can be 70-100 vol) may compress and be more contained relative to BTC vols (typically in the 40-50 vol range now) as dealers are more willing to run short single-name vs underlying commodity vol spreads

• • •

Missing some Tweet in this thread? You can try to

force a refresh