Lately, gold has been making headlines again, with prices surging to new highs in October. For an asset known for its stability, that’s no small feat.

But the real question is—what’s driving these prices up, and why has gold suddenly become more valuable?

But the real question is—what’s driving these prices up, and why has gold suddenly become more valuable?

Most of you watching or listening probably know that gold is often seen as a “safe haven” investment.

When things in the world feel uncertain—whether due to political, economic, or social reasons—people tend to put their money into gold, trusting it to hold steady even when other investments don’t.

When things in the world feel uncertain—whether due to political, economic, or social reasons—people tend to put their money into gold, trusting it to hold steady even when other investments don’t.

Right now, we’re seeing what almost feels like a “perfect storm” of global uncertainty.

There are multiple ongoing conflicts around the world, and until recently, there was a lot of uncertainty around the U.S. elections.

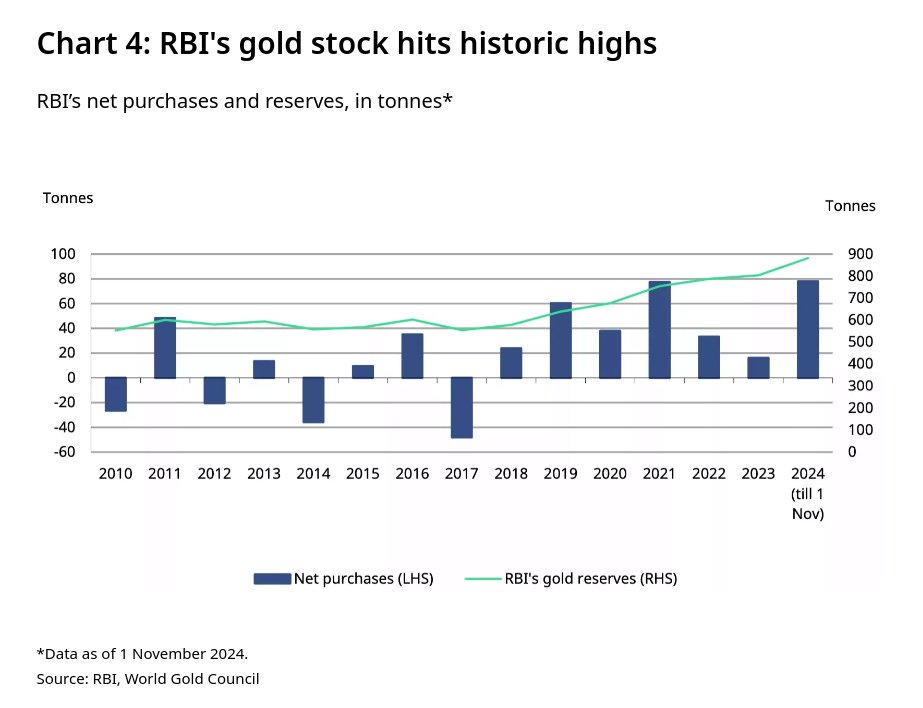

Because of this, central banks across the globe, including India’s RBI, have been buying gold at a record pace.

There are multiple ongoing conflicts around the world, and until recently, there was a lot of uncertainty around the U.S. elections.

Because of this, central banks across the globe, including India’s RBI, have been buying gold at a record pace.

Take the RBI, for example—it has added a massive 78 tonnes to its reserves this year. To put that in perspective, it’s the second-highest level of gold buying in the RBI’s history.

When central banks buy gold in such large amounts, it sends a clear message to the broader market that gold is a valuable asset, especially during turbulent times like these.

Now, typically, when gold prices climb, people tend to hold back from buying it—because, of course, it’s more expensive.

Now, typically, when gold prices climb, people tend to hold back from buying it—because, of course, it’s more expensive.

But in India, surprisingly, the demand for gold has stayed strong.

This Diwali season saw great sales for gold. People continued investing in the metal through jewellery, coins, and gold bars, despite the high prices.

This Diwali season saw great sales for gold. People continued investing in the metal through jewellery, coins, and gold bars, despite the high prices.

What’s even more interesting is that jewellers are taking note of this trend.

Titan Company, which owns Tanishq, has seen a rise in demand since July, particularly for wedding-related jewellery. This increase also coincides with the government’s recent decision to cut import duties on gold, making it cheaper to bring into the country.

This price adjustment brought buyers back into the market, especially those looking to make big purchases like wedding jewellery.

Titan Company, which owns Tanishq, has seen a rise in demand since July, particularly for wedding-related jewellery. This increase also coincides with the government’s recent decision to cut import duties on gold, making it cheaper to bring into the country.

This price adjustment brought buyers back into the market, especially those looking to make big purchases like wedding jewellery.

PNG Jewellers, another major brand, noticed an interesting trend during Diwali. Their sales grew by around 7-8% in terms of volume—the actual amount of gold sold.

But in terms of value, their sales saw a remarkable jump of 35-40% compared to last year.

This difference shows that people are not just buying jewellery but are also investing in pure gold, like coins or bars, which are more straightforward as investment assets.

But in terms of value, their sales saw a remarkable jump of 35-40% compared to last year.

This difference shows that people are not just buying jewellery but are also investing in pure gold, like coins or bars, which are more straightforward as investment assets.

This shift towards pure gold investment might be influenced by the government ending the gold sovereign bond scheme—a popular option for people to invest in gold without actually owning it physically.

With that scheme no longer available, people have fewer non-physical investment choices for gold, which is likely driving them to buy gold directly.

With that scheme no longer available, people have fewer non-physical investment choices for gold, which is likely driving them to buy gold directly.

On the supply side, India’s gold imports have surged thanks to the import duty cut in July.

In October alone, official gold imports were valued at ₹59,236 crore, a big jump from ₹36,482 crore in September.

Monthly imports are now at around 95 tonnes, almost double what we saw earlier this year.

In October alone, official gold imports were valued at ₹59,236 crore, a big jump from ₹36,482 crore in September.

Monthly imports are now at around 95 tonnes, almost double what we saw earlier this year.

This increase has also helped clean up the market by reducing black market activity, pushing more of the trade into official, transparent channels, which benefits both consumers and jewellers.

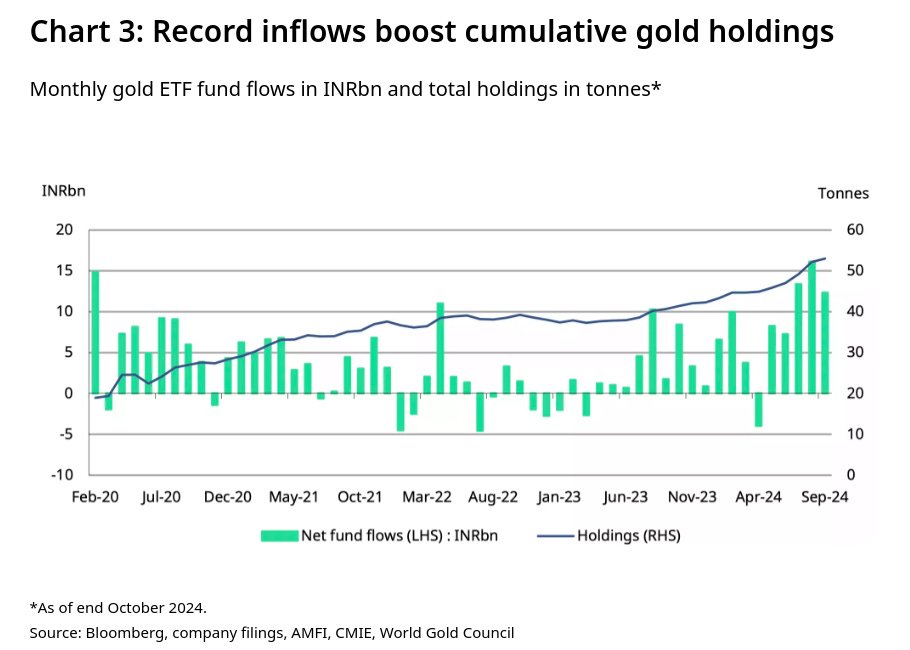

Another noteworthy trend is the rise in Gold ETFs or Exchange-Traded Funds. A Gold ETF lets people invest in gold without actually holding it physically.

Another noteworthy trend is the rise in Gold ETFs or Exchange-Traded Funds. A Gold ETF lets people invest in gold without actually holding it physically.

Instead, these funds track the price of gold, making it easier for people to benefit from price changes without dealing with the hassle of storage or security concerns.

In October, Gold ETFs in India saw record inflows of ₹1,960 crore, pushing the total assets in these funds to a new high of ₹44,500 crore.

In October, Gold ETFs in India saw record inflows of ₹1,960 crore, pushing the total assets in these funds to a new high of ₹44,500 crore.

This year alone, Indian Gold ETFs added 12.2 tonnes—a 32% increase from last year.

This trend highlights a change in how people view gold—not just as jewellery but also as a valuable investment tool that can be accessed easily through ETFs.

This trend highlights a change in how people view gold—not just as jewellery but also as a valuable investment tool that can be accessed easily through ETFs.

Interestingly, fewer people are trading in their old jewellery for new pieces.

For example, Tanishq has reported a drop in the number of customers exchanging old jewellery, about 3% lower than usual.

This suggests that with gold prices so high, people might prefer to hold onto their gold instead of trading it in for something new.

For example, Tanishq has reported a drop in the number of customers exchanging old jewellery, about 3% lower than usual.

This suggests that with gold prices so high, people might prefer to hold onto their gold instead of trading it in for something new.

In the past, jewellers often offered discounts on “making charges” to attract customers. But this year, some major brands, including Tanishq, have changed their strategy by offering discounts on the gold price itself.

This shift shows just how competitive the market has become, with big jewellers trying to match the aggressive pricing of smaller, local shops.

This shift shows just how competitive the market has become, with big jewellers trying to match the aggressive pricing of smaller, local shops.

Looking ahead, jewellers are feeling hopeful about the wedding season, which runs from November to March in India.

With several auspicious dates on the calendar, the expectation is for strong demand for wedding jewellery.

With several auspicious dates on the calendar, the expectation is for strong demand for wedding jewellery.

We cover this and two more interesting stories in today's episode of the Daily Brief. You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here:

thedailybrief.zerodha.com/p/what-is-happ…

thedailybrief.zerodha.com/p/what-is-happ…

• • •

Missing some Tweet in this thread? You can try to

force a refresh