Gas is Back

Worked in energy (banks / hedge funds / corporate) since '10. I work for Tourmaline. These posts & replies are my comments and views, not my firms.

How to get URL link on X (Twitter) App

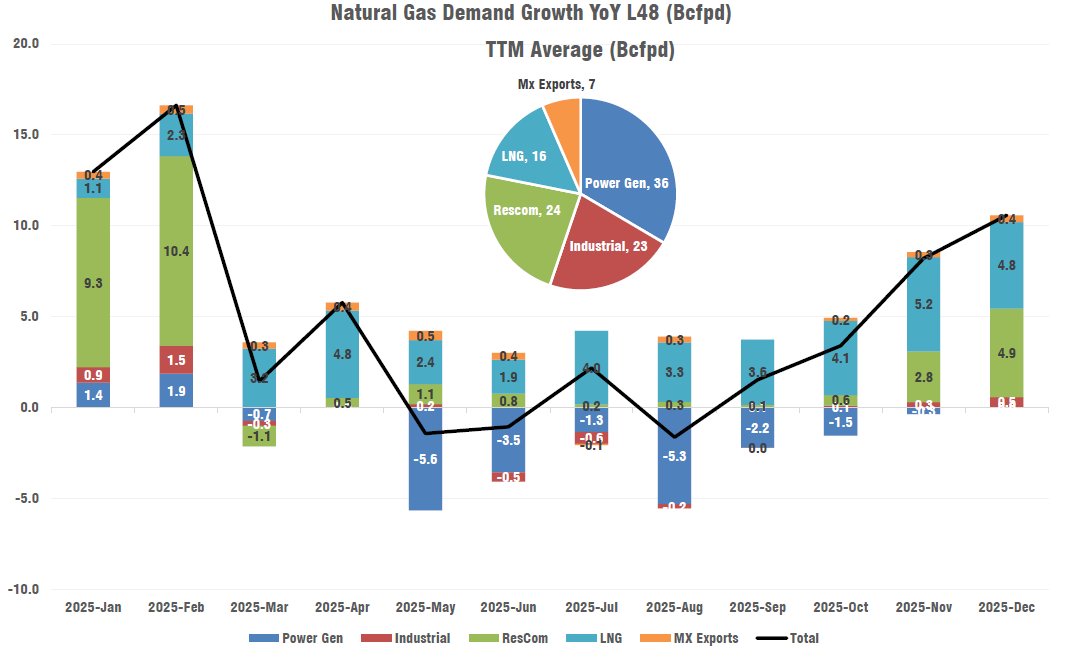

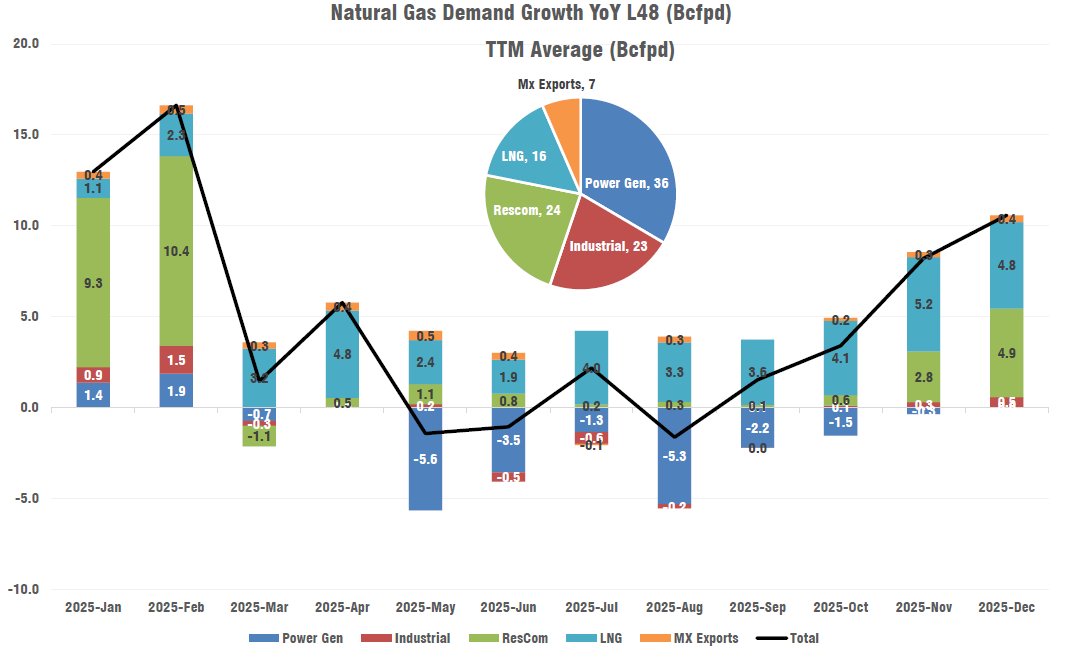

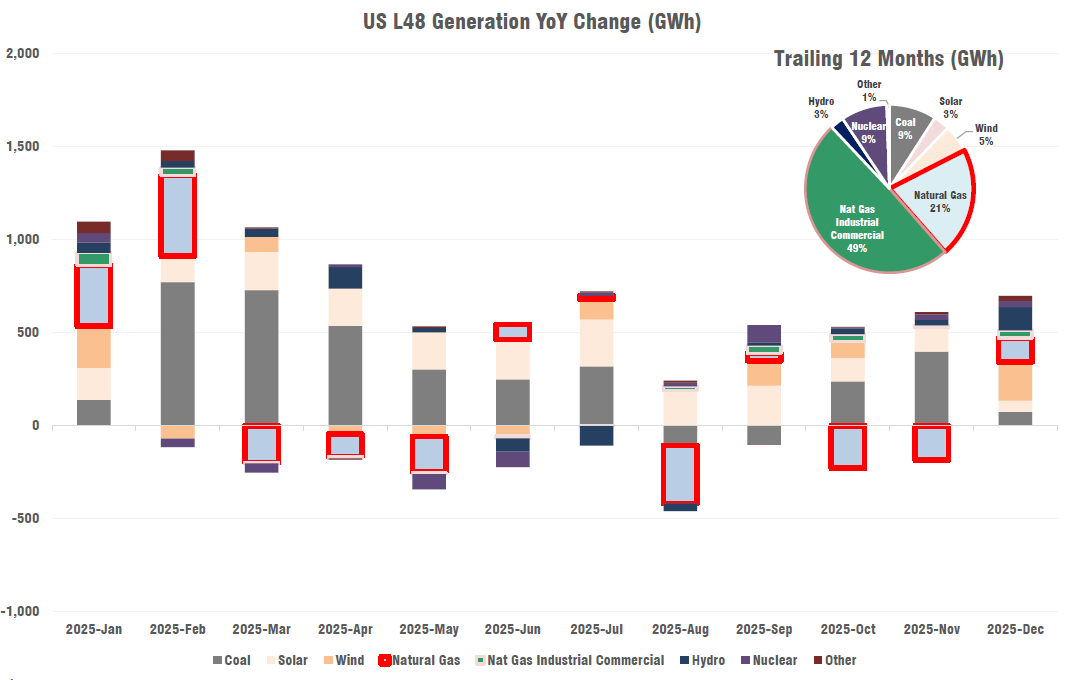

After taking the summer off gas generation is back on the uptick in December. Most pundits expect YoY gas generation growth in 2026 as the datacenter load comes on.

After taking the summer off gas generation is back on the uptick in December. Most pundits expect YoY gas generation growth in 2026 as the datacenter load comes on.

First off. Why now? We've had CNG trucks for 20 years and they've never taken a bite. Whats different?

First off. Why now? We've had CNG trucks for 20 years and they've never taken a bite. Whats different?

The simple load growth and market share assumptions that each scenario imply

The simple load growth and market share assumptions that each scenario imply

First. What could this look like. Estimates vary. Also data centers aren't the only thing going on in power. Heat pumps, air conditioning, industrial revamp are all vending into power demand forecasts. Lets broaden the net to total US power demand and acknowledge data centers will play a large role.

First. What could this look like. Estimates vary. Also data centers aren't the only thing going on in power. Heat pumps, air conditioning, industrial revamp are all vending into power demand forecasts. Lets broaden the net to total US power demand and acknowledge data centers will play a large role.

~1/2 as cheap? How can gas / Nuke / Coal / Hydro compete?

~1/2 as cheap? How can gas / Nuke / Coal / Hydro compete?

So near term 1/5th of this structurally higher rate will flow into tolling structures. And then longer term infra co cost of capital is going to have more and more of this interest spiked embedded in return hurdles.

So near term 1/5th of this structurally higher rate will flow into tolling structures. And then longer term infra co cost of capital is going to have more and more of this interest spiked embedded in return hurdles.

Haynesville is bottlenecked till Q3-23

Haynesville is bottlenecked till Q3-23https://twitter.com/JamieHeard5/status/1554933797434507265?s=20&t=KvQnsM4Jw3ztDtPtz4j-iw

Below is a matrix of 6 month total return slices, sorted vertically from best to worst WTI slices and left to right on best total return 2011 to 2022.

Below is a matrix of 6 month total return slices, sorted vertically from best to worst WTI slices and left to right on best total return 2011 to 2022.

The US is going to put up some incredible supply growth this decade.

The US is going to put up some incredible supply growth this decade.

"I want to buy cheap stocks" in December last year wouldn't have really worked year to date. December 31st multiples haven't correlated at all with total returns 2022 YTD.

"I want to buy cheap stocks" in December last year wouldn't have really worked year to date. December 31st multiples haven't correlated at all with total returns 2022 YTD.

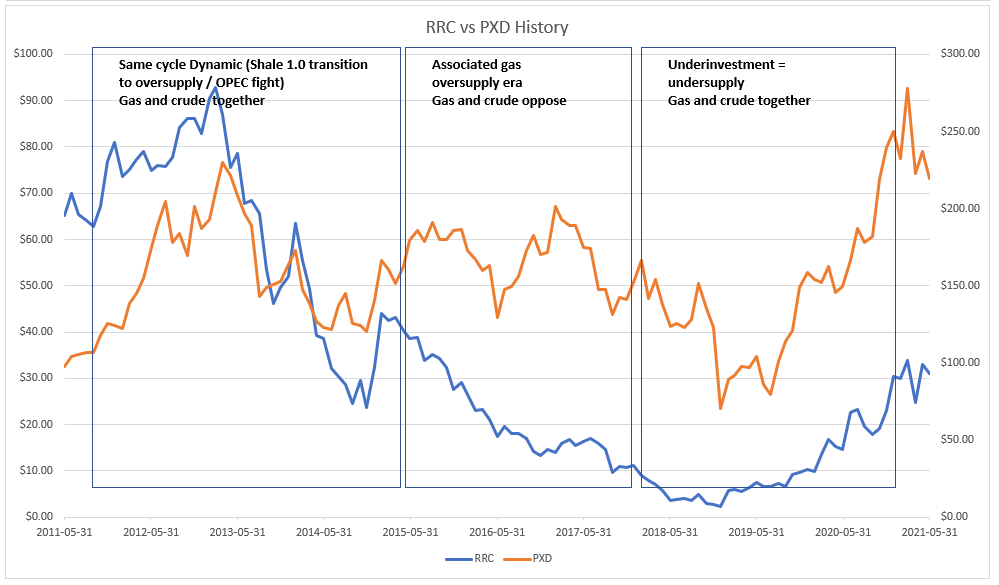

First, how did this work before. Oversupply crushed both oil and gas stocks. Then associated gas crushed gas stocks while crude stocks went sideways. and over the last two years the undersupply has lifted all stocks.

First, how did this work before. Oversupply crushed both oil and gas stocks. Then associated gas crushed gas stocks while crude stocks went sideways. and over the last two years the undersupply has lifted all stocks.