Ethereum's Roadmap is under fire.

But have we truly grasped the *economic* ripples that every proposal sets in motion?

Each pivot, upgrade, and idea impacts more than just the blockchain itself.

It shapes the experiences, challenges, and fortunes of:

1. Developers

2. Users

3. Validators

4. Service Providers

5. And Investors

That’s why I created a dashboard on @tokenterminal breaking it all down.

Past. Present. And Future.

A 🧵with some insights from the dashboard + a link at the end for those looking to go deeper 👇

Starting with EIP1559 in August of '21:

$12.4b has been “burned” or bought back since it’s implementation.

1/7

But have we truly grasped the *economic* ripples that every proposal sets in motion?

Each pivot, upgrade, and idea impacts more than just the blockchain itself.

It shapes the experiences, challenges, and fortunes of:

1. Developers

2. Users

3. Validators

4. Service Providers

5. And Investors

That’s why I created a dashboard on @tokenterminal breaking it all down.

Past. Present. And Future.

A 🧵with some insights from the dashboard + a link at the end for those looking to go deeper 👇

Starting with EIP1559 in August of '21:

$12.4b has been “burned” or bought back since it’s implementation.

1/7

Shifting to ETH 2.0 and the move to Proof of Stake in Sept. '22:

Annual issuance dropped 88% overnight.

Impact on Validators:

1. Now compensated with tips from users (fees paid in excess of the base fee for block inclusion) + new issuance.

2. Compensation from new issuance was reduced by 88% overnight (from roughly 13.5k ETH/day to 1.7k ETH/day).

3. Overhead costs (energy) reduced by 99.9%.

4. Compensation from fees + new issuance is now determined by the validator's portion of ETH staked pro-rata to the amount of ETH staked on the network.

[see dashboard for impact on ETH holders]

2/7

Annual issuance dropped 88% overnight.

Impact on Validators:

1. Now compensated with tips from users (fees paid in excess of the base fee for block inclusion) + new issuance.

2. Compensation from new issuance was reduced by 88% overnight (from roughly 13.5k ETH/day to 1.7k ETH/day).

3. Overhead costs (energy) reduced by 99.9%.

4. Compensation from fees + new issuance is now determined by the validator's portion of ETH staked pro-rata to the amount of ETH staked on the network.

[see dashboard for impact on ETH holders]

2/7

Moving on to The Shapella Upgrade (staking withdrawals) in April of '23:

Validators increased 58% in the first 6 months post-Shapella.

Impact:

1. Validators: decrease in yield

2. Tokenholders: drop in yield can impact demand for ETH

3. Network security: more validators = more secure network.

4. Applications: @LidoFinance was the largest beneficiary.

3/7

Validators increased 58% in the first 6 months post-Shapella.

Impact:

1. Validators: decrease in yield

2. Tokenholders: drop in yield can impact demand for ETH

3. Network security: more validators = more secure network.

4. Applications: @LidoFinance was the largest beneficiary.

3/7

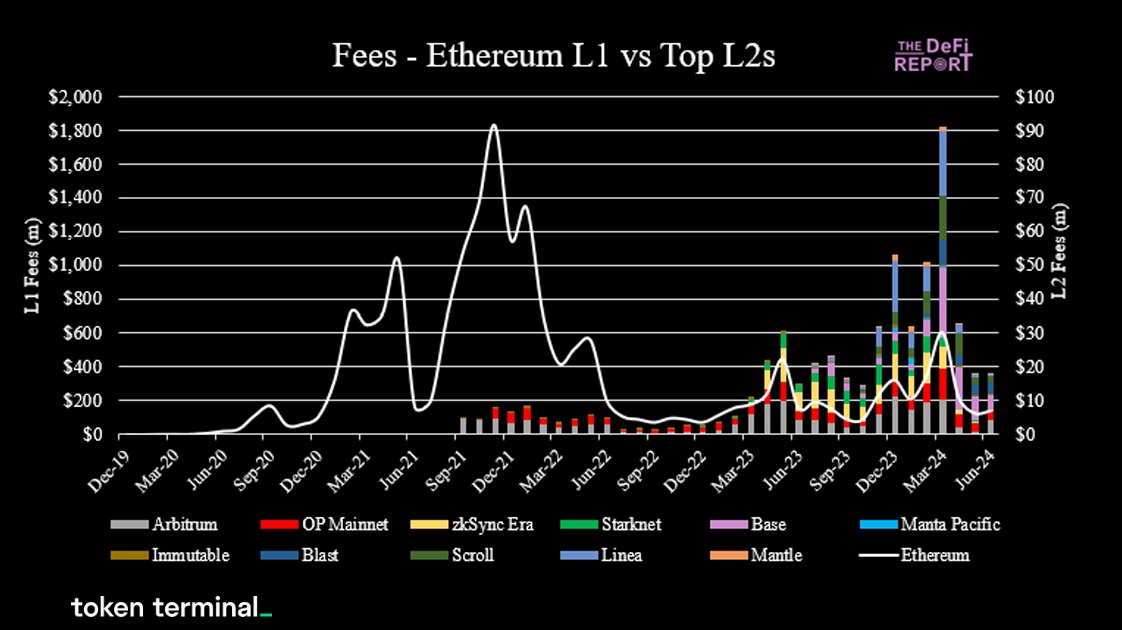

March '23 EIP4844: Introduction of “Blobs,” a new data structure that lowered costs for L2s.

Impact:

1. Users: reduced transaction fees on L2s an order of magnitude.

2. L1 Validators: the reduction in L2 fees has reduced the fees paid to L1 and the yield paid to validators/stakers.

3. L2 Sequencers: fees are down while transactions are up. Transaction volume will need to increase exponentially to backfill the loss in revenue from a lower avg. cost to transact.

4. Tokenholders: the reduction in fees at the L2 has also decreased fees at the L1 level, reducing burned ETH and yield paid to validators/stakers.

5. L2 Margins: increased from roughly 75% to 99%.

6.Applications/Developers: reducing costs on L2s can enable use cases that were previously not possible.

4/7

Impact:

1. Users: reduced transaction fees on L2s an order of magnitude.

2. L1 Validators: the reduction in L2 fees has reduced the fees paid to L1 and the yield paid to validators/stakers.

3. L2 Sequencers: fees are down while transactions are up. Transaction volume will need to increase exponentially to backfill the loss in revenue from a lower avg. cost to transact.

4. Tokenholders: the reduction in fees at the L2 has also decreased fees at the L1 level, reducing burned ETH and yield paid to validators/stakers.

5. L2 Margins: increased from roughly 75% to 99%.

6.Applications/Developers: reducing costs on L2s can enable use cases that were previously not possible.

4/7

The result? Ethereum is scaling as designed.

90% of transactions within the ecosystem now come from L2.

5/7

90% of transactions within the ecosystem now come from L2.

5/7

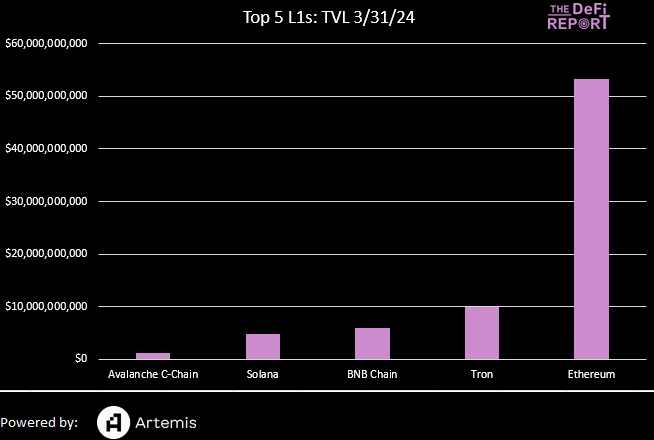

But the million-dollar question remains: Where will the most value accrue?

The market still values the L1 at 13x the combined valuation of the top L2s.

6/7

The market still values the L1 at 13x the combined valuation of the top L2s.

6/7

Want to go deeper and come to your own conclusions? 👇

Please tear it up and leave your comments below so that we can make it even better 🤝

7/7tokenterminal.com/terminal/studi…

Please tear it up and leave your comments below so that we can make it even better 🤝

7/7tokenterminal.com/terminal/studi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh