The Austin, TX rental market is collapsing before our eyes.

With the median apartment rent dropping 15% over the last 2+ years.

The vacancies have skyrocketed. Rental concessions are everywhere.

Rents are now only 9.8% higher than pre-pandemic. Meaning that many Austin landlords are losing money, as property taxes, insurance, and interest costs are way higher.

(This is a harsh lesson on the boom/bust cycle in real estate for many developers and investors who bought into Austin during the boom. Read more below to see how this happened.)

With the median apartment rent dropping 15% over the last 2+ years.

The vacancies have skyrocketed. Rental concessions are everywhere.

Rents are now only 9.8% higher than pre-pandemic. Meaning that many Austin landlords are losing money, as property taxes, insurance, and interest costs are way higher.

(This is a harsh lesson on the boom/bust cycle in real estate for many developers and investors who bought into Austin during the boom. Read more below to see how this happened.)

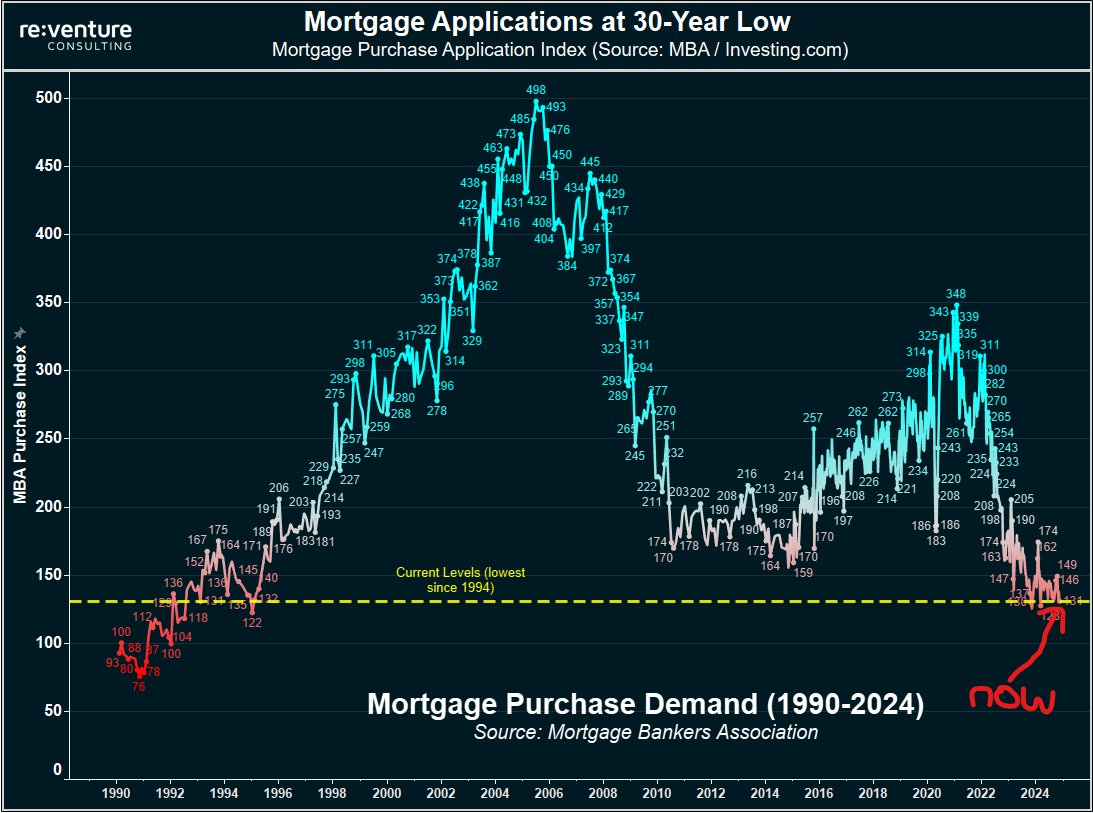

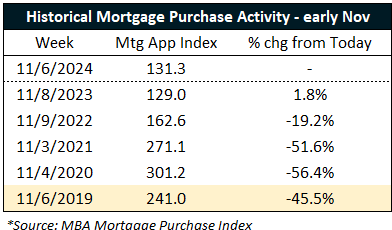

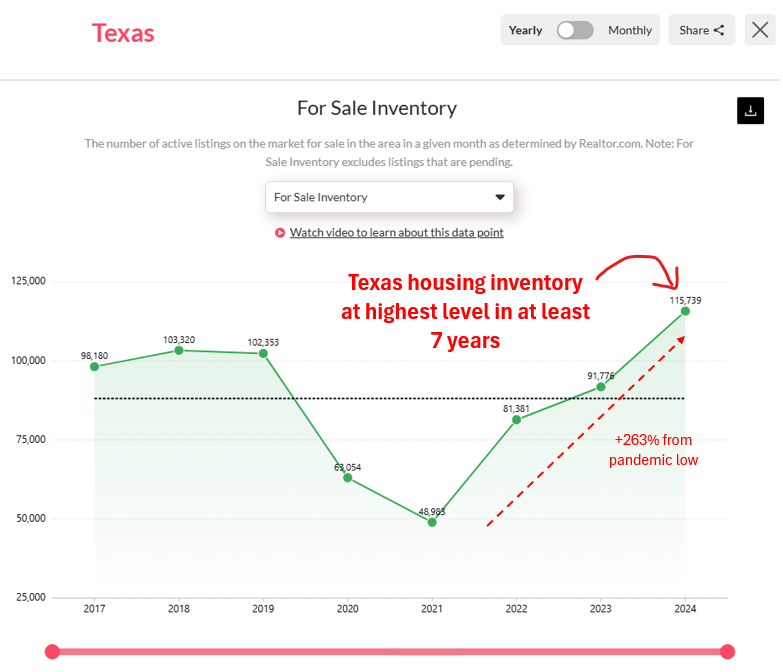

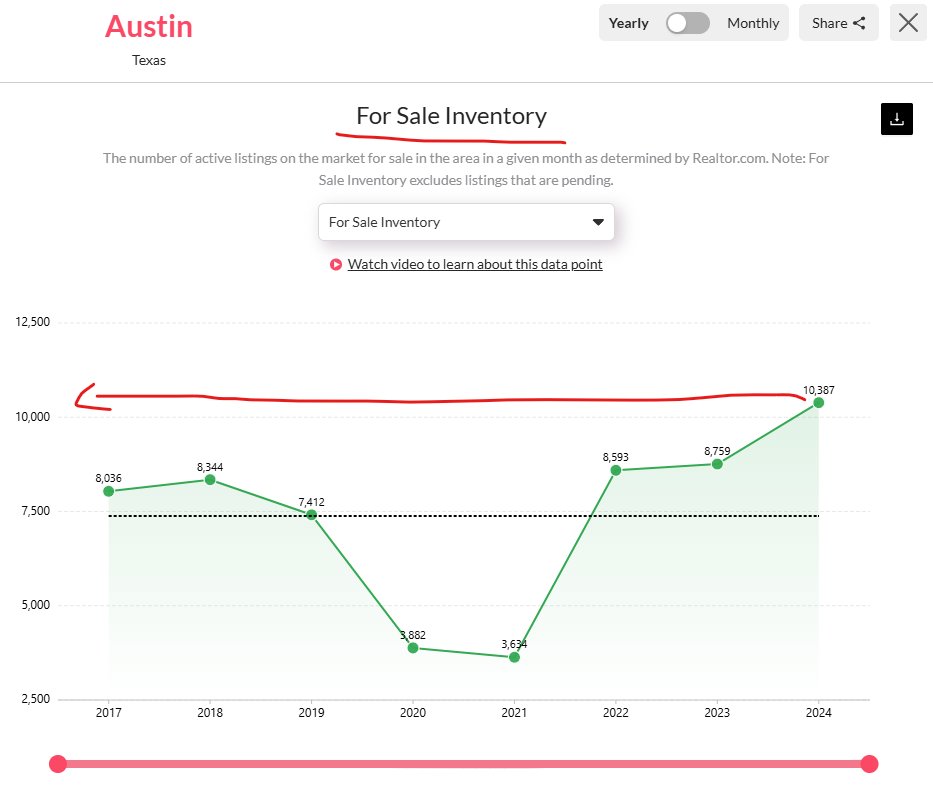

1) Austin's rental market is being dragged down by dueling forces right now: reduced demand combined with a deluge of new supply.

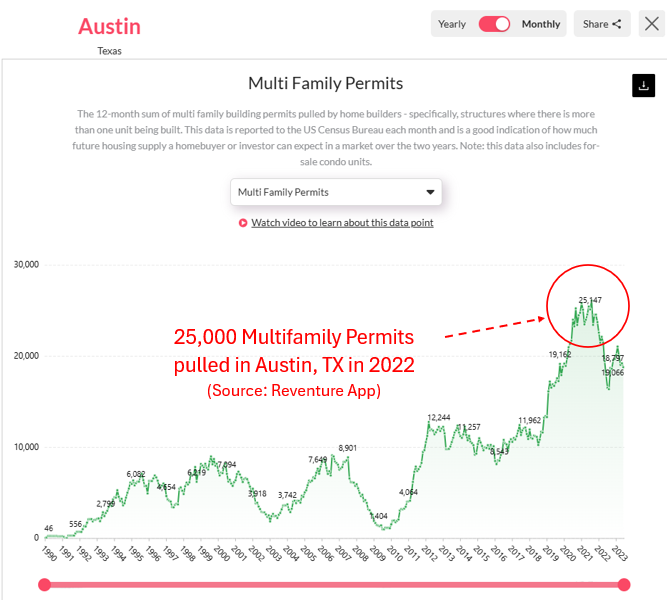

At the peak in 2022, apartment developers in Austin pulled permits for over 25,000 multifamily units in a year.

And now those permits are turning into completed units and sitting vacant, forcing landlords to do big rent reductions.

At the peak in 2022, apartment developers in Austin pulled permits for over 25,000 multifamily units in a year.

And now those permits are turning into completed units and sitting vacant, forcing landlords to do big rent reductions.

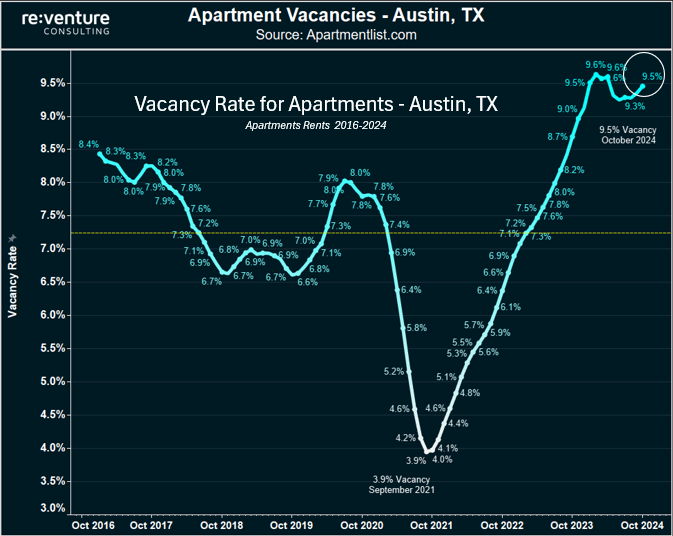

2) You can see this reality expressed in vacancy rate statistics from Apartment list.

At the height of the pandemic in Sept 2021, Austin's rental vacancy rate was only 3.9%.

Now it's 9.5% The highest level going back 7 years.

At the height of the pandemic in Sept 2021, Austin's rental vacancy rate was only 3.9%.

Now it's 9.5% The highest level going back 7 years.

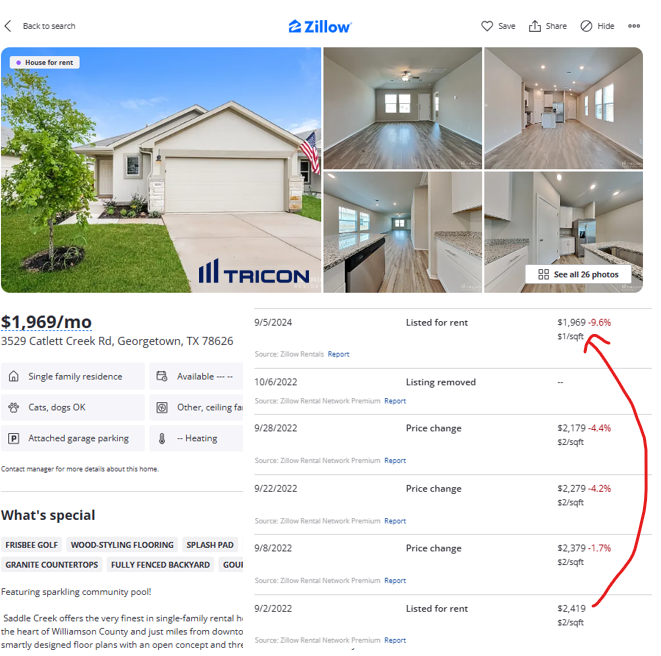

3) With so many vacant apartments, and rents that are still overpriced, landlords have no choice but to cut the rent to put heads in beds.

Especially on lease-up projects. Which often deliver 200-400 units vacant all at once.

This is exerting massive downward pressure on the rental market.

Especially on lease-up projects. Which often deliver 200-400 units vacant all at once.

This is exerting massive downward pressure on the rental market.

4) Which is of course good for renters. Incomes on Austin have grown quite a bit the last five years, and now rents are dropping, so locals are beginning to feel as apartments are affordable-ish again.

However, they will likely continue to get more affordable, as there is still a massive pipeline of construction projects underway.

However, they will likely continue to get more affordable, as there is still a massive pipeline of construction projects underway.

5) Building permit data available on Reventure App shows that, at the peak in 2022, apartment developers in Austin pulled over 25,000 multifamily permits.

That represented a 120% increase from pre-pandemic levels, which were already elevated.

From permit pull to completion, it takes about 24 months, or longer, for most projects.

Meaning there will still be an inundation of apartment supply in Austin throughout much of 2025.

Access building permit data for your city on Reventure App under a premium plan: map.reventure.app/dashboard?geo=…

That represented a 120% increase from pre-pandemic levels, which were already elevated.

From permit pull to completion, it takes about 24 months, or longer, for most projects.

Meaning there will still be an inundation of apartment supply in Austin throughout much of 2025.

Access building permit data for your city on Reventure App under a premium plan: map.reventure.app/dashboard?geo=…

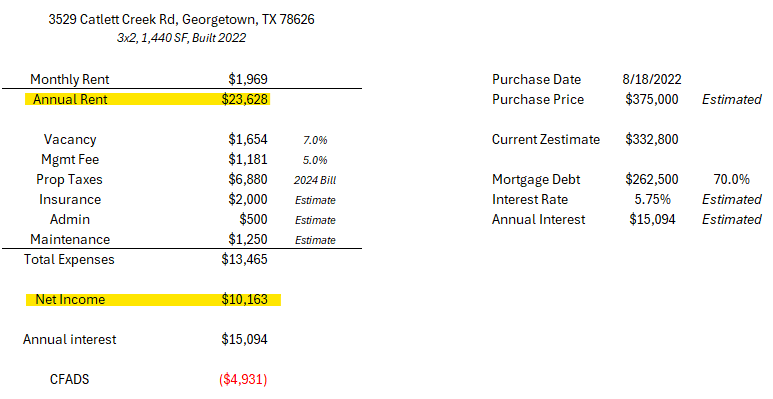

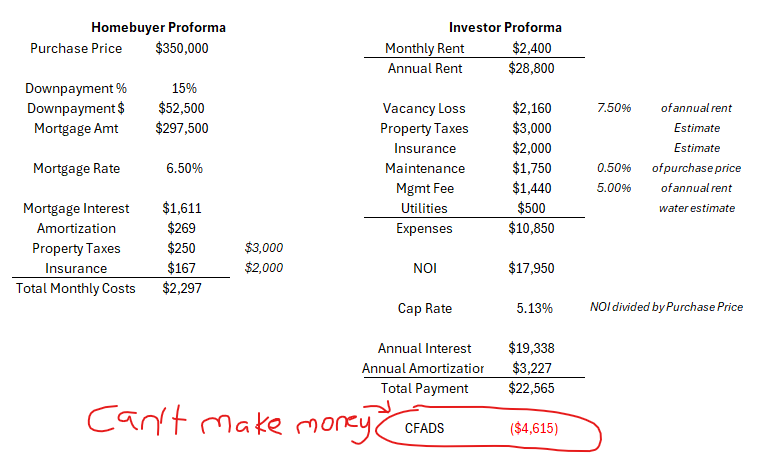

6) Now - to speculate a bit, I suspect there will be lots of distress at some point for Austin, TX landlords.

Because while their rents are dropping, their expenses are spiking.

Property taxes in some areas of Austin are up 30-40% from pre-pandemic levels.

Meanwhile - landlords who refinance their debt out of the pandemic ZIRP rates into prevailing market rates could see their interest costs double.

So there's a potential "nightmare scenario" that plays out over next several years in Austin where many apartment landlords are forced to liquidate. Particularly ones that bought in near peak in 2021-2022.

Because while their rents are dropping, their expenses are spiking.

Property taxes in some areas of Austin are up 30-40% from pre-pandemic levels.

Meanwhile - landlords who refinance their debt out of the pandemic ZIRP rates into prevailing market rates could see their interest costs double.

So there's a potential "nightmare scenario" that plays out over next several years in Austin where many apartment landlords are forced to liquidate. Particularly ones that bought in near peak in 2021-2022.

7) Amazingly, the building permit levels in Austin are still fairly high given how much both the sale and rental market are crashing.

Indicating that there could be more declines in both values and rents ahead.

Which of course, at some point, will reveal opportunity for new investors as well as renters.

Indicating that there could be more declines in both values and rents ahead.

Which of course, at some point, will reveal opportunity for new investors as well as renters.

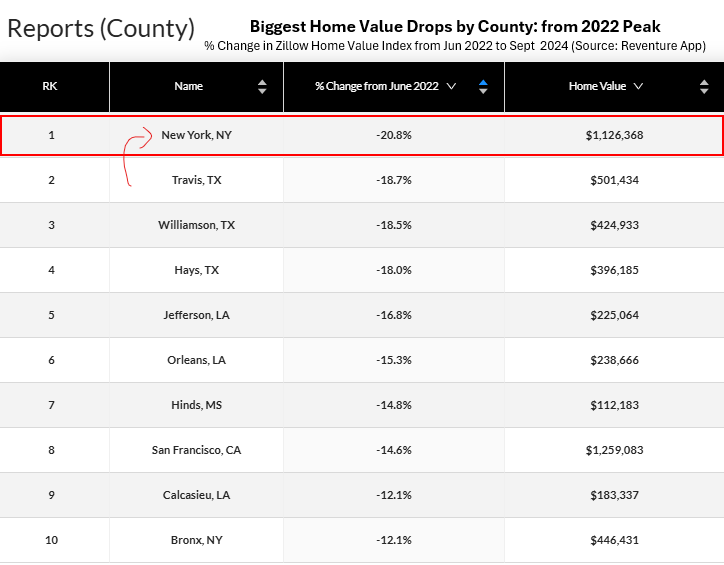

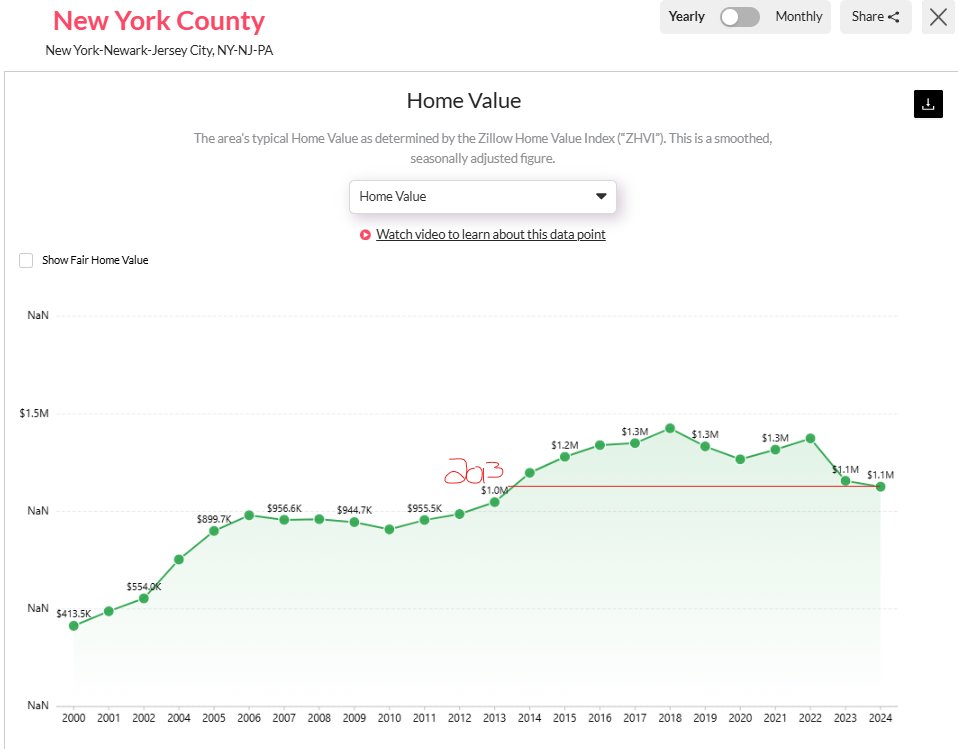

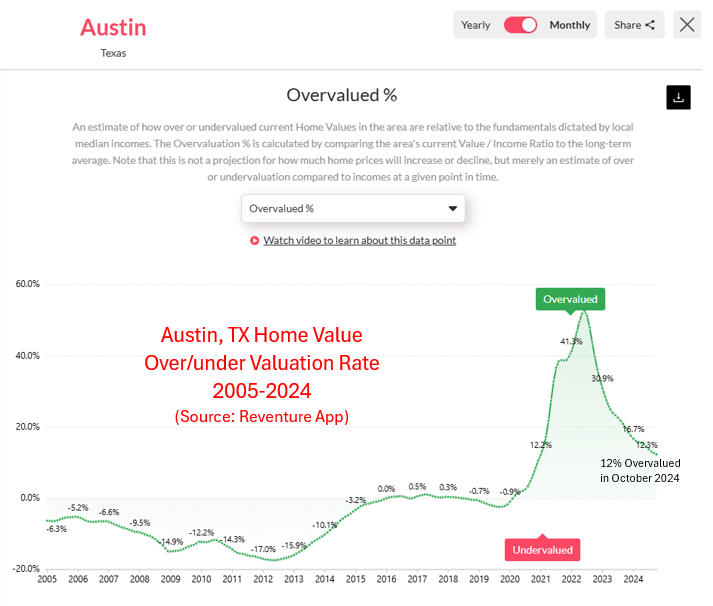

8) Data on Reventure App shows that Austin home prices (switching to the residential market) are now only 12% overvalued from their long-term norms.

Two years ago, they were close to 50% overvalued.

So a significant correction in Austin has already occurred on the home value front.

Two years ago, they were close to 50% overvalued.

So a significant correction in Austin has already occurred on the home value front.

9) If you squint, you can begin to see a bottom forming in Austin's housing market sometime in 2025.

Rents and values will need to drop a bit further. But once they both go down another 5-10%, the market will be fairly valued.

And could have some growth opportunities once the excess supply gets absorbed.

Rents and values will need to drop a bit further. But once they both go down another 5-10%, the market will be fairly valued.

And could have some growth opportunities once the excess supply gets absorbed.

10) To make a more informed investment decision on Austin and other housing markets across America, head to reventure.app.

Where you can access rental rate, building permit, and home price over/undervaluation data for nearly every state, metro, and county across the US.

The data is sourced from a variety of reputable sources, including Zillow, the US Census Bureau, and Realtor.com.

reventure.app

Where you can access rental rate, building permit, and home price over/undervaluation data for nearly every state, metro, and county across the US.

The data is sourced from a variety of reputable sources, including Zillow, the US Census Bureau, and Realtor.com.

reventure.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh