‼️ The OFZ Federal Bond Thread: Russia’s Race to Secure a Loan!

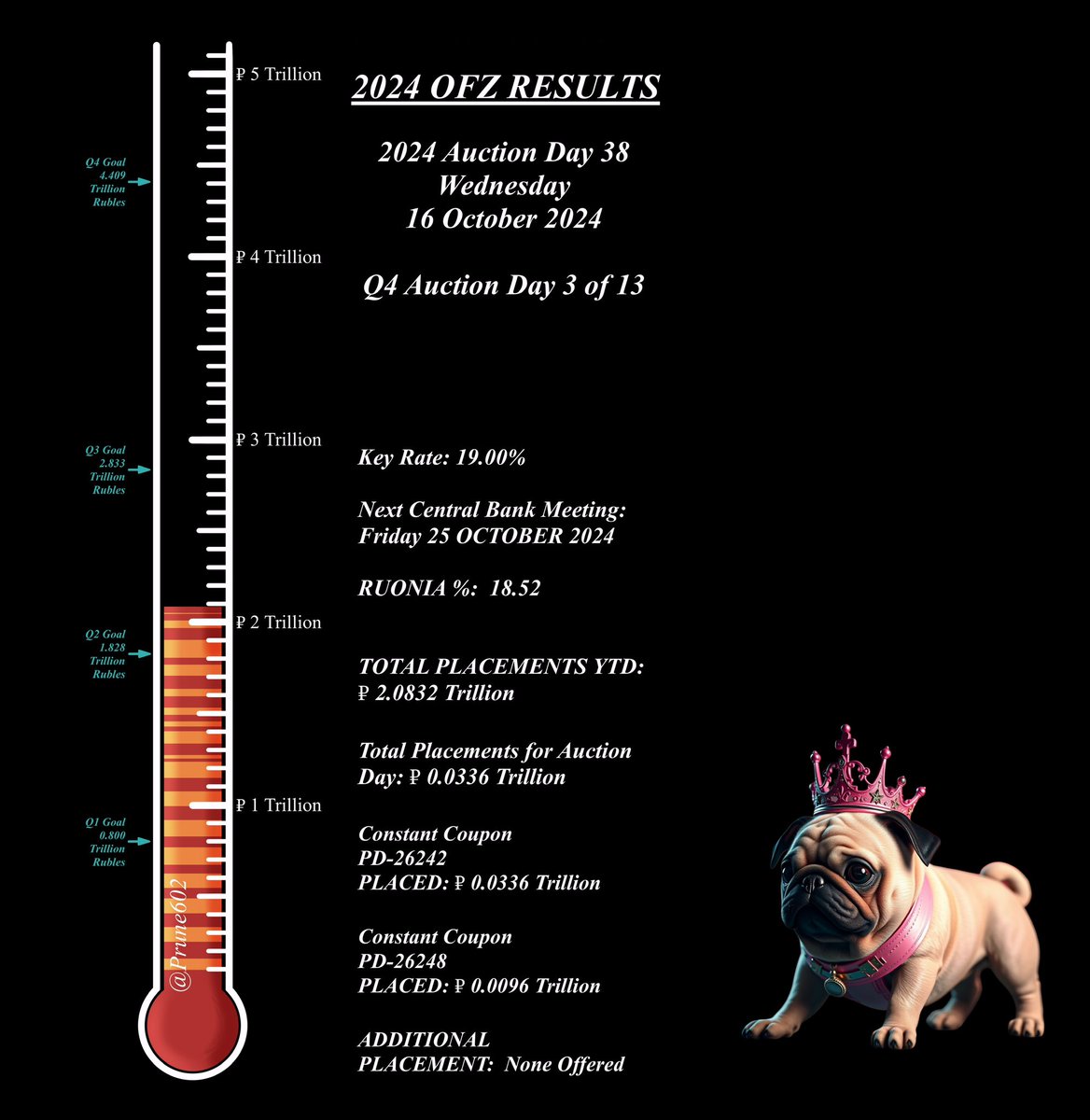

Q4 Auction Day 3 of 13

Part 4: CHARTS

(Don’t forget to use your bookmark)

If you don’t know where the rest of the thread is, worry not!

Q4 Auction Day 3 of 13

Part 4: CHARTS

(Don’t forget to use your bookmark)

If you don’t know where the rest of the thread is, worry not!

Here is the Table of Contents

Bookmark it if you haven’t

Bookmark it if you haven’t

https://twitter.com/prune602/status/1847029682425782777

I do want to remind you that there is a lot of discussion that was had in the previous OFZ Auction Day threads that I linked to back in Part 1.

In addition, I’ve been discussing some of these things in the Russian Debt thread. It will help you understand some basics.

In addition, I’ve been discussing some of these things in the Russian Debt thread. It will help you understand some basics.

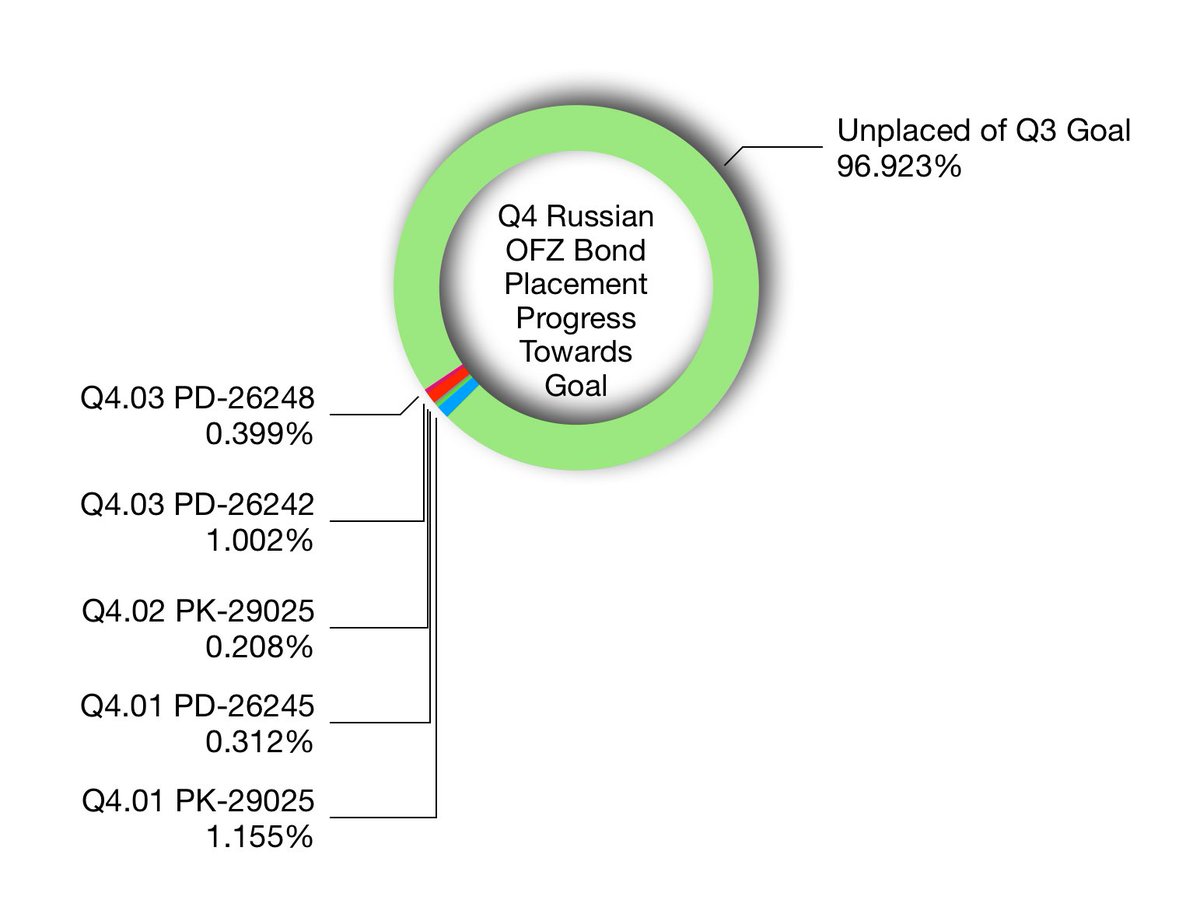

We need to discuss what has been happening, but for ease of reference, I’m going to dump all the charts here, and then I’ll work on going through and EXPLAINING what is going on there.

The charts are set up very similarly to the way they were before, but most notably the newest information is now at the bottom.

So it is easier to see I’m just displaying Q3 & Q4 in this chart.

So it is easier to see I’m just displaying Q3 & Q4 in this chart.

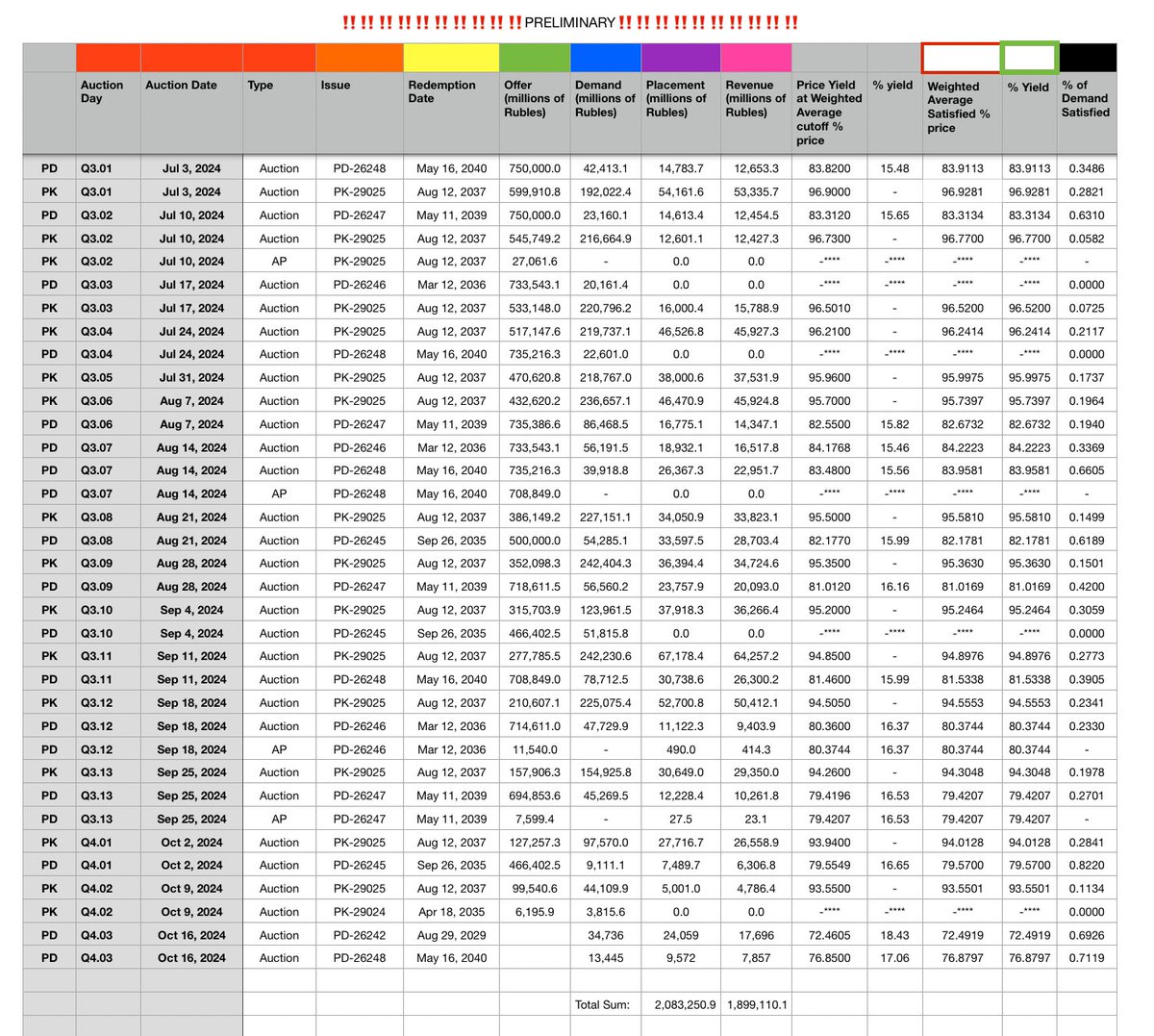

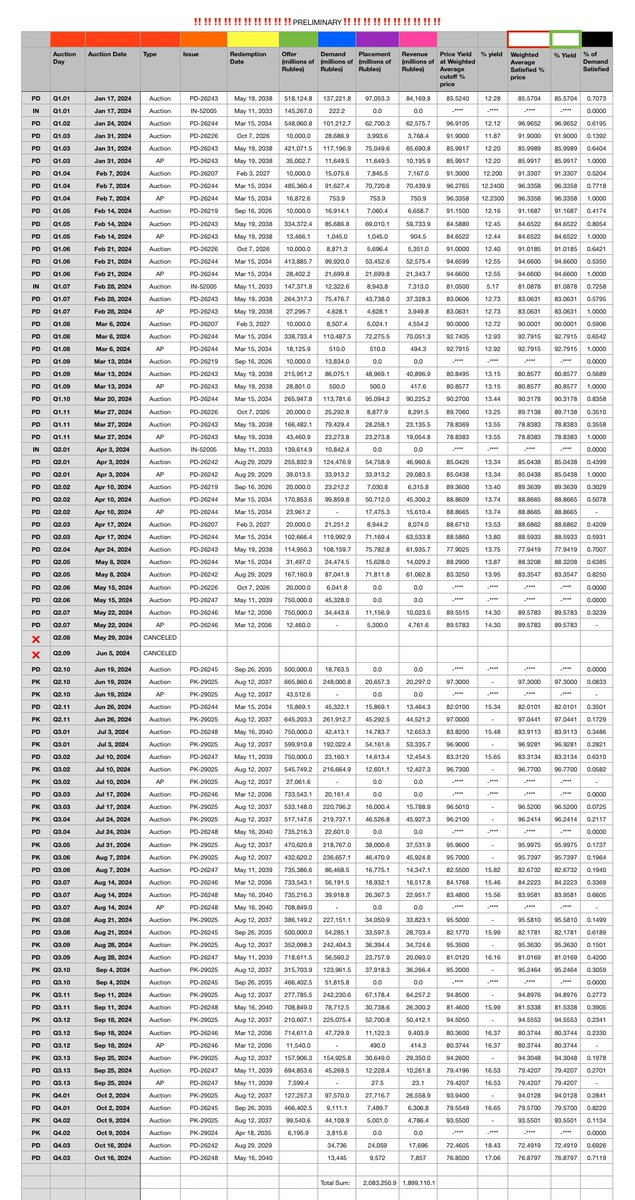

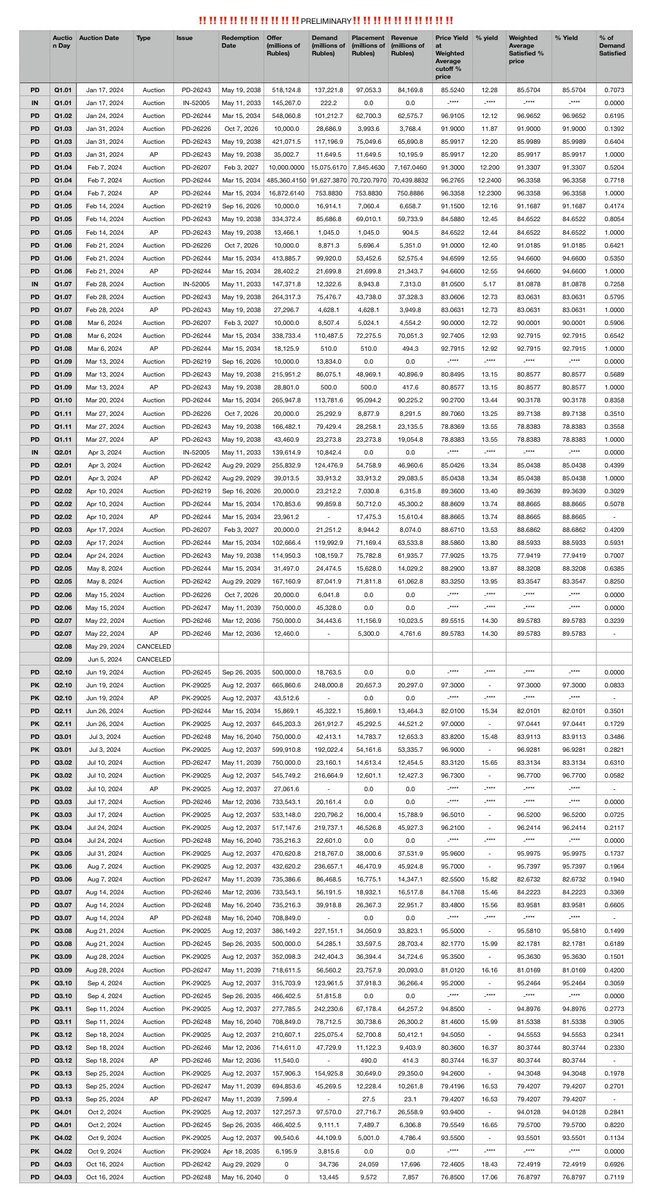

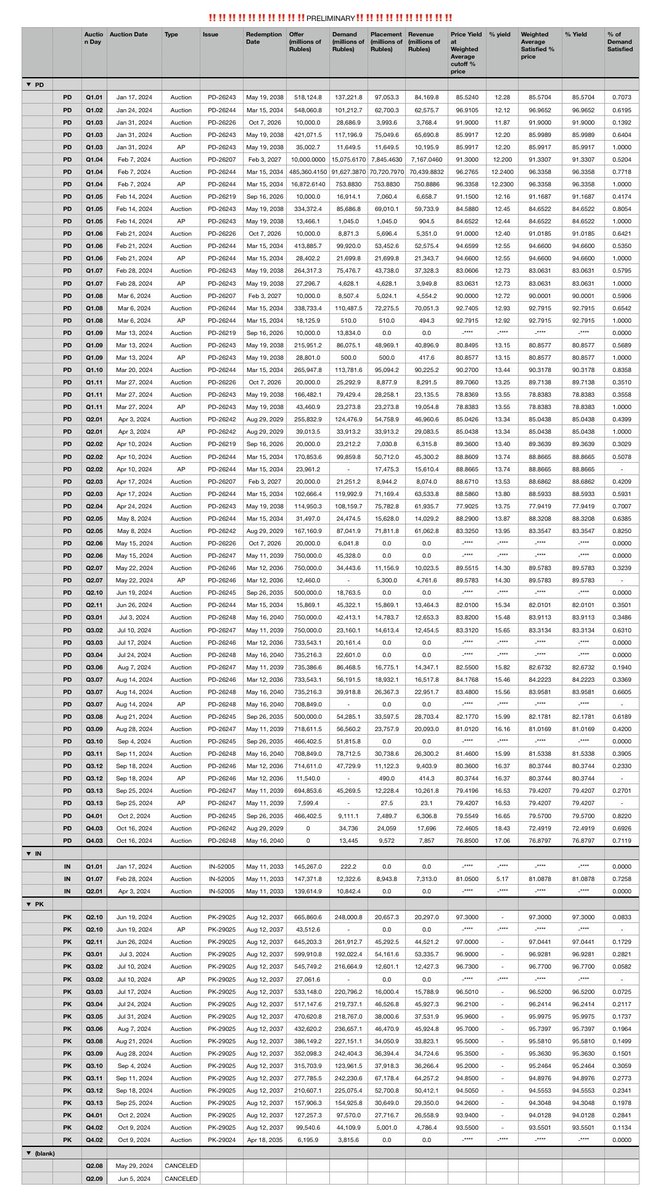

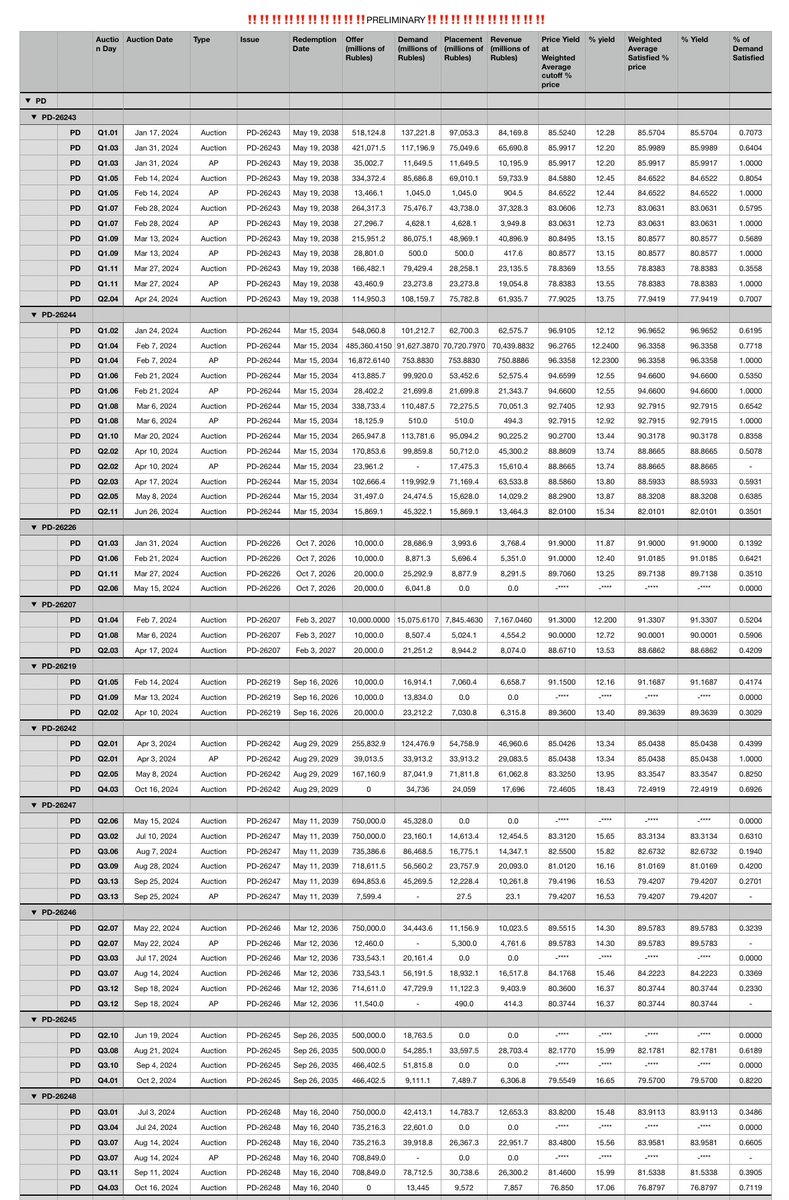

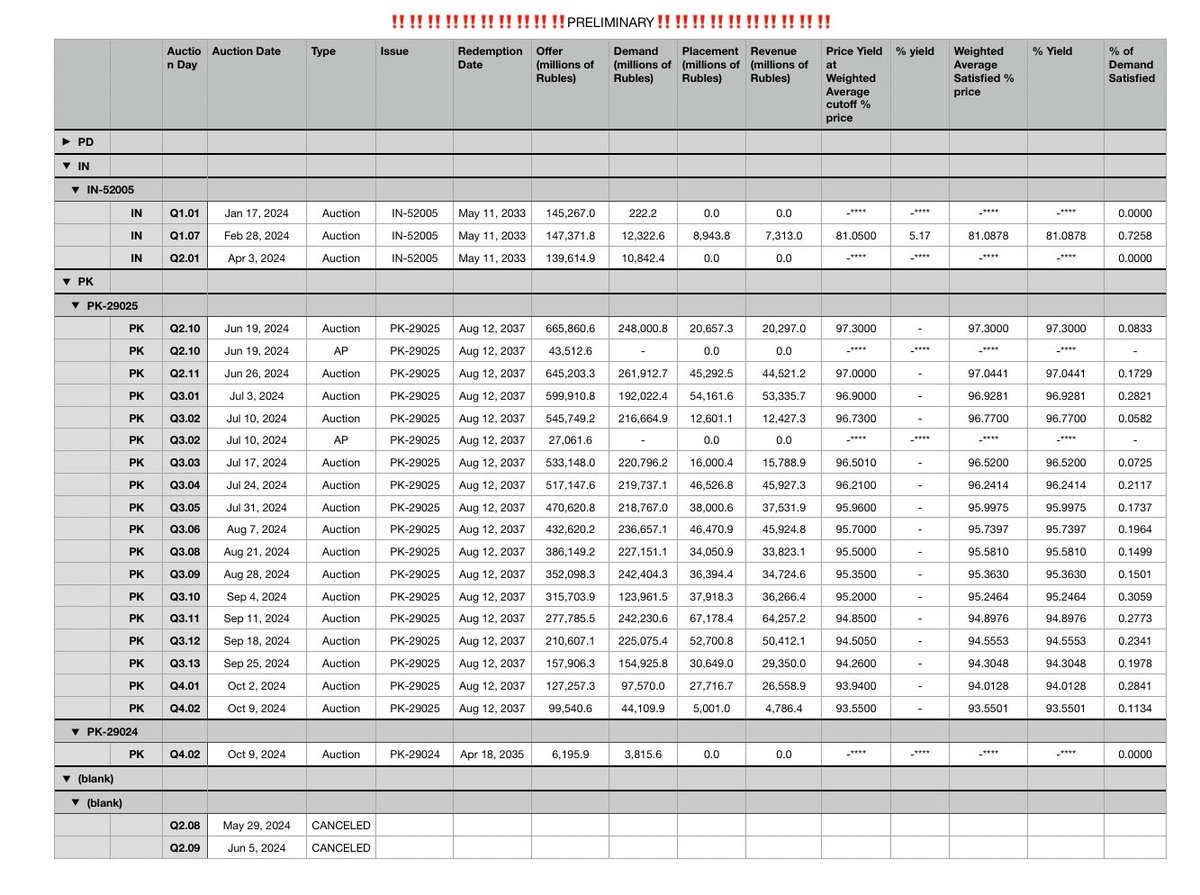

Some of these tables are now so large I had to split them into Images:

This is basically the same information just with sorted formatted differently, full charts

Rainbow Chart

Clean Chart

Chart Sorted By Bond Type

This is basically the same information just with sorted formatted differently, full charts

Rainbow Chart

Clean Chart

Chart Sorted By Bond Type

This is the same chart, in two parts.

It’s the data sorted by both bond type and bond number.

There are the ones that will give you the most accurate way to track how a bonds terms (what Ministry of Finance agrees to in the Auction) is doing over time.

It’s the data sorted by both bond type and bond number.

There are the ones that will give you the most accurate way to track how a bonds terms (what Ministry of Finance agrees to in the Auction) is doing over time.

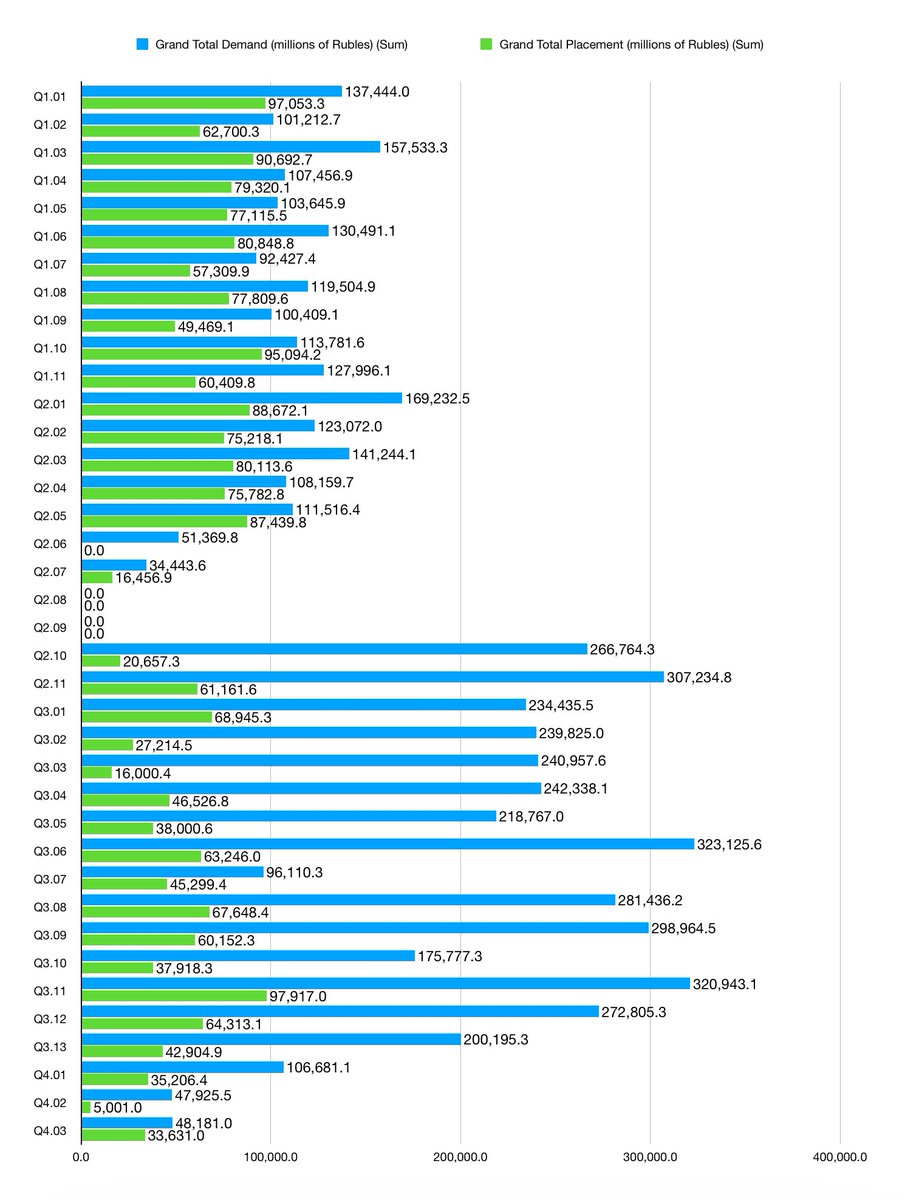

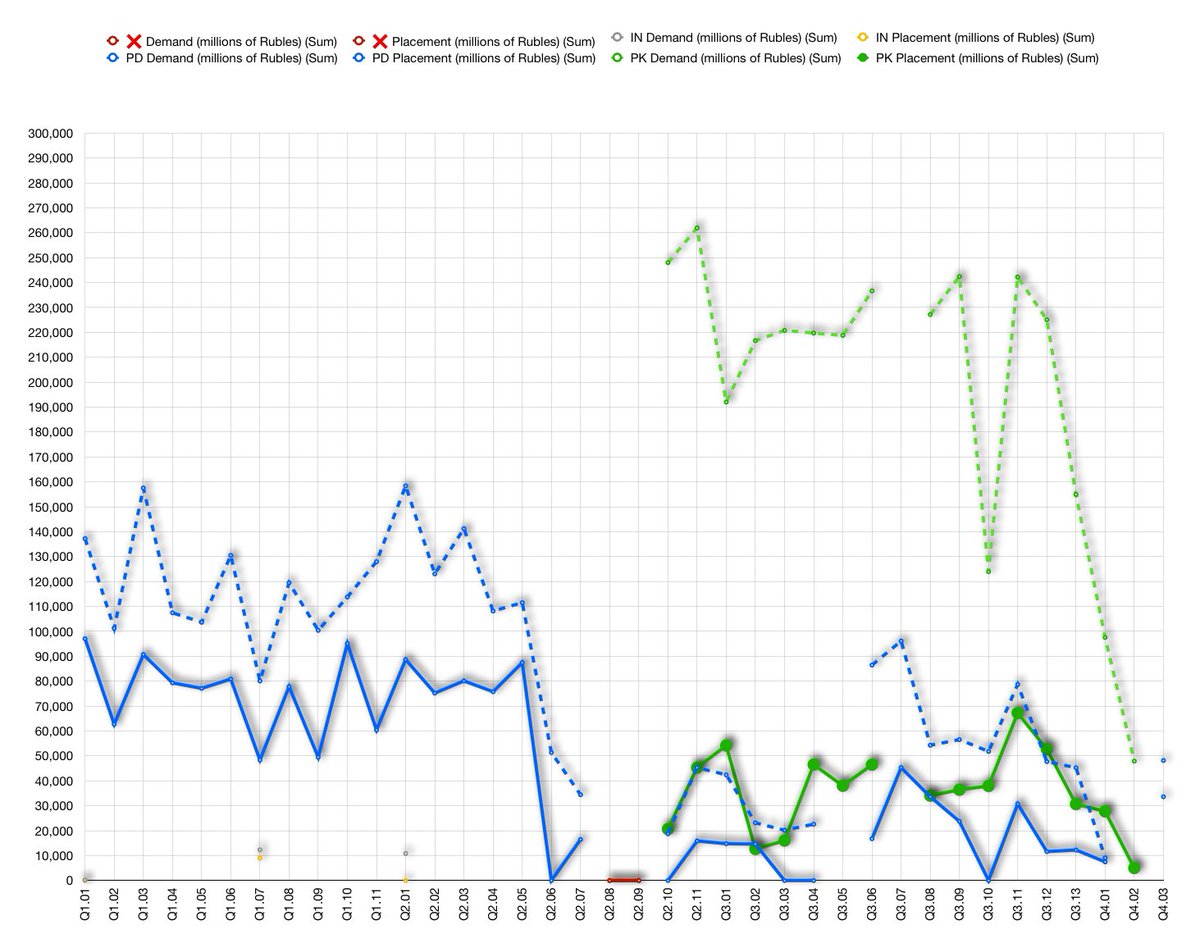

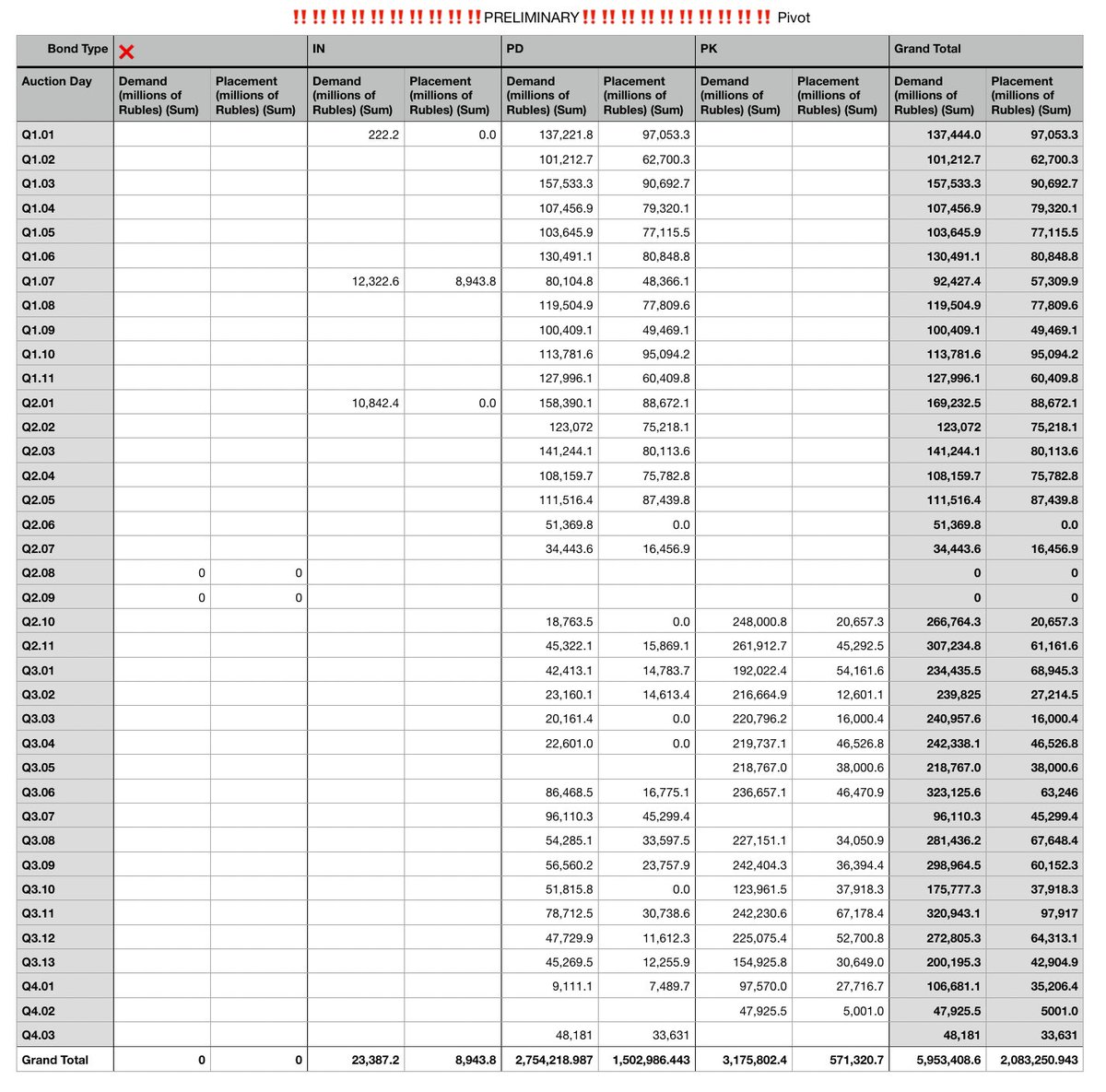

Here is the supply vs demand for each auction day.

If an auction is declared in valid, the demand is eventually published. That demand IS counted here also.

You would have to wait to get in that scenario, but none of them failed this week. These are accurate.

If an auction is declared in valid, the demand is eventually published. That demand IS counted here also.

You would have to wait to get in that scenario, but none of them failed this week. These are accurate.

Here is the chart of demand vs placement on each auction day, and also the table to used to make both this chart, and the chart above.

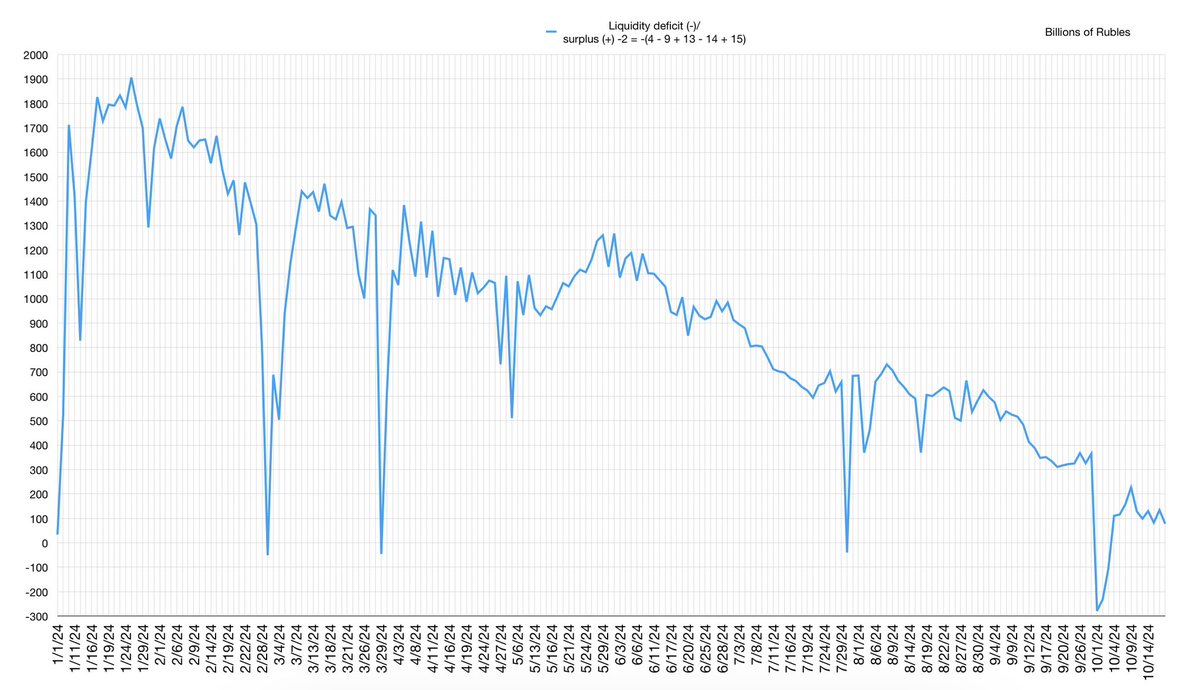

This is a supplementary chart that I add for reference.

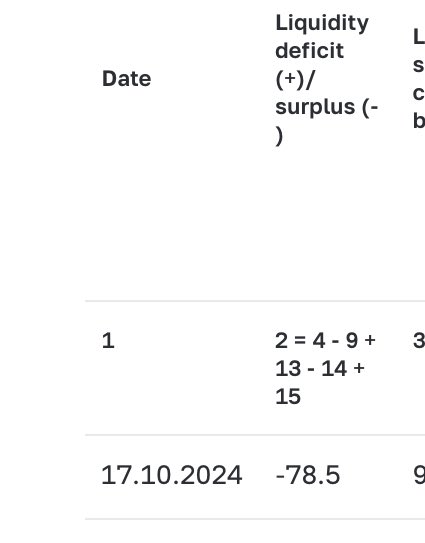

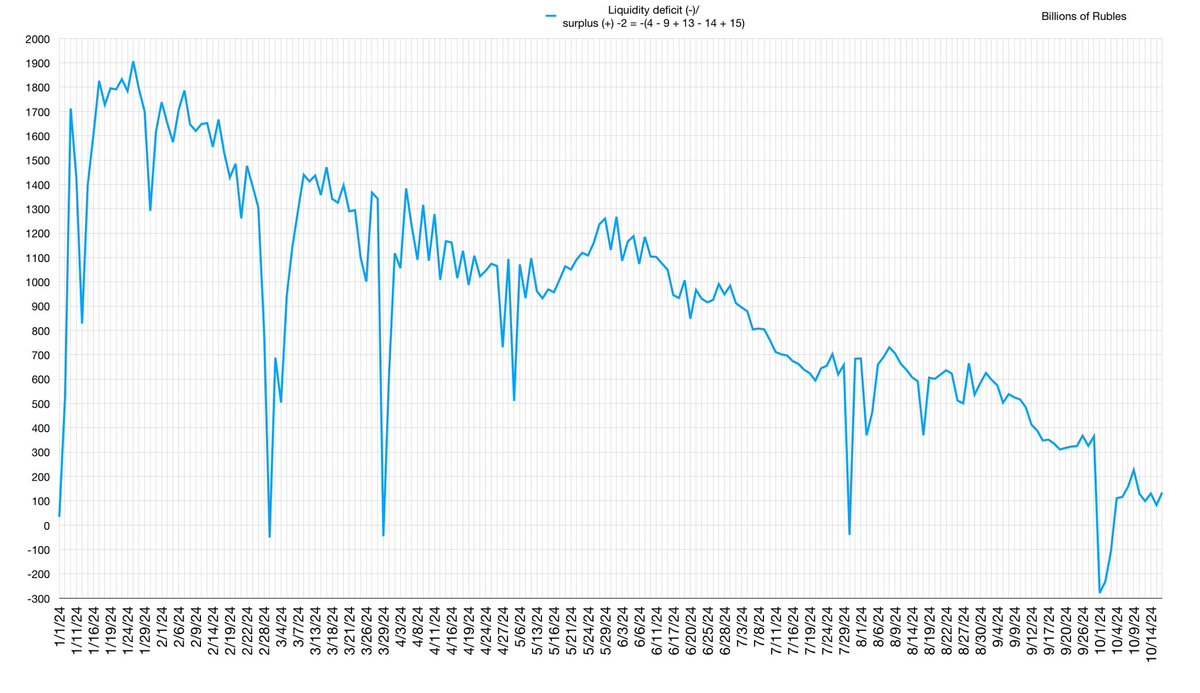

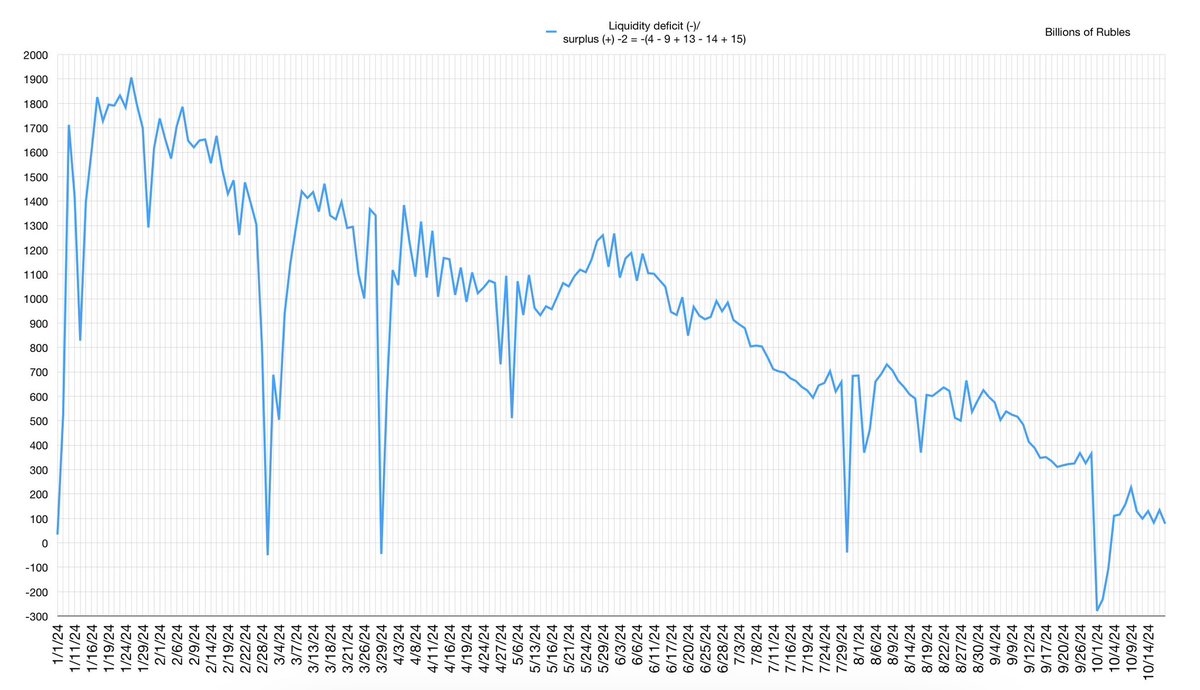

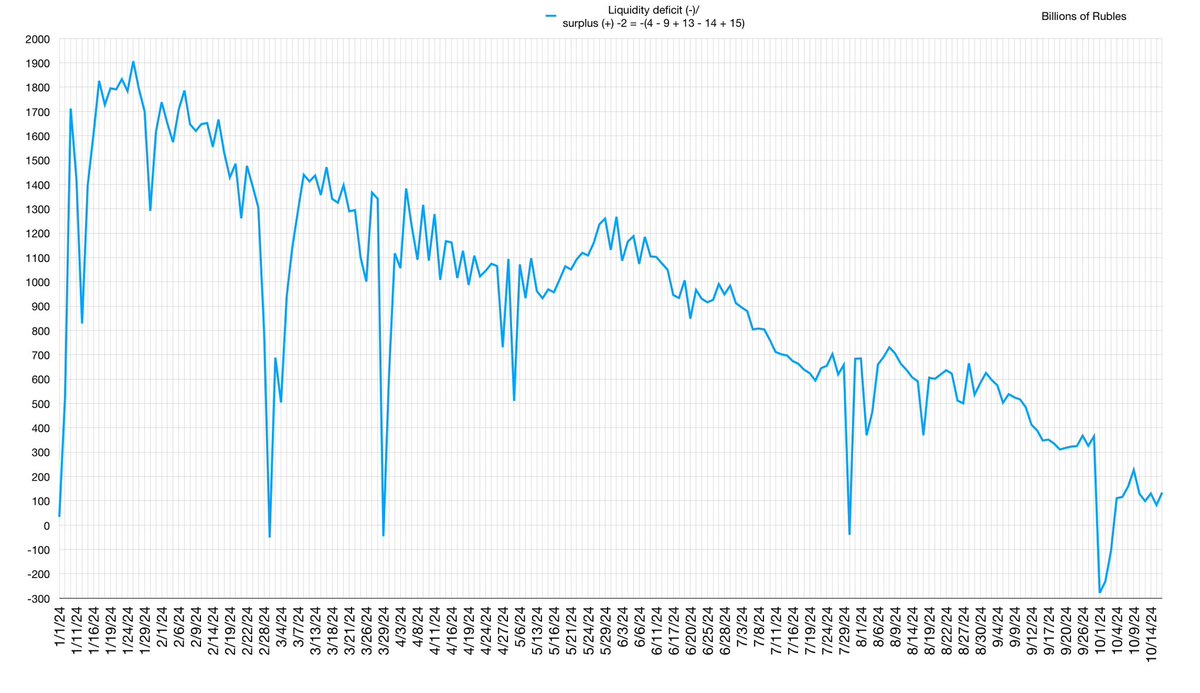

This is the Surplus Liquidity in the Russian Banking sector.

That data comes from the Russian Central Bank

👉

I just make a small change to that data when I make the Chart. SO PAY ATTENTION cbr.ru/eng/hd_base/bl…

This is the Surplus Liquidity in the Russian Banking sector.

That data comes from the Russian Central Bank

👉

I just make a small change to that data when I make the Chart. SO PAY ATTENTION cbr.ru/eng/hd_base/bl…

If you look at their definition…a SURPLUS in liquidity has a NEGATIVE number.

And that just hurts my head. This is why I hate accounting. A surplus should be a positive number!

Since I was making a SURPLUS Liquidity chart, I made them positive numbers.

You’re welcome!

And that just hurts my head. This is why I hate accounting. A surplus should be a positive number!

Since I was making a SURPLUS Liquidity chart, I made them positive numbers.

You’re welcome!

Therefore this chart should give you the surplus liquidity that is available in Russian Banking in order to buy these OFZ bonds.

So it’s the money that is available AFTER accounting for things like required reserves.

So it’s the money that is available AFTER accounting for things like required reserves.

I think the most obvious thing to point out is that in order to buy OFZ Bonds, you need to have the liquidity to do so.

I guess it’s *possible* to find liquidity elsewhere…maybe. But, if you’ve been reading the debt thread, you’ll be aware some of the many challenges.

I guess it’s *possible* to find liquidity elsewhere…maybe. But, if you’ve been reading the debt thread, you’ll be aware some of the many challenges.

Some of the liquidity refills as banking does banking things, but. I think the overall trend is pretty clear. We’ve reached the point that ALL the surplus liquidity in Russian banking isn’t enough on a PER WEEK basis to meet Russia’s OFZ goals.

So…that’s a problem…

So…that’s a problem…

In fact, it might be the BIGGEST problem. Because, as I discuss the more minute details of whether people want them, or the rates, and all the details of attracting placements…does it matter if there’s no liquidity to buy them?

Considering how closed off from the rest of the world the Russian Financial System is right now, could they even move enough things around to make a net change?

The MOEX is sanctioned, and cross border transactions are becoming extremely challenging.

The MOEX is sanctioned, and cross border transactions are becoming extremely challenging.

This is one of those things where the more I think about it the worse it gets. So…I’m not sure if there is a way to fix this before the end of the year.

And they aren’t really getting picked up by foreign investors. If anything they’re overall getting rid of them.

And they aren’t really getting picked up by foreign investors. If anything they’re overall getting rid of them.

Seriously…every time I try to think of a work around considering the way things are behaving overall. I’m coming up with a blank.

Except for that one many of you are thinking about…but that has consequences!

Except for that one many of you are thinking about…but that has consequences!

The liquidity is just going to have to be the elephant in the room that WE did talk about, but we need to talk about what is happening in these auctions.

And we’ll do that in Part 5!

And we’ll do that in Part 5!

• • •

Missing some Tweet in this thread? You can try to

force a refresh