Just published the "tax longlist" - 29 ways Rachel Reeves could raise £22bn.

I've tried to cover every serious proposal that's out there. This thread will be *long*.

I've tried to cover every serious proposal that's out there. This thread will be *long*.

The full article is here: , with footnotes, sources, references etc.taxpolicy.org.uk/2024/09/25/the…

How much room for manoeuvre does Rachel Reeves have?

Here’s how UK tax receipts looked in 2023/24 – about a trillion pounds in total:

Here’s how UK tax receipts looked in 2023/24 – about a trillion pounds in total:

During the election campaign, Labour ruled out increasing income tax, national insurance, VAT or corporation tax. They’ve committed to reform business rates. The promise not to increase tax on “working people” probably rules out council tax and air passenger duty...

Stamp taxes and bank taxes are already probably past the point of diminishing returns. Customs duties and IPT are technically hard to raise. Oil/gas duty already raised. Raising alcohol duty would be unpopular out of all proportion to its significance.

However the promises this time were repeated so often, and made so clearly, that breaking them feels (at least to me) out of the question.

Another solution: radical tax reform. That would be welcome - and I'll be writing more about it soon, but I fear we won't see much of it in this Budget.

If Ms Reeves isn't going to break pre-election promises, or do something radical, then it's a matter of scrabbling for numerous relatively small tax increases here and there.

Here are items I'd expect to be on the Chancellor's longlist, in a roughly descending order of likeliness. Note: I'm not in favour of all of these, by any means.

(to keep this thread manageable I'm just giving a one line description for each, and a link to further reading. Way more detail, and pro/con arguments, in the linked article)

1. Pension tax relief - £3-15bn. Right now, high earners get up to 45% relief. That could be limited to 30% or even 20%. Raises lots. But complicated, and unfair if public sector pensions are excluded. hl.co.uk/news/will-labo…

2. Limiting AIM tax reliefs - c£100m. It's daft that my estate would pay 40% inheritance tax on my share portfolio, but if I move it into AIM shares and live for two more years, there would be no inheritance tax at all. Funds have been created solely to take advantage.

3. Limit business and agricultural property relief - £1-2bn. Most private businesses - of any size - are exempt from inheritance tax. Sure, protect businesses/farms. But why should the estate of the Duke of Westminster pay almost no tax? See spearswms.com/wealth/farmer-…

4. Tax large gifts. The problem with reducing IHT reliefs is that people will avoid tax by giving property to kids. So, whilst there is already a lot of tax planning around gifts to children, that would explode. So we could tax lifetime gifts e.g. over £1m. accountingweb.co.uk/tax/hmrc-polic…

5. Pensions inheritance tax reform - £100m to £2bn. If you inherit the pension of someone who died before age 75, it's completely tax free. If they died aged 75 or over, the pension provider deducts PAYE from payments out; but still no IHT. ifs.org.uk/articles/raisi…

6. Increase CGT - £1-2bn. Full equalising income tax (top rate 45%) and CGT (20% or 28%) risks *losing* money, and would give us the highest rate in the developed world. But there's scope for increasing the rate, particularly with an inflation allowance. taxpolicy.org.uk/2024/02/28/oec…

7. Eliminate the stamp duty "loophole" for enveloped commercial property - £1bn+. It's common for high value commercial property to be sold by selling the single-purpose company in which it's held (or "enveloped"). Easy to end this. taxpolicy.org.uk/2022/10/25/sdl…

8. Increase ATED - £200m+. The "annual tax on enveloped dwellings" is an obscure tax that was introduced to deter people from holding residential property in single purpose companies to avoid stamp duty. There's a case for tripling the rate. taxpolicy.org.uk/2022/11/04/ate…

9. Increase inheritance tax on trusts - £500m. Put your property in trust, and there's no IHT when you die. Instead there's a 6% charge every ten years. That feels too good a deal. The rate could go up to 9%. theguardian.com/money/2016/aug…

10. Reform R&D tax relief (£3bn): we’ve had series of tax reliefs designed to incentivise research and development. They now cost £7bn per year, but I fear most of this is wasted. Make reliefs more generous for serious R&D. Scrap it for everyone else. ft.com/content/5e31b0…

11. Push the Bank of England to stop paying interest on some of the QE bonds it holds -c£5bn. This is somewhat esoteric and taxish rather than tax. @ChrisGiles_ and @toby_n are the people to read:

ft.com/content/2fbe15…

ft.com/content/3f2704…

ft.com/content/2fbe15…

ft.com/content/3f2704…

@ChrisGiles_ @toby_n 12. Council tax increases for valuable property - £1-5bn. It's indefensible that an average property in Blackpool pays more council tax than a £100m penthouse in Knightsbridge. Add more bands. taxpolicy.org.uk/2024/06/09/sta…

@ChrisGiles_ @toby_n 13. Introduce an exit tax - £unknown. It's unfair that someone can spend a lifetime in the UK, leave the UK, and then escape all CGT when they sell their assets. Alan Sugar tried & failed to do this. Many others have succeeded. Close the loophole. taxpolicy.org.uk/2023/09/10/sug…

@ChrisGiles_ @toby_n 14. Abolish business asset disposal relief - £1.5bn. This is a capital gains tax relief supposedly for the benefit of entrepreneurs. But the Treasury officials forced to create it named it "BAD" for a reason - it's widely exploited. resolutionfoundation.org/press-releases…

@ChrisGiles_ @toby_n 15. Increase vehicle excise duty - £200m+. A £5 increase would raise £200m, and raising £1bn wouldn't be terribly challenging. However it would affect the "working people" Labour said they wouldn't tax. labour.org.uk/updates/storie…

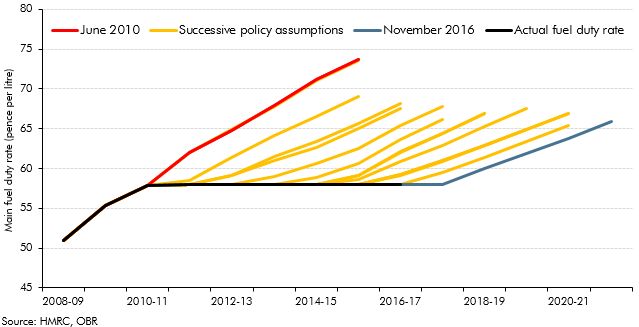

@ChrisGiles_ @toby_n 16. Reverse the Tories' cancellation of the fuel duty rise - £3bn. For years, Governments have been cancelling scheduled (and budgeted) rises in fuel duty. This chart is madness. . But, again - "working people". obr.uk/box/fuel-duty-…

@ChrisGiles_ @toby_n 17. Review VAT exemptions - £1bn+. Many of the VAT exemptions/special rates make little sense and should be abolished. 0% on children's clothes could be scrapped, and child benefit increased so most people saw no net change. gov.uk/government/sta…

@ChrisGiles_ @toby_n These changes could raise around £25bn (with pension tax relief capped at 30%, and taking the cautious/low end of the other estimates).

@ChrisGiles_ @toby_n Here are a few more possibilities, which could raise very significant sums but which I think are (for various reasons) unlikely:

@ChrisGiles_ @toby_n 18. End the pension tax free lump sum - £5.5bn. On retirement, we can withdraw 25% of our pension pot, up to £268k, as a tax free lump sum. IFS argue for abolition. I feel it's changing the rules late in the game. pensions-expert.com/Law-Regulation…

@ChrisGiles_ @toby_n 19. Introduce "sin taxes" on unhealthy food - £3.6bn. An IPPR report recently proposed this. I worry about the quality of the evidence base, and the difficulty of defining "unhealthy food" in a way that actually works.

ippr.org/articles/our-g…

ippr.org/articles/our-g…

@ChrisGiles_ @toby_n 20. Tax gambling winnings £1-3bn. The US taxes gambling winnings. The UK doesn't. That could change. .irs.gov/taxtopics/tc41…

21. Increase taxes on gambling - up to £2.9bn. The recent IPPR report also proposes increasing gaming duties. This would raise significantly more tax than taxing gambling winnings, and be easy to implement but (I expect) be less effective at reducing gambling. link.springer.com/article/10.100…

@ChrisGiles_ @toby_n 22. Cap tax relief on ISAs - up to £5bn. ISAs' CGT and income tax exemption costs c£7bn of lost tax each year, mostly for the relatively wealthy. But again it feels like changing the rules well after kick-off. gov.uk/government/sta…

@ChrisGiles_ @toby_n 23. Reduce the VAT registration threshold - £3bn. There is compelling evidence that the current £90k threshold acts as a brake on the growth of small businesses. But would take huge guts. taxpolicy.org.uk/vat_brake2

@ChrisGiles_ @toby_n 24. Raise the top rate of income tax - <£1bn. The rate was briefly 50% under Gordon Brown - could we return to that? I would be surprised. Doesn't raise much; possibly loses money. ifs.org.uk/articles/50p-t…

@ChrisGiles_ @toby_n 25. CGT on death. Lots of focus in the US on "buy borrow die" - borrowing against assets and never selling them, then having the capital gain disappear on death. We could have an up-front CGT charge. Or roll the gain over. .dcfpi.org/all/how-wealth…

@ChrisGiles_ @toby_n 26. Wealth tax - £1bn to £26bn. Many campaigning groups are keen on a wealth tax targeted at the very wealthy - e.g. people with assets of more than £10m. But most wealth taxes have failed, and the Spanish tax on the super-wealthy has raised peanuts. .reuters.com/article/techno…

@ChrisGiles_ @toby_n 27. CGT on unrealised gains. Another proposal popular with campaigners is to tax capital gains annually, regardless of whether they are realised. No developed country has implemented such a tax. But we can see what the US does. taxfoundation.org/blog/harris-un…

@ChrisGiles_ @toby_n 28. Means test the pension. State pension = £11.5k/year. It's easy to think we should means test the pension to stop the v wealthy benefiting. But actually it's worth £250k+ and 10% of the wealth of some in the top 1%. Confiscatory to remove that. obr.uk/forecasts-in-d…

@ChrisGiles_ @toby_n 29. Increase the rate of VAT. One of the easiest way to raise significant sums - a 1% increase in VAT raises £8.6bn. Cameron & Major Governments raised VAT upon coming into office, after saying they wouldn't during the previous election campaign. But feels unlikely now.

@ChrisGiles_ @toby_n The full version, with way more explanation, sources, arguments and background, is here: taxpolicy.org.uk/2024/09/25/the…

@ChrisGiles_ @toby_n I believe this covers most of the serious suggestions that are out there - but if I've missed anything, or you have any new ideas, do please get in touch (or comment below).

@ChrisGiles_ @toby_n If you want to support our work, and these articles and posts, we don't accept donations. But please consider making a donation to Bridge The Gap, the charity that provides top quality free tax advice to the elderly and people on low incomes. bridge-the-gap.org.uk

@ChrisGiles_ @toby_n And you can subscribe for updates here: taxpolicy.org.uk/subscribe?hell…

Ooops, I missed one.

30. CGT on peoples' homes. Practically hard, ends up raising little, and politically explosive. Nope.

30. CGT on peoples' homes. Practically hard, ends up raising little, and politically explosive. Nope.

And another:

31. Financial transaction tax. A hopeless idea that the EU tried hard to implement, but couldn't.

31. Financial transaction tax. A hopeless idea that the EU tried hard to implement, but couldn't.

• • •

Missing some Tweet in this thread? You can try to

force a refresh