In the spirit of trying to peer around the corner, here is a stab.

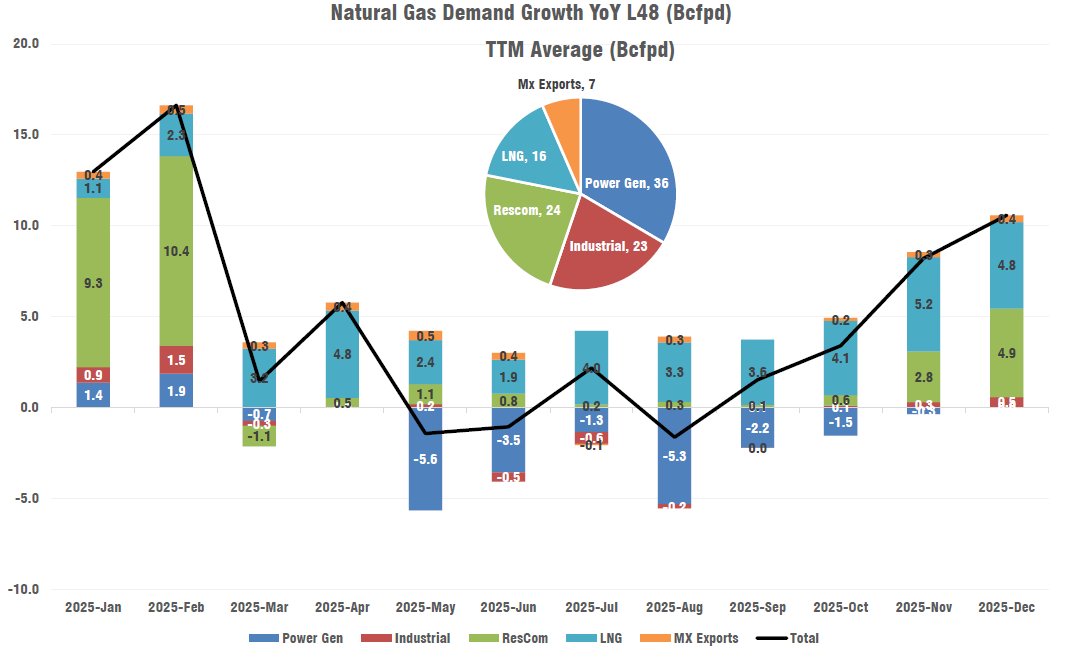

Nat Gas Themes:

2023 - LNG on the Horizon

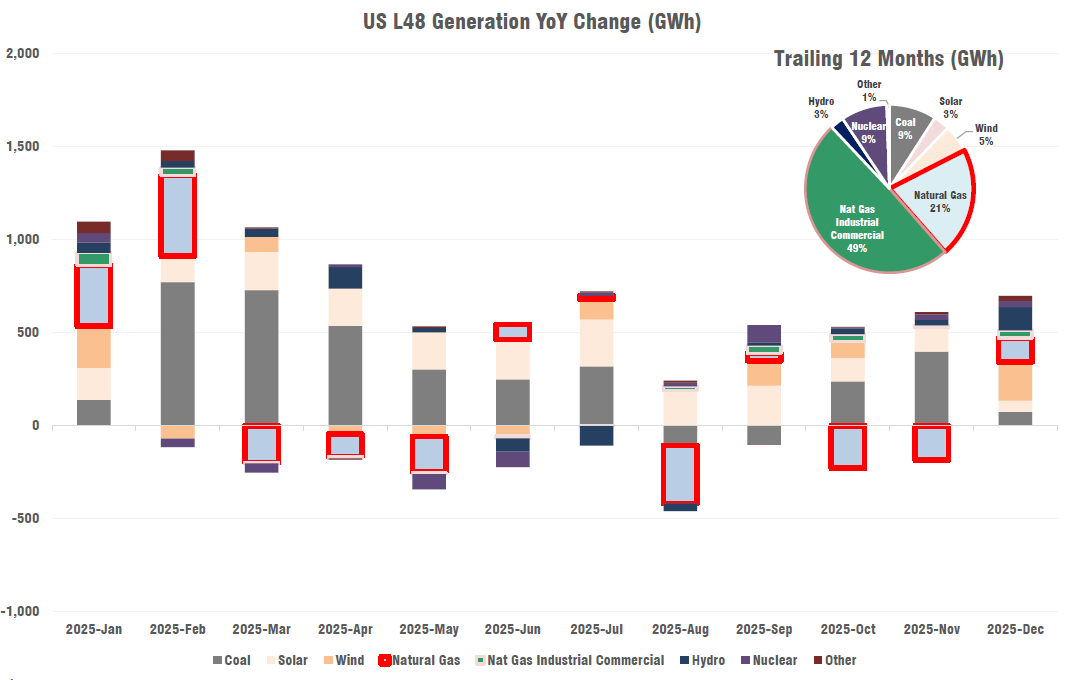

2024 - Power

2025 - CNG adoption

Quick unpack of CNG, what we know now and what could come to be. 🧵

Nat Gas Themes:

2023 - LNG on the Horizon

2024 - Power

2025 - CNG adoption

Quick unpack of CNG, what we know now and what could come to be. 🧵

First off. Why now? We've had CNG trucks for 20 years and they've never taken a bite. Whats different?

The engine is different. Higher displacement, higher torque, makes the new CNG engine a win for light haul and heavy haul. You can make the same distances, and carry the same loads for 2/3 to 1/2 the cost + a 30% emission win.

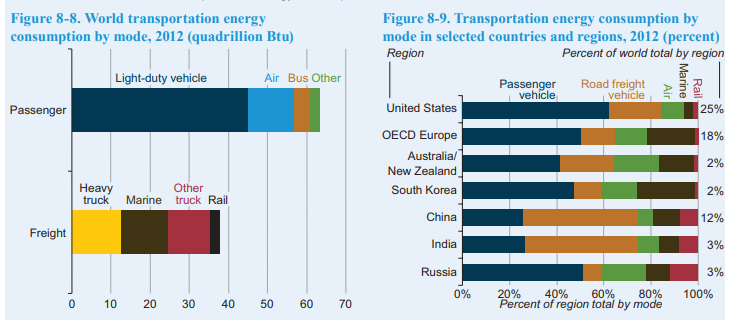

EV's can work for light duty vehicles but are terrible for heavy loads. This is the technological gap that CNG can plug.

ccjdigital.com/alternative-po…

The engine is different. Higher displacement, higher torque, makes the new CNG engine a win for light haul and heavy haul. You can make the same distances, and carry the same loads for 2/3 to 1/2 the cost + a 30% emission win.

EV's can work for light duty vehicles but are terrible for heavy loads. This is the technological gap that CNG can plug.

ccjdigital.com/alternative-po…

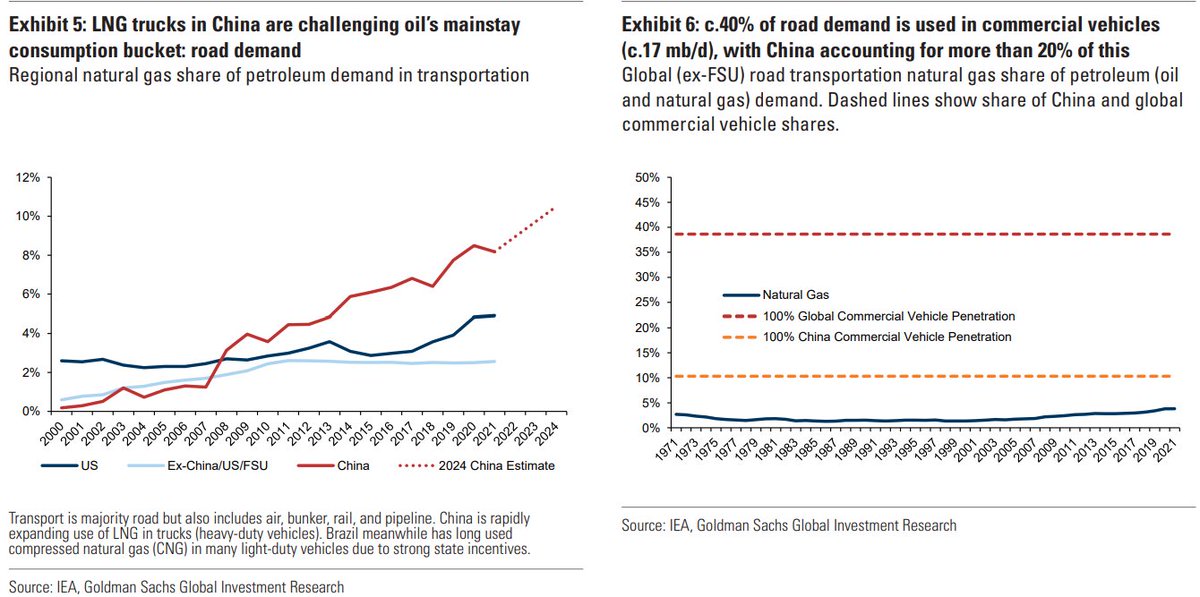

The 'buzziest' market is China.

ISI over the weekend

"We estimate demand displacement from LNG & CNG heavy-duty truck adoption at ~120 MBPD in China year to date, roughly triple the impact seen in 2022 and 2023."

"We estimate increase adoption in 2024 has displaced roughly ~120 MBPD of diesel demand, a meaningful headwind. For context here, the rapid adoption of electric cars in China is replacing ~200 MBPD of gasoline demand YTD."

"That said, most drivers recoup the added up front costs of purchasing an LNG truck in the first year of ownership. Diesel demand in China set to peak as a result of continued LNG/CNG adoption + EV transition. Continued LNG/CNG adoption is expected to result in diesel demand peaking in China sometime in the next couple years."

"Keeping an eye on India… When it comes to LNG heavy-duty truck adoption, we see India lagging China by ~7-10 years. To that end, we expect to see a significant lag in terms of when the above trends start to materialize."

ISI over the weekend

"We estimate demand displacement from LNG & CNG heavy-duty truck adoption at ~120 MBPD in China year to date, roughly triple the impact seen in 2022 and 2023."

"We estimate increase adoption in 2024 has displaced roughly ~120 MBPD of diesel demand, a meaningful headwind. For context here, the rapid adoption of electric cars in China is replacing ~200 MBPD of gasoline demand YTD."

"That said, most drivers recoup the added up front costs of purchasing an LNG truck in the first year of ownership. Diesel demand in China set to peak as a result of continued LNG/CNG adoption + EV transition. Continued LNG/CNG adoption is expected to result in diesel demand peaking in China sometime in the next couple years."

"Keeping an eye on India… When it comes to LNG heavy-duty truck adoption, we see India lagging China by ~7-10 years. To that end, we expect to see a significant lag in terms of when the above trends start to materialize."

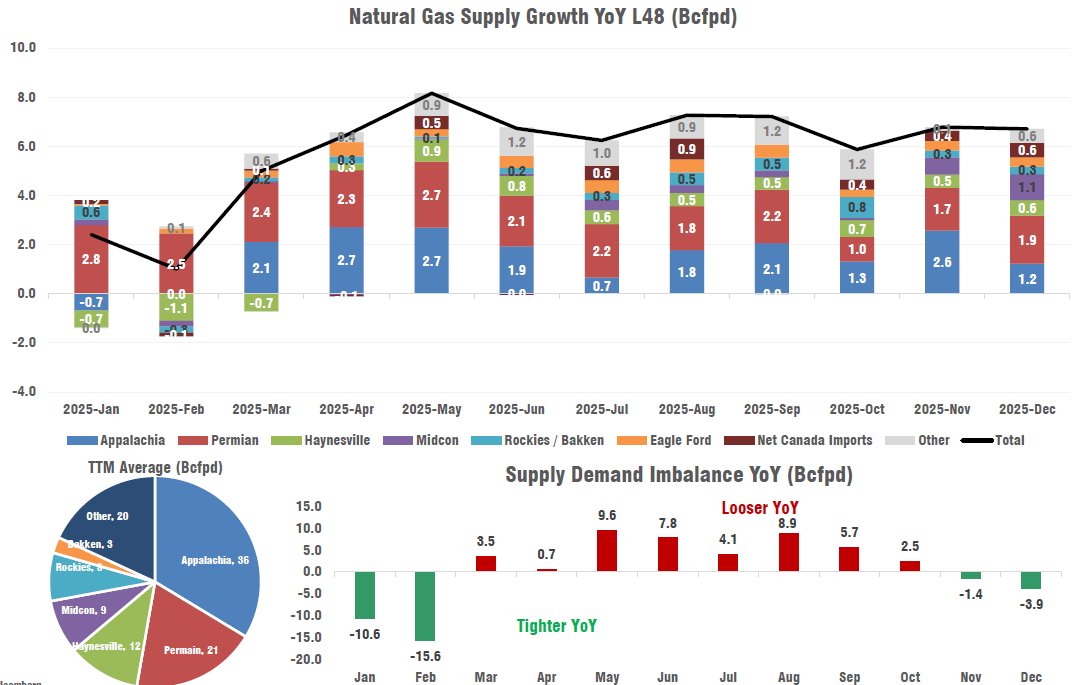

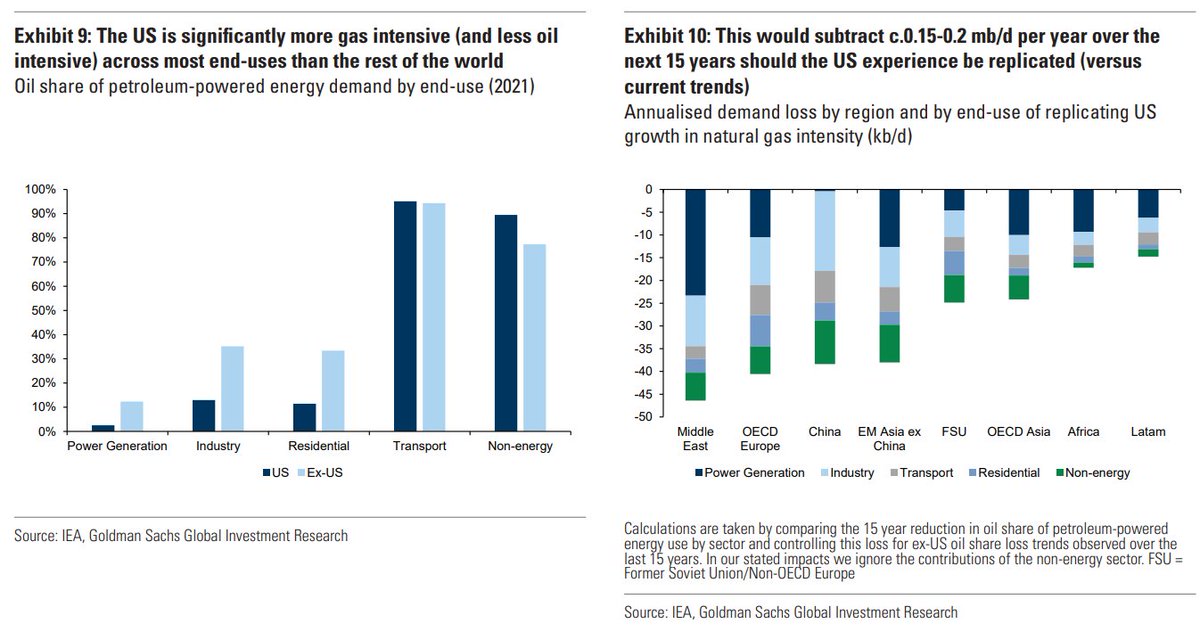

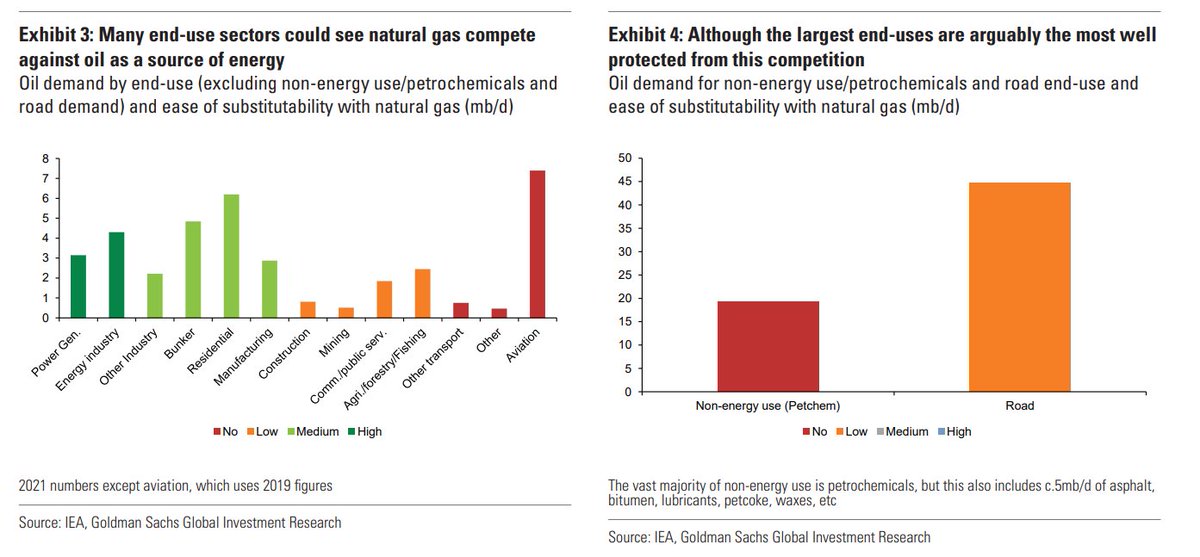

Almost all of these articles solely focus on the diesel displacement... Well what is the incremental natural gas consumption?

Efficiency and age of engine matter a little bit but the rough numbers are every 100 mbpd of diesel displacement is 0.5-0.6 bcfpd of additional natural gas consumption.

Remember these displacement numbers are showing up annually right now and there is a big fleet to replace. ISI estimated the displacement could get up to 200 mbpd per year in China alone, thats 1-1.2 bcfpd of additional natural gas demand... thats a >10% bump to global natural gas growth, and sops up a LNG export plant every 1-2 years!

Efficiency and age of engine matter a little bit but the rough numbers are every 100 mbpd of diesel displacement is 0.5-0.6 bcfpd of additional natural gas consumption.

Remember these displacement numbers are showing up annually right now and there is a big fleet to replace. ISI estimated the displacement could get up to 200 mbpd per year in China alone, thats 1-1.2 bcfpd of additional natural gas demand... thats a >10% bump to global natural gas growth, and sops up a LNG export plant every 1-2 years!

Where else, what about North America? Well the fleets have certianly figured out how cheap this is...

UPS, Amazon, GFL all are migrating. Also works on stationary combustion; if you are running a diesel generator, you could save yourselves a bucket of money moving to NG. (VoltaGrid, Certaurus/SPB, TOU know this well).

UPS, Amazon, GFL all are migrating. Also works on stationary combustion; if you are running a diesel generator, you could save yourselves a bucket of money moving to NG. (VoltaGrid, Certaurus/SPB, TOU know this well).

What's the blue sky; we can all try and napkin math out transport TAM, but high level I think its pretty reasonable to expect that this could turn into a 1-3 Bcfpd global demand theme that has meaningfully started in Asia, and is coming to a garbage truck, semi hauler, Zamboni near you...

Between power, LNG, and CNG, its demand on demand for gas to the end of the decade.

cleanenergyfuels.com/tourmaline/jda

Between power, LNG, and CNG, its demand on demand for gas to the end of the decade.

cleanenergyfuels.com/tourmaline/jda

• • •

Missing some Tweet in this thread? You can try to

force a refresh