How to get URL link on X (Twitter) App

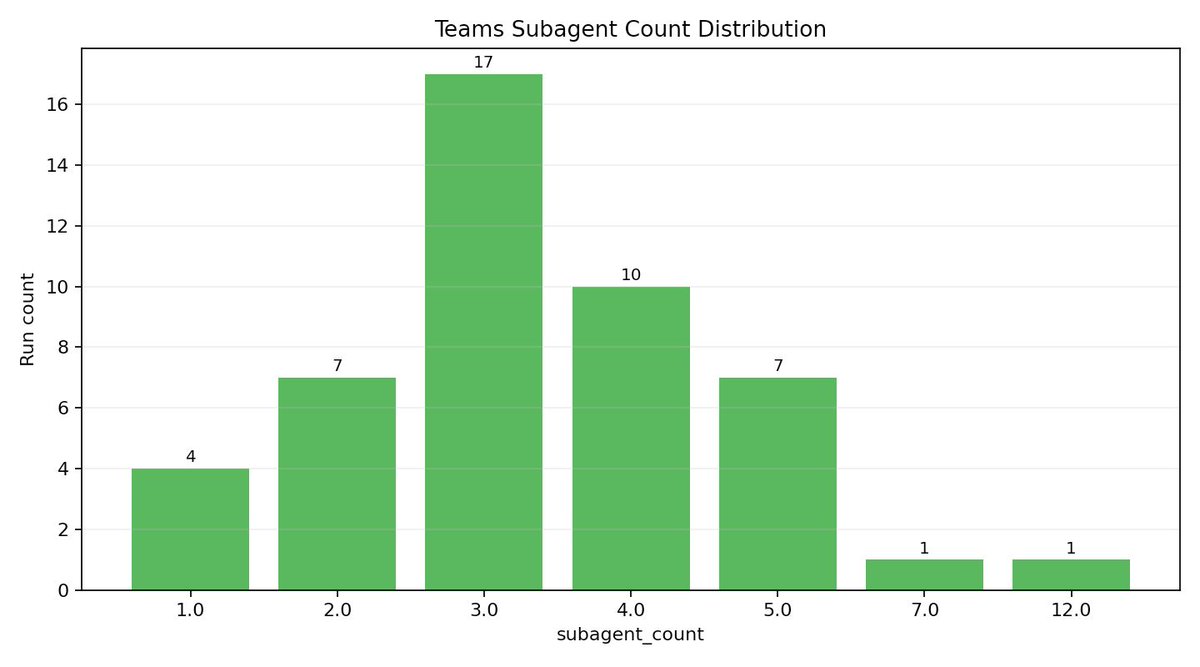

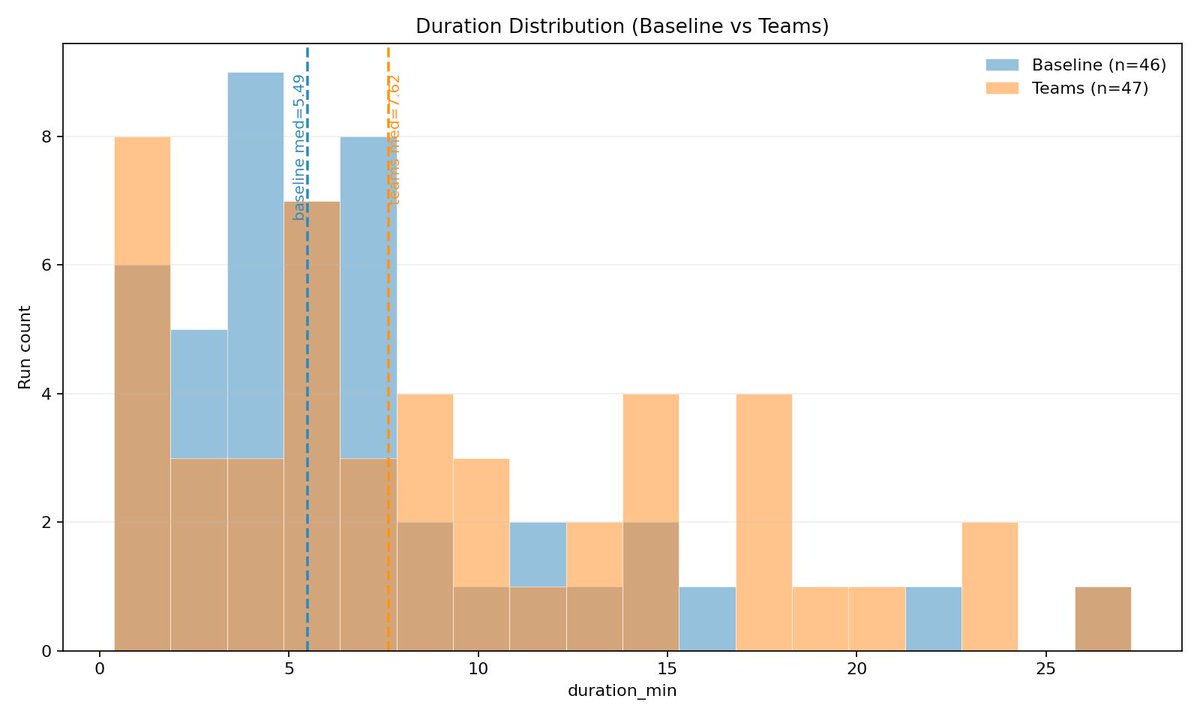

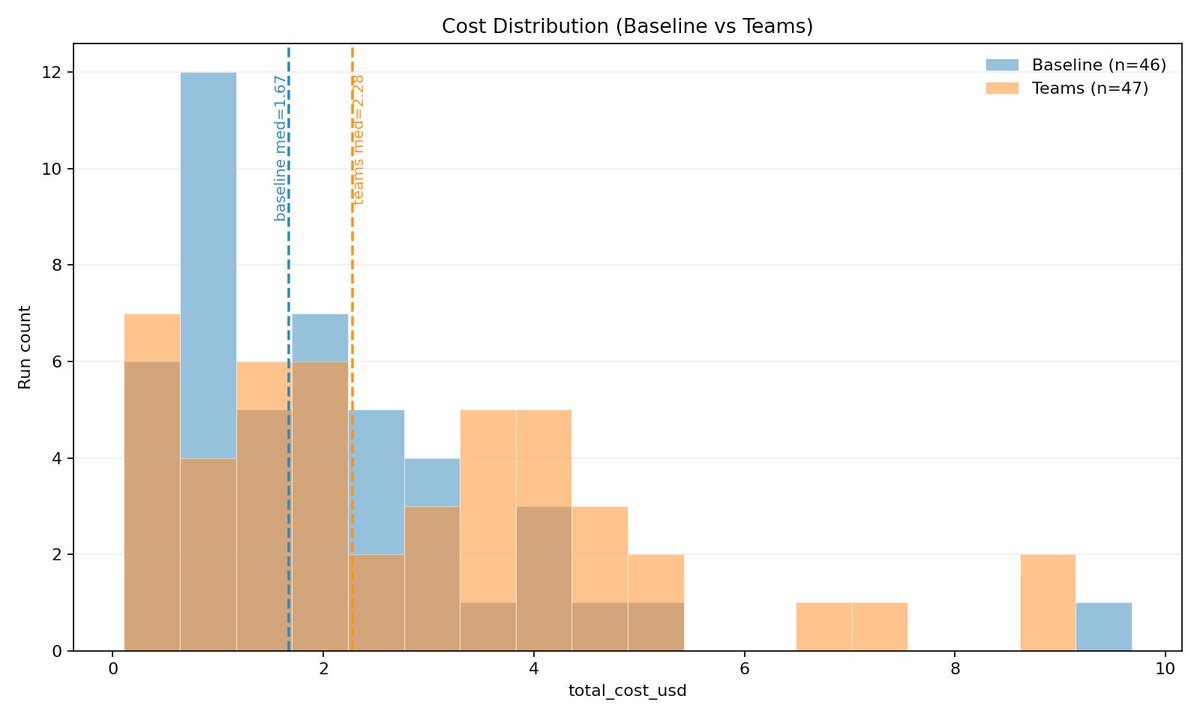

We ran a small benchmark with WideSearch on Claude Teams: 30 unique English tasks, 2 trials each, 30-min timeout, GPT-5.2 judge. We compare it to a Opus 4.6 baseline.

We ran a small benchmark with WideSearch on Claude Teams: 30 unique English tasks, 2 trials each, 30-min timeout, GPT-5.2 judge. We compare it to a Opus 4.6 baseline.

A fully loaded AI rack can weigh up to 3,700 lbs. That’s the weight of a Ford Explorer concentrated into a 2x4 foot footprint. Standard pallets would crush instantly. These AI racks require custom-engineered reinforced bases with shock-absorbent foam just to keep them from tearing through the floor. (2/9)

A fully loaded AI rack can weigh up to 3,700 lbs. That’s the weight of a Ford Explorer concentrated into a 2x4 foot footprint. Standard pallets would crush instantly. These AI racks require custom-engineered reinforced bases with shock-absorbent foam just to keep them from tearing through the floor. (2/9)

Although these two terms are often discussed together, they actually refer to two distinct domains.

Although these two terms are often discussed together, they actually refer to two distinct domains.

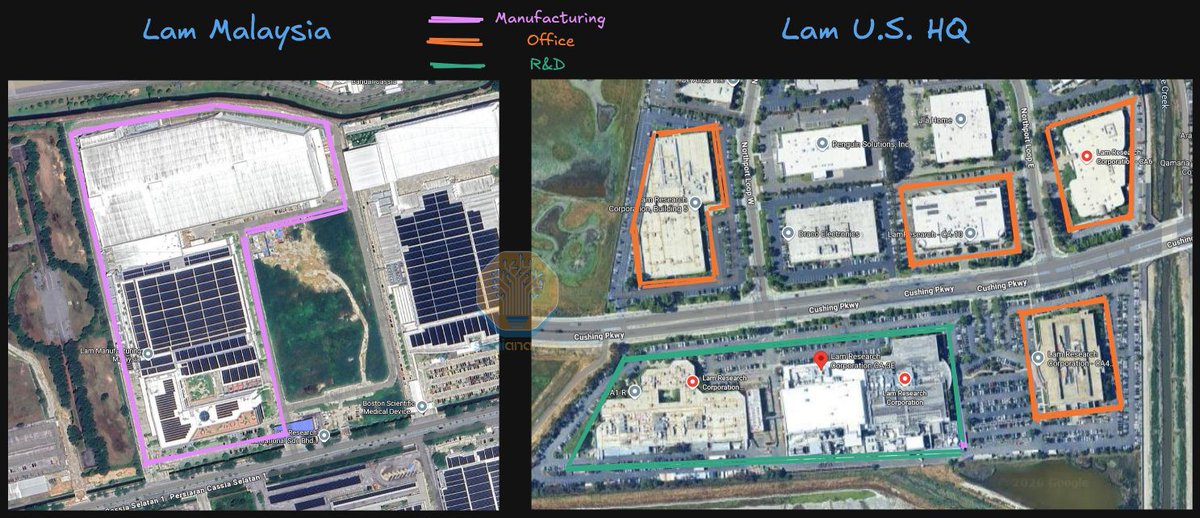

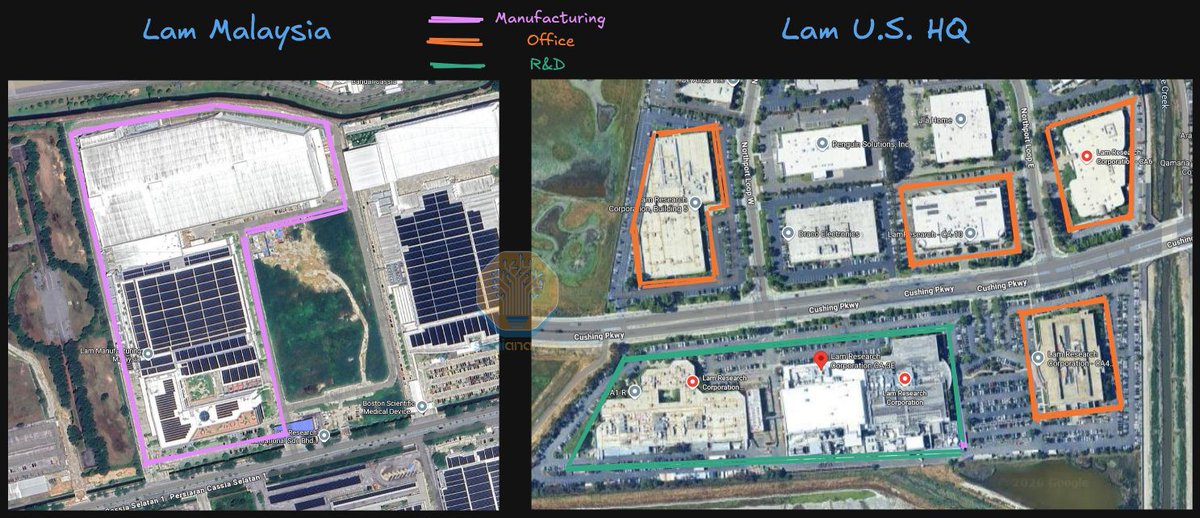

In 2022 we flagged Lam Research expanding in Malaysia. Today, most of its high-volume production is there, not the U.S. That trend has only accelerated. (2/6) newsletter.semianalysis.com/p/lam-research…

In 2022 we flagged Lam Research expanding in Malaysia. Today, most of its high-volume production is there, not the U.S. That trend has only accelerated. (2/6) newsletter.semianalysis.com/p/lam-research…

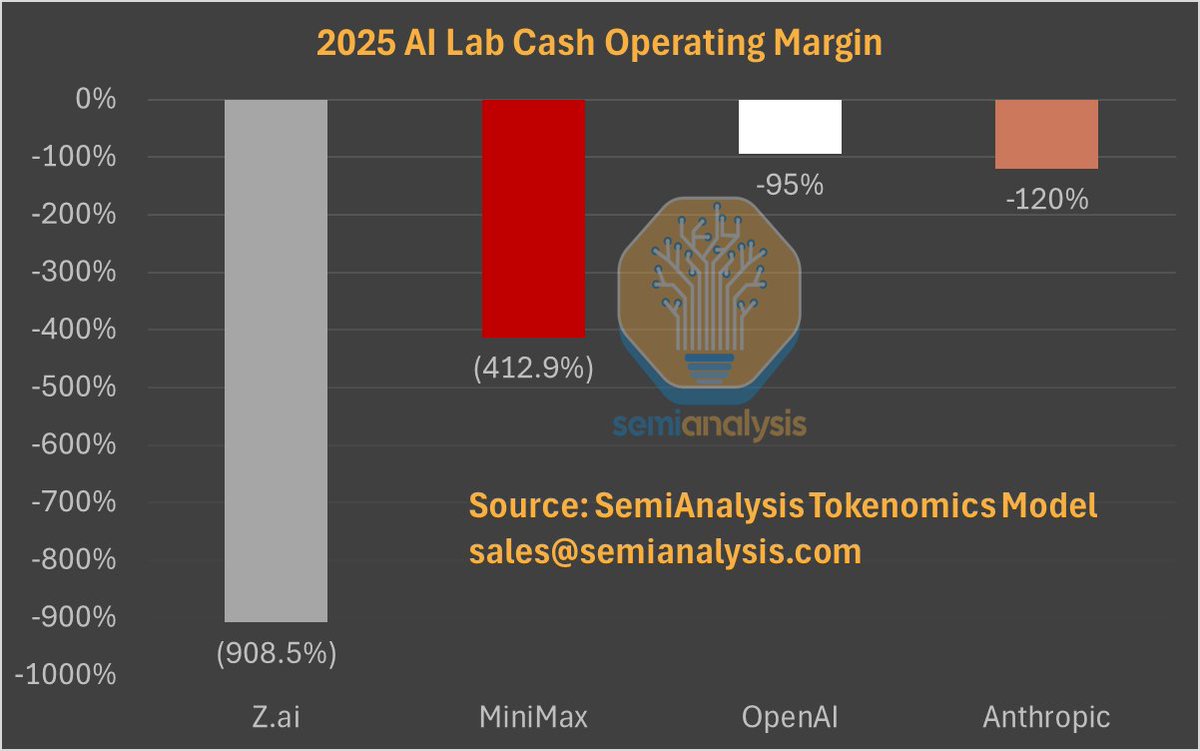

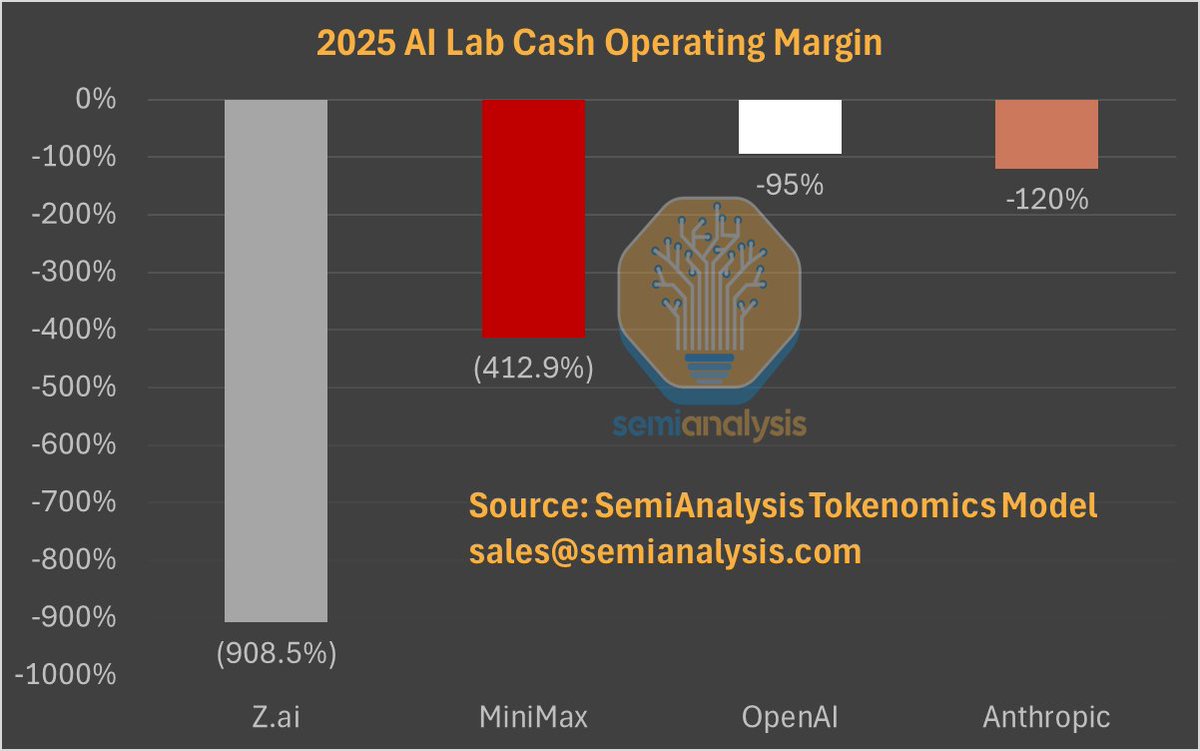

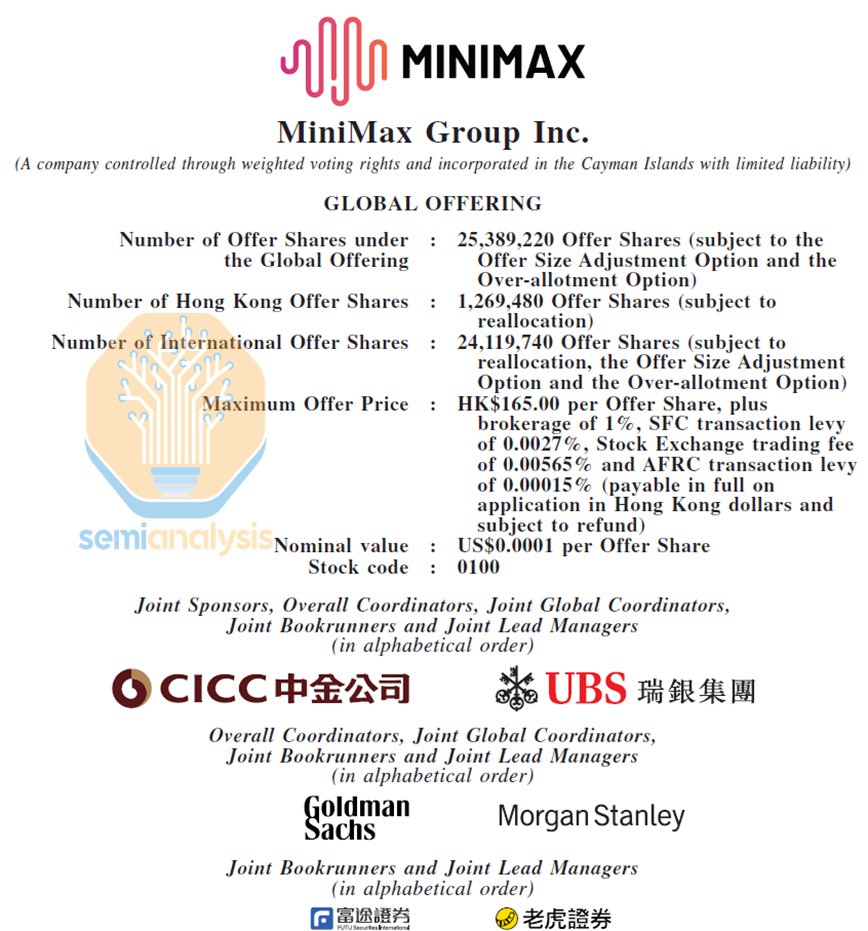

MiniMax (0100 HK) and aka Knowledge Atlas fka ZhiPu (2513 HK) both give a glimpse into the economics of an AI Lab, demonstrating strong product momentum as well as a flagrant disregard for profitability. (2/5) 🔥📉Z.ai

MiniMax (0100 HK) and aka Knowledge Atlas fka ZhiPu (2513 HK) both give a glimpse into the economics of an AI Lab, demonstrating strong product momentum as well as a flagrant disregard for profitability. (2/5) 🔥📉Z.ai

A recip is more modular than turbines, happier at partial loads, and more comprehensible to maintain. You're mostly changing lubricants, whereas a turbine requires no maintenance...until it needs a massive overhaul. (2/4)

A recip is more modular than turbines, happier at partial loads, and more comprehensible to maintain. You're mostly changing lubricants, whereas a turbine requires no maintenance...until it needs a massive overhaul. (2/4)

Back in the '90s, parts of the American electric grid were "deregulating." These reforms gave us commodity markets for electricity--aka ISOs and RTOs. INDEPENDENT POWER PRODUCERS (IPPs), often utilities from other states, could build and run their own power plants and make money on these new electricity markets. Their generator of choice? The COMBINED CYCLE GAS PLANT (CCGT), particularly the then-new F-CLASS. (2/8)

Back in the '90s, parts of the American electric grid were "deregulating." These reforms gave us commodity markets for electricity--aka ISOs and RTOs. INDEPENDENT POWER PRODUCERS (IPPs), often utilities from other states, could build and run their own power plants and make money on these new electricity markets. Their generator of choice? The COMBINED CYCLE GAS PLANT (CCGT), particularly the then-new F-CLASS. (2/8)

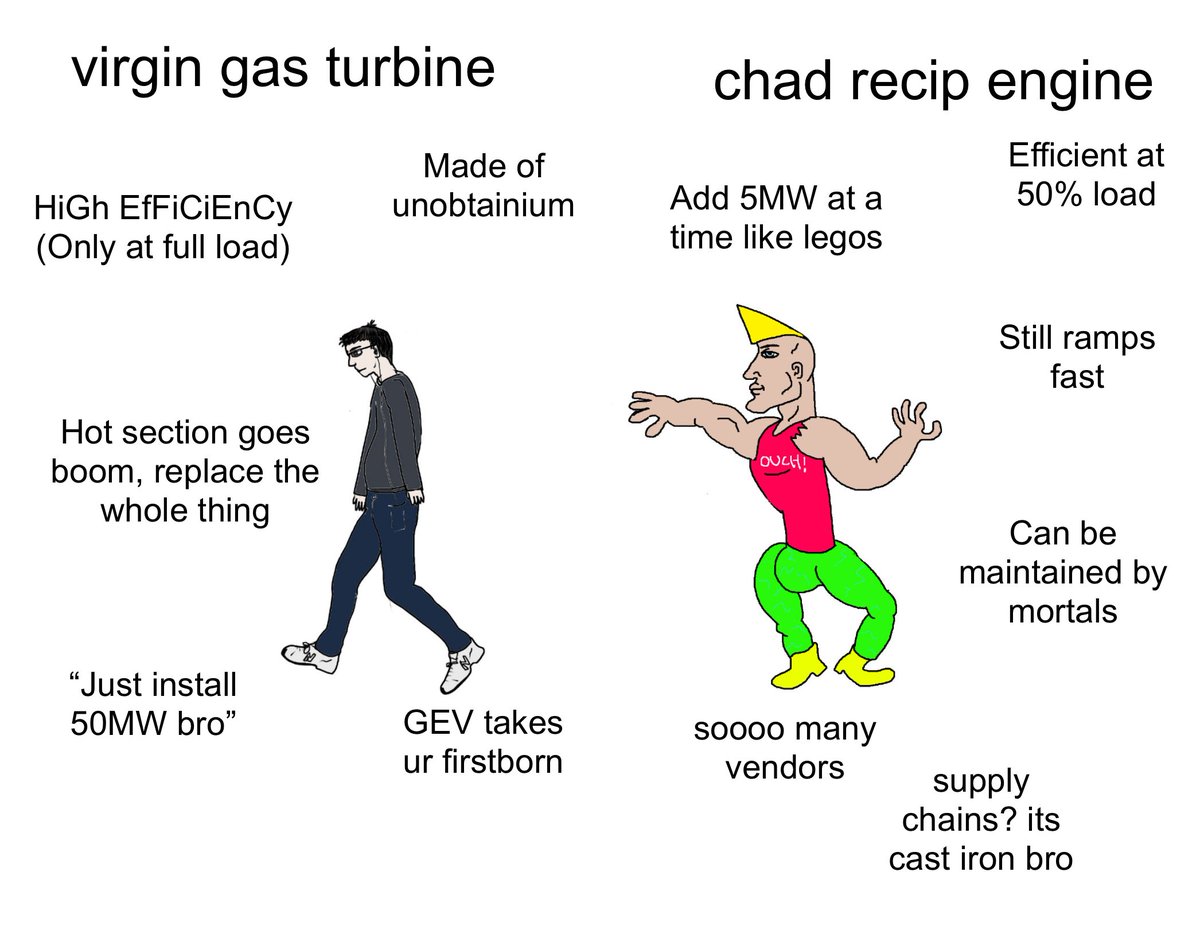

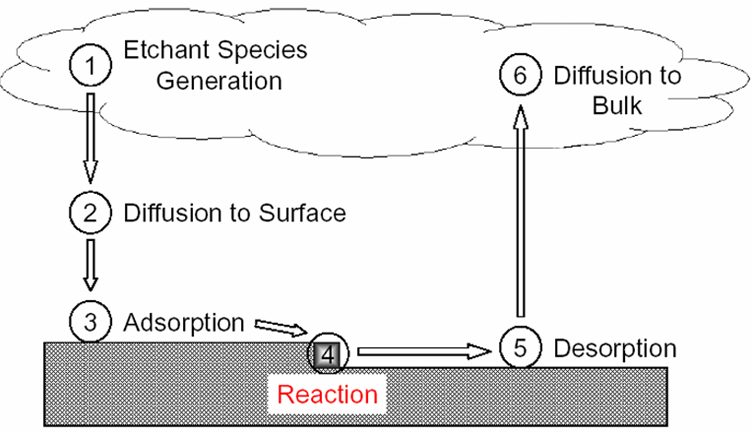

Before the 1970s, doping was performed through thermal diffusion in high-temperature furnaces.

Before the 1970s, doping was performed through thermal diffusion in high-temperature furnaces.

Both have increased their investments to capture more revenue in consumer, networking, industrial and computing markets. Non-smartphones account for 30% of Qualcomm's semiconductor revenue and 48% of MediaTek's. Qualcomm has a target of $22B non-smartphone chip revenue by FY29 at a 5-year CAGR of 21%. Qualcomm built a strong moat in autos but made mixed progress in IoT (a collection of end markets including PC, consumer, networking and infrastructure). (2/7)

Both have increased their investments to capture more revenue in consumer, networking, industrial and computing markets. Non-smartphones account for 30% of Qualcomm's semiconductor revenue and 48% of MediaTek's. Qualcomm has a target of $22B non-smartphone chip revenue by FY29 at a 5-year CAGR of 21%. Qualcomm built a strong moat in autos but made mixed progress in IoT (a collection of end markets including PC, consumer, networking and infrastructure). (2/7)

To solve this problem, Meta turned to the use of Disaggregated Scheduled Fabrics (DSFs). Being “Scheduled” means that a credit-based system is used to control flows and prevent congestion – before a node can send packets across the network, it must first send a credit request towards the receiving node to make sure that the receiving end has enough buffer to receive the packet. These packets also travel over a fabric that cellifies the packets, breaking it into smaller cells and spreading it across multiple routes in the fabric. (2/6)

To solve this problem, Meta turned to the use of Disaggregated Scheduled Fabrics (DSFs). Being “Scheduled” means that a credit-based system is used to control flows and prevent congestion – before a node can send packets across the network, it must first send a credit request towards the receiving node to make sure that the receiving end has enough buffer to receive the packet. These packets also travel over a fabric that cellifies the packets, breaking it into smaller cells and spreading it across multiple routes in the fabric. (2/6)

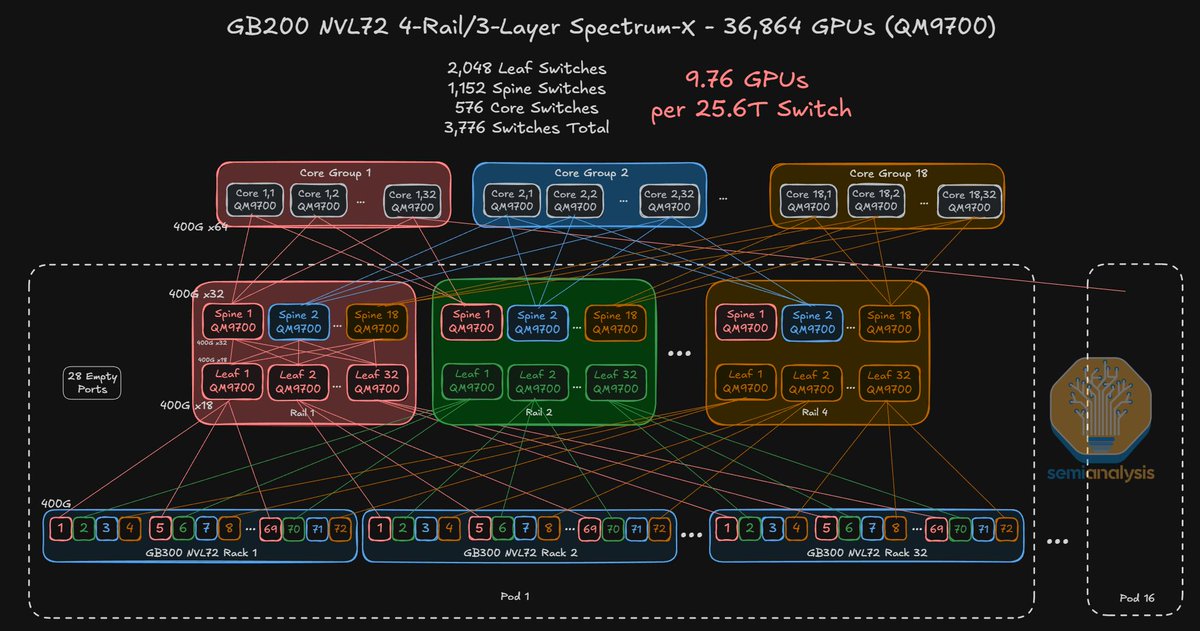

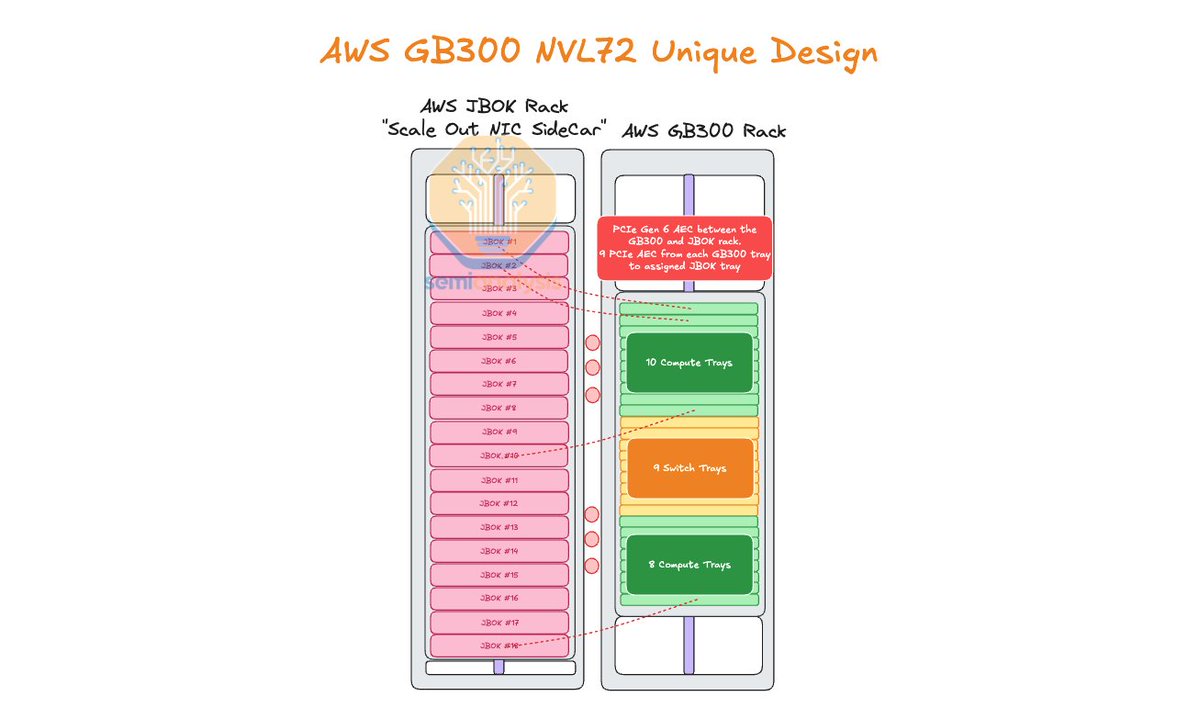

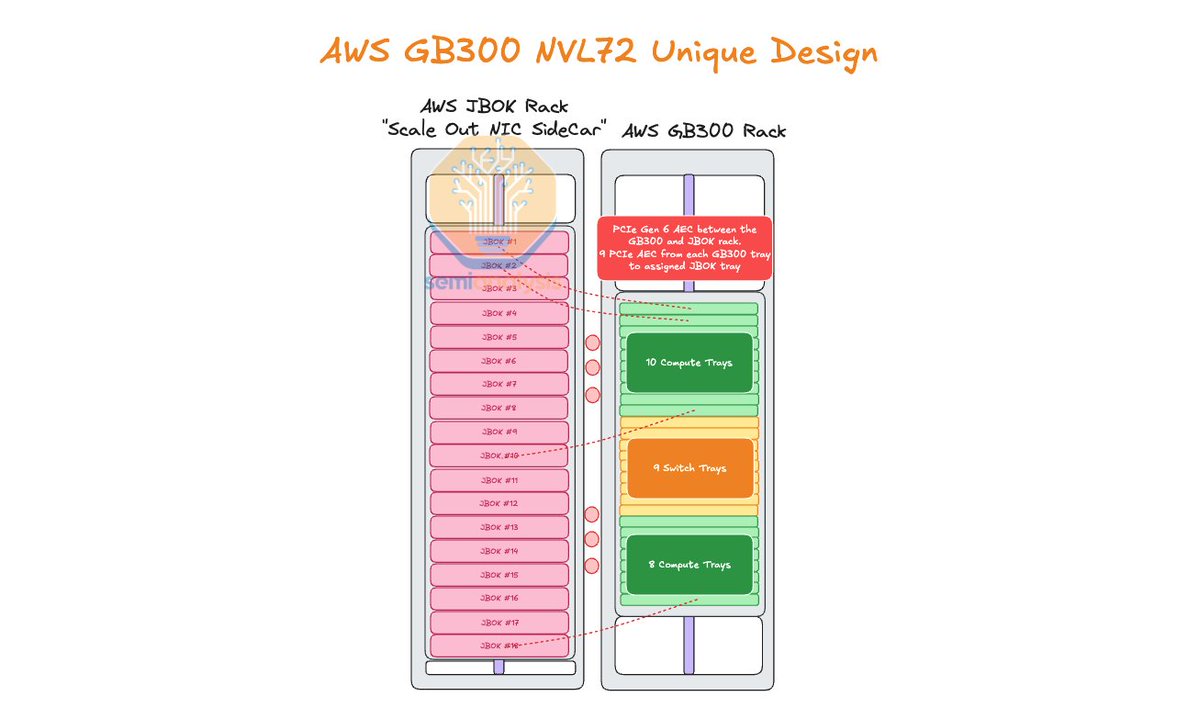

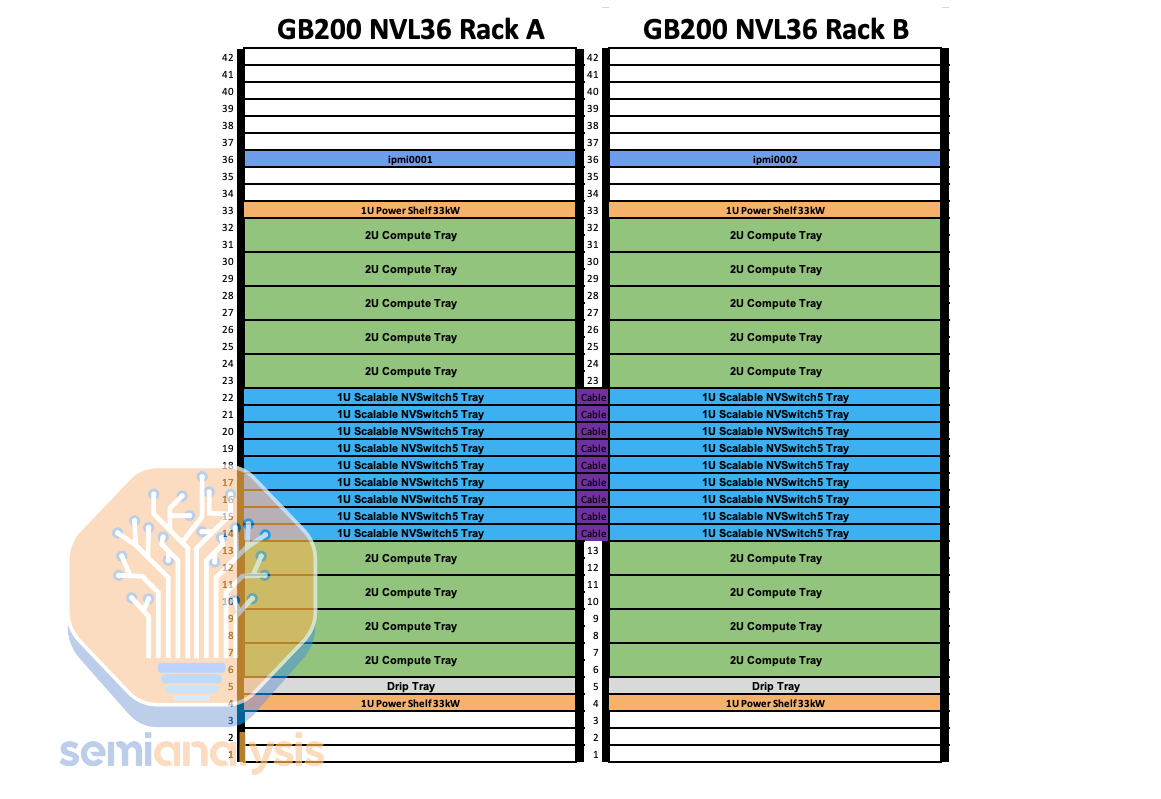

For GB200, AWS only supported GB200 NVL36x2 and NVL36 which allowed up to 72 GPUs per NVLink domain while allowing each rack to be 66kW power & 2U compute trays by connecting 2 NVL36 with NVLink ACC cables. As many GCP & AWS customers have noticed, NVIDIA's driver & physical engineering support for NVL36x2 has been lackluster and way more bugs than their standalone NVL72 design. Although AWS markets their NVL36x2 as "NVL72", it is not topologically equivalent to an actual NVL72. 2/N🧵

For GB200, AWS only supported GB200 NVL36x2 and NVL36 which allowed up to 72 GPUs per NVLink domain while allowing each rack to be 66kW power & 2U compute trays by connecting 2 NVL36 with NVLink ACC cables. As many GCP & AWS customers have noticed, NVIDIA's driver & physical engineering support for NVL36x2 has been lackluster and way more bugs than their standalone NVL72 design. Although AWS markets their NVL36x2 as "NVL72", it is not topologically equivalent to an actual NVL72. 2/N🧵

China’s new rare earth export controls focus on two key points:

China’s new rare earth export controls focus on two key points:

On datacenter chips: Intel will sell x86 CPUs to NVIDIA. NVIDIA will integrate them into superchips (such as the Grace Blackwell superchip board shown) and sold in rackscale NVL72 systems. Superchip means this is an alternative to Grace/Vera for enterprise customers who have to rely on x86. (2/9)

On datacenter chips: Intel will sell x86 CPUs to NVIDIA. NVIDIA will integrate them into superchips (such as the Grace Blackwell superchip board shown) and sold in rackscale NVL72 systems. Superchip means this is an alternative to Grace/Vera for enterprise customers who have to rely on x86. (2/9)

The proposed site for the Taiwan HQ was the T17 and T18 plots in the Beitou-Shilin Technology Park. NVIDIA had signed a Memorandum of Understanding (MOU) with Shin Kong Life Insurance, a Taiwanese company with total assets exceeding USD 100 billion, but the MOU expired on September 30 and is no longer valid. (2/7)

The proposed site for the Taiwan HQ was the T17 and T18 plots in the Beitou-Shilin Technology Park. NVIDIA had signed a Memorandum of Understanding (MOU) with Shin Kong Life Insurance, a Taiwanese company with total assets exceeding USD 100 billion, but the MOU expired on September 30 and is no longer valid. (2/7)

The PVD process typically uses two methods: evaporation and sputtering, with sputtering being the primary technique. This is because sputtering can deposit metal films with high purity and low resistivity, while also providing good uniformity and reliability.

The PVD process typically uses two methods: evaporation and sputtering, with sputtering being the primary technique. This is because sputtering can deposit metal films with high purity and low resistivity, while also providing good uniformity and reliability.

These steps are crucial for controlling the film's properties and uniformity.

These steps are crucial for controlling the film's properties and uniformity.

We are of course talking about Ajinomoto Build up Film (‘ABF’). This is the dielectric insulator film that goes into the organic package substrate of most modern processors today. How did it come from Japanese seasonings heavyweight Ajinomoto?

We are of course talking about Ajinomoto Build up Film (‘ABF’). This is the dielectric insulator film that goes into the organic package substrate of most modern processors today. How did it come from Japanese seasonings heavyweight Ajinomoto?