This chart is making a lot of investors panic

But the data tells a different story for now

A thread 🧵

But the data tells a different story for now

A thread 🧵

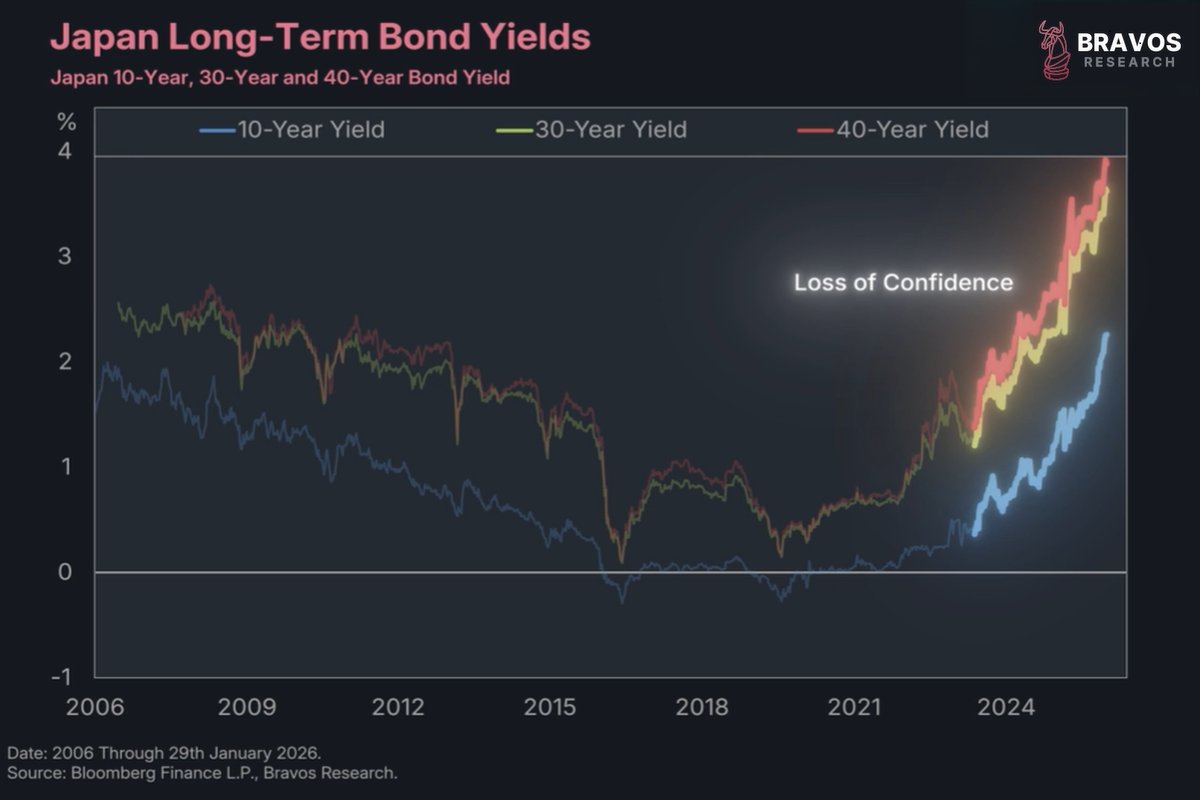

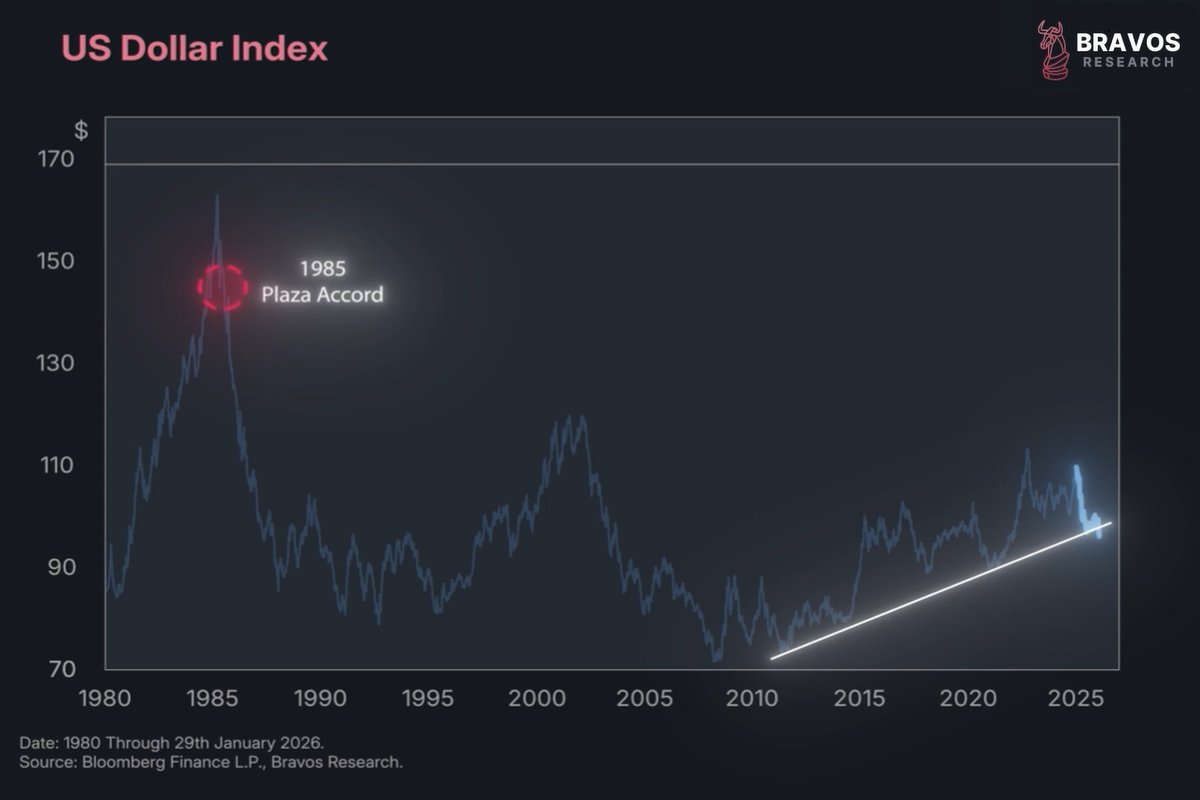

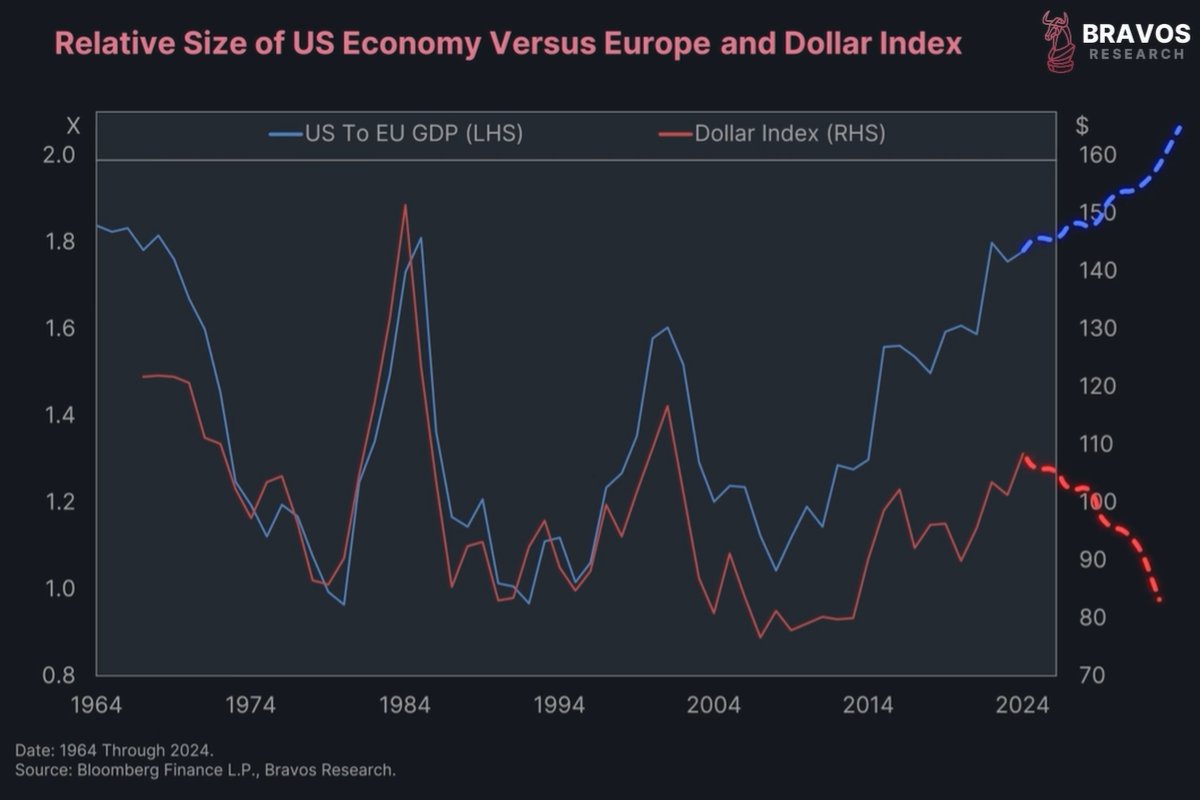

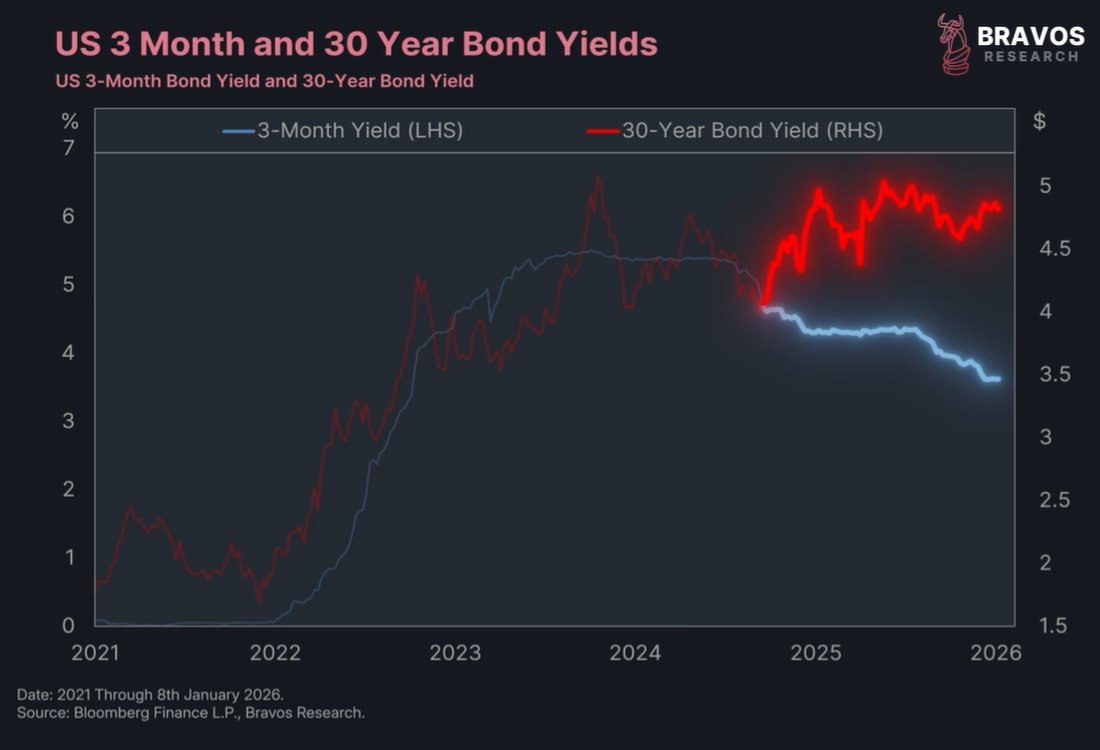

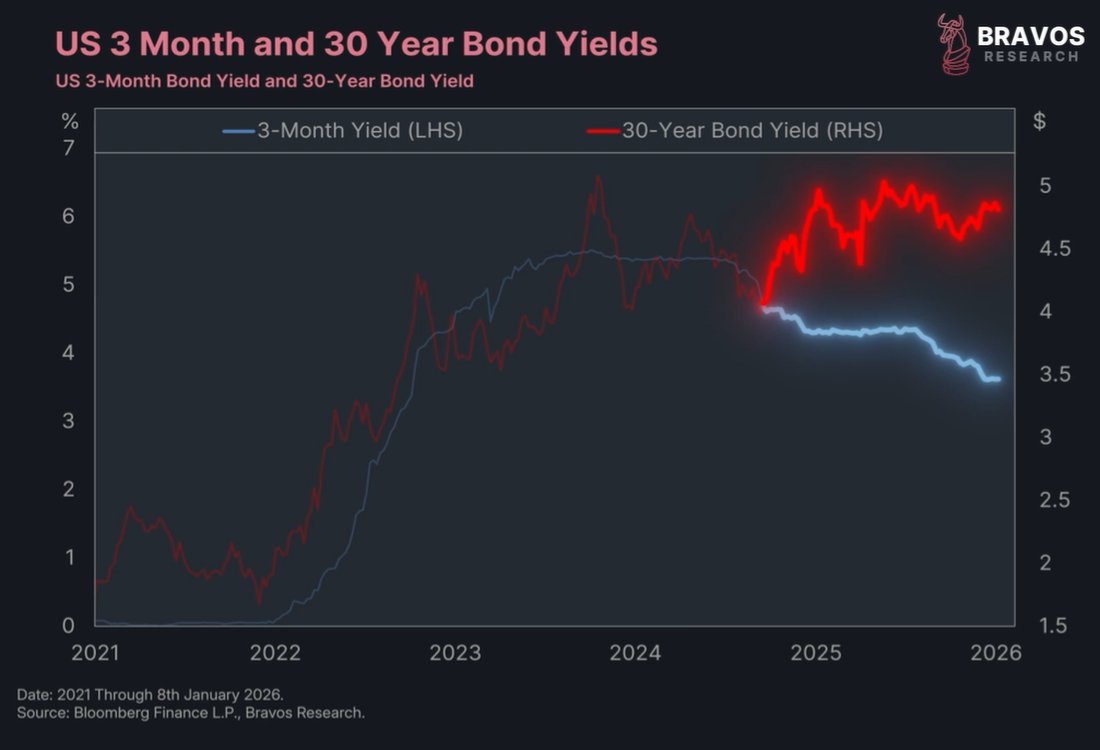

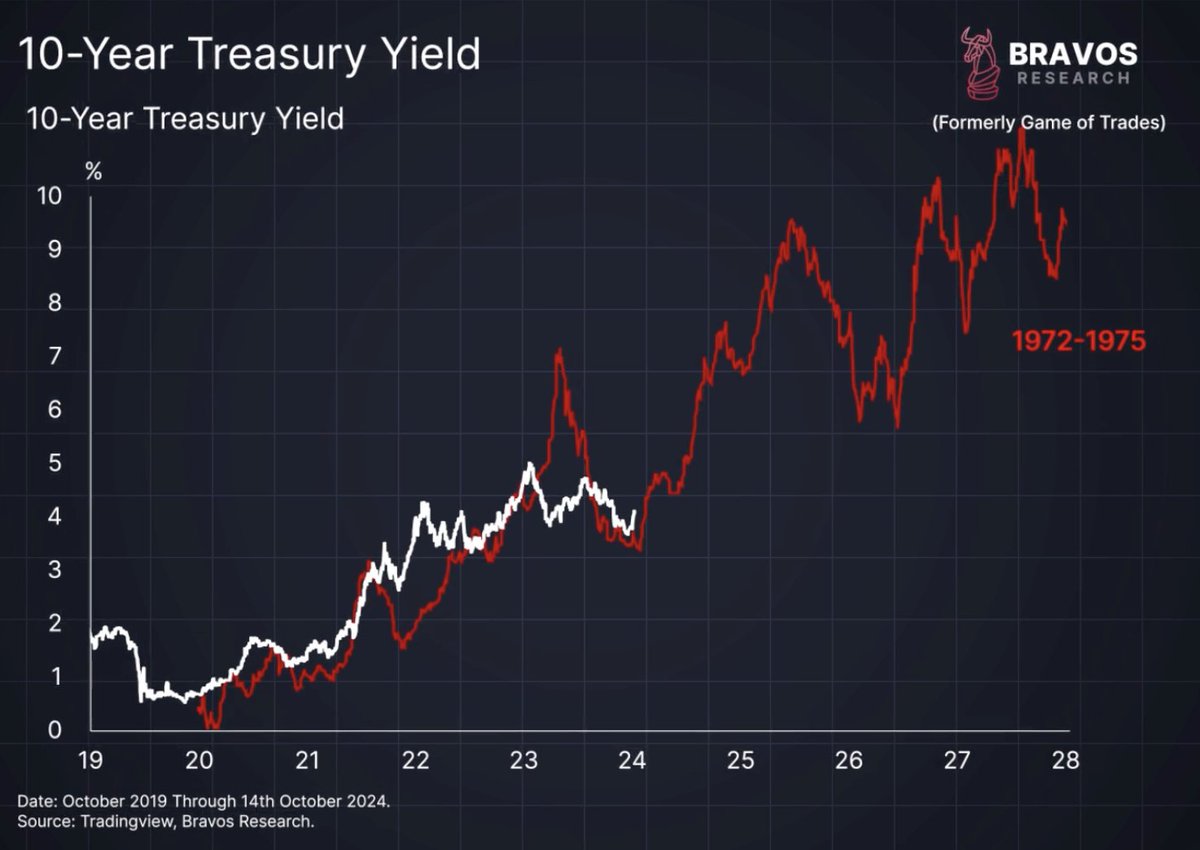

2/ Recently, some people have been comparing today’s market to the 1970s

If we overlay a 1970s chart on today’s interest rates, the similarities stand out

It’s easy to see why people get nervous when rates jump

But the data tells a different story

If we overlay a 1970s chart on today’s interest rates, the similarities stand out

It’s easy to see why people get nervous when rates jump

But the data tells a different story

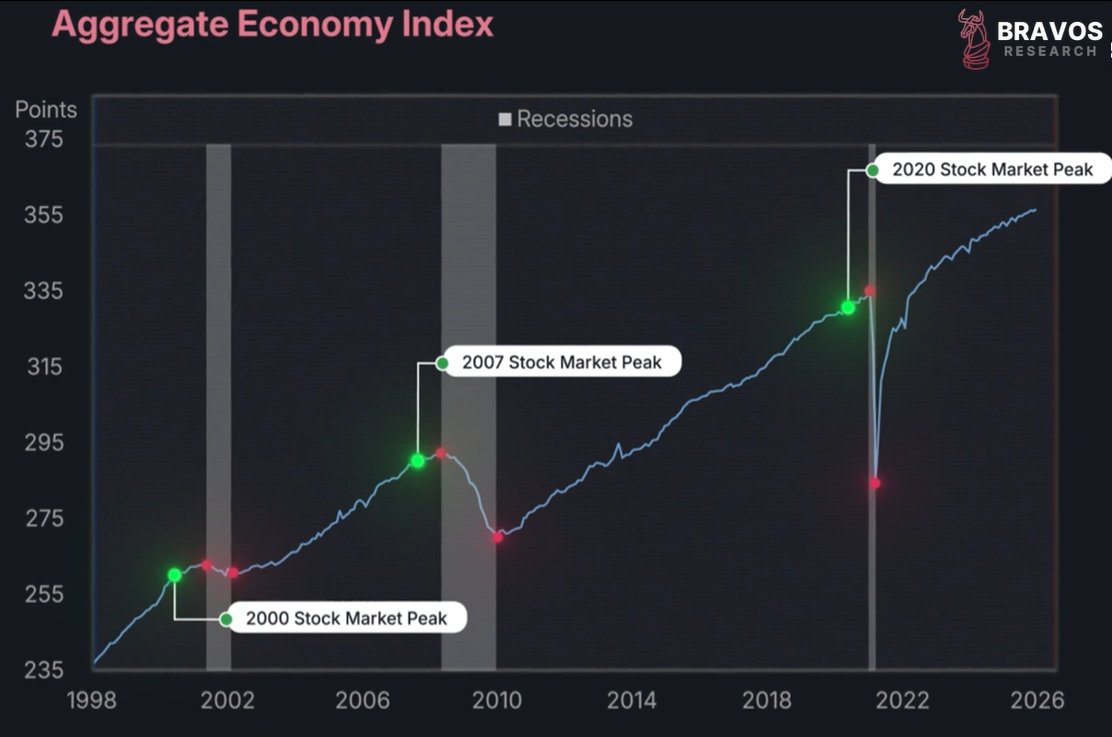

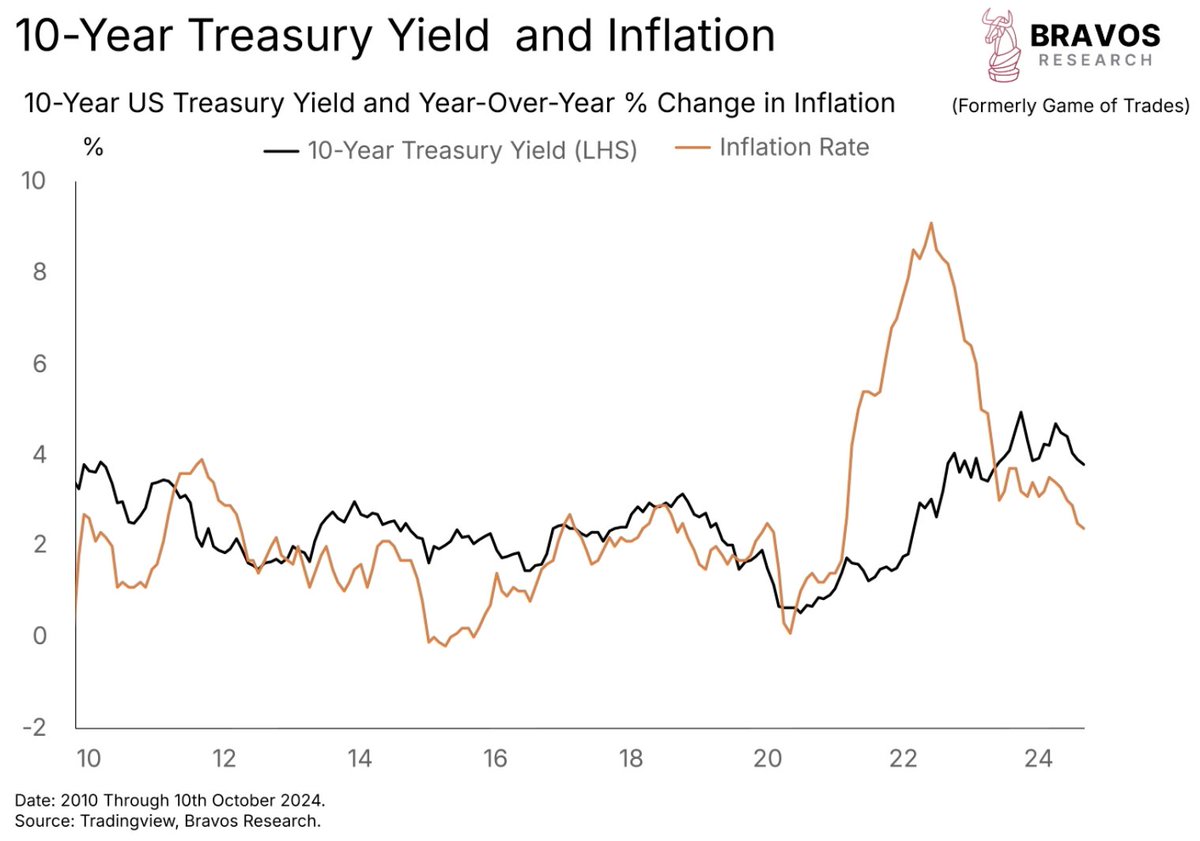

3/ In the 1970s, there were 3 waves of inflation

Each one progressively larger than the previous one

Which led to a prolonged period of rising rates

Each one progressively larger than the previous one

Which led to a prolonged period of rising rates

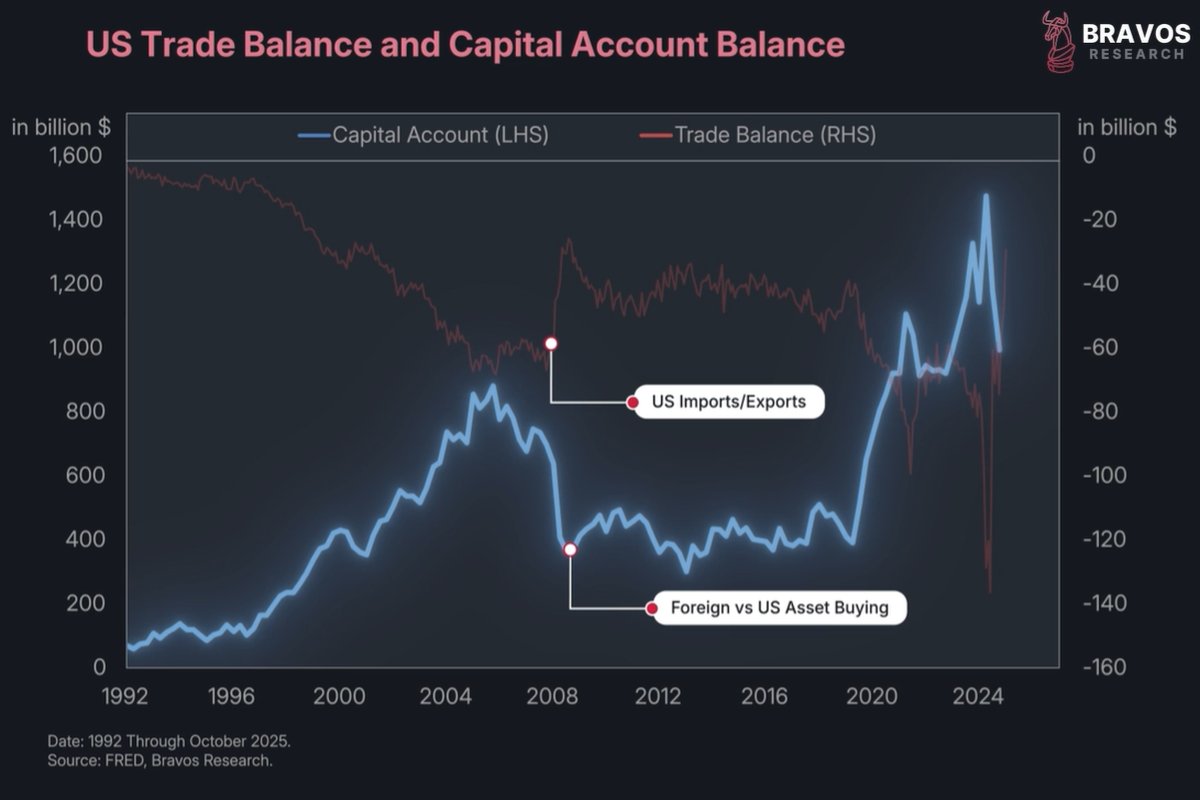

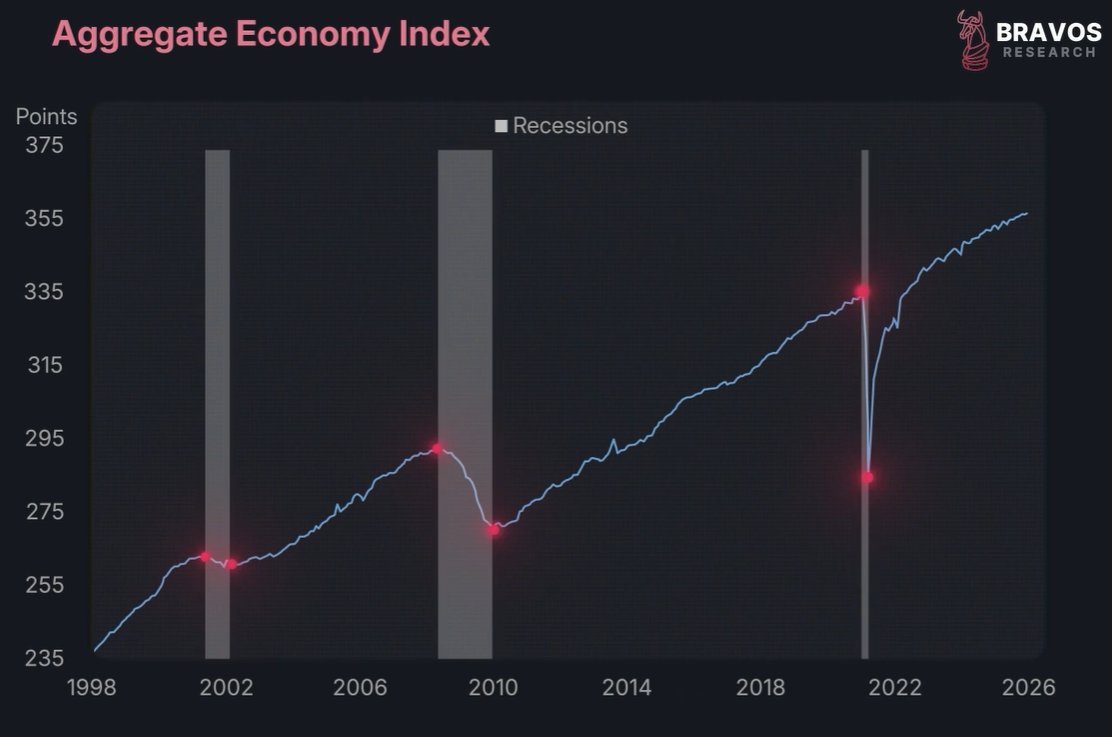

4/ Today, US inflation has been falling sharply, not rising

This is not the inflationary environment like the 1970s or 2021 that led to rising interest rates

This is not the inflationary environment like the 1970s or 2021 that led to rising interest rates

5/ Since interest rates tend to follow inflation, our expectation is that rates will likely trend lower

Assuming we don’t see a major escalation of conflict in the Middle East

Assuming we don’t see a major escalation of conflict in the Middle East

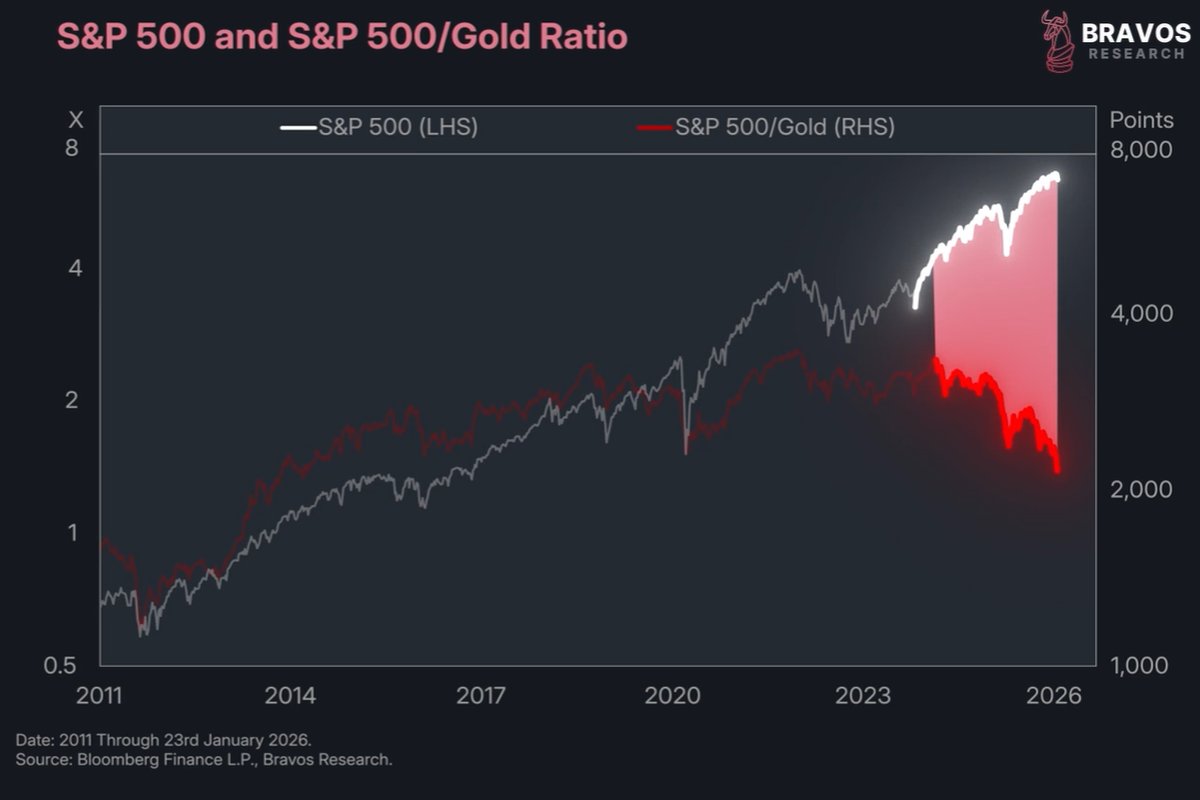

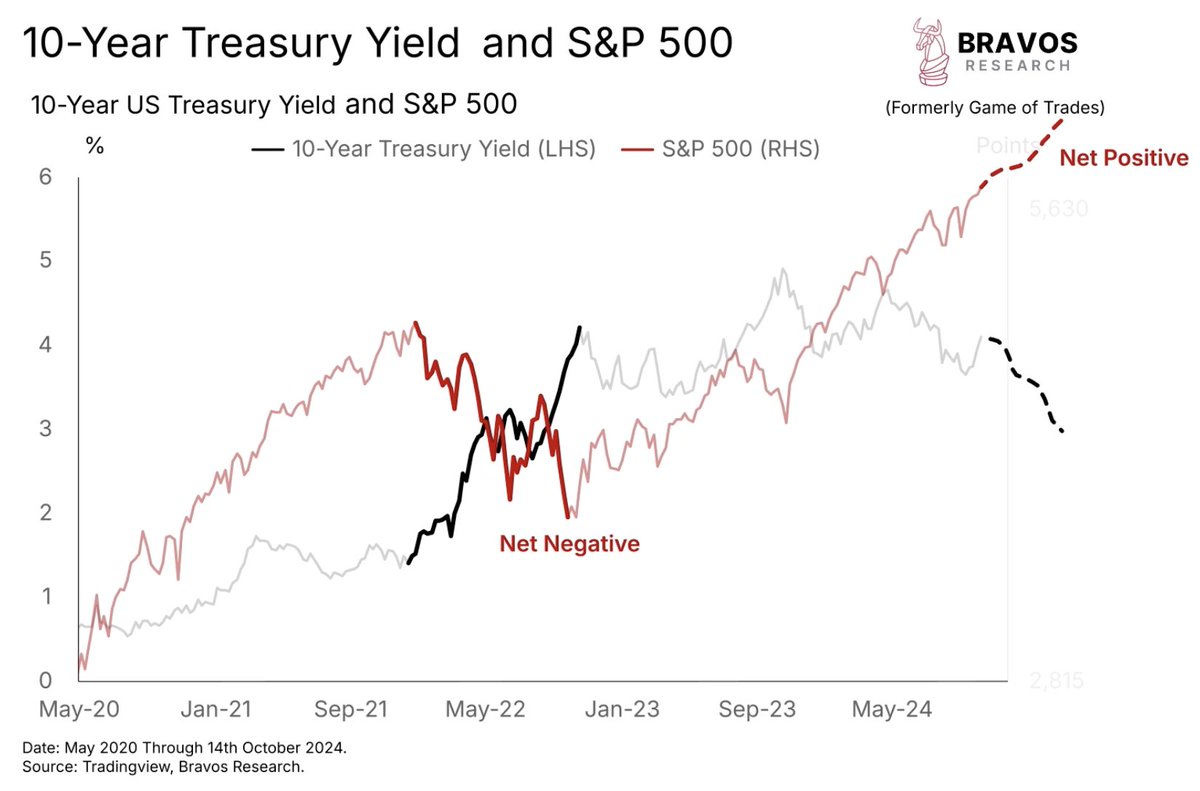

6/ Lower interest rates should be a net positive for the stock market

Just as rising rates were a headwind

Just as rising rates were a headwind

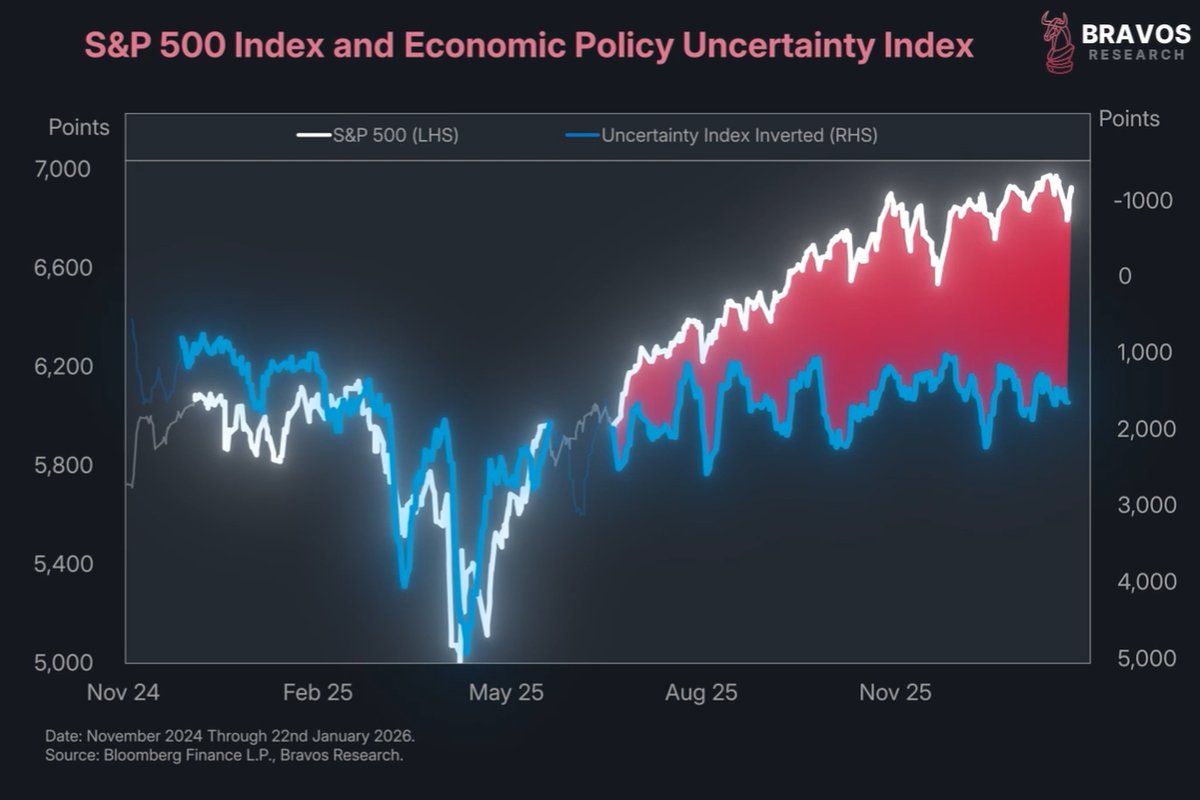

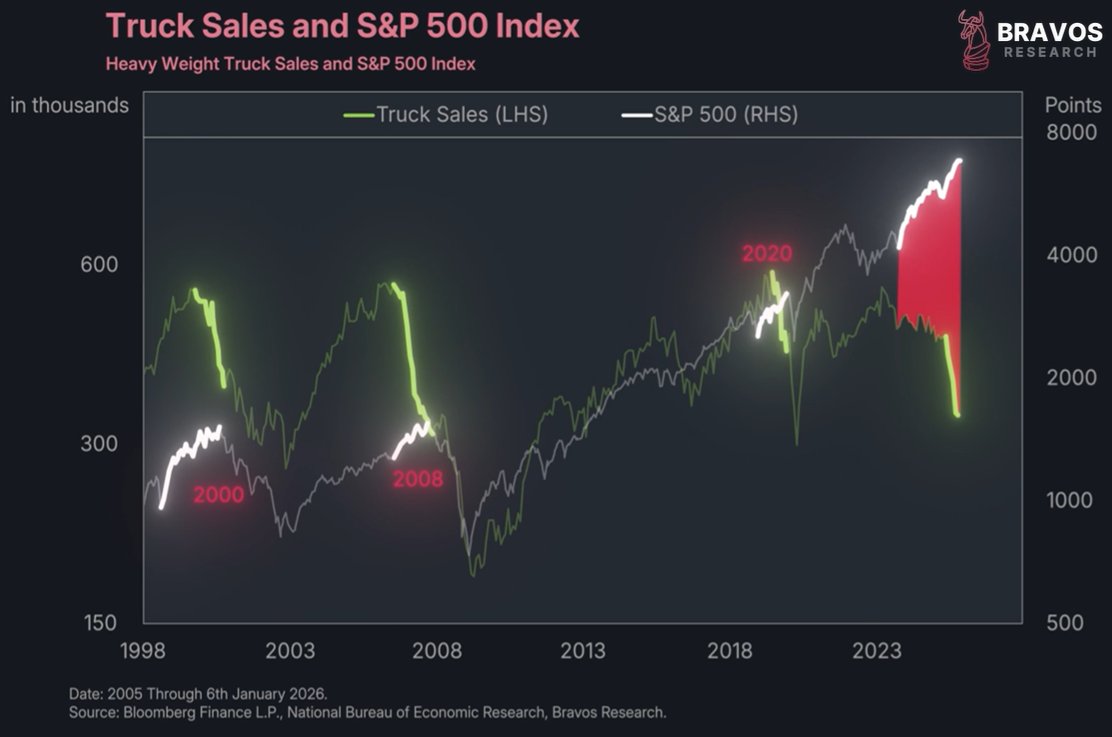

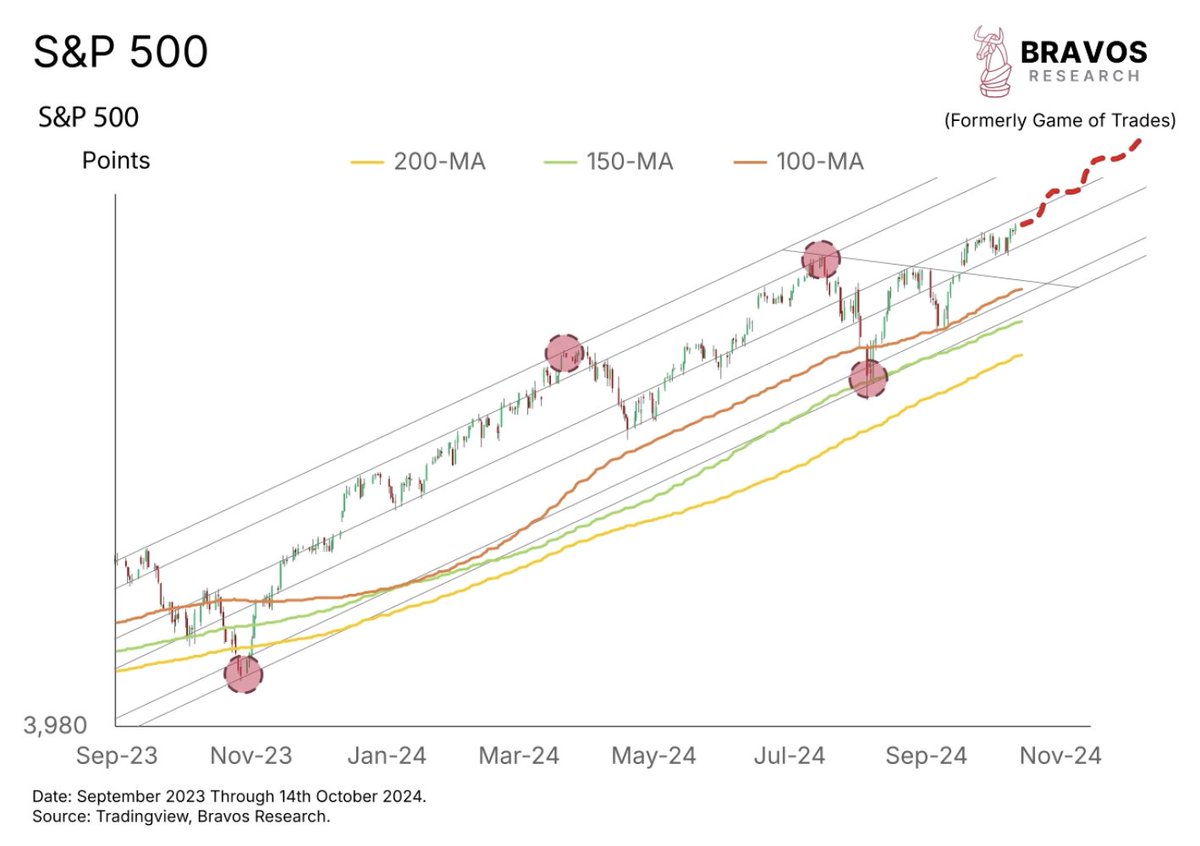

7/ The market recently broke out of a 3-month consolidation

With all key moving averages still pointing up

These are signs of a strong and healthy uptrend

With all key moving averages still pointing up

These are signs of a strong and healthy uptrend

8/ We’ve made some profitable trades with our clients throughout this bull market

Our buy & sell alerts on individual stocks, ETFs, crypto, and commodities have led to big winners

While our strict risk management has helped in keeping losses small and limited

Our buy & sell alerts on individual stocks, ETFs, crypto, and commodities have led to big winners

While our strict risk management has helped in keeping losses small and limited

9/ View our track record for FREE on our website

Our members have had a solid year

With an avg. win of 17.37% and an avg. loss of just 3.78%

Get real-time Trade Alerts at:

bit.ly/BravosResearch

Our members have had a solid year

With an avg. win of 17.37% and an avg. loss of just 3.78%

Get real-time Trade Alerts at:

bit.ly/BravosResearch

10/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1848379184332357904

• • •

Missing some Tweet in this thread? You can try to

force a refresh