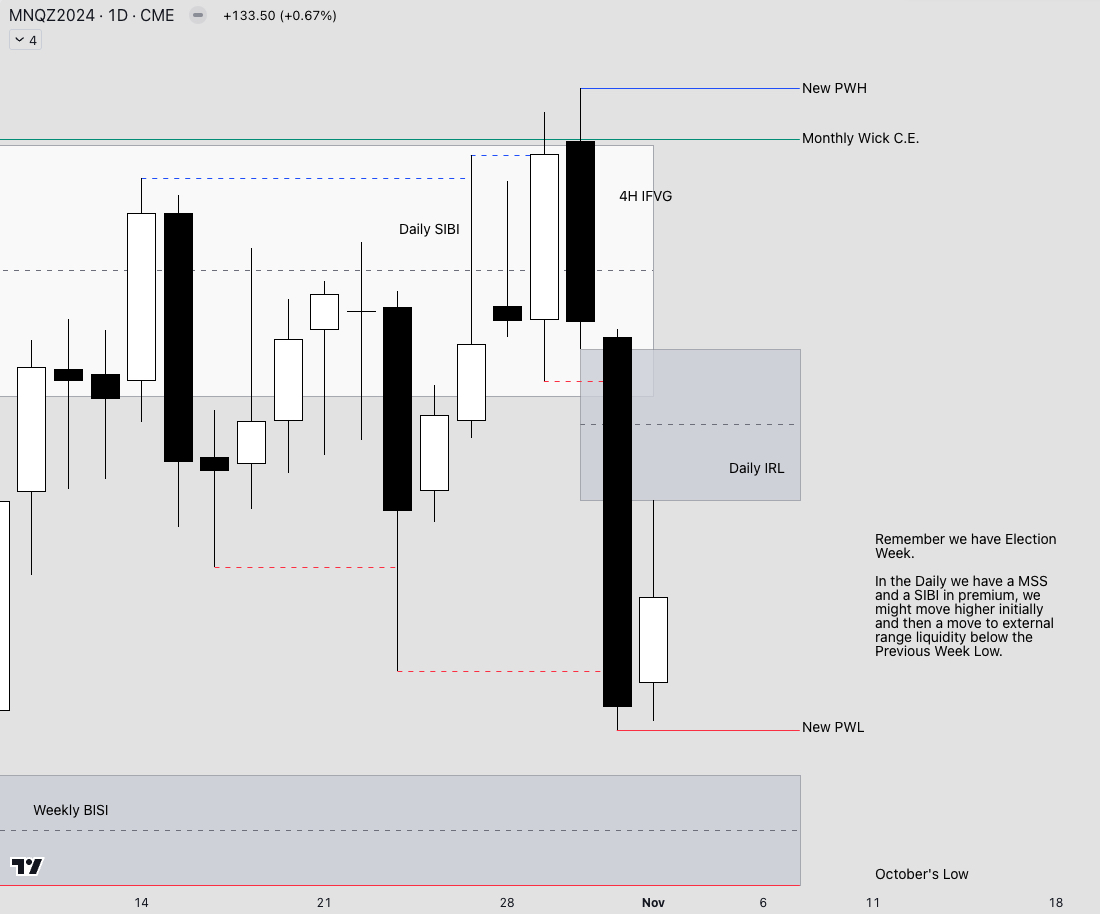

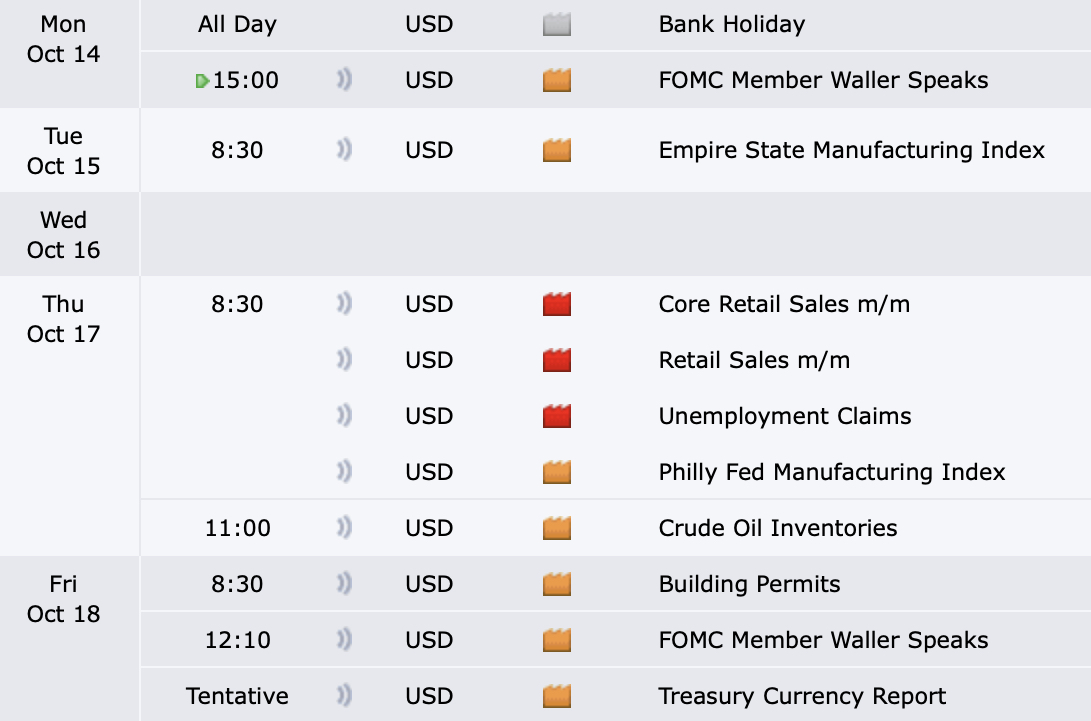

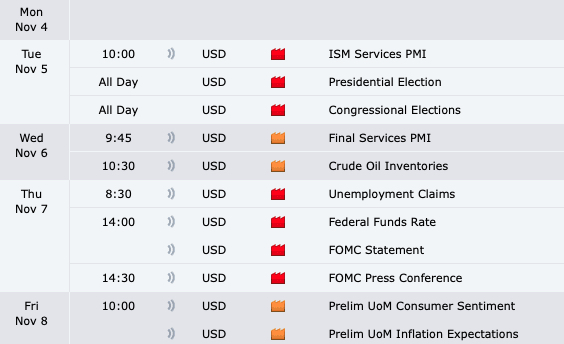

Economic Calendar:

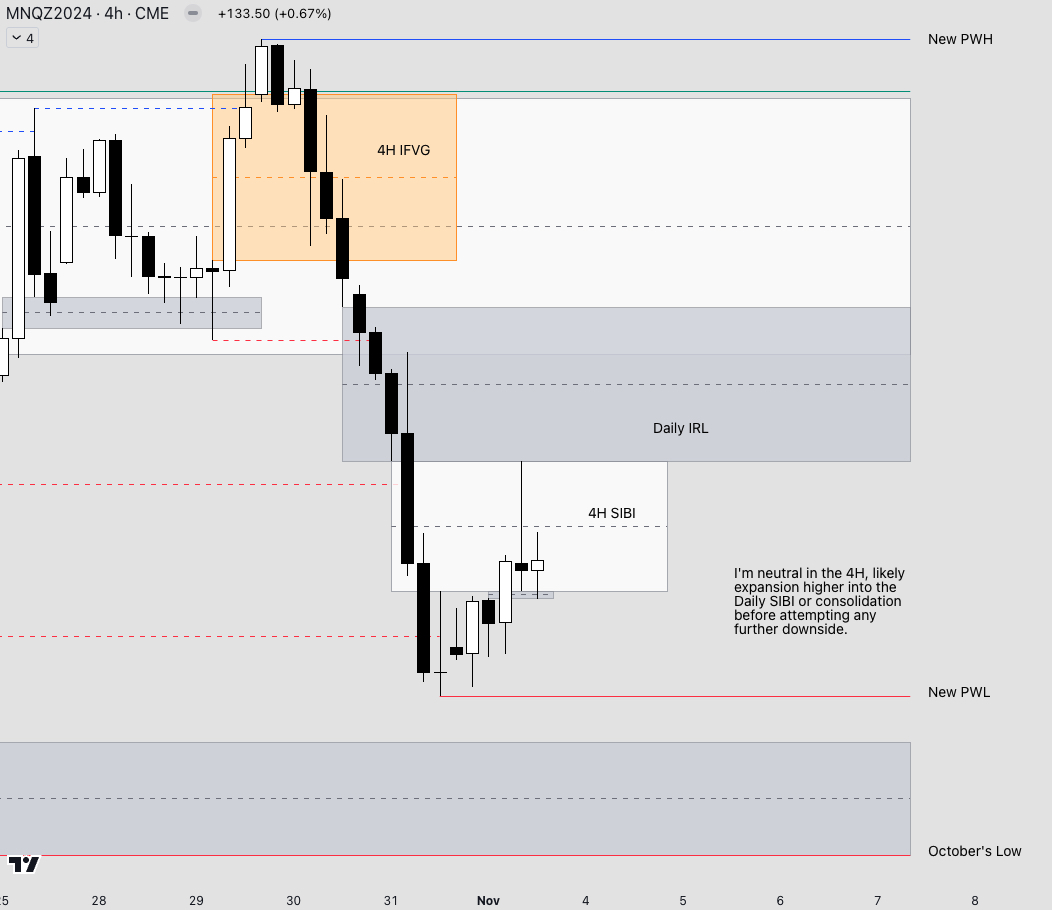

- This week we have high impact news on Tuesday and Thursday.

- I won't be looking for setups until elections day has passed, meaning I'll stay sidelined until Wednesday at the very least.

- On Thursday with FOMC I'll focus on hunting for setups early in the morning and then wait for the final hour macro to more setups.

- This week we have high impact news on Tuesday and Thursday.

- I won't be looking for setups until elections day has passed, meaning I'll stay sidelined until Wednesday at the very least.

- On Thursday with FOMC I'll focus on hunting for setups early in the morning and then wait for the final hour macro to more setups.

• • •

Missing some Tweet in this thread? You can try to

force a refresh