The stars are aligning for a monumental crypto rally, and altcoins look ready to rip.

But if you're sidelined and still waiting to pull the trigger, this is the only alpha you need.

🧵: My full altcoin guide to maximising your gains in Q4.👇

But if you're sidelined and still waiting to pull the trigger, this is the only alpha you need.

🧵: My full altcoin guide to maximising your gains in Q4.👇

Before we get into my strategy, let's firstly discuss 5 crucial factors at play which are impacting the market ahead of Q4.

1. A confirmed $BTC breakout.

#Bitcoin leads, altcoins follow.

BTC has just had its first daily candle close above $65k. This is a key midrange pivot point that is essential to hold in order to test ATHs.

Now we're just looking for a weekly/monthly close. 👀

#Bitcoin leads, altcoins follow.

BTC has just had its first daily candle close above $65k. This is a key midrange pivot point that is essential to hold in order to test ATHs.

Now we're just looking for a weekly/monthly close. 👀

2. TOTAL 3 (altcoin index) breakout.

Like BTC, we've just had the first official higher high on alts, which could signal the beginning of a new uptrend.

We were in the descending channel (downtrend) for 6 months.

Like BTC, we've just had the first official higher high on alts, which could signal the beginning of a new uptrend.

We were in the descending channel (downtrend) for 6 months.

Keep in mind, the most important factor here is the fact we're making higher highs on BTC/TOTAL3.

It doesn't mean we can't retrace - in fact, we likely will (even under the previous high).

The key here (to confirm a new uptrend) is higher highs and higher lows.

It doesn't mean we can't retrace - in fact, we likely will (even under the previous high).

The key here (to confirm a new uptrend) is higher highs and higher lows.

When we do experience these dips, they will likely be great opportunities to accumulate quality alts.

For my altcoin watchlist, refer to this thread.

For my altcoin watchlist, refer to this thread.

https://twitter.com/1530033576/status/1838862362302185709

3. Macro backdrop.

The FED recently pivoted with a 50bps cut, and markets have reacted well.

China also had their biggest rate cut since 2020, and is now actively injecting stimulus into the global economy.

The FED recently pivoted with a 50bps cut, and markets have reacted well.

China also had their biggest rate cut since 2020, and is now actively injecting stimulus into the global economy.

https://twitter.com/918138253617790976/status/1839235860195148103

4. Stocks are at ATHs.

$BTC usually doesn't lag equities for long.

If it catches up, this would imply a price of $81k (see below).

$BTC usually doesn't lag equities for long.

If it catches up, this would imply a price of $81k (see below).

https://twitter.com/1530033576/status/1839934881251635415

5. China is stimulating their economy.

They are set to inject ~1 trillion yuan ($141.7bn) in “long-term liquidity” into the market.

This should bode well for both equities and especially BTC, which is a highly sensitive asset to global liquidity.

They are set to inject ~1 trillion yuan ($141.7bn) in “long-term liquidity” into the market.

This should bode well for both equities and especially BTC, which is a highly sensitive asset to global liquidity.

But, despite all these bullish factors, many are scared that the current rally may simply be another fake out.

However, there are 2 critical pieces of data that suggests the fun may only just be beginning.

However, there are 2 critical pieces of data that suggests the fun may only just be beginning.

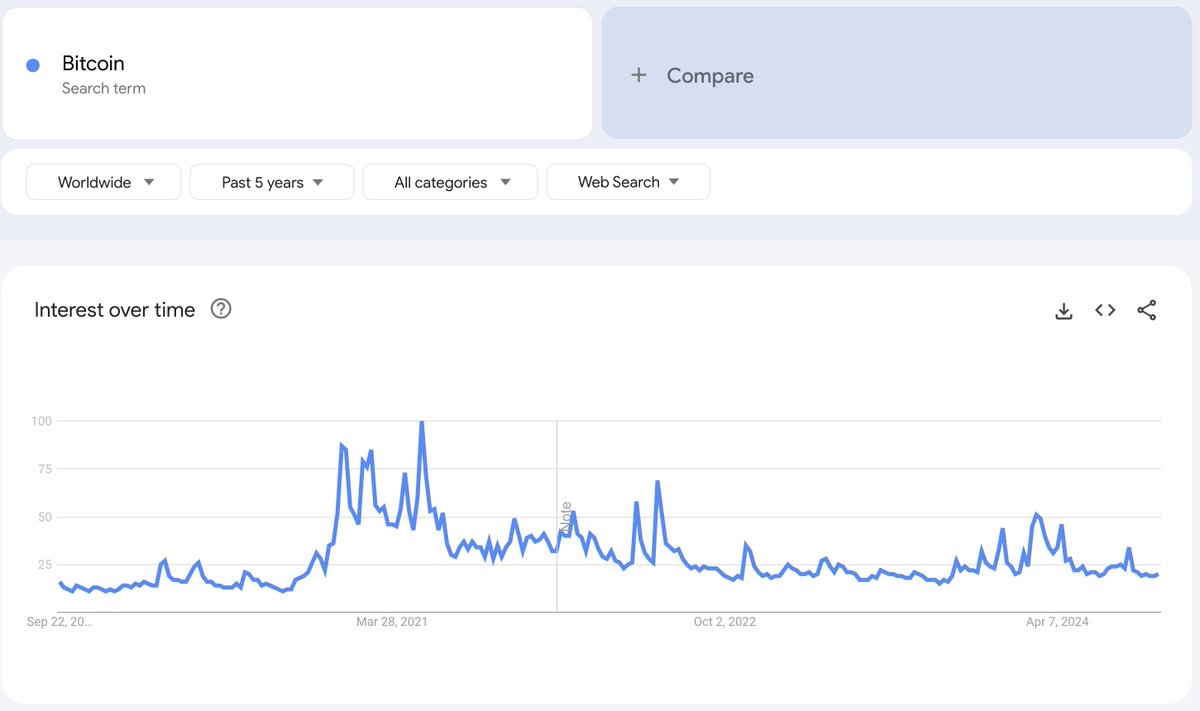

1. Retail isn't back (at all).

We're in a CT echo chamber.

It may seem like everyone is bullish again.

But the reality is, retail isn't back yet.

The YT views show this. The search volume shows this.

This rally is simply crypto-natives/insiders pre positioning.

We're in a CT echo chamber.

It may seem like everyone is bullish again.

But the reality is, retail isn't back yet.

The YT views show this. The search volume shows this.

This rally is simply crypto-natives/insiders pre positioning.

I liked this tweet from @ZssBecker which expands on that point.

https://twitter.com/1243470638477697024/status/1838570651059187986

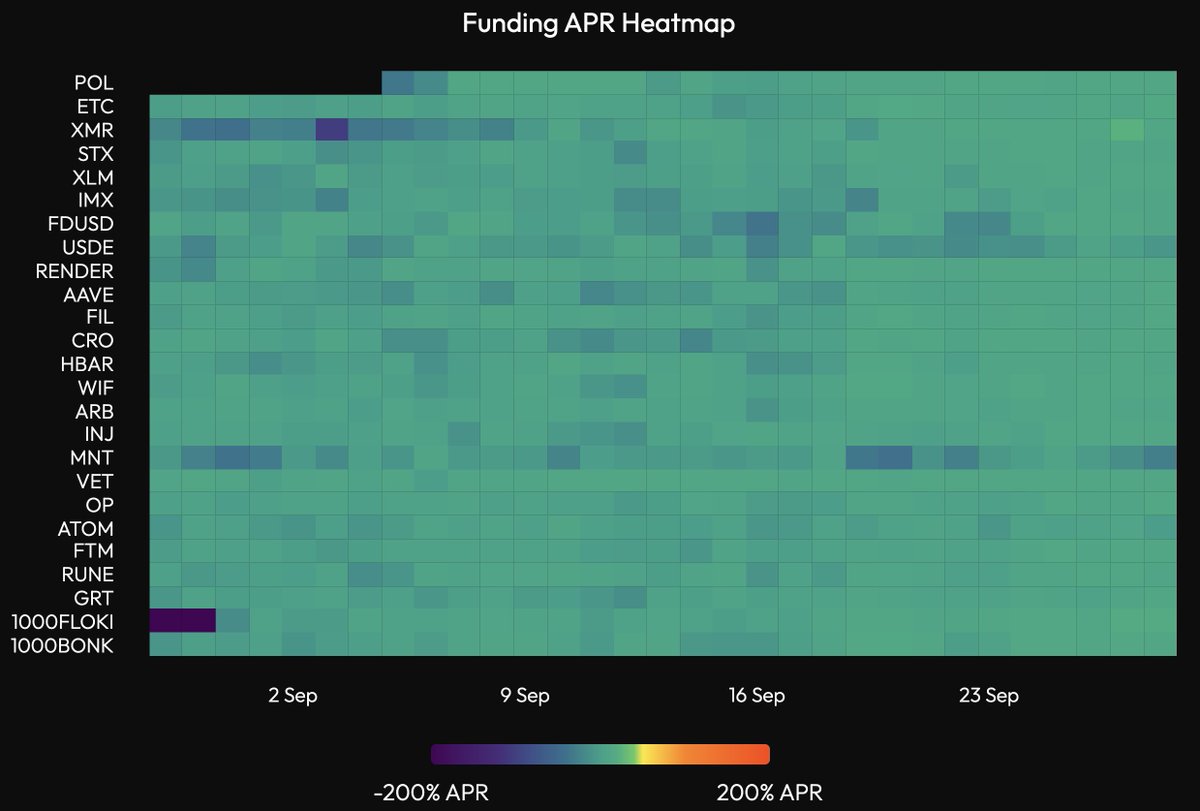

2. Funding rates are low.

We need to reset our mindsets when it comes to assessing the current state of the market.

Despite the recent rallies, leverage is nowhere near the highs that we saw during February and March earlier this year.

We need to reset our mindsets when it comes to assessing the current state of the market.

Despite the recent rallies, leverage is nowhere near the highs that we saw during February and March earlier this year.

https://twitter.com/3195785191/status/1839045871700205975

After seeing this tweet, I decided to dig a bit deeper into the data.

March was meme mania, with $WIF and $SOL leading the charge.

Given how tame the funding is right now, I wanted to see when SOL and WIF topped, as well as the associated funding rates then.

March was meme mania, with $WIF and $SOL leading the charge.

Given how tame the funding is right now, I wanted to see when SOL and WIF topped, as well as the associated funding rates then.

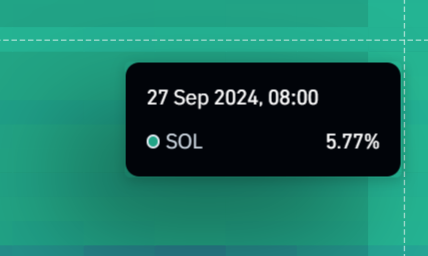

SOL topped out on the 31st of March, at the height of the meme coin craze.

Also, SOL's annualised funding rate hit 95.51% - a staggering amount of leverage.

Also, SOL's annualised funding rate hit 95.51% - a staggering amount of leverage.

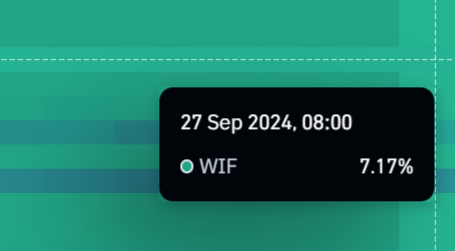

WIF also topped out on the 31st of March, with the annualised funding rate hitting 107.5%.

All the signs of euphoria were there.

All the signs of euphoria were there.

This data is in stark contrast to the current funding rates for SOL and WIF.

SOL with 5.77%.

WIF with 7.17%.

In fact, @VeloData shows us that funding is still low market-wide.

SOL with 5.77%.

WIF with 7.17%.

In fact, @VeloData shows us that funding is still low market-wide.

Whilst funding rates is only one indicator, it can give us an indication of the current state of the market, and whether or not mania is present.

For SOL to reach the same funding rate as the top in March, a 1,555% increase would be required.

Crazy.

For SOL to reach the same funding rate as the top in March, a 1,555% increase would be required.

Crazy.

For WIF, it's the same scenario.

WIF's current funding rate would have to increase with 1,399% to reach the same levels.

You can also apply this to many other altcoins.

WIF's current funding rate would have to increase with 1,399% to reach the same levels.

You can also apply this to many other altcoins.

The point I'm trying to illustrate here is that you can use historical data i.e. funding rates to gauge the froth in the market.

And, despite $BTC and altcoins rallying - we are NOWHERE near the degeneracy seen in March.

So, what can you do NOW to prepare?

And, despite $BTC and altcoins rallying - we are NOWHERE near the degeneracy seen in March.

So, what can you do NOW to prepare?

If I were to devise a strategy for Q4, I would follow this plan - a simple 4-step process to eliminate any noise and increase your chances of successfully navigating the market.

Step 1: Identify sector leaders.

Projects with strong mindshare and relative strength are likely to keep winning.

I think AI, memes, RWA and L1s will continue to be at the forefront - with the leaders in each sector being clear beneficiaries.

Projects with strong mindshare and relative strength are likely to keep winning.

I think AI, memes, RWA and L1s will continue to be at the forefront - with the leaders in each sector being clear beneficiaries.

Step 2: Set up your watchlists.

When the market starts heating up, it's crucial to have a watchlist on TradingView prepared with all the leading altcoins, categorised by the sectors you are bullish on.

Here are mine, but you should also create your own.

When the market starts heating up, it's crucial to have a watchlist on TradingView prepared with all the leading altcoins, categorised by the sectors you are bullish on.

Here are mine, but you should also create your own.

https://twitter.com/1530033576/status/1838862362302185709

Step 3: Bid HTF levels on altcoins.

Don't just ape blindly.

There will be dips along the way, as seen during Q4 last year when the market started heating up.

Set limit orders at key HTF support levels, or subsequently start bidding spot around those levels.

Don't just ape blindly.

There will be dips along the way, as seen during Q4 last year when the market started heating up.

Set limit orders at key HTF support levels, or subsequently start bidding spot around those levels.

Step 4: Use funding rates to gauge market sentiment.

We're far from euphoria at the moment, but funding rates can remain elevated for some time.

When the heat map turns orange and rates soar, that's the signal to lock in profits.

We're far from euphoria at the moment, but funding rates can remain elevated for some time.

When the heat map turns orange and rates soar, that's the signal to lock in profits.

In the @mileshighclub_ discord, I'll be sharing daily updates as to when I'm buying/selling certain alts.

If you want the early alpha from myself (and our amazing analysts like @paradisexbt_, @docXBT & @_FabianHD), then check it out.

If you want the early alpha from myself (and our amazing analysts like @paradisexbt_, @docXBT & @_FabianHD), then check it out.

I hope you've found this thread helpful.

Follow me @milesdeutscher for more content like this.

Also, Like/Repost the quote below if you can. 💙

Follow me @milesdeutscher for more content like this.

Also, Like/Repost the quote below if you can. 💙

https://twitter.com/1530033576/status/1840113816841170992

• • •

Missing some Tweet in this thread? You can try to

force a refresh