"Breast Cloth" and "Mulakkam" : a Breast tax or Adulthood tax

The projection as "Breast-Tax" is a recent twist.

No records in 300 years of history—discovery only 48 years ago.

#thread #bookmark

1/15

The projection as "Breast-Tax" is a recent twist.

No records in 300 years of history—discovery only 48 years ago.

#thread #bookmark

1/15

Mentions of Breast-Tax in Chronology:

- 1972: Book by T.K. Ravi

- 1973: Book by T.K. Ravi

- 2000: Book by S.N. Sadesivan

- 2011: Book by A. Raju

- 2016: BBC

- 2017: Indiatimes, Scroll, The Hindu

- 2018: Deccan Chronicle, India Today, Movie by Pagare

- 2019: Books by Menon, Emmanuel T, Subhrashis, S. Pillai

2/15

- 1972: Book by T.K. Ravi

- 1973: Book by T.K. Ravi

- 2000: Book by S.N. Sadesivan

- 2011: Book by A. Raju

- 2016: BBC

- 2017: Indiatimes, Scroll, The Hindu

- 2018: Deccan Chronicle, India Today, Movie by Pagare

- 2019: Books by Menon, Emmanuel T, Subhrashis, S. Pillai

2/15

Surprising to see sudden spurt in a story being pushed as an EVIL collectively by several people. Books are being written on a fake story.

3/15

3/15

MULAKKAM and THALAKARAM were actually head taxes payable by the Malayarans, an underprivileged group, upon reaching working age. These taxes were limited to a few villages in Travancore, not the entire southern region as widely propagated. Several other taxes were also imposed on the poor.

4/15

4/15

Not only Kerala's but most of the South East Asean region has tropical weather. It is uncomfortable to cover from head to toe.

5/15

5/15

However, with conversion to Christianity by some, they got some recognition and social status.

With start of NEW Tea plantation in Ceylon and Sugar factories, Nadar's interacted with colonisers and started to adopt their culture. Some turned land owner and few tree owners.

6/15

With start of NEW Tea plantation in Ceylon and Sugar factories, Nadar's interacted with colonisers and started to adopt their culture. Some turned land owner and few tree owners.

6/15

A decree from the Synod allowed converts to Christianity to maintain untouchability, even as it was punishable elsewhere. Surprisingly, converts from unprivileged backgrounds still adhere to the caste system.

7/15

7/15

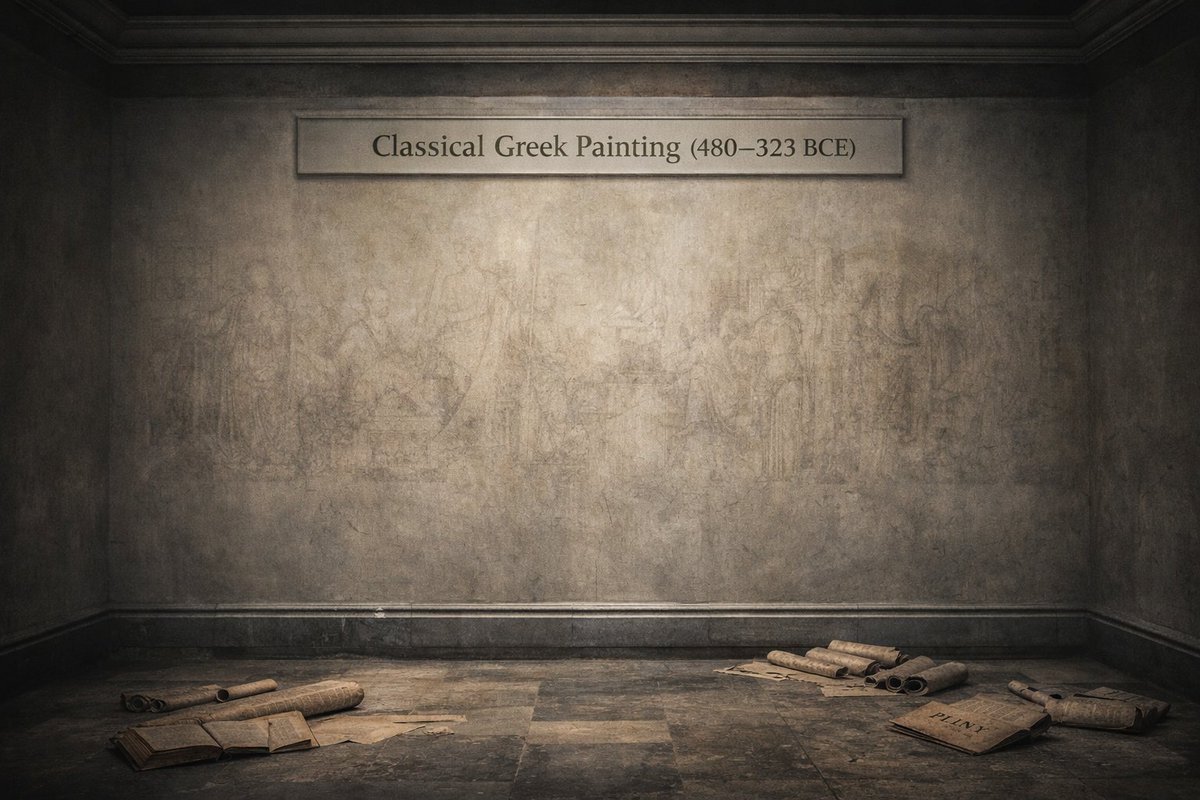

As the British tightened their grip, Col Munro's 1812 and 1814 policies in Travancore allowed different clothing for the converted underprivileged, unlike Syrian Christians and Moplahs. This unfair and divisive act sparked the UPPER CLOTH MOVEMENT.

8/15

8/15

The Nadar's unrest got further momentum when seasonal migrant Thirunelveli Nadar covering upper body have to bare in Trivancore. The Upper cloth movement can be categorised in 3 phases

9/15

9/15

Some wealthy NADAR wore upper clothes while the poorer did not, creating a divide not based on caste but on wealth. Finally, on July 26, 1859, a Royal Proclamation abolished all restrictions on Shanar women covering their upper bodies, except that they should not imitate the high class.

10/15

10/15

Marco polo an Italian traveller 1288-1292 AD who visited Malabar to Gujarat and noted that people here (including king) cover only middle portion of their body. They majorly eat milk, flesh and rice.

11/15

11/15

Abdur Razzak-Ambassador from Iran 1442-1443 ce also visited Under Reign of Dev Ray II (Vijay Nagar). He noticed - Hindus (including kings and beggars) wear Langot around middle of their bodies starting from naval to the knee; while woman wore ankle long clothes -Moambadans wear magnificent apparels similar to that of Arabians - KiII!ng C0w was punishable by de@th penalty He divided Infidels are divided into a great number of classes, such as the Bramins, the Djoghis and others fundamentally polytheist and idolators, each sect has its peculiar customs. Amongst them there is a class of men, with whom it is the practice for one woman to have a great number of husbands, each of whom undertakes a special duty and fulfils it. Src : The travels of Nicolo Conti in the East in the early part of the fifteenth century

12/15

12/15

You may. Watch this Balinese cultural integration of Hindu women with modern one

13/15

13/15

Thus a long UPPER Cloth controversy came to an end. Requesting

@HRDMinistry x.com/HRDMinistry

@GoI_MeitY x.com/GoI_MeitY

to act on removing all fictional stories published during last 48 years on mixing Cloth controversy with Tax issue.

14/15

@HRDMinistry x.com/HRDMinistry

@GoI_MeitY x.com/GoI_MeitY

to act on removing all fictional stories published during last 48 years on mixing Cloth controversy with Tax issue.

14/15

I hope you are enjoying my contents. Please subscribe my YouTube channel youtube.com/@gemsofindology and t.me/gemsofindology and support us.

Please RT and like first tweet of this thread if you can.

15/15 x.com/64098246/statu…

Please RT and like first tweet of this thread if you can.

15/15 x.com/64098246/statu…

• • •

Missing some Tweet in this thread? You can try to

force a refresh