Recently, India’s Oil Minister laid out an interesting strategy: instead of stepping back from fossil fuels, we’re planning to strengthen our reliance on them. The aim? To become a "regional refining hub" until at least 2040.

What does this really mean?🧵👇

What does this really mean?🧵👇

In simple terms, India doesn’t just want to refine oil for its own needs; we want to supply our neighbors too. There are plans in the works to build more refineries for oil, gas, and petrochemicals.

What makes this stand out is that, while the world is shifting toward green energy, India is doubling down on oil.

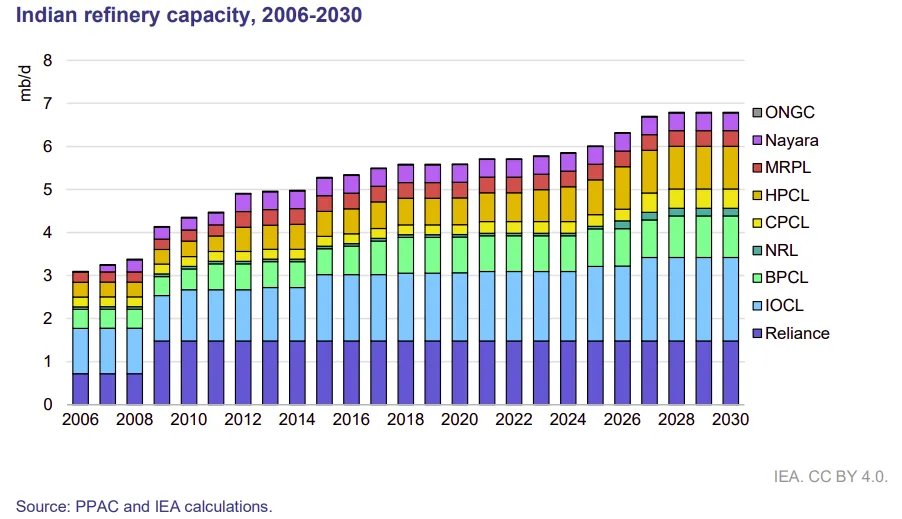

But this isn’t about resisting change. India’s energy demand is enormous, driven by a fast-growing and urbanizing population. Right now, we’re refining around 5 million barrels of oil a day—about 249 million metric tonnes a year. Even that isn’t enough to meet our rising needs.

The goal is to hit 450 million metric tonnes a year.

Driving this goal are state-owned giants like Bharat Petroleum (BPCL), Indian Oil Corporation (IOC), and Hindustan Petroleum (HPCL), each with its own plan to expand refining capacity.

Image: IEA

Driving this goal are state-owned giants like Bharat Petroleum (BPCL), Indian Oil Corporation (IOC), and Hindustan Petroleum (HPCL), each with its own plan to expand refining capacity.

Image: IEA

BPCL is working on a major expansion in Maharashtra and Kerala over the next 5 to 7 years. They’re not just focused on refining crude oil but also on producing petrochemicals. Why?

Because petrochemicals play a big role in industries like automotive, construction, and consumer goods—think plastics and synthetic fabrics. By producing more locally, BPCL hopes to meet rising demand and cut down on imports.

IOC, the largest refiner in India, is expanding its Panipat, Gujarat, and Barauni refineries. Panipat, for example, will grow from handling 15 million metric tonnes per year to 25 million. But IOC isn’t just making more fuel; it’s also adding petrochemicals to its mix, turning out everything from gasoline and diesel to industrial plastics—all from one site.

HPCL has a different focus—diesel self-sufficiency. HPCL is expanding its refineries in Barmer, Mumbai, and Visakhapatnam. By 2025, it aims to meet all its diesel needs with local production, cutting down reliance on outside suppliers and making India’s energy network more resilient.

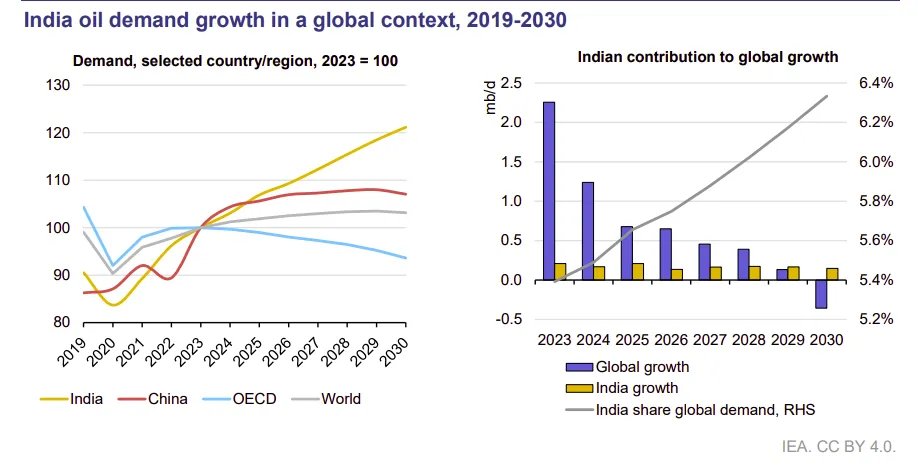

Why all this expansion? The answer lies in India’s rapid urbanization and industrial growth. According to the International Energy Agency (IEA), India is expected to become the largest source of global oil demand growth by 2030, with demand increasing by about 1.2 million barrels per day.

Image: IEA

Image: IEA

This growth isn’t just for vehicle fuel but also for petrochemicals like naphtha and LPG, which are used in everything from plastics to industrial chemicals.

Image: IEA

Image: IEA

While India is doubling down on fossil fuels, some companies are making quieter moves into renewables. Take Reliance Industries, for example—a major player in India’s oil sector.

Reliance is investing heavily in biogas, with plans to build 500 compressed biogas (CBG) plants and invest ₹65,000 crore in the process. The idea is to produce biogas from organic waste, like crop leftovers and food scraps.

This project ties into India’s SATAT initiative, which aims to integrate biogas into our natural gas supply, offering a cleaner, locally-made alternative to imported liquefied natural gas (LNG).

This shift isn’t just about going green; it’s practical too. Compressed biogas is renewable and can be made right here, helping to cut our reliance on imported LNG. So, even as Reliance continues to play a big role in oil, it’s taking steps towards a more sustainable future.

Beyond refining, India is also moving carefully to diversify its energy mix with biofuels. The government has set ambitious targets, like blending 20% ethanol into gasoline by 2025-26 and adding 5% biodiesel to diesel by 2030.

Ethanol and biodiesel come from crops and offer renewable, less harmful alternatives for the environment. Reliance’s investment in CBG fits in well with this plan, as SATAT looks to create a “gas-based economy” that reduces our reliance on imports.

To reduce our heavy reliance on imported oil—which currently makes up 87% of our supply—India is pushing for more domestic exploration. There are 26 sedimentary basins in the country (geographical zones where oil and gas reserves are likely found), but we’re only actively exploring 10% of that area.

Recently, India opened up 1 million square kilometers of previously restricted zones for oil exploration. The Petroleum Minister, Hardeep Singh Puri, has set ambitious goals to tap into around 22 billion barrels of untapped oil.

India’s energy strategy might seem like a contradiction, but it’s actually a careful balancing act. On one side, we’re committed to fossil fuels. BPCL, IOC, and HPCL are leading major refinery expansions to meet immediate energy demand, cut down fuel imports, and support key industries.

On the flip side, our renewable energy investments are slowly but steadily growing. Biofuels like compressed biogas (CBG) and ethanol-blended fuels offer homegrown energy alternatives.

While they won’t replace fossil fuels overnight, they do help diversify our energy mix and provide some protection against global oil price swings and supply risks.

Even though we’re deeply invested in fossil fuels, we haven’t lost sight of our climate goals. As the third-largest emitter of greenhouse gases, India has committed to reaching net-zero carbon emissions by 2070 and plans to generate 500 gigawatts of renewable energy by 2030.

Still, we’re taking a more gradual approach when it comes to cutting down on fossil fuels. Efforts in biofuels and biogas represent small but deliberate steps toward a cleaner energy future.

We cover this and two more interesting stories in today's episode of the Daily Brief.

You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here: thedailybrief.zerodha.com/p/can-india-be…

You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here: thedailybrief.zerodha.com/p/can-india-be…

• • •

Missing some Tweet in this thread? You can try to

force a refresh