🧵1/Ω

A thread about the recent connection of what WSJ calls “the shadow dollar that’s fueling the financial underworld” and the Trump campaign (basically a 🧵 version of my pinned tweet).

Ω👇Ω

A thread about the recent connection of what WSJ calls “the shadow dollar that’s fueling the financial underworld” and the Trump campaign (basically a 🧵 version of my pinned tweet).

Ω👇Ω

🧵2/Ω

Some background: there’s a NYC based financial firm called Cantor Fitzgerald whose CEO is a man named Howard Lutnick. Lutnick became somewhat infamous in the aftermath of 9/11 for cutting off payments to the many Cantor employees who died in the World Trade Center.

Some background: there’s a NYC based financial firm called Cantor Fitzgerald whose CEO is a man named Howard Lutnick. Lutnick became somewhat infamous in the aftermath of 9/11 for cutting off payments to the many Cantor employees who died in the World Trade Center.

🧵3/Ω

Lutnick has two roles that matter for the purposes of this 🧵. The first is he was recently made the co-chair of the Trump transition team, meaning if Trump wins Lutnick will be choosing who will run things like the Dept. of Justice, Defense, etc.

thehill.com/homenews/campa…

Lutnick has two roles that matter for the purposes of this 🧵. The first is he was recently made the co-chair of the Trump transition team, meaning if Trump wins Lutnick will be choosing who will run things like the Dept. of Justice, Defense, etc.

thehill.com/homenews/campa…

🧵4/Ω

The second is that Lutnick recently came out publicly as the man who manages "many" of the assets of "the shadow dollar that’s fueling the financial underworld" that I mentioned in the first tweet, a company called Tether. He's also just generally a crypto bro.

The second is that Lutnick recently came out publicly as the man who manages "many" of the assets of "the shadow dollar that’s fueling the financial underworld" that I mentioned in the first tweet, a company called Tether. He's also just generally a crypto bro.

🧵5/Ω

What is Tether? It's a "stablecoin" in the parlance of the bros.

- Tether issues a token "USDT"

- Each USDT is worth $1

If that term is unfamiliar envision an enormous bank account shared by every kind of criminal the world over (and some, I'm sure, who are good people).

What is Tether? It's a "stablecoin" in the parlance of the bros.

- Tether issues a token "USDT"

- Each USDT is worth $1

If that term is unfamiliar envision an enormous bank account shared by every kind of criminal the world over (and some, I'm sure, who are good people).

🧵6/Ω

Think organized crime groups of many and varied ethnicities, drug cartels, terrorists, rogue nuclear states, money launderers, offshore casino operators, and so on (and some, I'm sure, who are good people), all sharing a bank account.

Think organized crime groups of many and varied ethnicities, drug cartels, terrorists, rogue nuclear states, money launderers, offshore casino operators, and so on (and some, I'm sure, who are good people), all sharing a bank account.

🧵7/Ω

With that giant bank account in mind:

1) Tether is the accounting system that enables this cast of supervillains (and some, i'm sure, who are good people) to share the bank account. Keeps track of who owns what.

2) Howard Lutnick’s company Cantor Fitzgerald is the bank.

With that giant bank account in mind:

1) Tether is the accounting system that enables this cast of supervillains (and some, i'm sure, who are good people) to share the bank account. Keeps track of who owns what.

2) Howard Lutnick’s company Cantor Fitzgerald is the bank.

🧵8/Ω

How big is that bank account? Theoretically ~$120bn, meaning it's one of the largest pools of capital on the planet other than things like the Saudi Arabian sovereign wealth fund.

How big is that bank account? Theoretically ~$120bn, meaning it's one of the largest pools of capital on the planet other than things like the Saudi Arabian sovereign wealth fund.

https://x.com/Ian_Unsworth/status/1790023670183718935

🧵9/Ω

(At least, theoretically. Tether has never been audited so no one knows whether all this money exists. All we have to go on is what Tether and Lutnicks say.

Lutnick has not to my knowledge ever said he's seen "all" Tether's assets, only "many" of them, as he does here:

(At least, theoretically. Tether has never been audited so no one knows whether all this money exists. All we have to go on is what Tether and Lutnicks say.

Lutnick has not to my knowledge ever said he's seen "all" Tether's assets, only "many" of them, as he does here:

🧵10/Ω

This video of storied fund manager Hugh Hendry discussing Tether at a bitcoin event is a good approximation of how many competent financial professionals view Tether.

This video of storied fund manager Hugh Hendry discussing Tether at a bitcoin event is a good approximation of how many competent financial professionals view Tether.

https://x.com/hendry_hugh/status/1713816725211246686

🧵11/Ω

We're not going to relitigate Tether's solvency here. I will just note the only time said solvency has been litigated Tether was found to be lying about its assets. Most of Tether's money had been seized from a drug cartel bank.

ag.ny.gov/press-release/…

We're not going to relitigate Tether's solvency here. I will just note the only time said solvency has been litigated Tether was found to be lying about its assets. Most of Tether's money had been seized from a drug cartel bank.

ag.ny.gov/press-release/…

🧵12/Ω

Let's assume Tether has the money and it's at Cantor.

As I said Tether's USDT token is roughly the accounting system of a shared bank account. It's not the best accounting system for many reasons but it kind of works.

Let's assume Tether has the money and it's at Cantor.

As I said Tether's USDT token is roughly the accounting system of a shared bank account. It's not the best accounting system for many reasons but it kind of works.

🧵13/Ω

(Now might be a good time to mention that USDT tokens have literally none of the "decentralized" and "immutable" features bros love to harp on about. Tether can, on the whims of two people, seize anyone's tokens at any time. But I digress.)

(Now might be a good time to mention that USDT tokens have literally none of the "decentralized" and "immutable" features bros love to harp on about. Tether can, on the whims of two people, seize anyone's tokens at any time. But I digress.)

https://x.com/Cryptadamist/status/1666917834662789120

🧵14/Ω

A roughly equivalent way of thinking about Tether's shared bank account + accounting system is that it's a bunch of little bank accounts.

In fact that's exactly how Tether wants you to think about it w/constant refrains of "banking the unbanked".

A roughly equivalent way of thinking about Tether's shared bank account + accounting system is that it's a bunch of little bank accounts.

In fact that's exactly how Tether wants you to think about it w/constant refrains of "banking the unbanked".

🧵15/Ω

Let's look at a specific case of how that plays out. "Tradfi" companies like banks and EMTs are barred from providing services to Iranians bc of longstanding sanctions.

Mysteriously however it is actively advertised that Iranians freely use Tether.

Let's look at a specific case of how that plays out. "Tradfi" companies like banks and EMTs are barred from providing services to Iranians bc of longstanding sanctions.

Mysteriously however it is actively advertised that Iranians freely use Tether.

https://x.com/Cryptadamist/status/1713178162023014544

🧵16/Ω

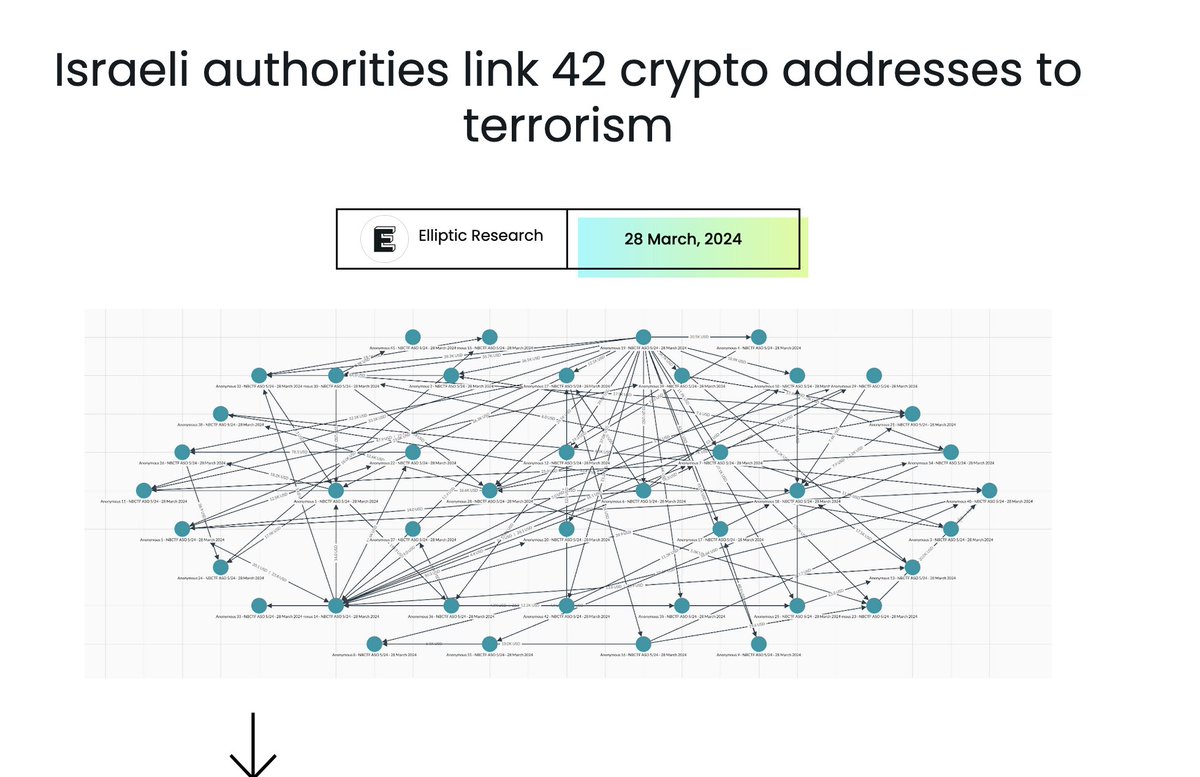

Those Iranians are widely rumored to include the Iranian Revolutionary Guard who are in turn rumored to use Tether as a way to distribute US dollar equivalents to groups like Hezbollah. But it doesn't really matter; US sanctions on Iran are wide ranging. It's all bad.

Those Iranians are widely rumored to include the Iranian Revolutionary Guard who are in turn rumored to use Tether as a way to distribute US dollar equivalents to groups like Hezbollah. But it doesn't really matter; US sanctions on Iran are wide ranging. It's all bad.

🧵17/Ω

Putting aside for a moment the fact that this means Lutnick, who seems to be an ardent zionist, is more or less "banking the unbankable" Iranians just as Israel and Iran are on the verge of all out war, you may be wondering "how does that work?"

Putting aside for a moment the fact that this means Lutnick, who seems to be an ardent zionist, is more or less "banking the unbankable" Iranians just as Israel and Iran are on the verge of all out war, you may be wondering "how does that work?"

🧵18/Ω

A "tradfi" banker who opened bank accounts for Iranians could be sent to prison (and probably would be if it came out there was IRGC involvement). Even if that banker didn't know!

There is a heavy burden on financial companies to "know their customers" ("KYC").

A "tradfi" banker who opened bank accounts for Iranians could be sent to prison (and probably would be if it came out there was IRGC involvement). Even if that banker didn't know!

There is a heavy burden on financial companies to "know their customers" ("KYC").

🧵19/Ω

So how does Tether get away with letting Iranians buy USDT tokens? Here's the theory:

1) Tether only has ~300 *actual* customers

2) If those customers buy USDT in bulk they can sell it to... pretty much anyone.

So how does Tether get away with letting Iranians buy USDT tokens? Here's the theory:

1) Tether only has ~300 *actual* customers

2) If those customers buy USDT in bulk they can sell it to... pretty much anyone.

🧵20/Ω

Possibly worth mentioning that Tether's biggest customer until recently was Sam Bankman-Fried who bought almost $40 billion worth of USDT...

Possibly worth mentioning that Tether's biggest customer until recently was Sam Bankman-Fried who bought almost $40 billion worth of USDT...

https://x.com/CasPiancey/status/1458474418288558080

🧵21/Ω

Which he seems to have sold to people in Hong Kong who turned up at the offices of an FTX subsidiary with garbage bags full of cash every day for years.

Definitely not Tether's problem where all that cash came from (at least according to Tether).

Which he seems to have sold to people in Hong Kong who turned up at the offices of an FTX subsidiary with garbage bags full of cash every day for years.

Definitely not Tether's problem where all that cash came from (at least according to Tether).

https://x.com/Cryptadamist/status/1600012333450817538

🧵22/Ω

This 🧵 suggests it's reasonable for American voters to be a bit concerned that a billionaire Wall St. bro whose company is roughly the central bank of int'l criminal finance is on track to choose who will enforce the law if Trump wins.

Consider an RT if you agree.

This 🧵 suggests it's reasonable for American voters to be a bit concerned that a billionaire Wall St. bro whose company is roughly the central bank of int'l criminal finance is on track to choose who will enforce the law if Trump wins.

Consider an RT if you agree.

🧵23/Ω

For more info see the original post on The Blogging Site That Shall Not Be named (link in bio).

@Bitfinexed @ParrotCapital @ImDrinknWyn @WillHild @RhoRider @Nostre_damus @CasPiancey @coffeebreak_YT @molly0xFFF @EggerDC @StringwallApp @mopeng @patio11 RT's appreciated.

For more info see the original post on The Blogging Site That Shall Not Be named (link in bio).

@Bitfinexed @ParrotCapital @ImDrinknWyn @WillHild @RhoRider @Nostre_damus @CasPiancey @coffeebreak_YT @molly0xFFF @EggerDC @StringwallApp @mopeng @patio11 RT's appreciated.

@DennisKelleher @BetterMarkets @BennettTomlin @CasPiancey @Marc_Fagel @JohnReedStark @mcuban @MikeBurgersburg

Thread might be of interest to you guys.

Thread might be of interest to you guys.

@davidgerard @ahcastor

🧵24/Ω

[shill section] I'll be publishing my next piece on The Blogging Site That Shall Not Be Named about New York City's recently indicted mayor Eric Adams's many crypto connections so if that kind of thing interests you consider subscribing (it's free). #EricAdams

[shill section] I'll be publishing my next piece on The Blogging Site That Shall Not Be Named about New York City's recently indicted mayor Eric Adams's many crypto connections so if that kind of thing interests you consider subscribing (it's free). #EricAdams

@vortoxica

@ryangrim

@gilduran76 @shanley @ExkrementKoin @Pledditor @RogueCfpb @gmorgenson @davetroy @laurenbalik

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh