#IEX Fundamentals, Technical and the other data, a🧵:

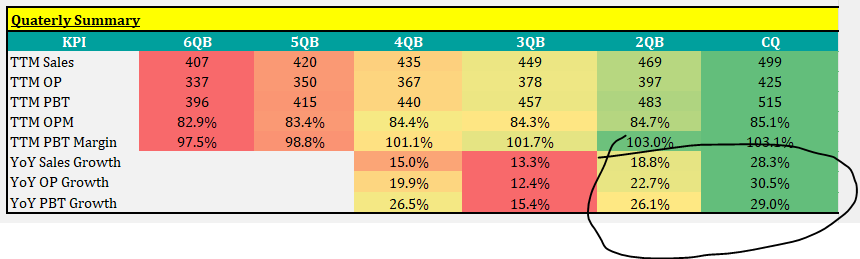

IEX has been coming up with great results but market is anticipating coupling fear and hence stock is falling. This is the common perception.

Is this the case, let us deep dive?

IEX has been coming up with great results but market is anticipating coupling fear and hence stock is falling. This is the common perception.

Is this the case, let us deep dive?

Was curious to check which institutions are selling because if I blindly look at charts - then all we see is stoploss. Something very interesting came out. First thing, looking at screener, looks like FIIs and DIIs are buying and retail is selling. Also, evident in falling count of retail investors. So, who is moving the prices down?

Such a market cap stock can be moved up or down only by institutions. Given FII data is quarterly available but mutual fund data is monthly available, looked at the mutual fund data and here is the interesting stuff

69% of all sellers (by MF count) are either index funds or arbitrage funds. They act more on quantitative rules than any long term fundamental analysis

Only 20% of normal holding (assuming they take decisions based on fundamentals) funds are selling

Only 20% of normal holding (assuming they take decisions based on fundamentals) funds are selling

26% of funds are doing nothing but 46% of funds are buying which means only 29% of funds are selling

The 29% of funds which are selling hold 21% of the MF shareholding. Those doing nothing hold 57% of MF shares and those who are buying hold least 22% of MF shares

At least in the MF space, the current selling more based on index readjustments and arbitrage based decisions than fundamental decision, this is what it looks like. Also, ~80% of shareholding in MF is either doing nothing or in buy mode. Retail has been continuously selling.

FIIs we need more granular analysis to conclude anything. The reason t write this thread was - We just look at few lines of data or few days of charts and conclude so many things - devil lies in the detail. Any data, till we can, we should try to go deeper and deeper till we can

I plan to study more on how Arbitrage funds work and specially those active in this counter. However, if someone has idea what they are doing here and how it impacts stock in short term, please enlighten @SahilKapoor

• • •

Missing some Tweet in this thread? You can try to

force a refresh