LRT² ($LRT2) fixes everything.

• Stops ~40% of $EIGEN sell pressure

• Prevents AVS tokens from being auto-sold by LRTs

• Value aligns all modularity participants

• Acts as a Modularity Narrative Index (MNI)

• Creates arbitrage opportunities for defi nerds

• Also, there's going to be an airdrop

This asset will change the way we think about emissions.

It desperately needs an explainer, so let's dive in 🧵👇

• Stops ~40% of $EIGEN sell pressure

• Prevents AVS tokens from being auto-sold by LRTs

• Value aligns all modularity participants

• Acts as a Modularity Narrative Index (MNI)

• Creates arbitrage opportunities for defi nerds

• Also, there's going to be an airdrop

This asset will change the way we think about emissions.

It desperately needs an explainer, so let's dive in 🧵👇

What is LRT² (Ticker: $LRT2)?

In short, LRT² is tokenized restaking emissions.

For example:

Let's say you're restaking BTC on @ether_fi.

You might get:

• Eigenlayer Tokens

• eOracle Tokens

• Lagrange Tokens

• ARPA Tokens

• Symbiotic Tokens

• Babylon Tokens

• Lombard Tokens

• etc

Which would be a huge pain in the arse .

In short, LRT² is tokenized restaking emissions.

For example:

Let's say you're restaking BTC on @ether_fi.

You might get:

• Eigenlayer Tokens

• eOracle Tokens

• Lagrange Tokens

• ARPA Tokens

• Symbiotic Tokens

• Babylon Tokens

• Lombard Tokens

• etc

Which would be a huge pain in the arse .

SO INSTEAD,

Restaking-aligned protocols can just emit $LRT2.

Users will get the same effective APR as if they were earning all of those different emissions, BUT they'll all be wrapped up in a single token, $LRT2.

This means:

► 1 Claim

► 1 Token

► 1 Transaction

Restaking-aligned protocols can just emit $LRT2.

Users will get the same effective APR as if they were earning all of those different emissions, BUT they'll all be wrapped up in a single token, $LRT2.

This means:

► 1 Claim

► 1 Token

► 1 Transaction

IT ALSO MEANS,

Those AVS, LRT, and Modularity gov tokens won't be insta-dumped for higher intrinsic yields.

EXAMPLE

Many LRTs like $eBTC might want to sell their Symbiotic, Eigen, AVS, etc emissions to compound into more $eBTC and create a higher intrinsic yield.

This would be directly predatory to the AVS and restaking protocols, putting non-stop, automated sell pressure on their assets.

This would disincentivize emissions from AVS and Restaking protocols and reduce the overall yield for LRT and modular composability in defi.

Those AVS, LRT, and Modularity gov tokens won't be insta-dumped for higher intrinsic yields.

EXAMPLE

Many LRTs like $eBTC might want to sell their Symbiotic, Eigen, AVS, etc emissions to compound into more $eBTC and create a higher intrinsic yield.

This would be directly predatory to the AVS and restaking protocols, putting non-stop, automated sell pressure on their assets.

This would disincentivize emissions from AVS and Restaking protocols and reduce the overall yield for LRT and modular composability in defi.

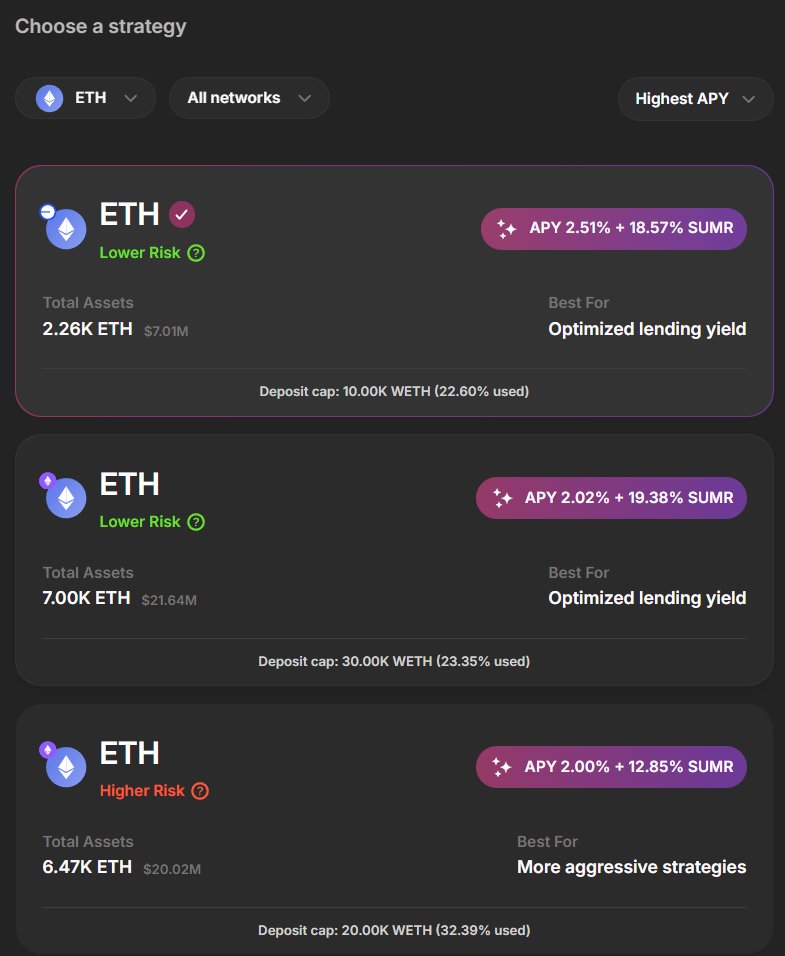

$LRT2 solves those issues by value aligning all of these entities by mitigating auto-dumping sell pressure and solving the micro-emission issue.

All white-listed and participating protocols will use LRT2 for emissions. None of the tokens will be auto-sold.

Users can sell LRT2 (which doesn't sell any underlying tokens) and then arbitragers can decide whether or not to arb the LRT2 price back.

All white-listed and participating protocols will use LRT2 for emissions. None of the tokens will be auto-sold.

Users can sell LRT2 (which doesn't sell any underlying tokens) and then arbitragers can decide whether or not to arb the LRT2 price back.

There are a few other important things to know about $LRT2.

All the underlying assets will be staked.

The ETHFI will be staked

The EIGEN will be staked

The AVS gov tokens will be staked

The Restaking protocol tokens will be staked

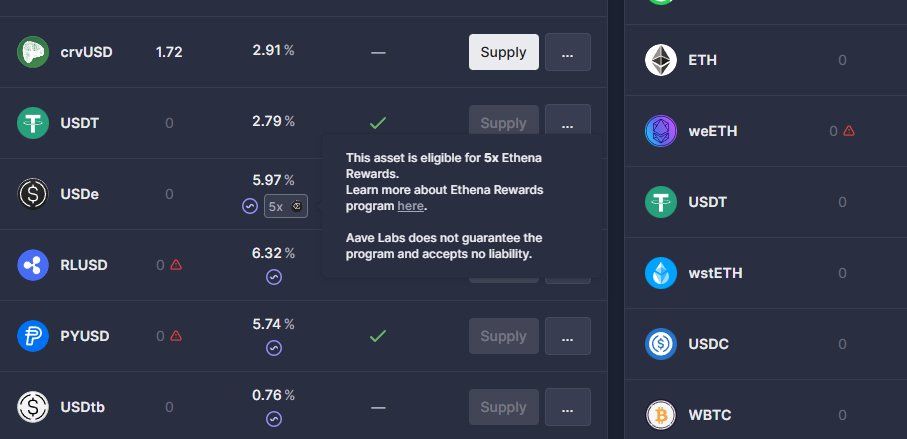

Making LRT2 an interest-bearing derivative that will qualify users for any of the underlying AVS or restaking protocol seasons or rewards.

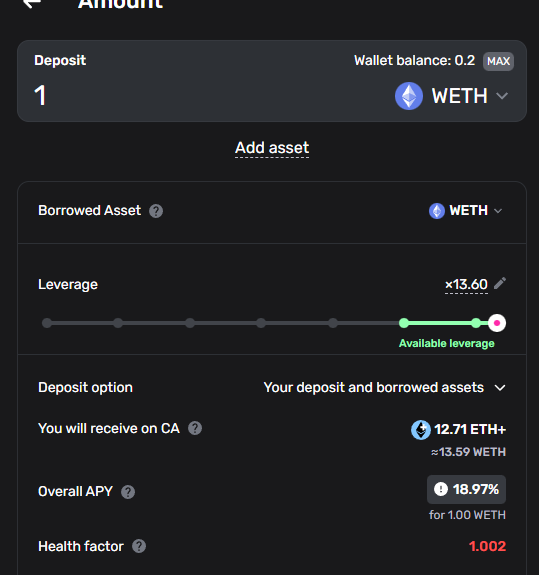

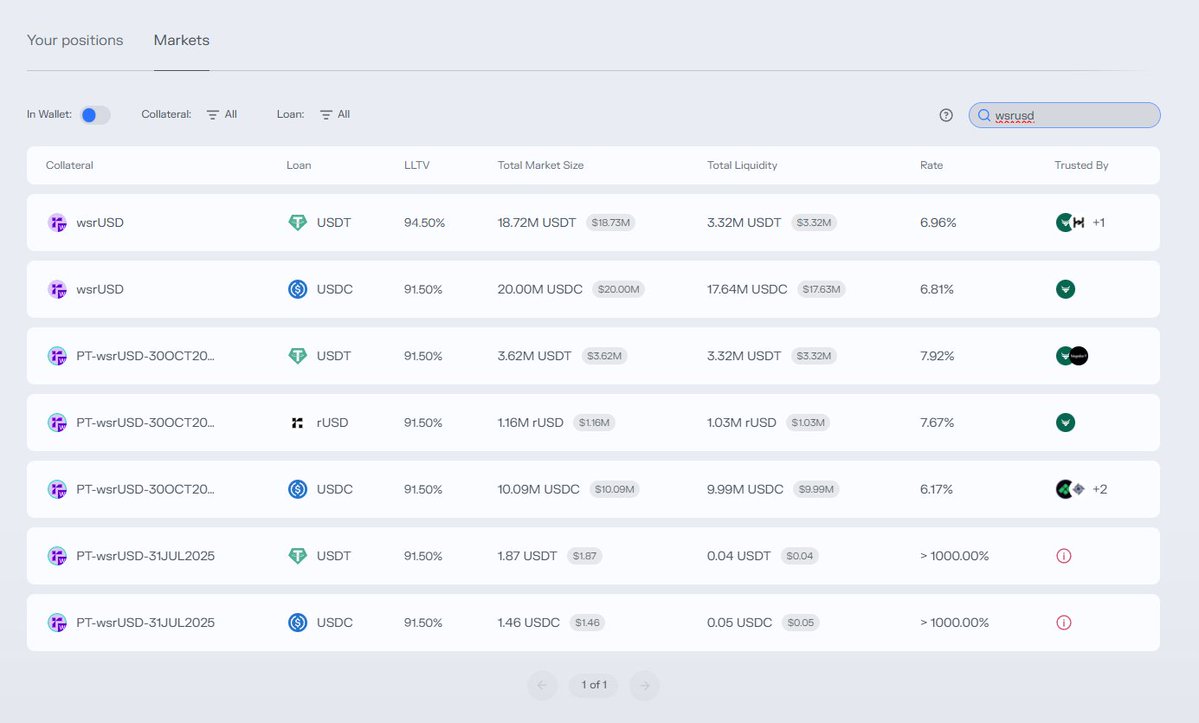

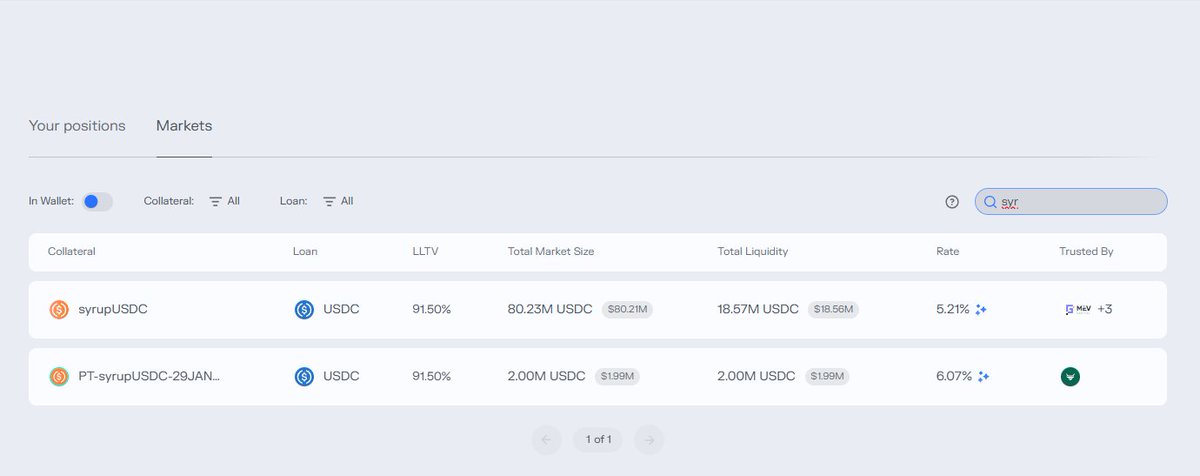

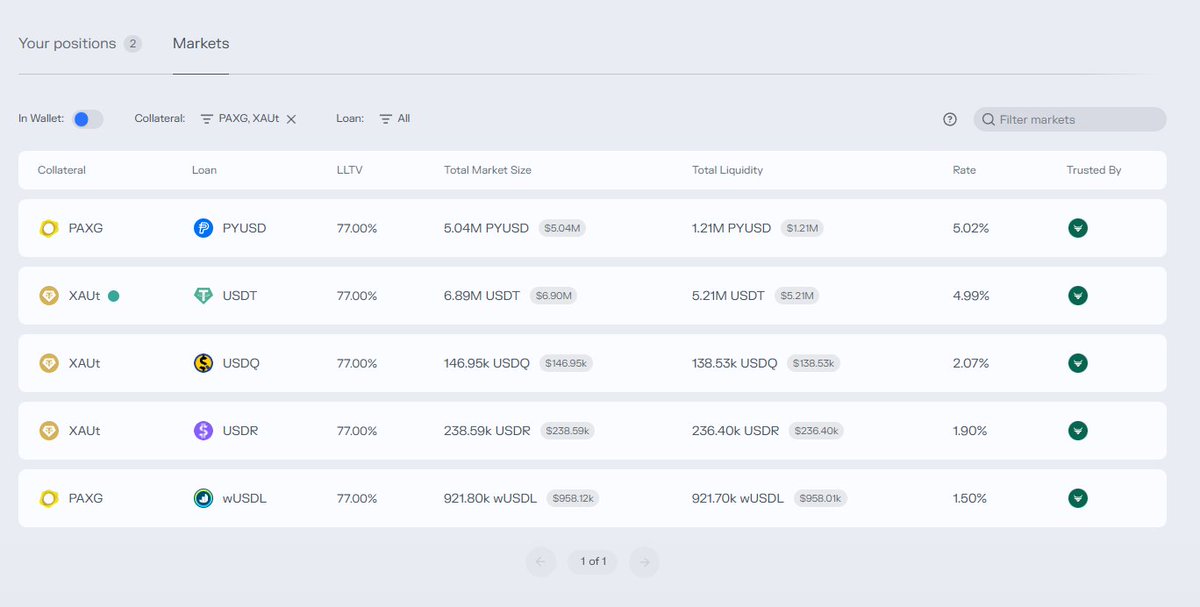

It also makes it a more interesting asset for future defi integrations that might abstract away the yield or offer leverage, etc.

All the underlying assets will be staked.

The ETHFI will be staked

The EIGEN will be staked

The AVS gov tokens will be staked

The Restaking protocol tokens will be staked

Making LRT2 an interest-bearing derivative that will qualify users for any of the underlying AVS or restaking protocol seasons or rewards.

It also makes it a more interesting asset for future defi integrations that might abstract away the yield or offer leverage, etc.

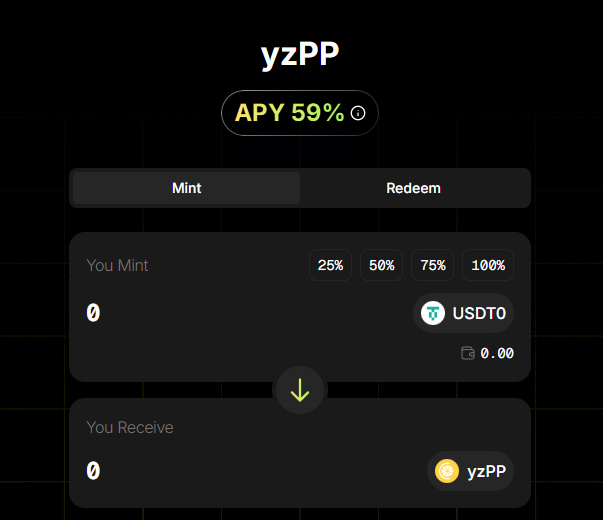

RIGHT NOW, you can LP $LRT2 against ETH and historically this has generated a very spicy yield.

7-Day Backtest in a wide range showing 256% APR

BUT, let me caveat this.

The APR is skewed by day-1 volume. The current 1-Day APR is closer to 40%, and this is more indicative of what we should expect moving forward.

h/t @okutrade for the stellar Uni V3 backtesting and analytics

7-Day Backtest in a wide range showing 256% APR

BUT, let me caveat this.

The APR is skewed by day-1 volume. The current 1-Day APR is closer to 40%, and this is more indicative of what we should expect moving forward.

h/t @okutrade for the stellar Uni V3 backtesting and analytics

ALSO (I told you this thing really needed an explainer)

@LRTsquared will have their own token.

This token will be used for a lot of things.

➢ Whitelisting integrated assets

➢ Determining $LRT2GOV emissions

➢ Setting rate / risk parameters

And much more.

@MikeSilagadze explained this really well in a recent interview

@LRTsquared will have their own token.

This token will be used for a lot of things.

➢ Whitelisting integrated assets

➢ Determining $LRT2GOV emissions

➢ Setting rate / risk parameters

And much more.

@MikeSilagadze explained this really well in a recent interview

But the existence of an LRT2 governance tokens also means points and a potential airdrop.

SO ALL OF THE STUFF that I mentioned above about

• Value Alignment

• Minimizing Transactions

• Reducing Token Dumping

Is additionally incentivized by a potential airdrop from @LRTsquared and potentially by future emissions from the protocol.

SO ALL OF THE STUFF that I mentioned above about

• Value Alignment

• Minimizing Transactions

• Reducing Token Dumping

Is additionally incentivized by a potential airdrop from @LRTsquared and potentially by future emissions from the protocol.

This is all to say,

LRT2 is going to be everywhere.

Most modular protocols in EVM will be using it to avoid undue sell pressure on their native asset.

On top of that:

• it will have yield

• it will have composability

• it will potentially have an airdrop

• it will act as an index

AND it will act as a new incentives paradigm in DeFi. Aligning a plethora of like-protocols under one umbrella emissions.

THIS, if nothing else, is incredibly exciting.

LRT2 is going to be everywhere.

Most modular protocols in EVM will be using it to avoid undue sell pressure on their native asset.

On top of that:

• it will have yield

• it will have composability

• it will potentially have an airdrop

• it will act as an index

AND it will act as a new incentives paradigm in DeFi. Aligning a plethora of like-protocols under one umbrella emissions.

THIS, if nothing else, is incredibly exciting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh