Today we're publishing our 2nd annual State of Seed report

We analyzed 1000+ companies that raised seeds rounds in 2022 and evaluated if they were finding PMF, raising follow on funding, and launching tokens

1/ Let's look and see where all those VC dollars went

We analyzed 1000+ companies that raised seeds rounds in 2022 and evaluated if they were finding PMF, raising follow on funding, and launching tokens

1/ Let's look and see where all those VC dollars went

2/ Here is the full report including the dataset, which are we open sourcing

Kudos to @MikeZajko and @PChuzeville who drove the research on our end

I just sit here and tweet :)

lattice.fund/writing-and-pr…

Kudos to @MikeZajko and @PChuzeville who drove the research on our end

I just sit here and tweet :)

lattice.fund/writing-and-pr…

3/ So why is this data valuable?

It generally takes 1-2 year for a seed-stage team to find commercial validation and raise more funds

So a look back two years on is a reasonable view at how a cohort is likely to do long term

It generally takes 1-2 year for a seed-stage team to find commercial validation and raise more funds

So a look back two years on is a reasonable view at how a cohort is likely to do long term

4/ We looked at 1000+ companies that raised $5B+ and organized them by sector, ecosystem

We then researched if those teams had raised follow on rounds, launched tokens, found product market fit, and were still operating

We then researched if those teams had raised follow on rounds, launched tokens, found product market fit, and were still operating

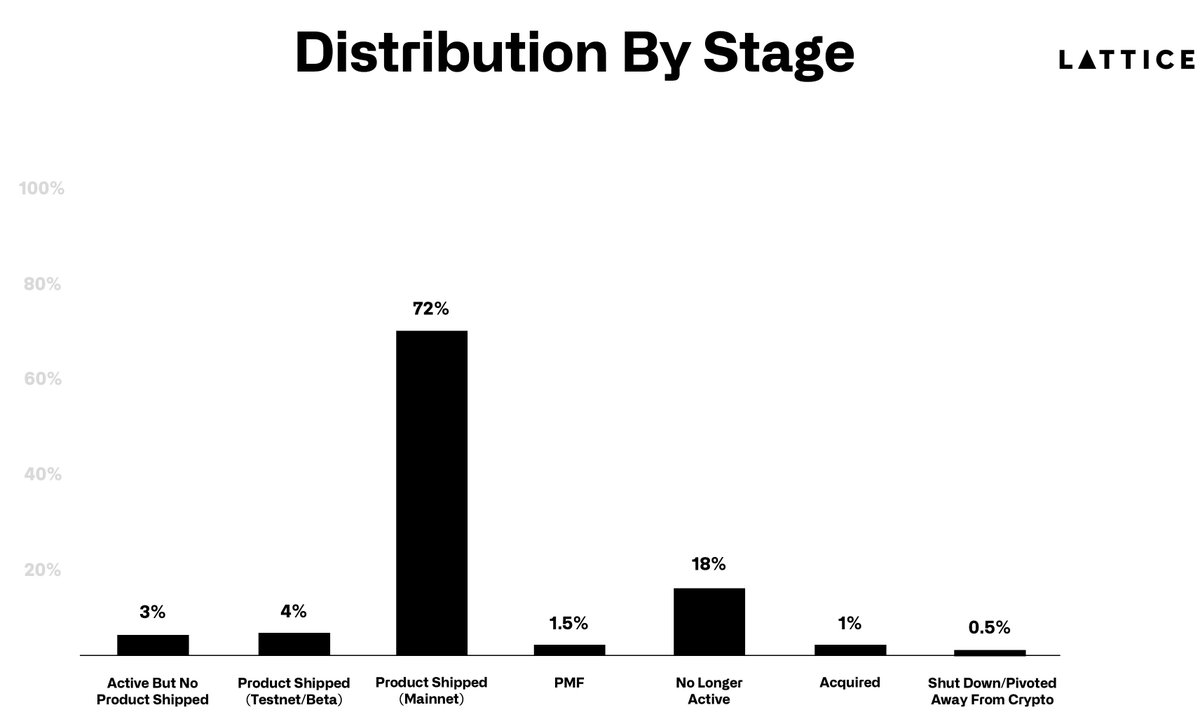

5/ What are the high level takeaways?

There were ~1200 companies in the 2022 seed vintage

~80% of them are still operating

~18% of them have shut down

~1% have have found product-market fit

There were ~1200 companies in the 2022 seed vintage

~80% of them are still operating

~18% of them have shut down

~1% have have found product-market fit

6/ Our internal view is that the tail end of bull markets/early stage of bear markets is the worst time to make venture investments. The data supports this:

Follow on rounds:

2021: ~30%

2022: ~12%

Token Launches:

2021: 50%

2022: 15%

Follow on rounds:

2021: ~30%

2022: ~12%

Token Launches:

2021: 50%

2022: 15%

7/ Chasing narratives can get you rekt

$700M went into gaming seeds rounds but Gaming & Metaverse had some of the highest fail rates and likelihood to be active without anything shipped

$700M went into gaming seeds rounds but Gaming & Metaverse had some of the highest fail rates and likelihood to be active without anything shipped

8/ A clear takeaway from both 2021 and 2022 is to be careful following the herd. In both years the hot trend of the year was much quieter two years later.

Remember, in this job you get paid to frontrun the narrative

Remember, in this job you get paid to frontrun the narrative

https://x.com/reganbozman/status/1769775047554793505?s=20

9/ Some of the leading companies in now-hot categories raised seed rounds in 2022

Shared Security: @eigenlayer

DePIN: @daylightenergy_

Wallets as a Service: @privy_io

Ai: @gensynai

It pays to be early :)

Shared Security: @eigenlayer

DePIN: @daylightenergy_

Wallets as a Service: @privy_io

Ai: @gensynai

It pays to be early :)

10/ Underestimate platform risk at your own peril

13% of Ethereum and Solana based teams raised follow on rounds

This was 5% for Avalanche teams

And 0% for NEAR teams

13% of Ethereum and Solana based teams raised follow on rounds

This was 5% for Avalanche teams

And 0% for NEAR teams

11/ We talked about @Polkadot in 2021 but didn't even bother covering it this year

The L1 carousel will likely continue to spin next year with emerging ecosystems like @SuiNetwork @berachain and @monad_xyz rising

The L1 carousel will likely continue to spin next year with emerging ecosystems like @SuiNetwork @berachain and @monad_xyz rising

12/ Thanks to @CoinDesk and @realDannyNelson

for the coverage and to our summer intern

@Solana_Luke

for compiling the data.

x.com/Solana_Luke

for the coverage and to our summer intern

@Solana_Luke

for compiling the data.

x.com/Solana_Luke

https://x.com/MikeZajko/status/1841141163363037495

• • •

Missing some Tweet in this thread? You can try to

force a refresh