in crypto: co-head markets @falconxglobal; co-founder ceo @arbelosxyz (acq by FalconX); head of derivatives, genesis; galaxy. prior life: equity derivs GS; UBS

2 subscribers

How to get URL link on X (Twitter) App

2/ first things first, we have to remember crypto already has a well-known and extremely liquid (by crypto standards) options venue called Deribit. it trades ~$40 bn notional monthly in BTC options. this compares to CME at ~$3bn

2/ first things first, we have to remember crypto already has a well-known and extremely liquid (by crypto standards) options venue called Deribit. it trades ~$40 bn notional monthly in BTC options. this compares to CME at ~$3bn

2/ we know tradfi guys / macro tourists are already long crypto ahead of ETF news, they’ve built the position over the last few months and are now paying handsomely to roll it

2/ we know tradfi guys / macro tourists are already long crypto ahead of ETF news, they’ve built the position over the last few months and are now paying handsomely to roll it

2/ at 11:11 AM ET, customer bought 600x of the May 32k / 38k call spread, each contract has a 5 BTC multiplier, so the notional of this trade is $82mm. customer paid $1085 per unit = $3.26mm in premium for a max payout of $18mm at maturity

2/ at 11:11 AM ET, customer bought 600x of the May 32k / 38k call spread, each contract has a 5 BTC multiplier, so the notional of this trade is $82mm. customer paid $1085 per unit = $3.26mm in premium for a max payout of $18mm at maturity

https://twitter.com/osec_io/status/1579969927020412929

2/ attacker then offered out 483mm units of MNGO perps on the order book

2/ attacker then offered out 483mm units of MNGO perps on the order book

2/ last night, trader X successfully extracted profits from GMX's AVAX/USD market by opening large positions at 0 slippage, then moving AVAX/USD on other venues in their favor

2/ last night, trader X successfully extracted profits from GMX's AVAX/USD market by opening large positions at 0 slippage, then moving AVAX/USD on other venues in their favor

2/ first metric is the ETH/BTC ratio, ETH price divided by BTC price, which is 0.0733. this is still near multi-year highs of 0.0880 which we touched prior to the Fed-induced meltdown in risk assets in Dec 2021

2/ first metric is the ETH/BTC ratio, ETH price divided by BTC price, which is 0.0733. this is still near multi-year highs of 0.0880 which we touched prior to the Fed-induced meltdown in risk assets in Dec 2021

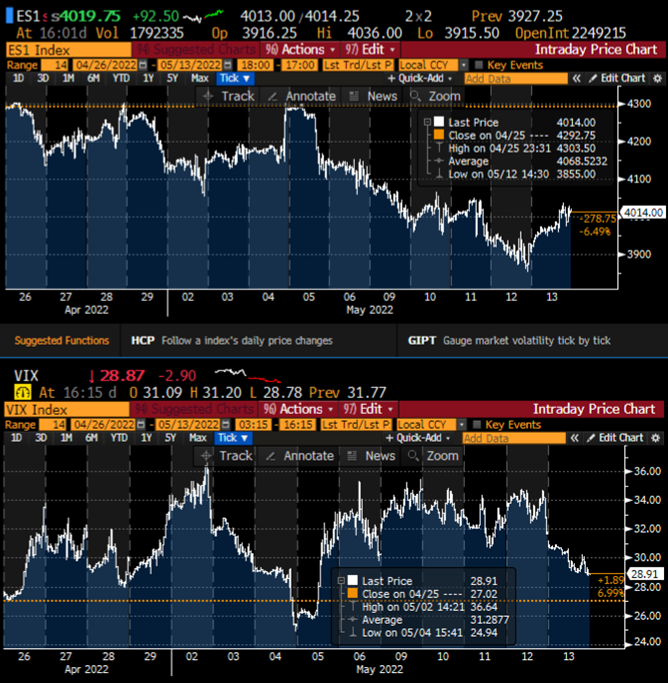

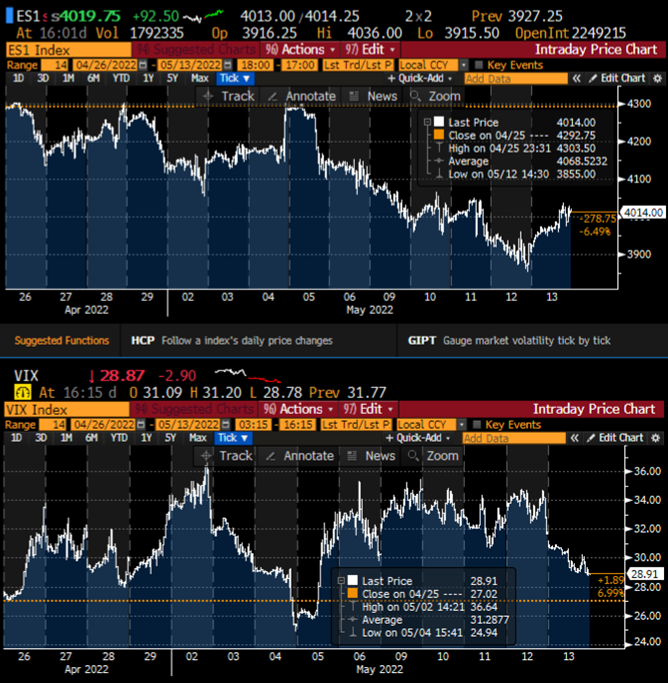

2/ we're seeing a somewhat orderly equity de-risking last 2 weeks and plenty of cash on sidelines waiting for liquidation to abate

2/ we're seeing a somewhat orderly equity de-risking last 2 weeks and plenty of cash on sidelines waiting for liquidation to abate

2/ BTC vs equities correlation is realizing 60-70 to start 2022. this is up from 10-40 corr through most of 2021

2/ BTC vs equities correlation is realizing 60-70 to start 2022. this is up from 10-40 corr through most of 2021

2/ in previous years, our trading desk would see regular supply in 6-12 month vega from dealers hedging books. there's less systematic flow of this type hitting screens now -- this goes hand in hand w dealers having larger balance sheets and being more willing to warehouse risk

2/ in previous years, our trading desk would see regular supply in 6-12 month vega from dealers hedging books. there's less systematic flow of this type hitting screens now -- this goes hand in hand w dealers having larger balance sheets and being more willing to warehouse risk