How to get URL link on X (Twitter) App

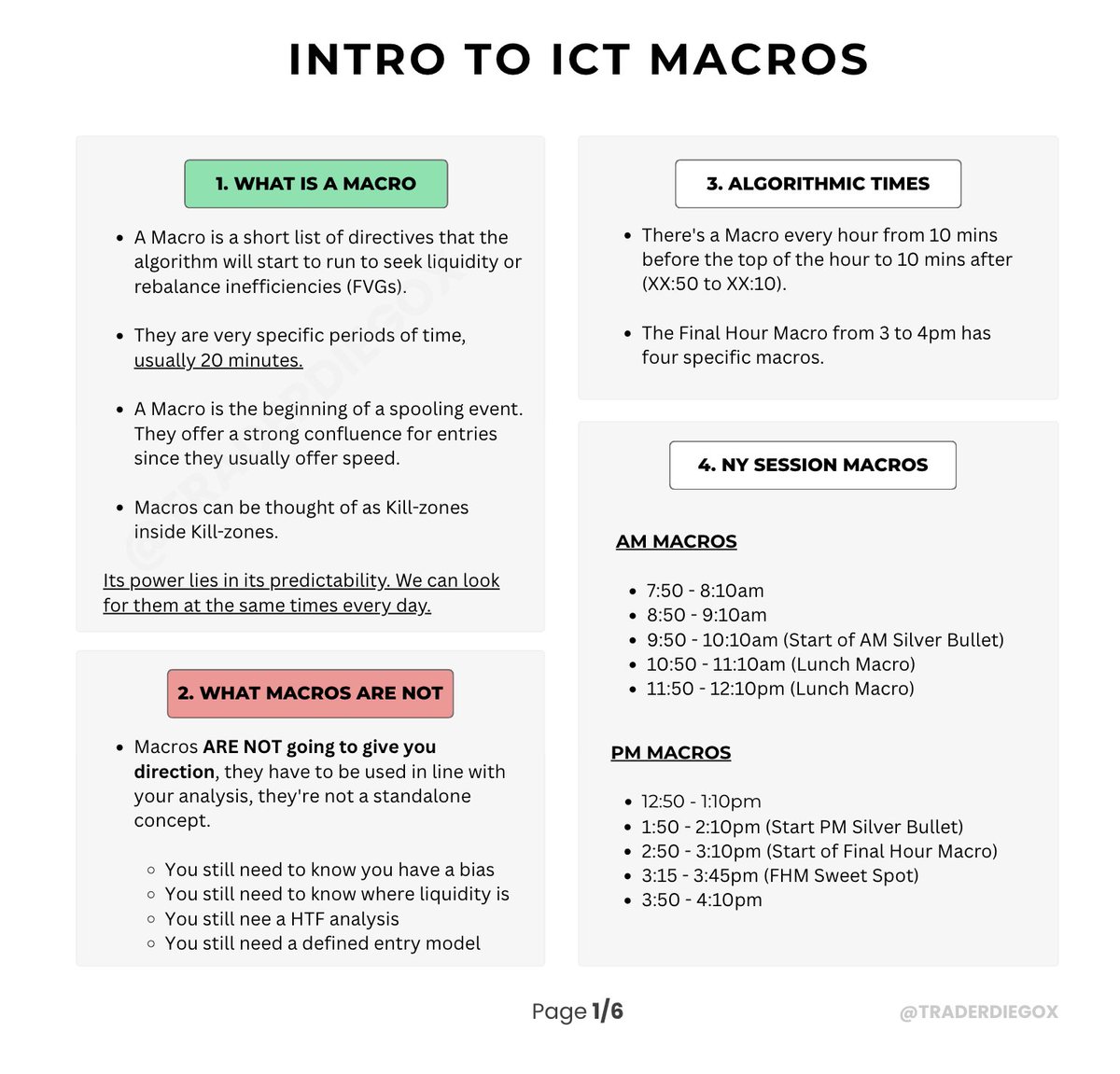

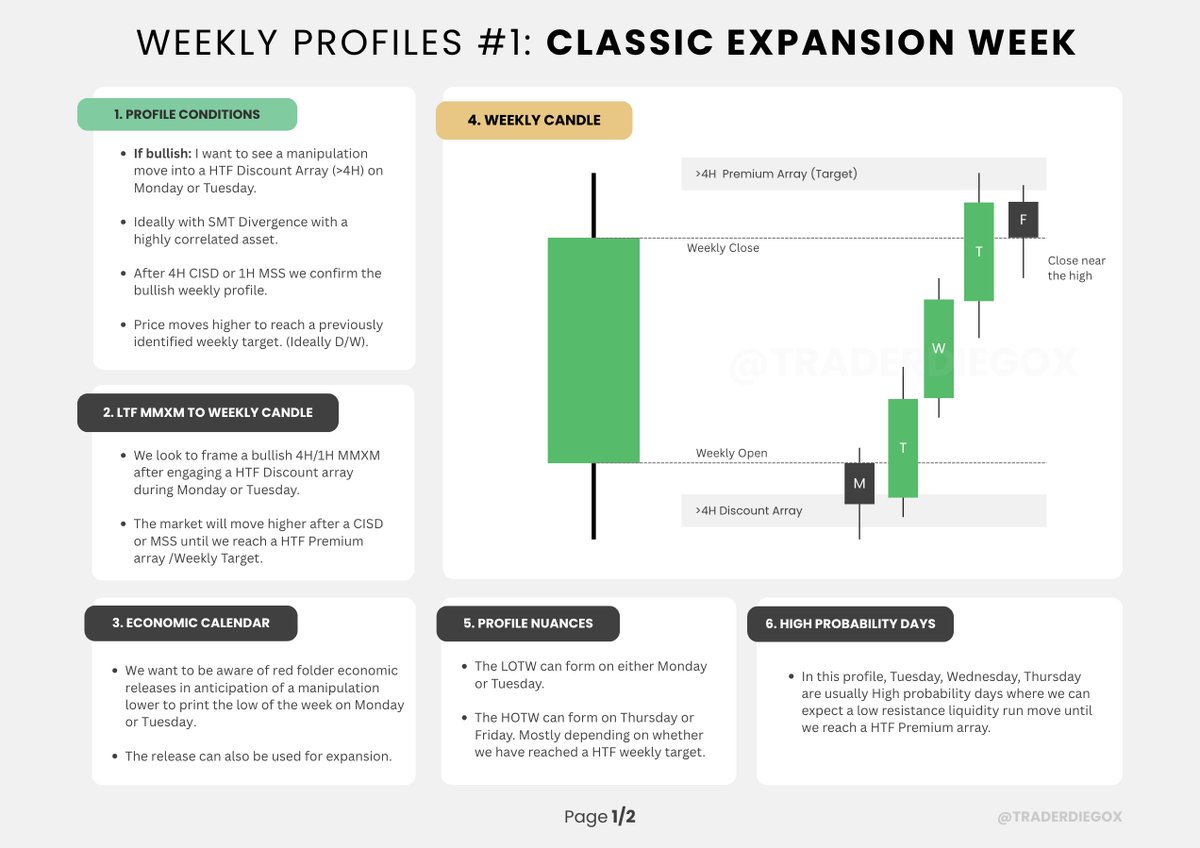

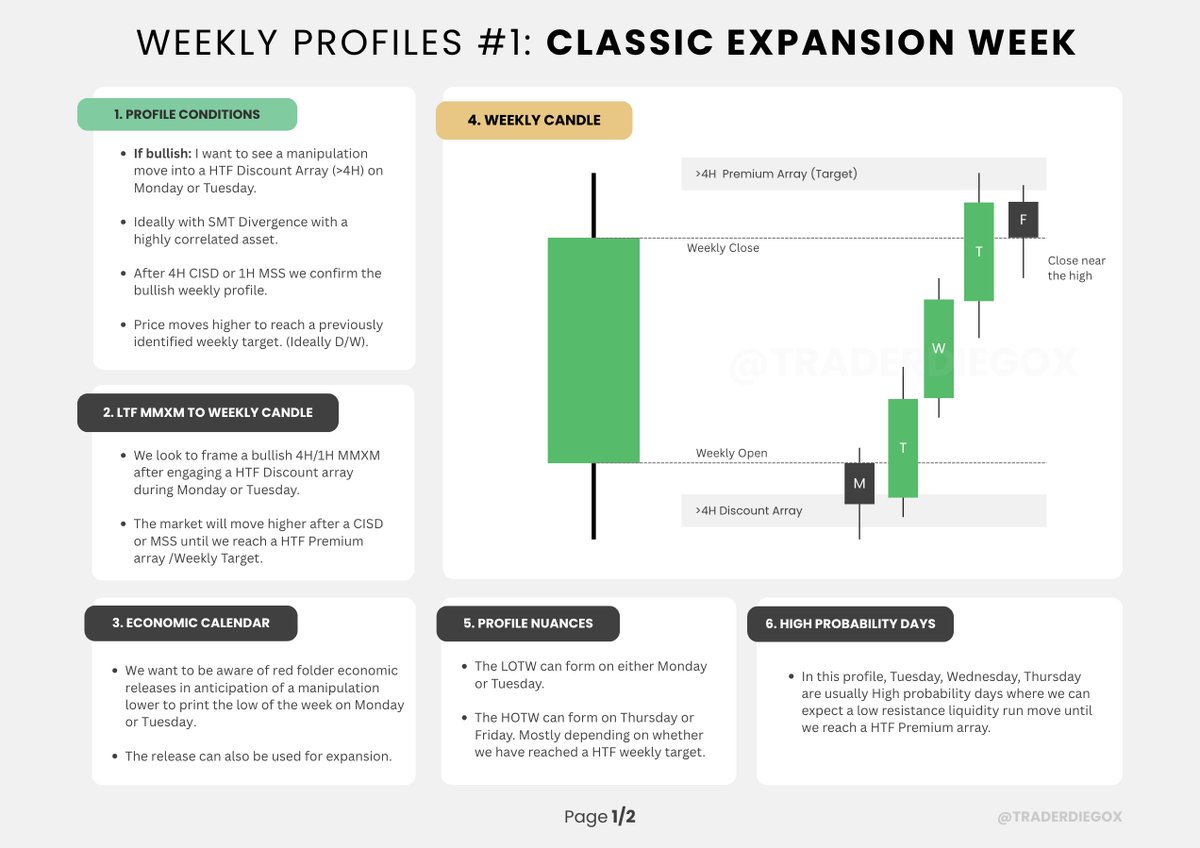

Macros are very specific periods of time, usually 20 minutes.

Macros are very specific periods of time, usually 20 minutes.

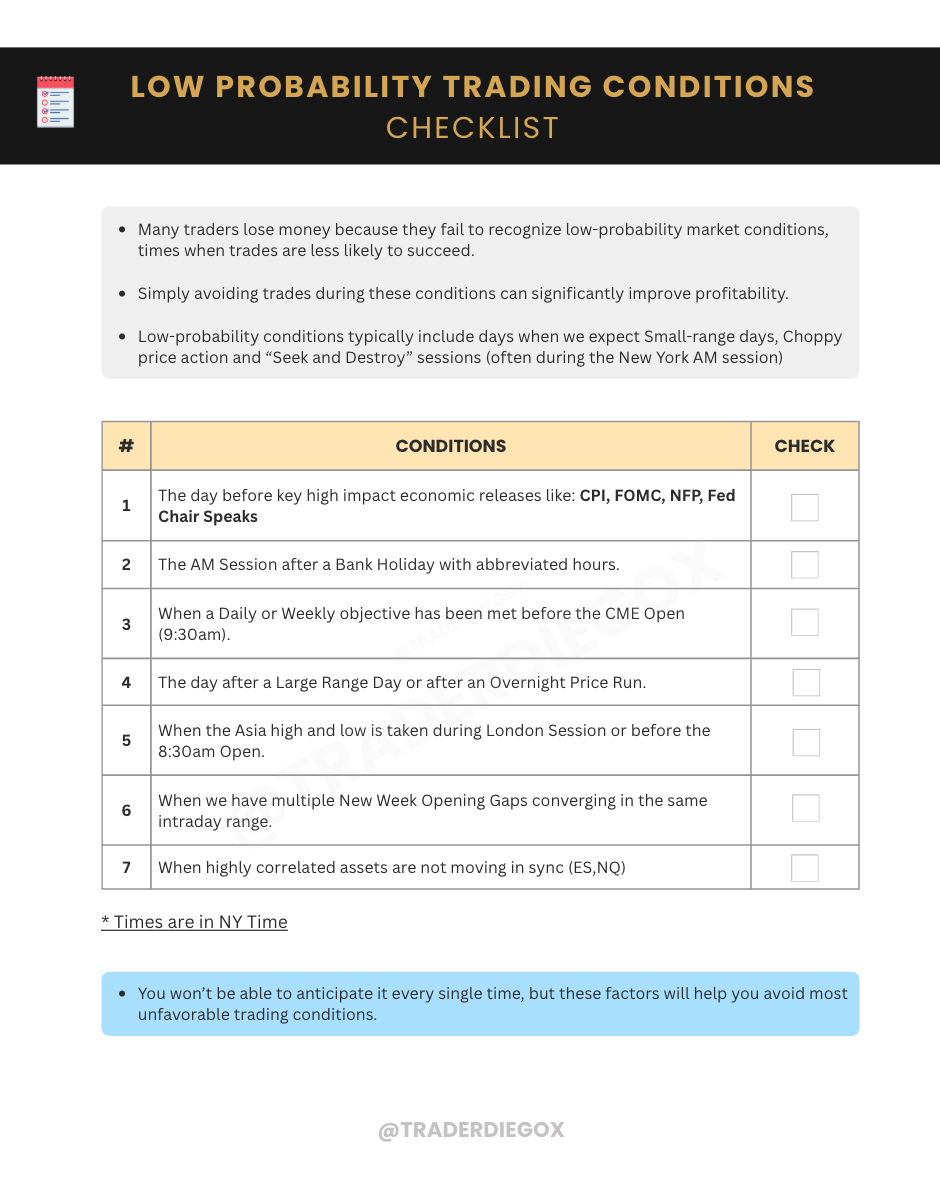

ICT Low Probability Trading Conditions Checklist

ICT Low Probability Trading Conditions Checklist

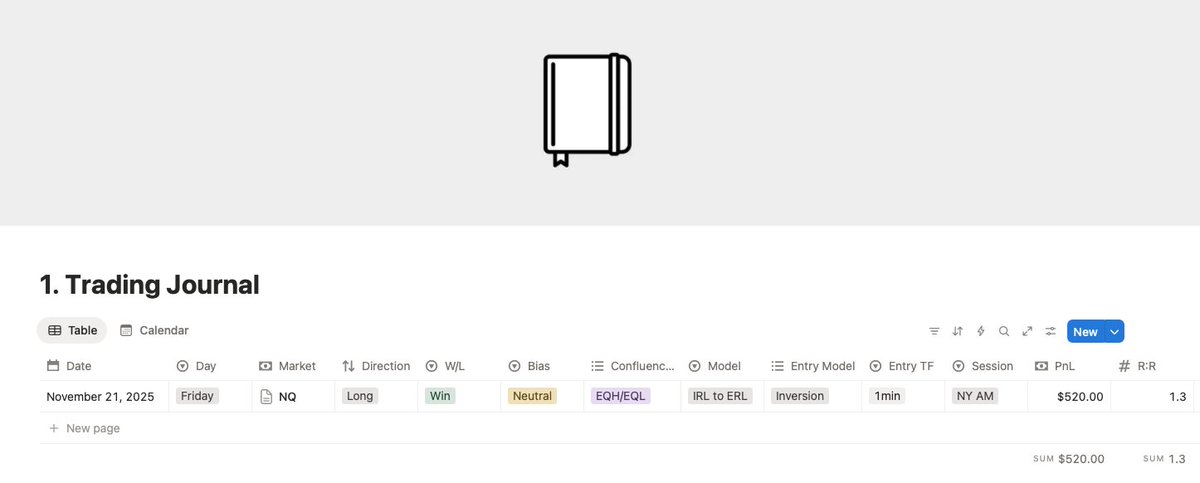

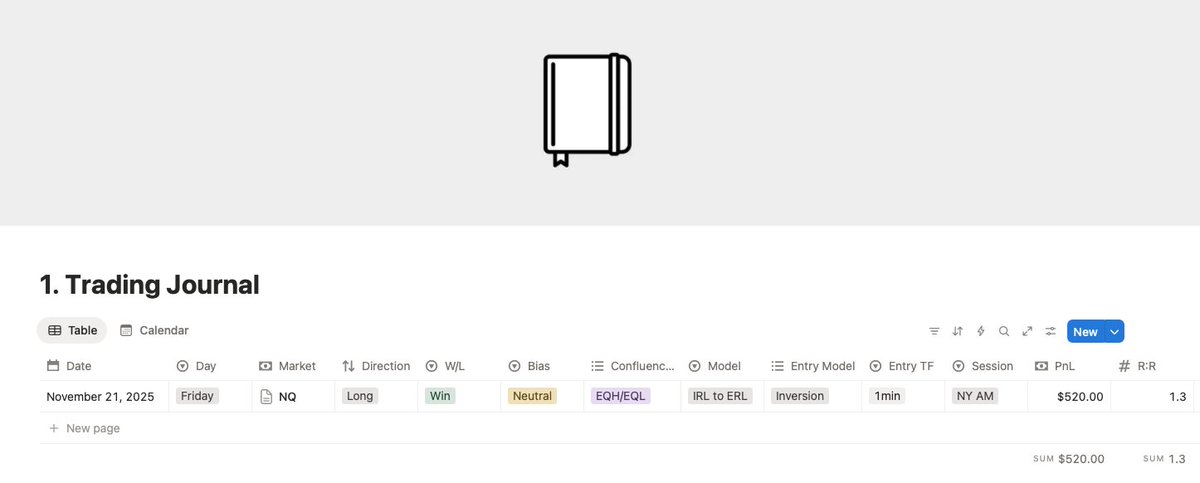

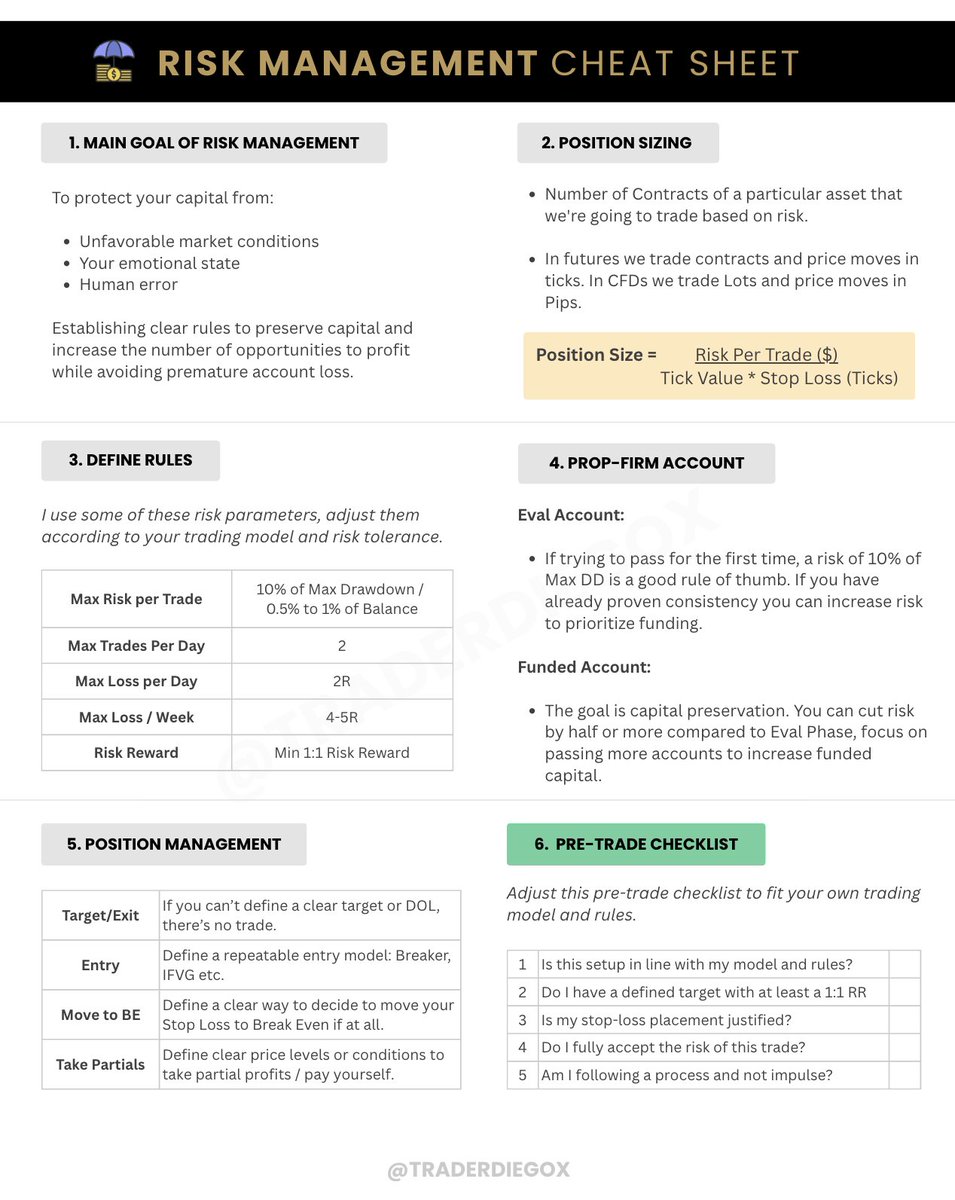

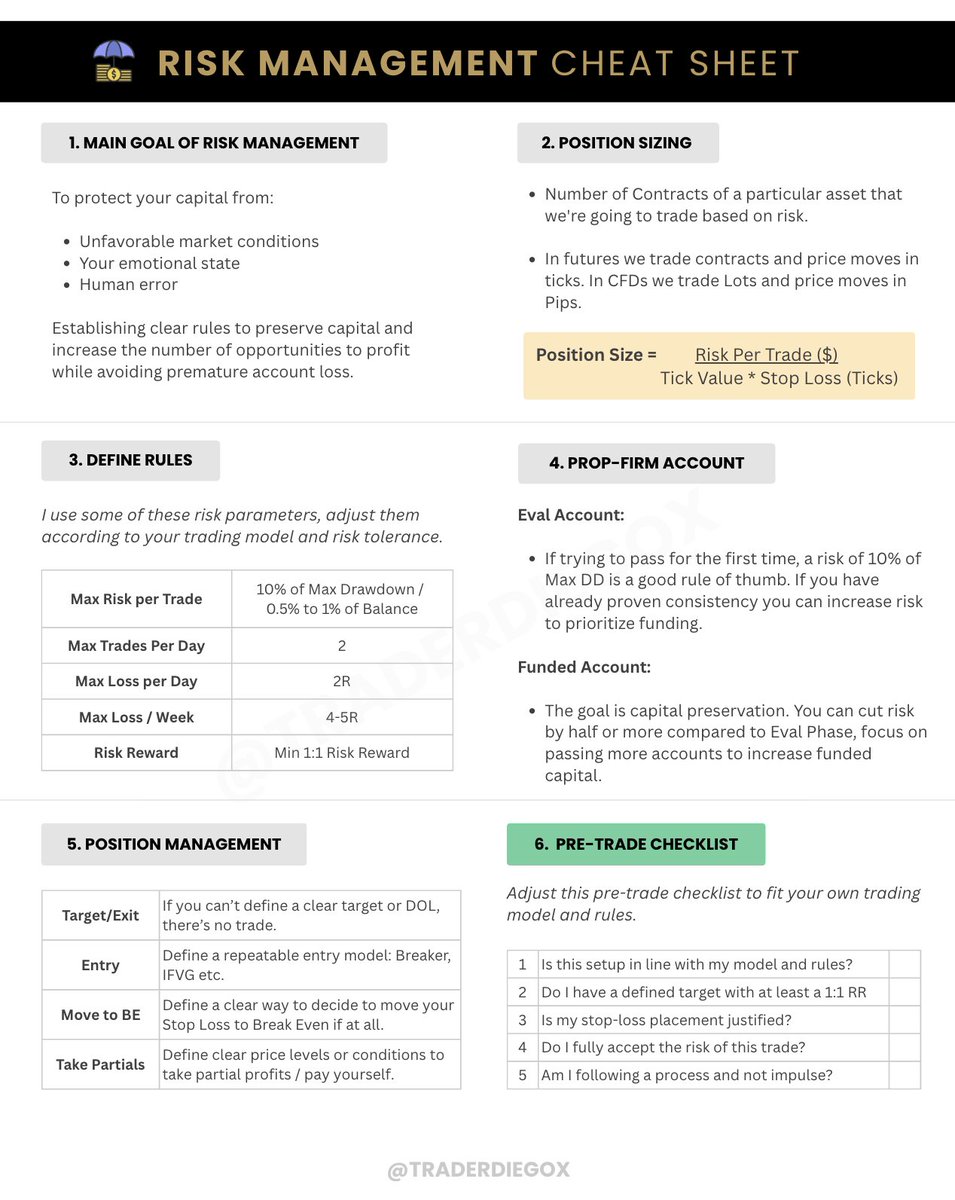

Risk Tools to Consider!

Risk Tools to Consider!

MFFU JULY PROMO! 50% Off For All Users - 1 use.

MFFU JULY PROMO! 50% Off For All Users - 1 use.

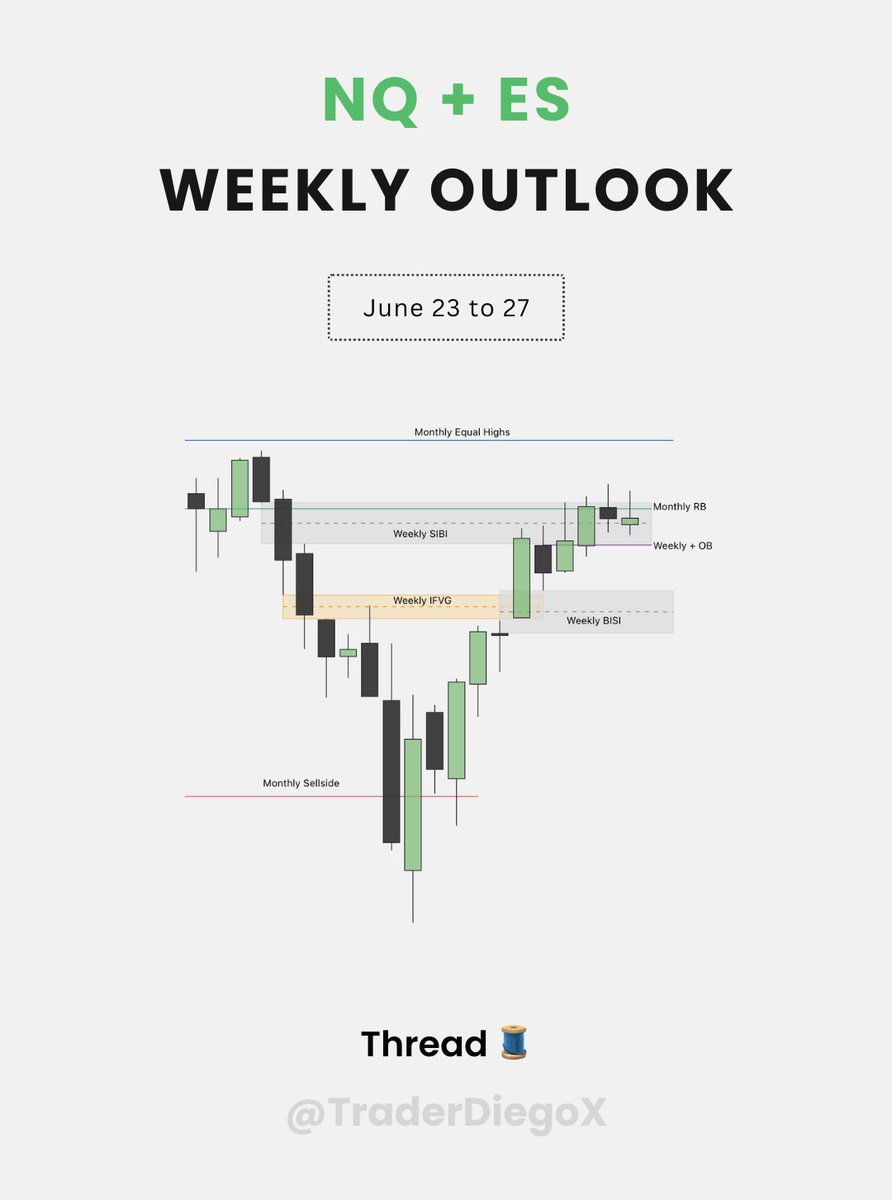

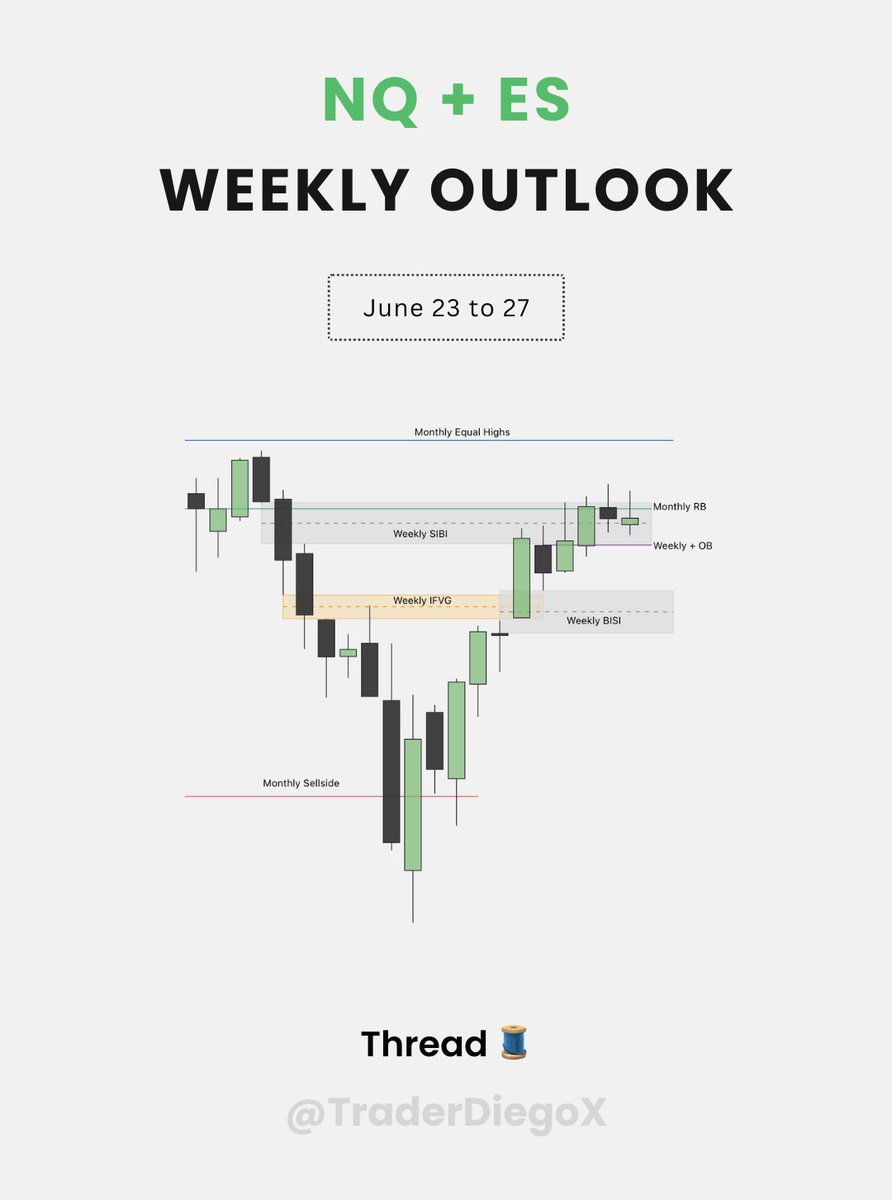

Calendar Weekly Outlook: June 23 to 27

Calendar Weekly Outlook: June 23 to 27

Calendar Weekly Outlook: June 16 to 20

Calendar Weekly Outlook: June 16 to 20