The Country Land and Business Association says the new £1m cap on agricultural inheritance tax relief will "harm 70,000 farms". That's 1/3 of all farms.

What does the actual data show? Less than 500 farms/year will be pay more tax as a result of this change every year. Possibly as few as 100.

What does the actual data show? Less than 500 farms/year will be pay more tax as a result of this change every year. Possibly as few as 100.

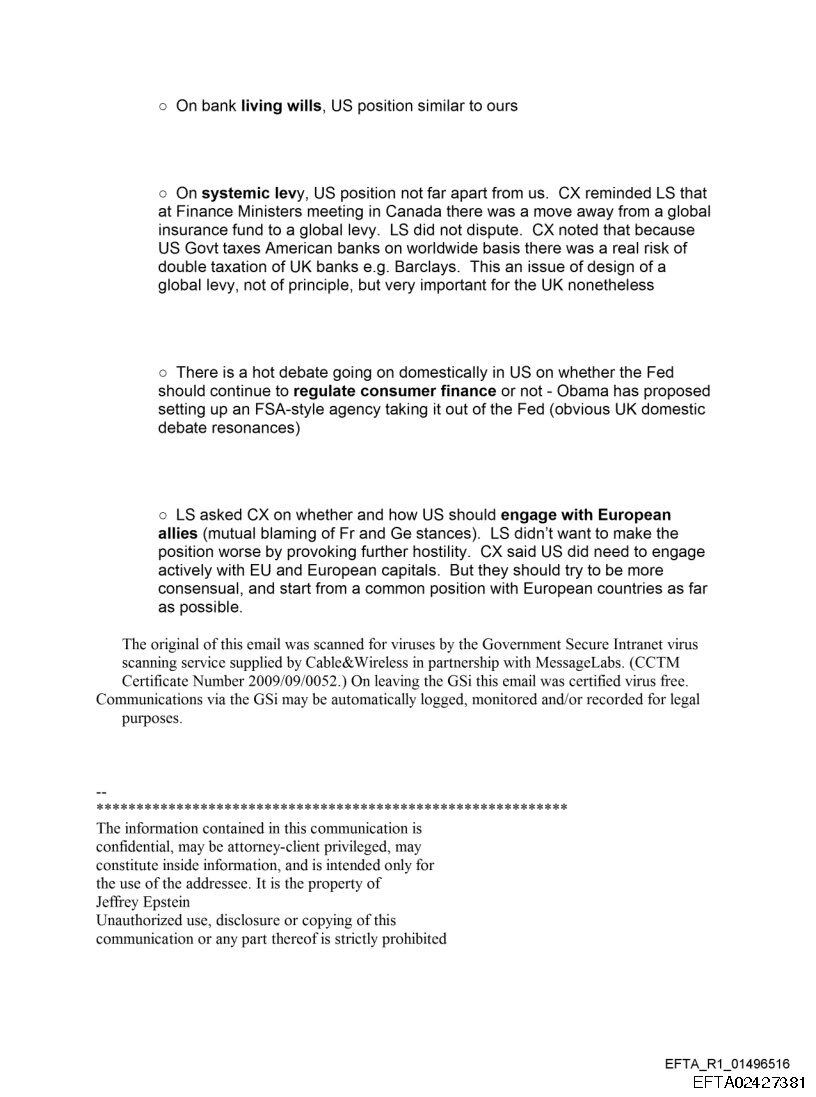

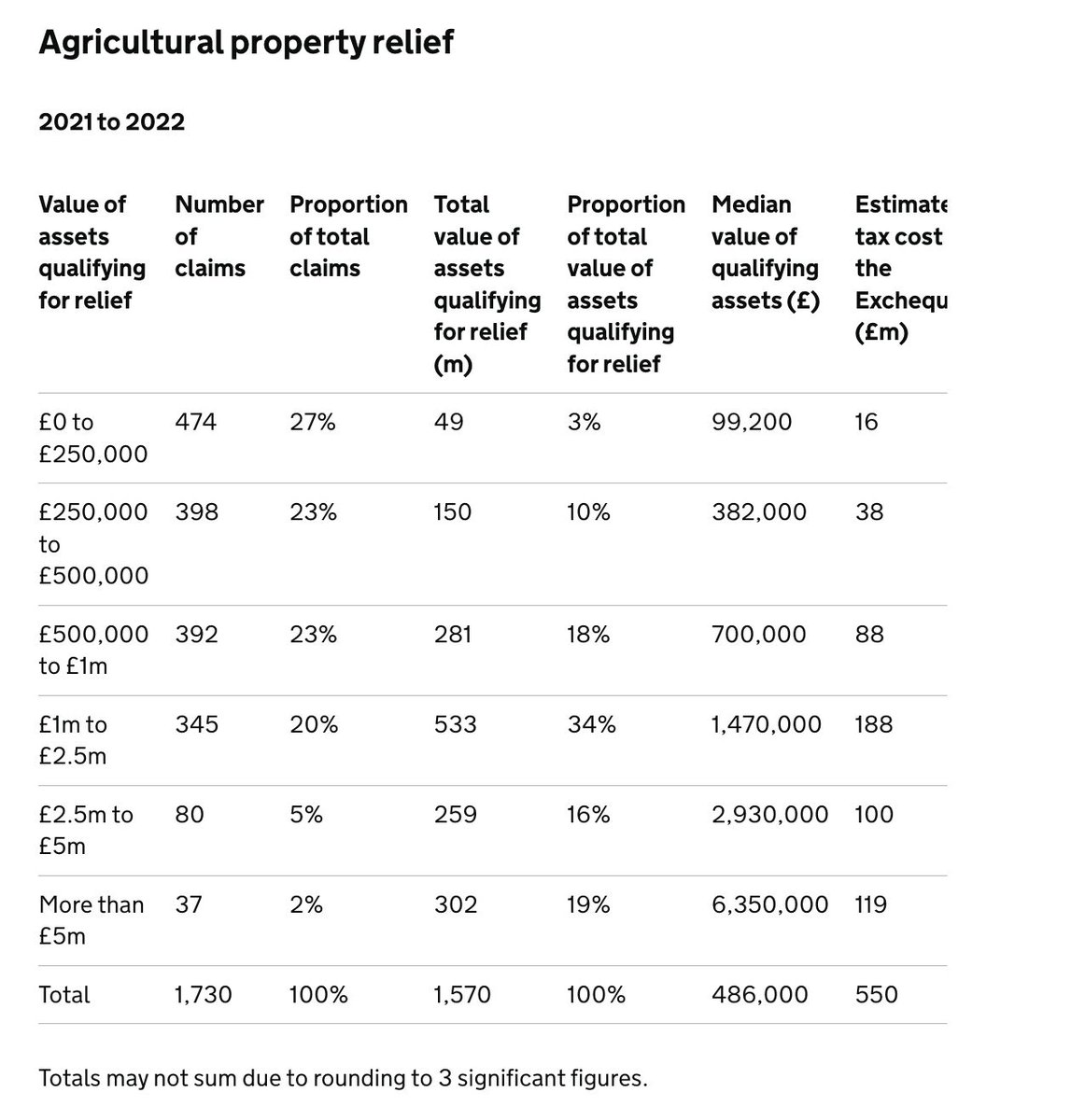

Why 500? Because this table shows only 500 farm estates claimed agricultural property relief (APR) of more than £1m in 2022.

But that overstates the issue. Married couples can easily claim the £1m cap twice. Small farmers without other assets can use their nil rate band. So for a married couple running a farm, it could be worth £2.65m before the restriction on the relief costs them a penny.

That could mean as few as 100 farms per year are affected. And the 20% tax is only on the excess over the threshold, so for most of the 100, the additional tax will be reasonably small. Insure against it when you're young(ish). Give some/all to your kids when you get older.

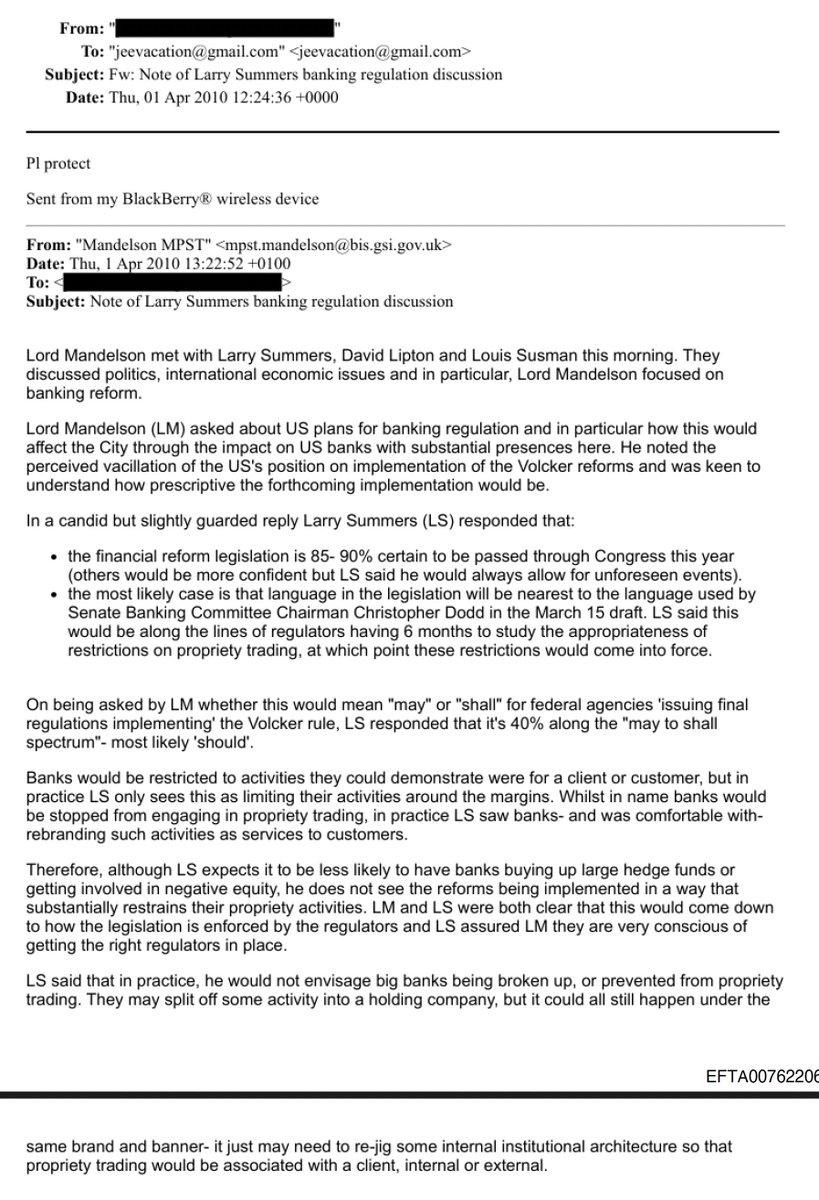

And the data shows that most of the cost of the tax increase will be borne by a few very large estates. In 2022 2% of agricultural estates - just 37 - claimed an average of £6m.

That's what this is really about - not 70,000 farms. So let's drop the hyperbolic fake stats.

That's what this is really about - not 70,000 farms. So let's drop the hyperbolic fake stats.

@bea_johanssen @triplesilk @melindiscott There are other valuation points here too - average price per acre may not reflect the price of a large estate; the IHT changes may themselves reduce value; etc 2/2

• • •

Missing some Tweet in this thread? You can try to

force a refresh