There’s a lot of fear mongering surrounding high purity quartz (“HPQ”) and Spruce Pine, NC following the devastating flooding from Hurricane Helene

The area contains the purest form of natural quartz, but the significance of supply disruptions from the mines is exaggerated

1/8

The area contains the purest form of natural quartz, but the significance of supply disruptions from the mines is exaggerated

1/8

https://twitter.com/FossilLocator/status/1840218595541778791

First - inventory levels for raw wafer companies are currently low, but even then, there’s ~3 months of DIO at Globalwafers and Siltronic and 8 months of DIO at SUMCO. Existing inventory is a buffer.

Can mining activities restart within 3 months?

Probably.

2/8

Can mining activities restart within 3 months?

Probably.

2/8

High-purity quartz deposits are scarce, but purification methods exist even if they are time and resource intensive.

3/8

sciencedirect.com/science/articl…

3/8

sciencedirect.com/science/articl…

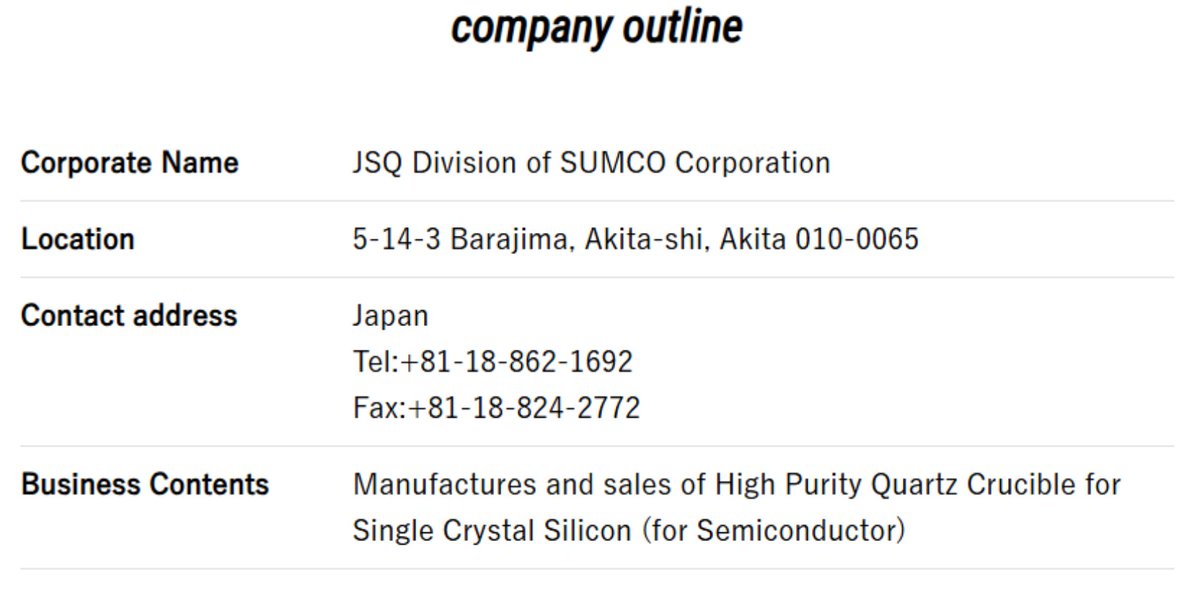

SUMCO’s JSQ division manufactures HPQ crucibles for single crystal silicon (semiconductors). The product is a high purity synthetic quartz crucible. The manufacturing process laid out on its website.

4/8

4/8

Sibelco and TQC (sub of Imerys) hold the mining rights for the Spruce Pine deposit and are share leaders

However, Pacific Quartz is a major player in China

Additionally, the Russian Quartz company operates the mine in Kyshtym, Russia with average content of 99.999% purity

4/8

However, Pacific Quartz is a major player in China

Additionally, the Russian Quartz company operates the mine in Kyshtym, Russia with average content of 99.999% purity

4/8

Plus there are numerous mines for HPQ that can be purified further

Homerun Resources has a supply agreement for 99.88% average raw HPQ silica sand - Bahia Silica Sand District, Brazil

HMR also has a HPQ project in Canada working on commercializing upgraded raw quartz silica

5/8

Homerun Resources has a supply agreement for 99.88% average raw HPQ silica sand - Bahia Silica Sand District, Brazil

HMR also has a HPQ project in Canada working on commercializing upgraded raw quartz silica

5/8

Ferroglobe (GSM) acquired a high-purity quartz mine in SC last year with 300kt/yr capacity and +10 years of reserve life. They supply high-purity silicon metal to the electronics industry.

6/8

6/8

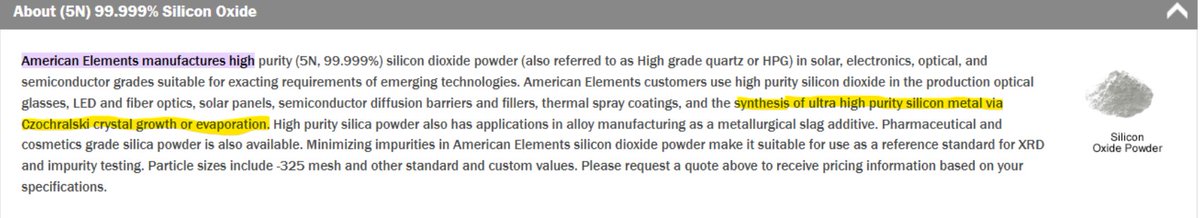

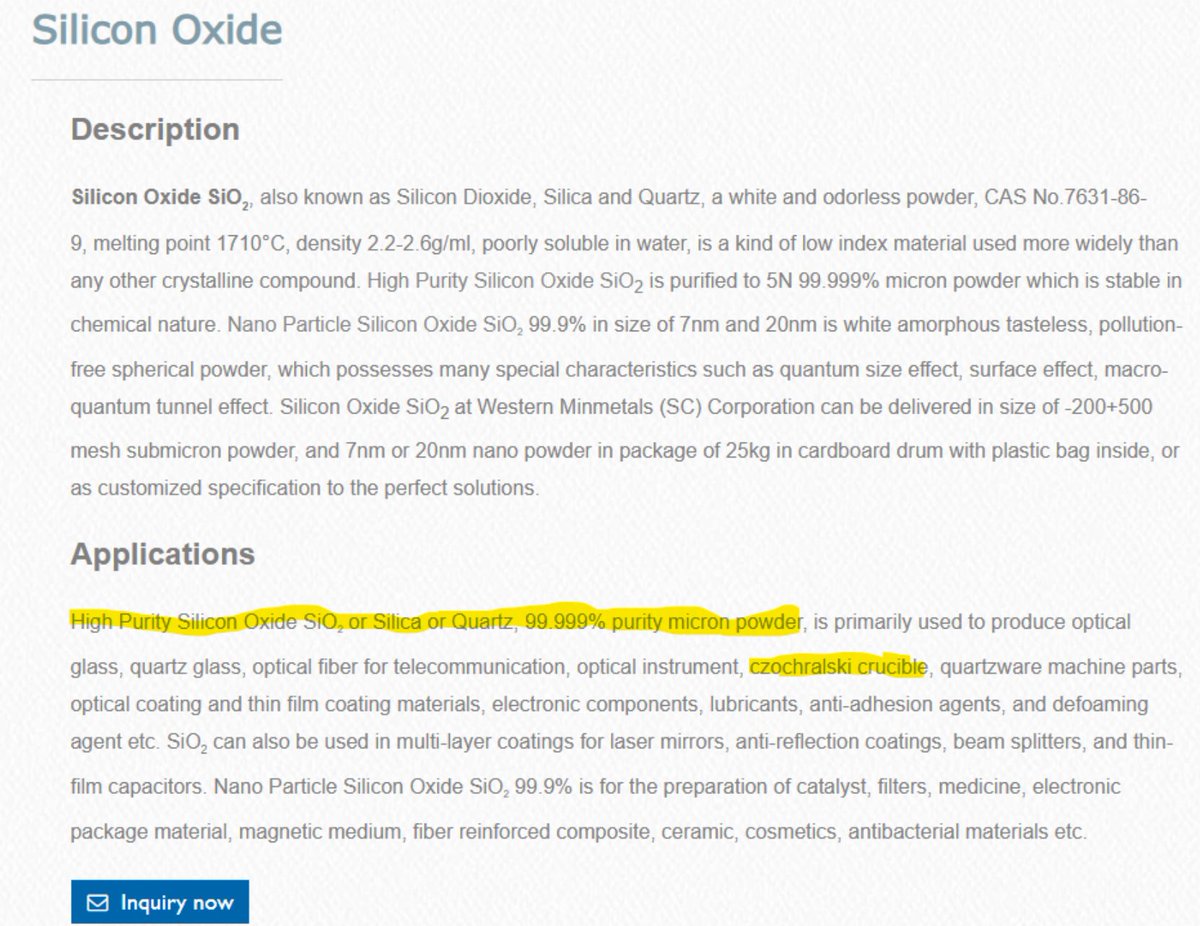

Companies like American Elements and Western Minmetals can produce high-purity (5N, 99.999%) quartz powder that can be used to create crucibles.

7/8

7/8

In conclusion – existing wafer inventory provides a buffer as mining operations restart, major companies are already using synthetic methods to produce semiconductor-grade quartz crucibles, and there are other sources of HPQ. Spruce Pine FUD is exaggerated.

8/8

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh