‼️ The Russian Debt Thread: Part 9

(You might want to bookmark this)

If you’re seeing this and don’t know where Part 1 is….

(You might want to bookmark this)

If you’re seeing this and don’t know where Part 1 is….

At the end of last thread, I explained how the OFZ Federal Bonds are like mortgages. In addition to the way people bid on them, the Russian Ministry of Finance is obligated to make payments on them in fixed intervals depending on what type of Bond they are.

But they’re also a big like gift cards. See, these auctions that we’re watching are like sales between a company and their wholesale distributors. These are usually entities like banks that are buying large chucks of these bonds.

They can then turn around and sell them on the secondary market. But they want to be able to make a profit too. So think of it like a business selling gift cards.

Gift cards have a face value, just like these bonds.

Gift cards have a face value, just like these bonds.

But they sell it at BELOW face value to their wholesalers, and the wholesalers can then make money in the area between the face value and discounted price they paid for it.

Every once in a while, these savings can get passed on to you, and you can buy the gift cards at a lower price than the face value too!

And depending on how desperate business is for cash, they can be significant discounts off the face value.

And depending on how desperate business is for cash, they can be significant discounts off the face value.

Same thing goes for these bonds. When they go into these auctions they will bid on how big of a discount they want off the face value. Depending on how old the bond is, how the market is going and how desperate the Min. of Finance is, they can be steep.

We’re only really going to focus on 2 types of Bonds, because that’s the majority of what the Ministry of Finance has been offering and placing.

1. Constant Coupons 👉 these are indicated with a PD code

These bonds are like a fixed mortgage, people bid on the interest rate, which is then fixed for the length of the bong & the discount off the face value.

These bonds are like a fixed mortgage, people bid on the interest rate, which is then fixed for the length of the bong & the discount off the face value.

In this scenario you can imagine why people would not be interested in picking up a constant coupon in a period when everyone is sending signals that the Key Rate is going to increase. Especially if a Russian Central Bank meeting is coming up soon.

Why lock yourself into a bond when you could wait a week or more and get an even BETTER interest rate after the Key Rate increases.

The problem here that the secondary market feels the same way.

The problem here that the secondary market feels the same way.

Also the people who picked up a bond in January and rate of around 12% are probably not thrilled that the new bonds are going for over 16% now…and with the rate of inflation…they might actually be losing money.

But the Russian Ministry of Finance would like to place constant coupon bonds because they would then KNOW what their future debt obligations on them are.

But…when you need the money….something has to be done. So in June of 2024, they returned to offering the second type

But…when you need the money….something has to be done. So in June of 2024, they returned to offering the second type

2. Variable Rate Bonds, these are also called Floating Rate Bonds, and thus are often referred to as “floaters”

👉 these are indicated with a PK or PC

There is no difference between the two, it just depends on the translation

👉 these are indicated with a PK or PC

There is no difference between the two, it just depends on the translation

This is what it is: ОФЗ-ПК

This could get translated as OFZ-PK or OFZ-PC, sometimes I use them interchangeably. It means the same thing.

These bonds are just like other variable rate type loans. The rate on them is tied back to the RUONIA Rate.

This could get translated as OFZ-PK or OFZ-PC, sometimes I use them interchangeably. It means the same thing.

These bonds are just like other variable rate type loans. The rate on them is tied back to the RUONIA Rate.

If you go to the Russian Central Bank website you’ll see this on this start page along with other important statistics. If you click on it, you can access historical data on it.

cbr.ru/eng/

cbr.ru/eng/

Because the rate is set by the RUONIA Rate, the only thing there is to bid on is how much of a discount they want off the face value.

At the bottom of this article on the failed auction from last week, you can see how the RUONIA rate is used.

interfax.ru/business/986007

At the bottom of this article on the failed auction from last week, you can see how the RUONIA rate is used.

interfax.ru/business/986007

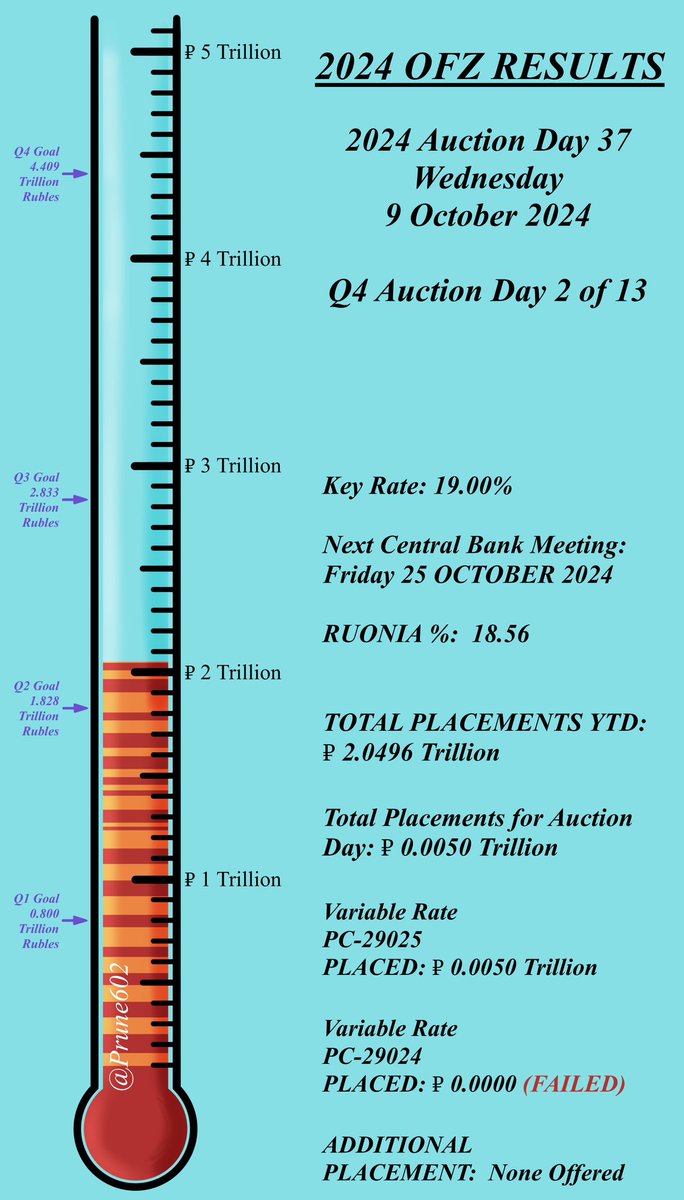

Right now…things have not been looking good on these placements which indicates there may be some bigger problems. This is something I usually go into more detail in the OFZ thread. This is where we are right now heading into Q4 Auction Day 3 of 13 on 16 October 2024

We are now very close to the next Russian Central Bank Meeting, 25 October 2024, where the general consensus in the the Key Rate will get raised to AT LEAST 20%

No one will know what the Key Rate actually is until AFTER the Central Bank Meeting, but these discussion can impact the markets & these auctions in particular

Note: the week of a Central Bank meeting (that takes place on a Friday) the Central Bank takes a sort of vow of silence

Note: the week of a Central Bank meeting (that takes place on a Friday) the Central Bank takes a sort of vow of silence

That means if there is anything the Central Bank wants send messaging on, they have to do it NOW, this week. Because next week, they’re supposed to zip it. 🤐

The two weeks before a Central bank meeting always get a little crazy in messaging sent by everyone. Prepare thyself.

The two weeks before a Central bank meeting always get a little crazy in messaging sent by everyone. Prepare thyself.

There is only one scheduled Central Bank Meeting left in the year after this one. It will be in December. If they want any of their decisions to help things in 2024, the time to act is now.

As we discussed, Russia needs every bit of these placements to fund the deficit, at least according 2024 Budget 2.0, and 2024 Budget 3.0 has an even bigger deficit.

But, you may be wondering…

Prune, you said they were giving a discount on these things, where’s that?

But, you may be wondering…

Prune, you said they were giving a discount on these things, where’s that?

Well, that is a good point…and THAT is part of why things are actually EVEN WORSE than it looks right now!

EVEN MORE BAD NEWS IS COMING!

In Part 10

EVEN MORE BAD NEWS IS COMING!

In Part 10

• • •

Missing some Tweet in this thread? You can try to

force a refresh