Your go-to place to understand what's happening in the Indian stock market and why. No drama, no nonsense — just insights.

9 subscribers

How to get URL link on X (Twitter) App

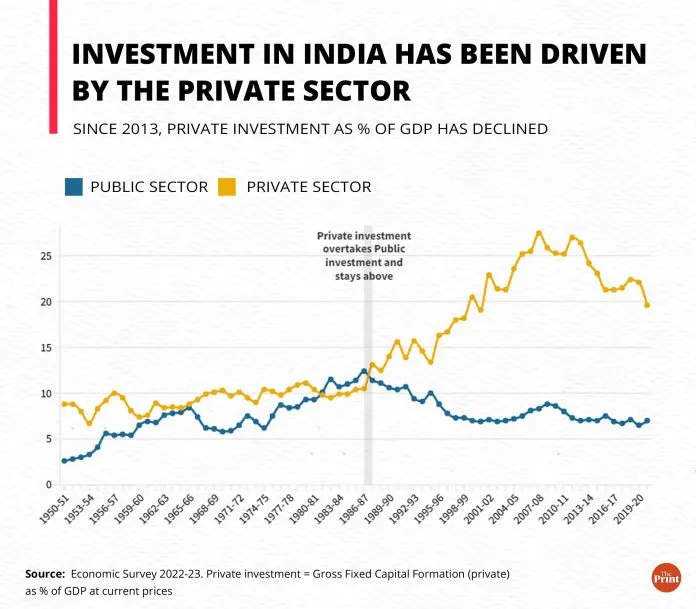

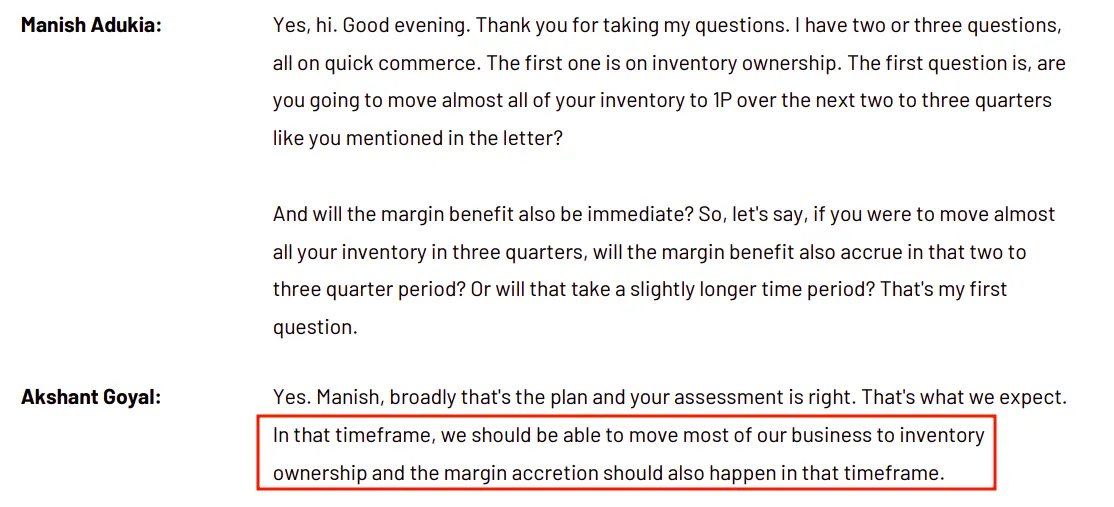

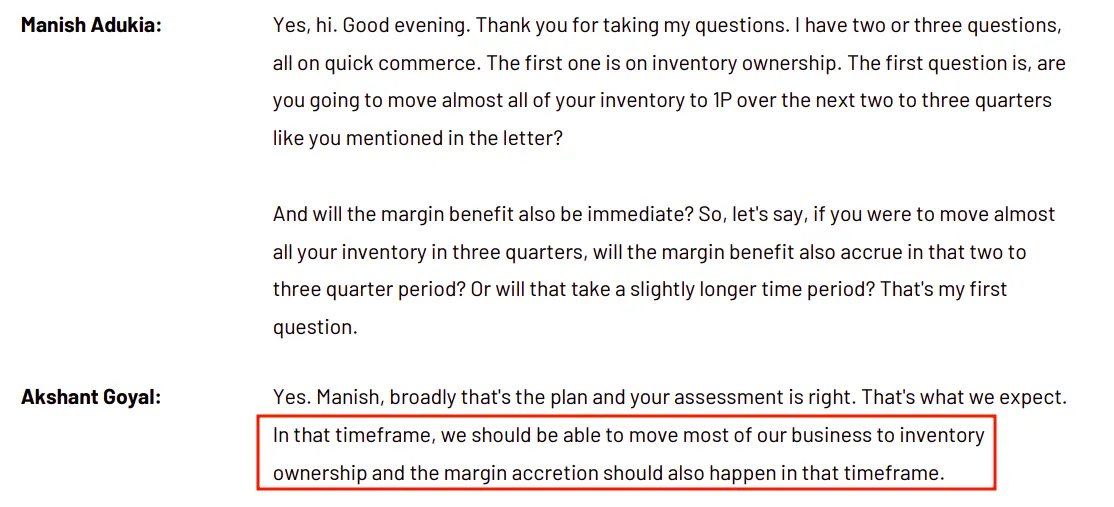

Owning stock changes the unit economics. You don’t just earn a commission, you earn the full spread between buying price and selling price.

Owning stock changes the unit economics. You don’t just earn a commission, you earn the full spread between buying price and selling price.