The Simplest Way Of Looking At Candlesticks: OHLC/OLHC

This was a game-changer in my understanding of price movement!

After reading this, you'll see just how powerful the OHLC/OLHC concept really is in anticipating moves before they happen.

A Thread🧵

This was a game-changer in my understanding of price movement!

After reading this, you'll see just how powerful the OHLC/OLHC concept really is in anticipating moves before they happen.

A Thread🧵

First, let’s define them properly.

As you can see, OLHC stands for Open, Low, High, and Close which is the movement of a bullish candle.

The understanding of power of 3 can be applied here.

If we are expecting the next candle to be bullish, it will almost always form like this:

Price accumulates in the open, then manipulates below opening price, and then distributes higher, and finally closes.

As you can see, OLHC stands for Open, Low, High, and Close which is the movement of a bullish candle.

The understanding of power of 3 can be applied here.

If we are expecting the next candle to be bullish, it will almost always form like this:

Price accumulates in the open, then manipulates below opening price, and then distributes higher, and finally closes.

Next, we have the OHLC which stands for Open, High, Low, and Close which is the movement of a bearish candle.

The understanding of power of 3 can also be applied here.

If we are expecting the next candle to be bearish, it will almost always form like this:

Price accumulates in the open, then manipulates above opening price, and then distributes lower, and finally closes.

The understanding of power of 3 can also be applied here.

If we are expecting the next candle to be bearish, it will almost always form like this:

Price accumulates in the open, then manipulates above opening price, and then distributes lower, and finally closes.

As stated, you can also view OHLC and OLHC through the lens of Power of Three.

When you’re expecting an OLHC, it is ideal to buy below the open.

When you’re expecting an OHLC, it is ideal to sell above the open.

Essentially, the reversal in the manipulation phase of power of three.

When you’re expecting an OLHC, it is ideal to buy below the open.

When you’re expecting an OHLC, it is ideal to sell above the open.

Essentially, the reversal in the manipulation phase of power of three.

You can also pair OHLC/OLHC with the concept respect/disrespect candles.

When we see price tapping and respecting a HTF PD array, we can anticipate the next candle to be OHLC/OLHC towards the direction of our draw.

Essentially allowing us to anticipate with high accuracy exactly how the next candle will form

When we see price tapping and respecting a HTF PD array, we can anticipate the next candle to be OHLC/OLHC towards the direction of our draw.

Essentially allowing us to anticipate with high accuracy exactly how the next candle will form

So, to summarize,

We can use OHLC/OLHC to:

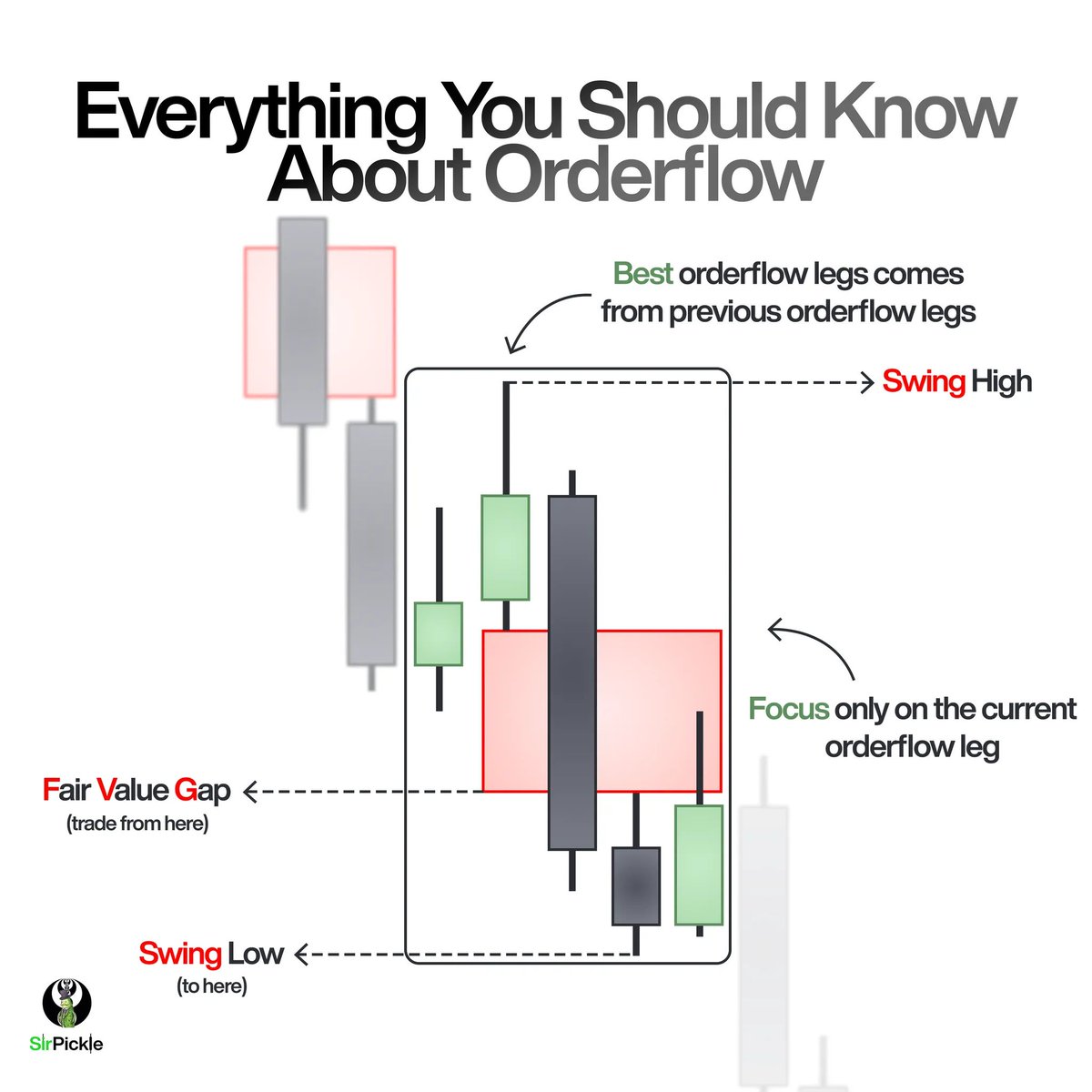

-See LTF orderflow through 1 candle

-See if it respects/disrespects a HTF PD array

-Anticipate Power of Three forming

We can use OHLC/OLHC to:

-See LTF orderflow through 1 candle

-See if it respects/disrespects a HTF PD array

-Anticipate Power of Three forming

Now, for your homework,

I want you to observe live how OHLC/OLHC forms after respecting a HTF PD array and journal them.

This will lead you to better understanding of direction.

I want you to observe live how OHLC/OLHC forms after respecting a HTF PD array and journal them.

This will lead you to better understanding of direction.

I hope you’ve found this insightful!

Thanks for reading until the end!

Bookmark, Retweet, Like and Comment under this thread! Would greatly appreciate that💚

Thanks for reading until the end!

Bookmark, Retweet, Like and Comment under this thread! Would greatly appreciate that💚

If you love the value that these threads provide,

Join my free community where you will find even more.

And if you're struggling, I'll help you get on the right path (promise).

See you there :)

Click here: discord.gg/picklejar

Join my free community where you will find even more.

And if you're struggling, I'll help you get on the right path (promise).

See you there :)

Click here: discord.gg/picklejar

• • •

Missing some Tweet in this thread? You can try to

force a refresh