"The Calculator Guy"

Founder of DeFi Dojo

Co-Founder of Mezzanine

"A truffle sniffer, but for yields."

Wildly Christian | Father of Four

26 subscribers

How to get URL link on X (Twitter) App

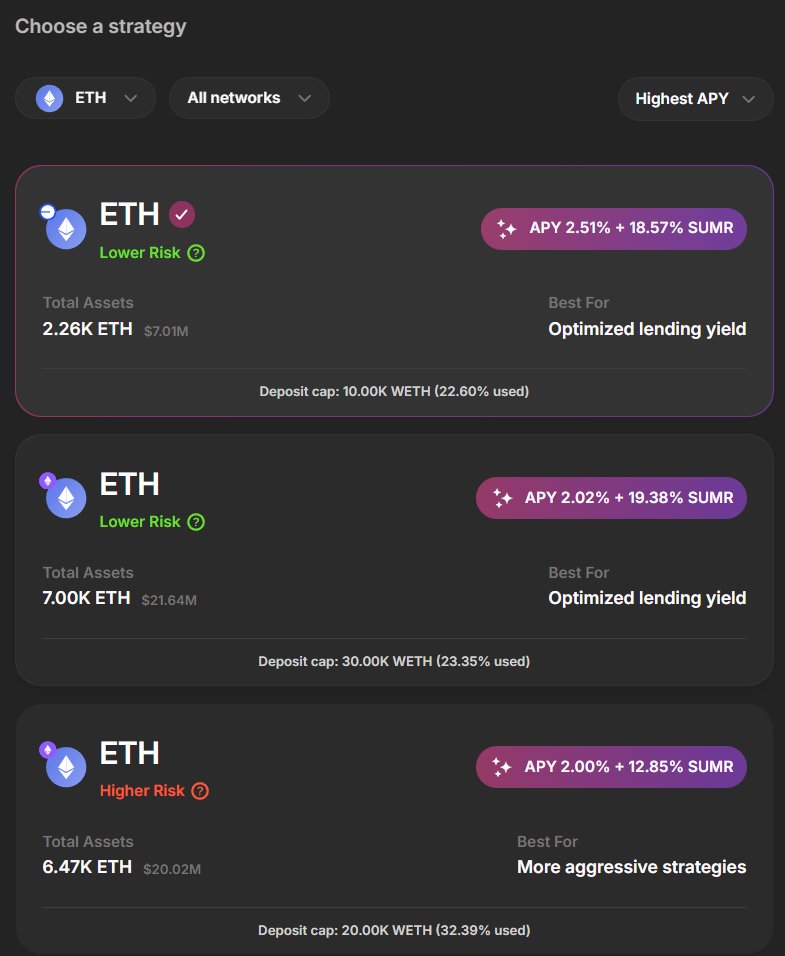

🏆HIGHEST BASE YIELD

🏆HIGHEST BASE YIELD

1) @summerfinance_: 8-20% APR

1) @summerfinance_: 8-20% APR

The first thing to realize is that the Monad campaign is much smaller than, say, @Plasma, though also substantially less farmed than Plasma.

The first thing to realize is that the Monad campaign is much smaller than, say, @Plasma, though also substantially less farmed than Plasma.

https://x.com/phtevenstrong/status/1978844261794631697

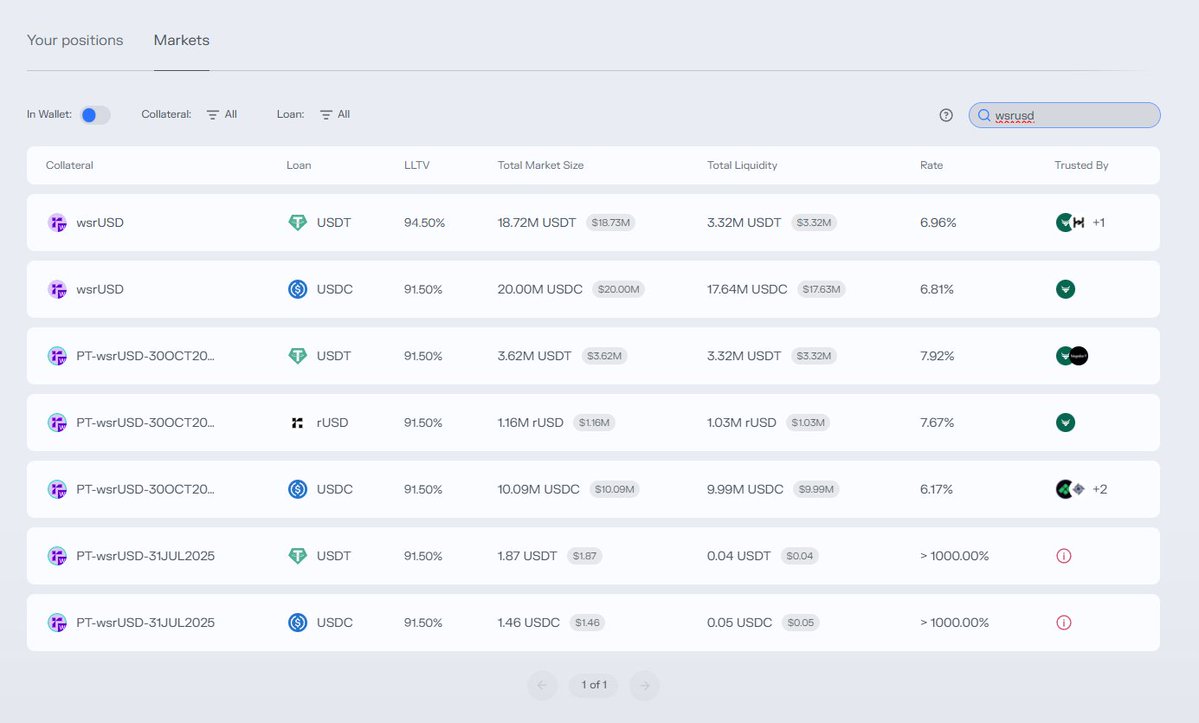

1) @reservoir_xyz wsrUSD/USDC loop on @MorphoLabs

1) @reservoir_xyz wsrUSD/USDC loop on @MorphoLabs

Gold is difficult to get a native yield on. Virtually all gold yields involve collateralizing a gold derivative and farming against borrowed stables.

Gold is difficult to get a native yield on. Virtually all gold yields involve collateralizing a gold derivative and farming against borrowed stables.

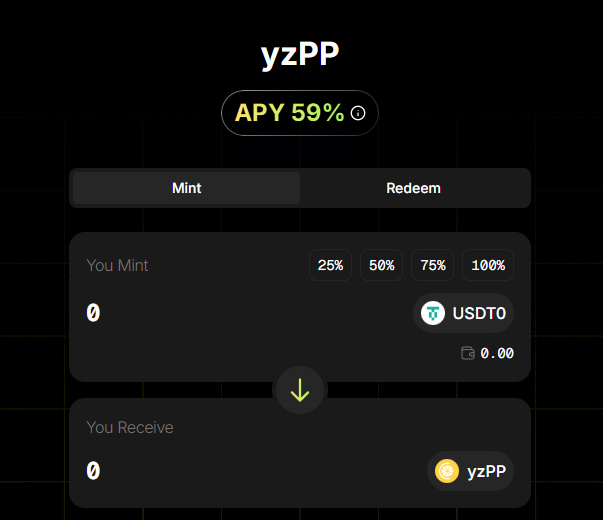

1) @summerfinance_

1) @summerfinance_

1) @reservoir_xyz yields are remarkably slept on.

1) @reservoir_xyz yields are remarkably slept on.

1) Aavethena

1) Aavethena

1) @summerfinance_

1) @summerfinance_

https://twitter.com/Route2FI/status/19673310177501473401) The Contango / Basis (no, not the protocol)

The play is very difficult to understand if you just read the details on Aave (no shade, @lemiscate, I love you guys).

The play is very difficult to understand if you just read the details on Aave (no shade, @lemiscate, I love you guys).

First, let's look at how users get farmed and lose money through simple lack of diligence or understanding...

First, let's look at how users get farmed and lose money through simple lack of diligence or understanding...

1) Lend Aggregators

1) Lend Aggregators

1) @summerfinance_

1) @summerfinance_

1) beHYPE on @0xHyperBeat

1) beHYPE on @0xHyperBeat

We know that there will be 51M hearts.

We know that there will be 51M hearts.

1) Everyone's new favorite vault on @HyperliquidX

1) Everyone's new favorite vault on @HyperliquidX

1) Let's start on @solana

1) Let's start on @solana